5 Ways Open Banking API Integrations Are Powering Modern Financial Solutions

Key Takeaways:

- APIs are the new power grid — they light up the financial ecosystem, keeping personalization, payments, and partnerships always switched on.

- Think of APIs as bridges — connecting banks, fintechs, and enterprises so ideas, data, and value can flow without traffic jams.

- APIs are the secret playbook — giving financial institutions the competitive edge to outpace rivals, secure growth, and win in the digital game.

Welcome to the age where open banking API integrations aren’t just tech jargon—they’re the secret sauce powering modern financial solutions. In simple terms, open banking means banks letting approved third-party apps safely access customer financial data and initiate services via APIs, or Application Programming Interfaces. Think of APIs like bridges or messengers quietly connecting systems so they can talk and share data securely.

Today, APIs are the backbone of digital transformation in financial services. They make financial software development services agile, smart, and future-ready. The open banking market is booming—one study pegs it at about USD 25.9 billion in 2025, poised to surge to USD 46.9 billion by 2030, growing at a steady 15.2% CAGR.

But here’s the real story: API integrations for fintech aren’t just a shiny upgrade—they’re a business enabler. They unlock smarter financial solutions, let businesses respond faster to customer needs, and drive innovation in secure API design and open banking API integration. For a B2B leader like Sigma Infosolutions, investing in these transparent, API-driven banking innovations is more than smart—it’s essential.

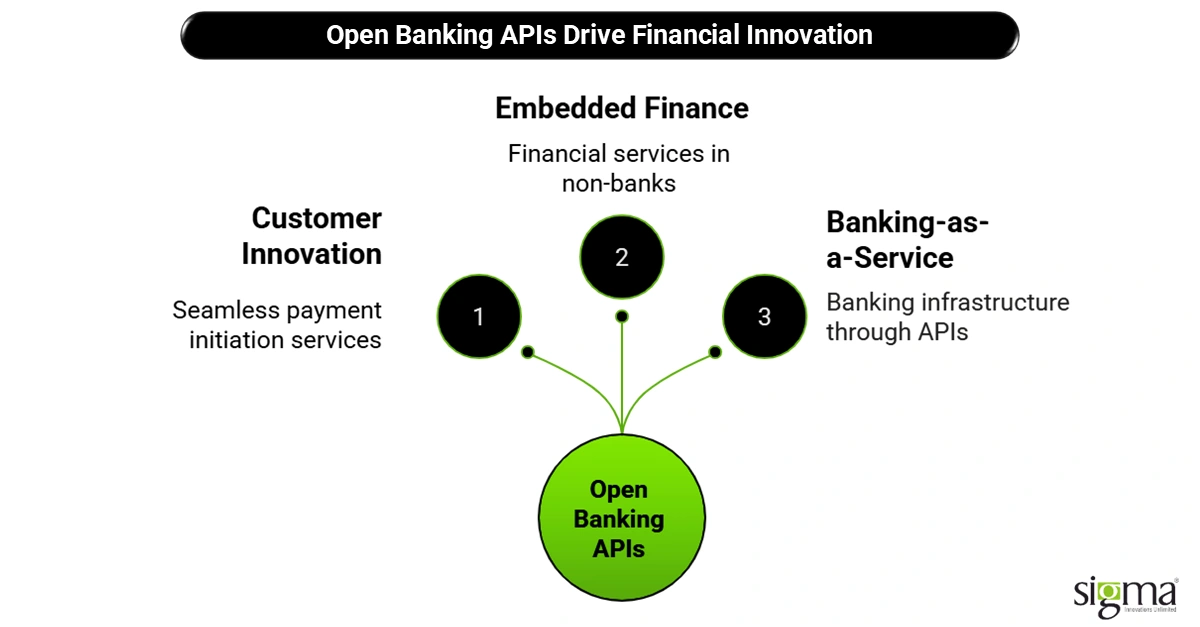

The Rise of Open Banking APIs: From Compliance to Competitive Advantage

Open banking didn’t emerge just because it was cool—it started as a regulatory push across the globe. The ever-evolving rules and regulations necessitating banks to open up access to customer data via APIs and acts allowing consumers share data with trusted third parties are fuelling the surge of open banking APIs

At first, banks adopted these open banking API implementations purely to comply with regulations, not because they saw any upside. But things quickly changed. Instead of viewing APIs as a burden, forward-looking banks realized APIs could be powerful strategic assets. They shifted from compliance to customer-centric innovation—creating seamless payment initiation services, dashboard-style account aggregation, and embedded finance experiences that enrich digital interactions.

These APIs now live at the heart of modern financial ecosystems. Embedded finance—bringing financial services into non-bank apps—relies on these secure API connections.

Banking-as-a-Service (BaaS) platforms have thrived by offering banking infrastructure through APIs, enabling neobanks, marketplaces, and even retailers to deliver modern financial solutions instantly.

Here’s a stat that makes the point: over 87% of Tier-1 banks globally have adopted open banking APIs, and 84% of fintechs are partnering with incumbent financial institutions. That’s not just compliance—that’s a competitive edge. APIs are transforming financial institutions from gatekeepers into innovation hubs.

Also Read: Managing Virtual and Physical Cards with Banking-as-a-Service Solutions

Five Ways Open Banking API Integrations Are Powering Modern Financial Solutions

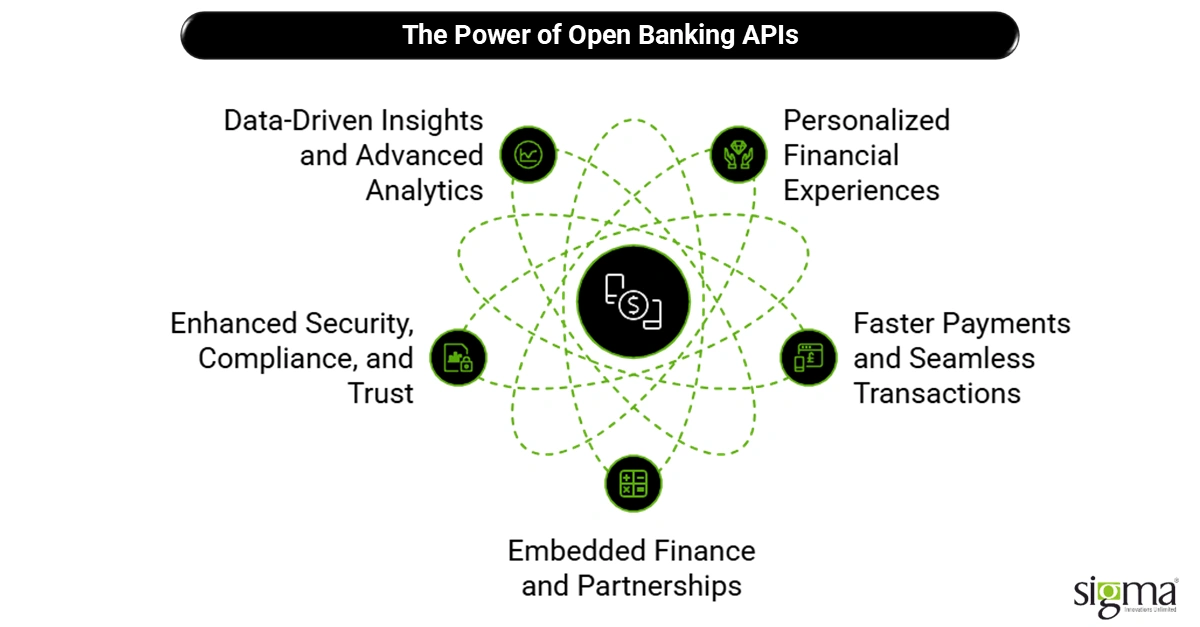

Personalized Financial Experiences

Customers today expect banks and financial apps to know them as well as Spotify knows their playlists. That’s where open banking API integrations come in. By tapping into real-time financial data, APIs make it possible to deliver hyper-personalized experiences—like insights into spending habits, tailored savings tips, or custom lending offers.

Take neobanks and wealth management platforms, for example. They rely on APIs to categorize transactions into easy-to-understand buckets (food, rent, travel, subscriptions). This not only improves financial literacy tools but also enables apps to recommend smarter budgeting strategies or investments aligned with a user’s goals. A budgeting tool that says “Hey, you spent 25% more on dining out this month, here’s how to adjust your savings” is far more valuable than a static statement.

For businesses, the payoff is huge. Personalization powered by APIs drives engagement, retention, and brand loyalty. When customers feel understood, they’re more likely to stay and grow with the platform. For B2B players, APIs create the foundation for building scalable financial software development services that empower both end-users and enterprises.

Faster Payments and Seamless Transactions

Nobody likes waiting for money to move, whether it’s a paycheck, a P2P transfer, or a cross-border invoice. Secure APIs for financial services are eliminating these frictions by powering instant payments and real-time money movement. With rails like FedNow and RTP (Real-Time Payments) in the U.S., banks and fintechs are leaning heavily on APIs to deliver near-instant settlement.

Look at how platforms like Stripe and Modern Treasury are leading the charge. Their API-driven ecosystems let businesses integrate payment workflows effortlessly—from accepting cards and ACH to reconciling transactions in seconds. For CFOs and treasurers, this translates to faster settlement cycles, stronger liquidity, and ultimately, greater trust with customers and partners.

In cross-border commerce, APIs also reduce costs and delays, replacing legacy wire systems with real-time, transparent transactions. For global businesses, that means fewer “funds in limbo” moments and smoother cash flow management.

The bottom line: API integrations aren’t just about speed; they’re about creating modern financial solutions that match the instant-gratification expectations of today’s digital economy.

Embedded Finance and Partnerships

Once upon a time, only banks provided banking services. Now, thanks to API-driven banking innovation, non-financial companies—from ride-hailing apps to eCommerce retailers—are embedding financial products directly into their platforms. That’s the essence of embedded finance, and APIs are the engine driving it.

Think of a retailer offering buy-now-pay-later credit at checkout, or a ride-hailing app letting drivers access earnings instantly through a digital wallet. Behind the scenes, APIs connect these experiences to traditional banks or fintechs, enabling seamless Banking-as-a-Service (BaaS) models.

Partnerships between banks, fintechs, and even big tech companies are multiplying as APIs create a plug-and-play financial ecosystem. For enterprises, this opens entirely new revenue streams and customer engagement models.

At Sigma Infosolutions, we help enterprises integrate these critical APIs—whether it’s payments, lending, or even insurance—to create frictionless customer journeys. By leveraging our financial software development services, businesses can move beyond compliance and tap into a powerful growth engine.

Enhanced Security, Compliance, and Trust

When it comes to money, nothing matters more than trust. Open banking APIs don’t just improve functionality—they strengthen security. With industry standards like OAuth 2.0, tokenization, and zero-trust architecture, APIs enable consent-driven access to financial data. In other words, customers control who sees their data, and only for as long as they allow it.

This model of secure, transparent access is a major upgrade over screen-scraping methods of the past. APIs also help institutions stay compliant with rules like PCI DSS, GDPR, and the CFPB’s upcoming open banking mandates in the U.S.

A growing trend in the industry is “security-as-an-experience.” Customers now trust platforms that not only protect their data but make them feel secure in doing so. Businesses that adopt secure API frameworks for financial services don’t just meet regulatory requirements—they gain a trust advantage in a competitive market.

Data-Driven Insights and Advanced Analytics

Financial data is the new oil—but only if it’s accessible and usable. Open banking API integrations democratize access to rich datasets, allowing banks, lenders, and fintechs to build advanced analytics capabilities. From credit scoring to portfolio analysis, APIs feed real-time information into AI and ML models, powering smarter decision-making.

Take SME lending as an example. Traditional credit scoring often overlooks small businesses without lengthy credit histories. With APIs pulling in alternative data—like cash flow, supplier payments, and even eCommerce sales—lenders can make faster, more inclusive lending decisions. This reduces defaults and expands access to capital.

We’re also seeing wealth management firms use API-driven analytics to provide dynamic portfolio insights, while insurers tap into transactional APIs for risk modeling. The result: more accurate underwriting, better personalization, and a measurable impact on bottom lines.

For enterprises, these insights are a competitive differentiator. By harnessing open finance architecture and API integrations for fintech, businesses unlock opportunities to innovate and serve customers in ways that simply weren’t possible a decade ago.

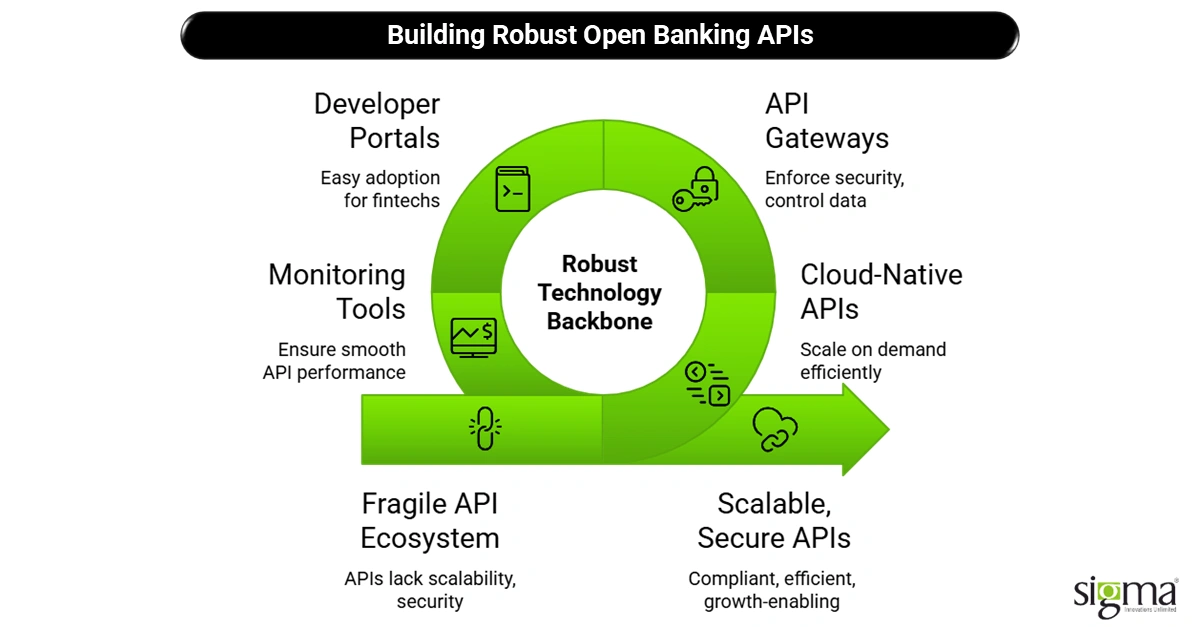

Making Open Banking APIs Work

Behind every slick customer experience powered by open banking API integrations lies a sophisticated technology backbone. Financial institutions can’t just plug in an API and call it a day—they need robust infrastructure to make these secure APIs scale reliably, compliantly, and efficiently.

Here are some of the key pillars:

- Cloud-Native APIs & Microservices: Modern financial platforms rely on cloud-native architectures and microservices that scale on demand. This flexibility is crucial for handling unpredictable transaction volumes in modern financial solutions.

- API Gateways: Acting as traffic managers, gateways enforce security, control data flow, and simplify integration for both internal and third-party developers.

- Developer Portals: A well-documented portal makes APIs discoverable, testable, and easy for fintech partners to adopt—fueling API-driven banking innovation.

- Monitoring & Observability Tools: Continuous monitoring ensures APIs perform smoothly while helping institutions maintain open banking compliance and avoid costly downtime.

This is where tech service partners come in. At Sigma Infosolutions, we specialize in building secure, scalable API ecosystems for banks, fintechs, and enterprises. From financial software development services to advanced API integrations for fintech, we ensure your infrastructure isn’t just compliant—it’s a growth enabler.

APIs may be the connectors, but it’s the underlying technology that keeps the entire ecosystem running. Without the right backbone, even the best-designed open banking API integration can fall short.

Also Read: Breaking Down Enterprise App Integration Services: How It All Connects

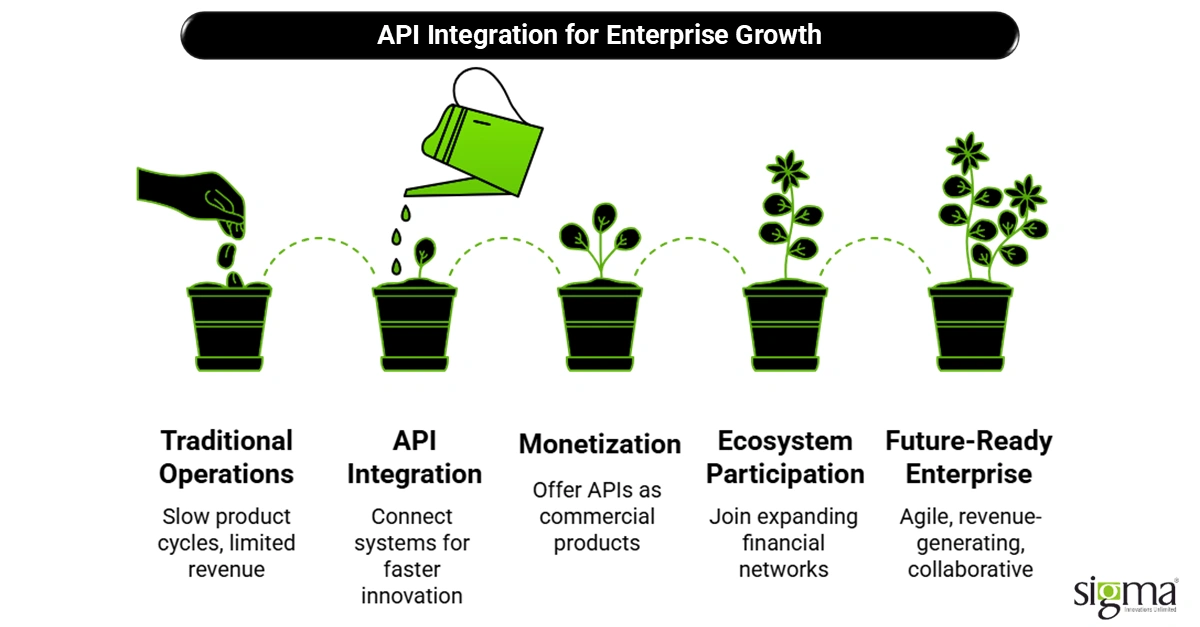

Why Enterprises Should Invest in API Integrations Now

For B2B leaders, investing in financial software development services through API integrations is no longer optional—it’s strategic. Here’s why enterprises that lean into open banking API integrations today are positioned to lead tomorrow:

Competitive Differentiation: Accelerated Innovation

APIs enable faster product cycles: new features, services, and business models can be rolled out in weeks instead of months. That speed gives businesses a sharp edge in responding to market shifts and customer demands.

Monetization: Unlocking New Revenue Streams (API-as-a-Product)

Savvy organizations are transforming internal APIs into commercial offerings—charging partners for access. Think of APIs as platforms in their own right, fueling both usage-based and subscription revenue models. This positions your integrations as growth lines, not just backend plumbing.

Long-Term Growth: Capitalizing on the Open Financial Ecosystem

Today’s API investments lay the foundation for participating in ever-expanding networks that include embedded finance platforms, cross-industry partnerships, and new digital channels. This ecosystem mindset delivers sustainable value while fostering collaboration and resilience.

Stat Snapshot: API-Driven Market Growth

- The global API banking market is projected to climb from roughly USD 24.5 billion in to an impressive USD 118.1 billion by 2030, representing a 25.2% CAGR.

- Meanwhile, the broader open banking market is forecast to reach USD 135.17 billion by 2030, growing at a 27.6% CAGR.

Future Outlook: The Next Frontier of Open Banking APIs

If the past few years were about compliance and modernization, the future of open banking API integrations is about possibility. We’re moving from Open Banking → Open Finance → Open Data → Embedded Everything—a progression where APIs don’t just connect financial services but weave them into the broader digital fabric of our lives.

Three forces will shape this frontier:

- AI + Real-Time Analytics: With APIs feeding massive streams of financial data, AI models will deliver instant credit decisions, personalized investment guidance, and dynamic fraud detection—turning raw data into actionable insights in real time.

- Blockchain & Digital Trust: Secure APIs combined with distributed ledger technology will power transparent transactions, digital ID verification, and next-gen asset exchanges—fueling trust in decentralized ecosystems.

- Cross-Industry Interoperability: APIs won’t stop at finance. Imagine healthcare, insurance, mobility, and retail platforms exchanging value seamlessly. From metaverse payments to biometric authentication, APIs will serve as the universal glue.

The prediction? By the early 2030s, open finance architecture will power not just banking apps, but immersive digital experiences—where paying, borrowing, and verifying identity happen instantly across industries.

For enterprises, this means opportunity. Those who invest today in scalable, secure API ecosystems for financial services will be the ones shaping tomorrow’s digital economy—not just participating in it.

Final Thoughts

At the end of the day, open banking API integrations are no longer just a technical upgrade—they’re the connective tissue holding together modern financial ecosystems. From hyper-personalized experiences to faster payments, embedded partnerships, stronger security, and advanced insights, APIs are reshaping how financial services are designed, delivered, and consumed.

The vision is simple but powerful: enterprises that embrace secure API frameworks today won’t just keep up with the digital economy—they’ll define the future of finance itself. By investing in financial software development services and building scalable, compliant, API-first ecosystems, businesses unlock new revenue streams, accelerate innovation, and deepen customer trust.

At Sigma Infosolutions, we help financial enterprises design, build, and scale the infrastructure needed for this transformation. Our expertise in API integrations for fintech, open banking standards, and modern architecture ensures that your organization is ready to thrive in an API-driven world.

Ready to take the next step? Explore how our Financial Software Development Services and Open Banking API Integrations can help your business stay ahead: Sigma Infosolutions Fintech Services!