Banking-as-a-Service (BaaS) Solutions Driving Growth in Embedded Finance

Key Takeaways:

- Regulations, legacy systems, and silos are the roadblocks, and BaaS is the GPS that finds a faster, safer route to embedded finance.

- Building financial products from scratch is like reinventing the wheel. Banking-as-a-service (BaaS) gives you a ready-made engine to accelerate innovation.

- With BaaS, every business can play in the big financial leagues without breaking compliance rules.

Every modern business is fast becoming a “financial business.” Think of eCommerce sites offering branded credit cards at checkout, SaaS tools giving users in-app financing, or even loyalty apps issuing virtual wallets. These aren’t just add-ons; they’re central to how brands build stickiness, trust, and long-term customer relationships.

So what is Embedded Finance? It’s when non-financial companies embed financial services like payments, lending, cards, and insurance right into their user experience. Instead of sending customers off to banks, everything happens where they already are. And because of that shift, more businesses are moving from standalone banking products to “contextual” financial experiences.

Here’s what the numbers tell us: the Embedded Finance market valued around USD 83.32 billion is expected to hit USD 588.49 billion by 2030, growing at a CAGR of ~32.8%. Also, demand is surging, especially in North America, where companies want to own more of the customer journey.

But there’s a catch. Non-financial businesses that want to offer embedded financial solutions often run into big hurdles like complex regulation, compliance risk, integration challenges, and core banking dependencies. That’s where Banking-as-a-Service (BaaS) solutions come in. They eliminate those barriers by giving businesses an API-first, compliant foundation to embed financial services fast, safely, and without becoming a bank themselves.

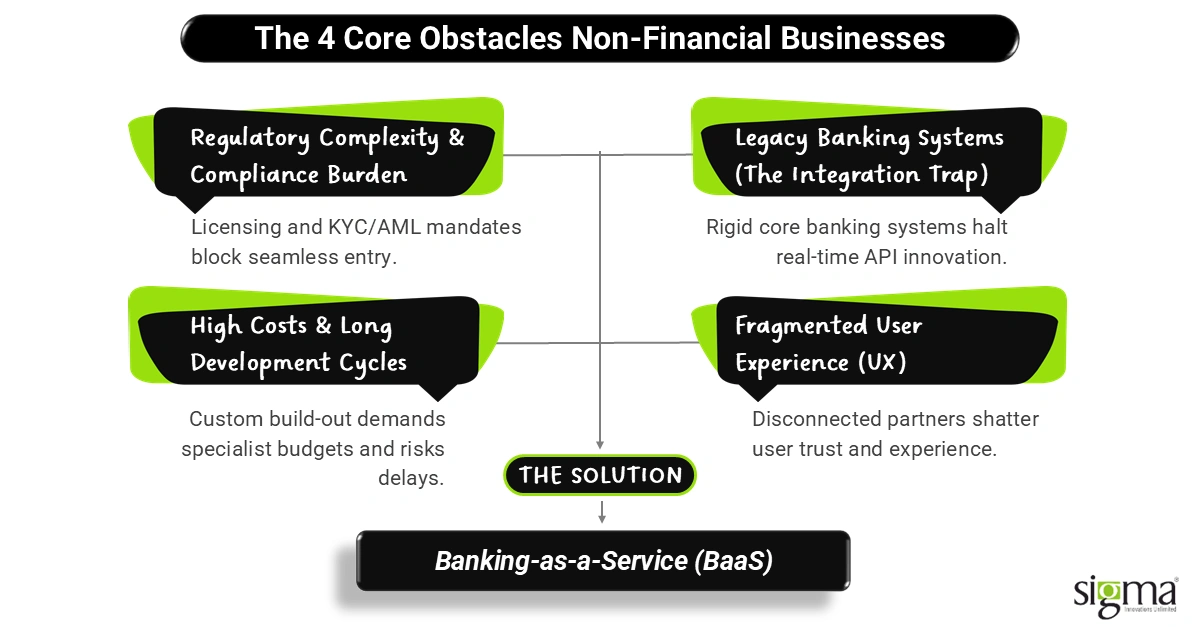

Why Non-Financial Businesses Struggle to Offer Financial Products

If you’re a SaaS company, eCommerce store, or any non-financial business thinking of adding financial features, it’s not as simple as “just add payments or lending.” Several obstacles block the way.

- Regulatory complexity: Laws around finance are strict. You need licensing (for lending, payments, and money-transmitter), and must follow Know Your Customer (KYC) and Anti-Money Laundering (AML) rules. You also have to protect customer data, meet privacy regulations, and often report to multiple regulatory bodies. Many companies say compliance is one of their top challenges for embedded finance.

- Legacy banking systems not built for integration or real-time digital experiences: Traditional banks and payment providers often use old core banking systems, mainframes, or monolithic software. These are hard to adapt to modern requirements like API speed, real-time transactions, and mobile UX. Updating them is slow, costly, and risky.

- Long development cycles and high costs for custom financial infrastructure: Building everything yourself (backend, compliance, integrations with banking partners, risk scoring, UI, etc.) takes time, large budgets, and specialist talent. For non-financial firms that are used to shipping software features, this is a big stretch. Delays and cost overruns are common.

- Fragmented user experiences across payment, lending, and card systems: Because different financial services are often offered via different partners or platforms, users can get a broken experience: switching apps, handling different interfaces, delays between steps, and confusing compliance flows. Fragmentation undermines trust and loyalty.

These pain points, regulation, old systems, high cost & complexity, and UX fragmentation, cause many non-financial companies to stall or abandon plans for embedded financial solutions.

Transition to solution

Luckily, there is a way through: Banking-as-a-Service (BaaS) solutions. They are designed to resolve these exact barriers by offering pre-built, compliant, integrated, API-first building blocks.

The Solution: Banking-as-a-Service (BaaS)

Banking-as-a-Service (BaaS) in the USA refers to a platform model where a licensed bank exposes banking functions via modular APIs so that non-financial businesses (like eCommerce, SaaS, product engineering firms) can embed financial products (payments, cards, lending, digital wallets, etc.) without needing to build banks from scratch. It differs from traditional banking (which requires you to own the license, maintain regulated infrastructure, core banking, compliance, etc.) and pure fintech APIs (which might address only one function, e.g. payments or identity). BaaS bundles regulatory, core banking, and operational plumbing into reusable, secure building blocks.

Here’s how BaaS connects the players:

- A licensed bank or financial institution holds the regulation, risk, license, and compliance responsibilities.

- A BaaS provider/enabler builds the middleware: APIs for account management, KYC/AML, card issuing, risk scoring, payments, etc.

- A non-financial business (brand, retailer, SaaS vendor) uses those APIs to embed financial services into its product.

Example

Imagine a retailer in the USA wants to launch a branded payment card. Using a BaaS provider, they don’t need to become a bank. The provider handles regulatory compliance, card-issuing, partner bank charter, and API integration. The retailer integrates those APIs into its checkout flow, UX, and app, so customers get a seamless experience under the retailer’s brand.

Or take a SaaS firm: it wants to offer embedded lending to its customers, like financing upgrades for enterprise users. Rather than developing credit scoring, underwriting, regulatory risk, and the backend, the SaaS company utilizes BaaS & Neobank Enablement Solutions to integrate lending APIs, KYC, risk tools, and frontend UX, thereby making lending a core part of their product.

Neobank Enablement Solutions

Neobank Enablement extends BaaS by supplying end-to-end digital banking capability. This means not just cards or payments or lending, but full bank-like services: online account opening, digital wallets, savings or checking accounts, mobile app or portal, real-time transactions, etc., white-labelled under the non-financial business’s brand. Neobank enablement leverages the BaaS infrastructure plus design, product engineering, compliance, UI/UX, etc.

Embedded Finance & BaaS: Layers & Models

In this synergy, BaaS is the technology layer of the regulated, API-first, modular architecture that non-financial companies consume. Embedded Finance is the business model: embedding financial products into non-financial platforms to enhance loyalty, increase revenue, and improve CX. The BaaS model in the USA enables embedded financial solutions to be rolled out faster and more safely.

Also Read: 5 Ways Open Banking API Integrations Are Powering Modern Financial Solutions

Trends Powering BaaS and Embedded Finance Adoption

The momentum behind Banking-as-a-Service (BaaS) & Embedded Finance is no fluke. Across industries, companies are investing heavily in embedded financial solutions because customers want simplicity and speed, and the economics make sense. Here are the strong trends and data points that show where things are headed.

Key Trends & Statistical Evidence

- API-based ecosystems and open banking frameworks are taking off: Open banking and standardized APIs are making it easier for regulation-aware banks and BaaS providers to connect with non-financial platforms. According to Mordor Intelligence, the embedded finance market is forecast to grow at a ~24.43% CAGR from 2025 to 2030, driven largely by BaaS roll-outs and open banking mandates.

- Composable banking and Banking-as-a-Platform (BaaP): Rather than building full bank systems in-house, companies are using modular, API-first, plug-and-play components. Systems for KYC, payments, card issuing, risk, and ledger services are composed together. Research shows embedded banking (digital accounts, cards etc.) is leading the market: for example, in a FutureMarketInsights report, embedded banking accounts for ~47.3% of the embedded finance market in 2025.

- Consumer demand for seamless, in-context financial experiences: Users expect the financial side of things to be invisible, instant, and embedded in whatever app or service they are using. Recent surveys show non-financial companies are increasing their R&D or tech investments because embedded finance is becoming strategic.

- Expansion of BaaS providers and middleware enablers: The number of firms offering BaaS solutions (the ones providing regulatory & bank partnerships, core banking via APIs, card issuance, risk modules etc.) is growing. Platforms and fintech infrastructure providers are raising funding, expanding product lines (for credit, payments, cards, risk), and forming partnerships with non-financial companies. This growth is reflected in the increasing share of embedded finance market segments tied to investment, lending, and insurance beyond just payments. For instance, Mordor Intelligence reports that while the payment segment led with ~44.2% share in 2024, investments are projected to grow at ~28.5% CAGR to 2030.

Beyond Payments: Credit, Insurance & Investment Embedded

A striking shift: embedded finance is no longer just about making payments easier. We now see non-financial companies embedding credit (lending, BNPL), insurance products (micro-insurance, on-demand), and investment experiences (fractional investing, scripted portfolios). These new embedded financial solutions are appealing because they deepen customer relationships, open up recurring revenue streams, and provide higher lifetime value.

These trends show clearly that embedded finance + BaaS isn’t experimental; it’s becoming foundational. The technology is maturing, regulators are waking up to how to allow properly structured partnerships, and consumers are embracing embedded financial experiences across more use cases.

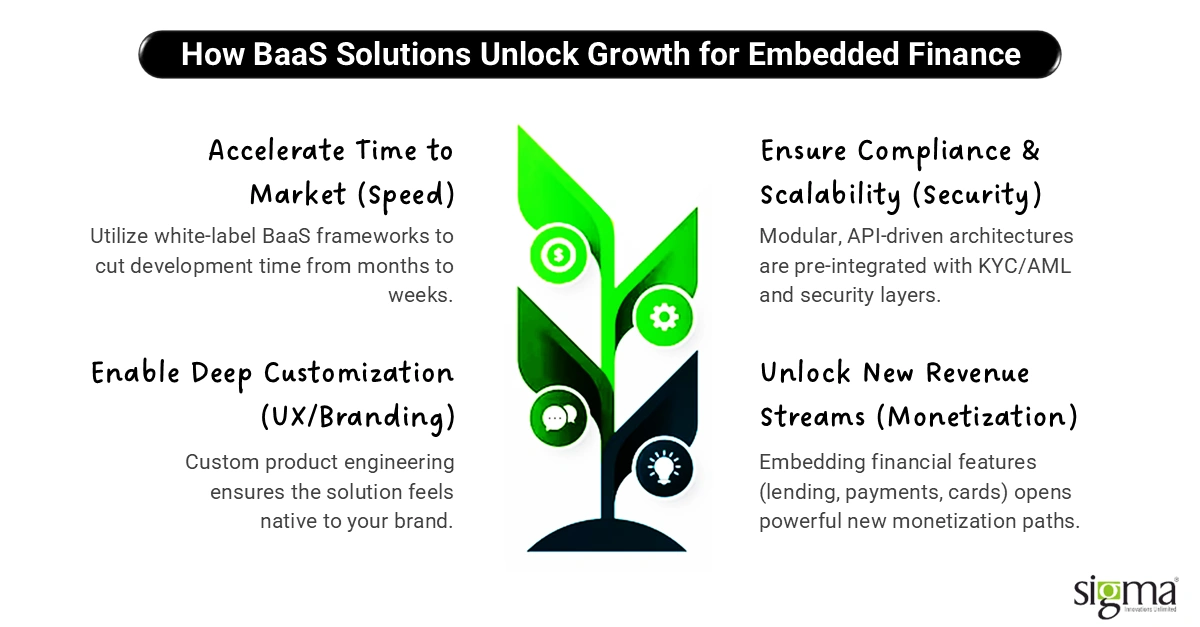

How BaaS Solutions Unlock Growth for Embedded Finance

At Sigma Infosolutions, we believe Banking-as-a-Service (BaaS) solutions are not merely a technology upgrade; they are the architectural foundation that enables any business to launch financial features without becoming a bank.

The future of competitive differentiation lies in Embedded Finance and BaaS & Neobank Enablement Solutions are the engine behind it. Our Financial Software Development Services in the USA are designed to help forward-thinking businesses harness this transformation faster and smarter.

Here’s how Sigma makes it possible:

- Accelerate time to market: We provide white-label BaaS frameworks that cut months of development into weeks. Businesses can plug in ready-to-use modules (accounts, cards, payments, or lending) without building from scratch.

- Ensure compliance and scalability: Sigma’s modular, API-driven BaaS architectures come pre-integrated with compliance, KYC/AML, and security layers, ensuring regulatory peace of mind while supporting scalable growth.

- Enable deep customization: Our custom product engineering expertise ensures every embedded financial solution feels native to your brand. From UI/UX to backend orchestration, we tailor everything to match your customer journey.

- Unlock new revenue streams: By embedding financial features that include lending, payments, cards, insurance, etc., businesses open doors to new monetization paths and improved customer retention.

In short, we help organizations transform from service providers into financial experience enablers, delivering embedded financial solutions in the USA that are compliant, scalable, and future-ready.

Also Read: US FinTech Market Growth, Trends, and Forecast

How Sigma’s BaaS & Neobank Enablement Solutions Work

At Sigma Infosolutions, we help businesses turn bold financial ideas into reality fast. Our Banking-as-a-Service (BaaS) Solutions in the USA combine modular technology, regulatory readiness, and deep product engineering expertise to help non-financial businesses launch embedded financial solutions without the complexity of building a bank.

Here’s how our BaaS & Neobank Enablement Solutions work:

- White-label digital banking development: Build branded, customer-facing financial experiences such as digital wallets, savings accounts, or micro-lending apps powered by compliant, white-label technology.

- API integrations for cards, payments, and lending platforms: Connect seamlessly with card issuers, payment gateways, and lending platforms through secure APIs that simplify real-time financial operations.

- Core banking modernization and middleware integration: Modernize outdated core banking systems or integrate with third-party cores to deliver faster processing, real-time updates, and API-first agility.

- RegTech and compliance automation: Ensure end-to-end compliance with built-in KYC/AML, transaction monitoring, and data security modules to reduce manual effort and regulatory risk.

- Product engineering for scalability and innovation: Extend functionality with custom features such as risk scoring, AI-driven analytics, and customer engagement dashboards built for scale and performance.

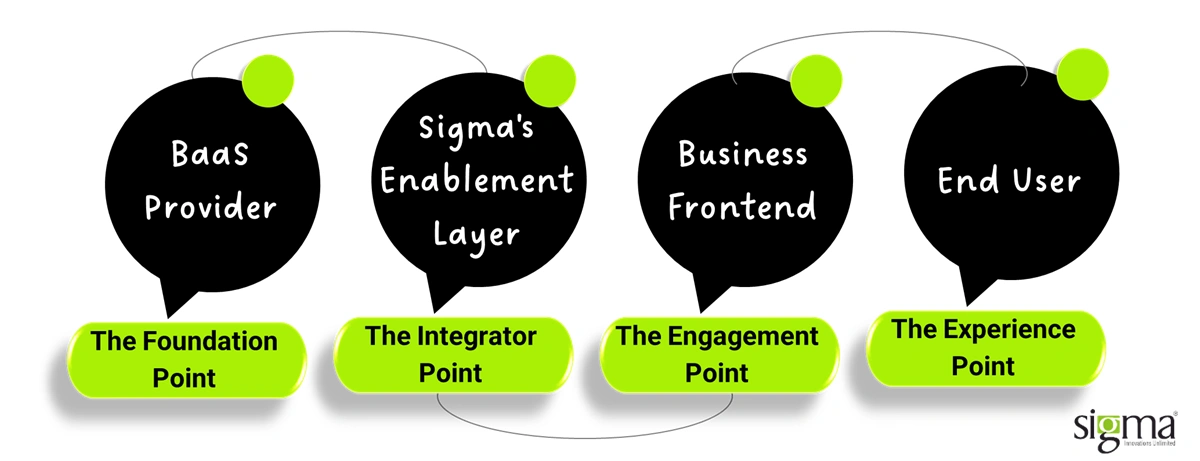

Suggested Flow Diagram

- BaaS Provider: Supplies regulated banking infrastructure and APIs.

- Sigma’s Enablement Layer: Integrates, customizes, and orchestrates these APIs into a cohesive, branded experience.

- Business Frontend: The client’s application (eCommerce site, SaaS platform, fintech portal) where customers engage.

- End User: Experiences smooth, secure, in-context financial interactions for payments, cards, and loans under the brand’s name.

Sigma bridges the gap between regulated banking systems and modern customer experiences, delivering BaaS & Neobank Enablement Solutions in the USA that are secure, compliant, and innovation-ready.

Use Cases Across Industries

Banking-as-a-Service (BaaS) and Embedded Finance are redefining how businesses deliver financial experiences, transforming transactions into engagement opportunities and loyalty drivers. Across industries, organizations are leveraging BaaS-enabled architectures to embed banking capabilities seamlessly into their existing ecosystems.

- eCommerce: Retailers are integrating Buy Now, Pay Later (BNPL) and digital wallet options to improve checkout conversions and reduce cart abandonment. With BaaS APIs, they can offer instant credit approvals and personalized payment plans without maintaining banking licenses.

- SaaS Platforms: Enterprise and SMB SaaS providers are embedding invoicing, payments, and credit management features directly into their platforms, giving users a unified workflow while generating new revenue through transaction fees or interest margins.

- Lending Platforms: Digital lenders are streamlining partner onboarding, borrower verification, and loan disbursal via embedded APIs. This reduces operational overhead and accelerates decision-making across loan lifecycles.

Power faster onboarding, verification, and disbursal with Sigma’s Digital Lending Solutions.

- Insurance and Wealth Management: Providers are embedding micro-insurance, savings, and investment tools within customer journeys to turn passive policyholders into active financial participants through contextual engagement.

Reimagine investment with Sigma’s wealth and portfolio management solutions.

Example: Banking Reimagined for Long-Term Growth

A U.S.-based financial association partnered with Sigma Infosolutions to revolutionize its banking operations and deliver a modern digital experience. Through Sigma’s BaaS and Neobank Enablement Solutions, the organization combined smart automation, intuitive interfaces, and robust integrations to drive a decade of innovation and resilience.

The results?

- Faster Operations: Automated workflows slashed manual tasks and minimized human error.

- Better Learning Experience: Real-time dashboards, interactive simulations, and seamless integrations boosted user engagement.

- Improved Security: Zero data retention for sensitive data and ISO-compliant systems ensured trust and transparency.

- Greater Scalability: A modular architecture empowered future-ready integrations and feature expansion.

- Long-Term Innovation: Over 10 years of partnership fueled agility, trust, and continuous improvement.

Read the full story of how Sigma helped reimagine banking for the digital age in our case study.

The Future: From BaaS to Full Embedded Financial Ecosystems

The evolution from Banking-as-a-Service (BaaS) to fully embedded financial ecosystems marks the next frontier of digital transformation. What began as the integration of banking services through APIs is rapidly maturing into interconnected financial experiences where payments, lending, insurance, and investments coexist seamlessly within non-financial platforms.

The future belongs to financial experience ecosystems driven by AI, predictive analytics, and hyper-personalization. These technologies will empower businesses to anticipate user needs, deliver contextual financial offers in real time, and enhance engagement through intelligent automation. Imagine retail apps that automatically suggest financing options, SaaS platforms that forecast working capital needs, or marketplaces that offer built-in insurance with every purchase, all powered by invisible banking rails.

This transformation is being accelerated by collaborative partnerships among fintechs, licensed banks, BaaS providers, and technology enablers like Sigma Infosolutions. By combining domain expertise, regulatory readiness, and engineering excellence, these alliances redefine how digital businesses compete and grow in the embedded finance era.

Quote-worthy takeaway:

“In the near future, every digital company will be a financial company, powered by BaaS infrastructure.”

As the boundaries between financial and non-financial services blur, Sigma stands at the intersection of technology and innovation, helping enterprises design, build, and scale the embedded financial ecosystems of tomorrow.

Conclusion

The shift toward Embedded Finance is no longer optional; it’s the next competitive frontier. Businesses that once relied solely on products or digital services are now integrating financial features to deliver richer, more personalized customer experiences. Yet, challenges such as regulatory hurdles, integration complexity, and legacy infrastructure often slow this transformation.

That’s where Sigma Infosolutions comes in. With deep expertise in Banking-as-a-Service (BaaS), Neobank Enablement, Product Engineering, and Custom API Development, Sigma helps businesses move from concept to compliant, customer-ready financial ecosystems. Our modular frameworks, API-driven architectures, and white-label digital banking capabilities enable companies to embed payments, lending, cards, and more without the burden of becoming a bank.