Fintech Software Development Services Powering Inclusive Growth in Emerging Markets

Key Takeaways:

- Breaking the Walls of Finance: Traditional banking systems built for yesterday can’t serve tomorrow’s world—fintech innovation is the bulldozer breaking those walls down.

- From Pockets to Platforms: Mobile-first, cloud-native solutions are turning smartphones into financial lifelines for millions left outside the system.

- Engineering Inclusion, Not Just Apps: Sigma Infosolutions transforms fintech ideas into scalable ecosystems—because true inclusion isn’t built in code, it’s engineered with purpose.

For decades, financial inclusion has been viewed as a moral goal, helping people gain access to savings, credit, and insurance. But in today’s connected world, it’s far more than that. It’s a massive economic opportunity. According to the World Bank, 1.4 billion adults remain unbanked globally, most of them living in emerging markets where traditional banking infrastructure simply cannot reach due to cost, geography, and regulatory barriers.

This is where fintech innovation is rewriting the rules. Mobile-first platforms, microloans, and digital payment solutions are creating new pathways to prosperity, not just for individuals but for entire economies. With smartphone penetration climbing even in rural areas, people who once relied on cash are now entering digital ecosystems that offer safety, transparency, and opportunity.

For North American technology leaders, the challenge isn’t discovering the opportunity; it’s scaling it. Expanding securely, compliantly, and profitably across diverse markets takes more than a one-size-fits-all product; it takes empathy-driven technology.

That’s where Sigma Infosolutions steps in. Our custom fintech software development services empower inclusive finance with mobile-first, API-driven, and cloud-ready architectures designed for global scalability and local relevance. Because when innovation meets inclusion, growth follows for everyone.

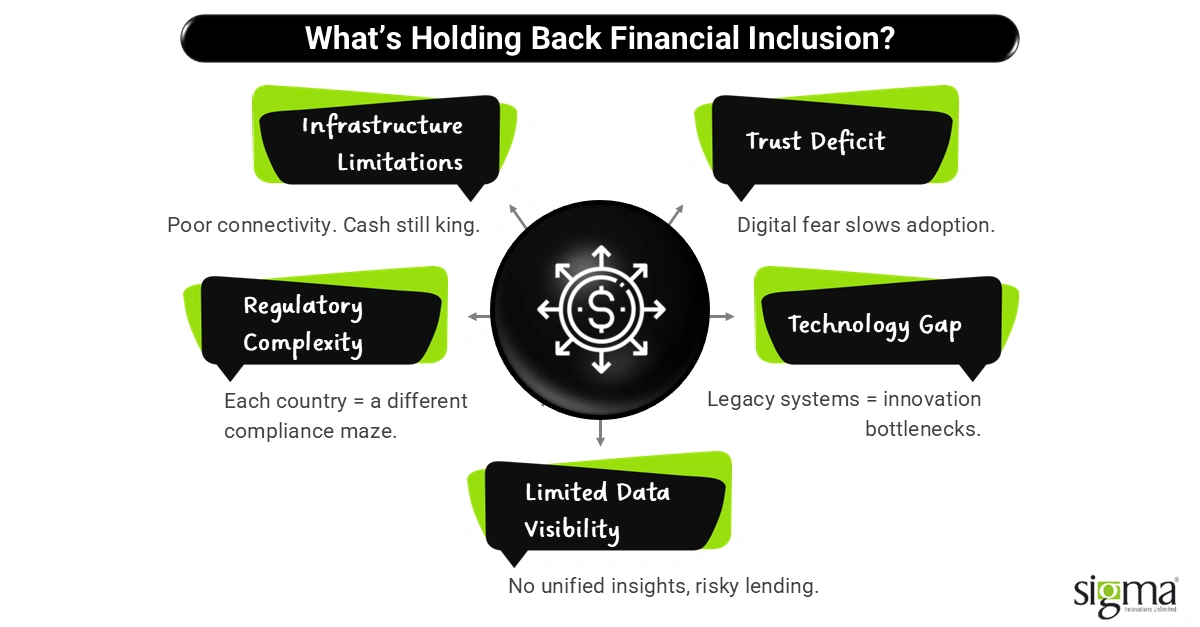

Structural Gaps Blocking Financial Inclusion (The Problem)

The promise of inclusive finance in emerging markets is real, but so are the obstacles. Many fintech leaders eye these markets with optimism, only to discover structural gaps that stall progress.

- Infrastructure Limitations: Many emerging economies still lack reliable internet connectivity and cohesive banking systems. Global Findex 2025 shows, nearly 60% of adults in low-income countries depend primarily on cash. This fragmentation limits real-time transaction data, complicating efforts to design digital financial services that can reach remote users.

- Regulatory Complexity: Each country brings its own mix of licensing rules, capital controls, and data residency laws. Without agile, cloud-based compliance tools, firms are reeling under the pressure of mounting financial crime compliance costs

- Trust Deficit: Digital literacy remains low in underserved communities, and with that comes skepticism. According to recent studies, most unbanked adults cite distrust in financial institutions as their main reason for not adopting digital banking, a barrier that technology alone can’t fix.

- Technology Gap: Legacy systems weren’t built for this reality. Monolithic architectures slow down innovation and make it nearly impossible to deliver localized features like multi-currency wallets or alternative credit scoring. Without scalable fintech architecture, agility turns into a bottleneck.

- Limited Data Visibility: When customer data sits in silos, lenders can’t create effective microloan or payment risk models. A lack of unified insights makes inclusive credit inaccessible to those who need it most, the small entrepreneurs and gig workers driving local economies.

Bridging these gaps demands not just better apps, but purpose-built fintech software solutions that are secure, compliant, and adaptable to market realities.

Fintech as a Force for Inclusive Growth (The Turning Point)

Something remarkable is happening across emerging markets: fintechs are outpacing banks in bringing digital finance to the underserved. From Kenya’s M-Pesa to Brazil’s Nubank, digital wallets, alternative credit scoring, and embedded finance platforms are breaking barriers that traditional institutions couldn’t.

Emerging markets are now recording double-digit fintech adoption growth, outstripping mature economies. Each mobile transaction, each microloan, and each digital payment solution is unlocking new forms of participation in the economy.

But here’s the key insight: inclusive finance isn’t charity, it’s smart business. The World Bank estimates that closing the global financial inclusion gap could add $5.7 trillion, equivalent to 19% of Global GDP. When people and small businesses gain access to credit and payment systems, they fuel entrepreneurship, job creation, and financial resilience.

The leaders succeeding in this shift treat inclusion as a scalable business model, not a CSR initiative. They invest in technology that adapts to local needs, building resilient cloud-based fintech platforms that meet regulatory demands and scale fast.

This is where Sigma Infosolutions brings its strength: designing custom fintech software development frameworks that translate inclusion into impact; one line of code, one community at a time.

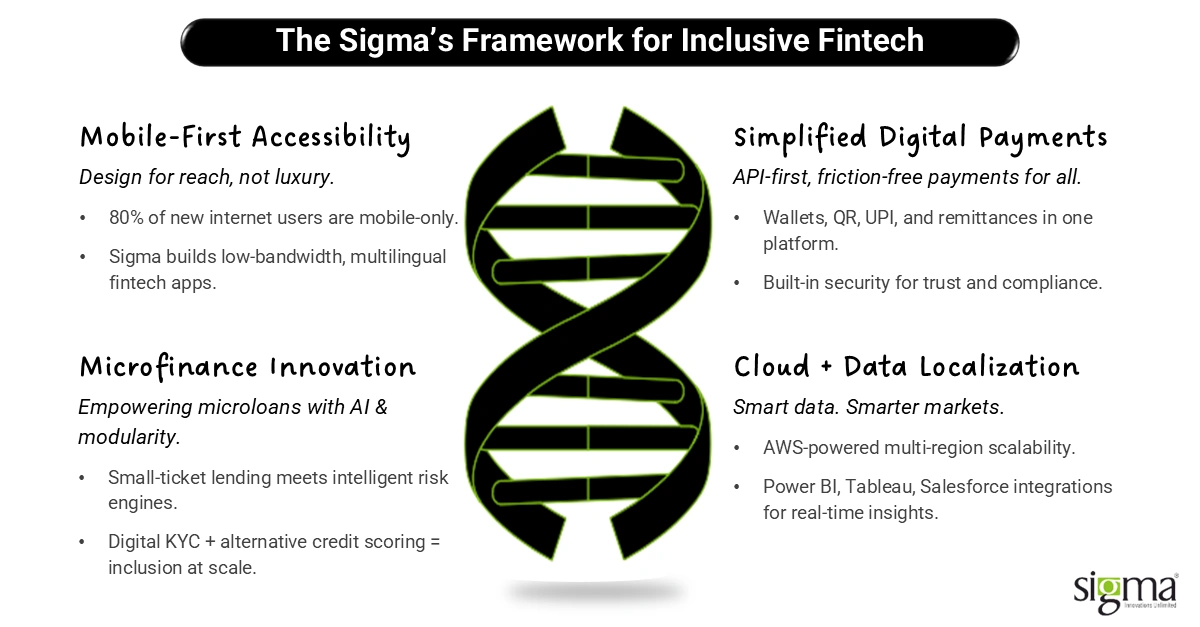

How Technology Leaders Can Drive Scalable Inclusion (The Solution Framework)

Bridging the inclusion gap in emerging markets takes more than ambition; it demands architecture built for agility, compliance, and trust. Technology leaders in North America are increasingly realizing that the path to financial inclusion isn’t about reimagining banking from scratch; it’s about engineering smarter, modular systems that meet people where they are — on their phones, in cash-heavy economies, and within diverse regulatory landscapes.

At Sigma, we help fintechs turn that vision into execution. Our fintech software development services are designed to balance innovation with practicality, delivering custom fintech software development that scales securely across borders. Here’s how we help you drive inclusive growth through technology that’s built to adapt:

Design for Mobile-First Accessibility

- Over 60% of new internet users in emerging markets access the web exclusively via smartphones.

- Sigma engineers mobile-first fintech software solutions that run smoothly even on low bandwidth or older devices, ensuring inclusivity from the ground up.

- Our teams use ReactJS and progressive web app frameworks to create responsive, intuitive interfaces for lending, payments, and digital banking.

- These apps are not just lighter; they’re smarter, built for offline sync, local language options, and scalable updates that enhance real-world usability.

Think of these apps like solar lanterns: lightweight, accessible, and capable of brightening financial access even where infrastructure is weak.

Enable Microfinance Innovation

- Microloans are transforming local economies, but scaling them requires strong tech underpinnings.

- Sigma’s Fintech Product Engineering Services and AI-driven RegTech Compliance Automation Solutions empower lenders with modular architectures that adapt quickly to local market needs.

- We integrate digital KYC, alternative credit scoring models, and AI-powered risk engines to enable accurate, fast lending decisions even with thin-file borrowers.

- Our cloud-based and data analytics frameworks give real-time visibility into borrower behavior, improving repayment rates and portfolio quality.

Simplify Digital Payments

- From UPI in India to M-Pesa in Africa, digital payments are redefining access.

- Sigma builds API-first, cloud-native fintech software solutions that integrate digital wallets, QR payments, UPI, and remittance networks under one unified system.

- Our Digital Payment Solutions ensure compliance and trust through security-by-design principles, encryption standards, and continuous monitoring.

- By combining scalability with compliance, we help fintechs deliver safe, seamless cross-border payment experiences.

Localize Through Cloud and Data Analytics

- No two markets are the same. Local relevance requires flexible infrastructure and deep data insights.

- Sigma leverages AWS-powered cloud frameworks to ensure multi-region compliance and scalability, enabling fintechs to deploy faster and adapt to evolving local regulations.

- With Power BI, Tableau, and Salesforce integrations, we enable real-time performance tracking, customer segmentation, and credit risk analysis.

- These insights help fintechs personalize offerings, from Digital Lending Solutions to Investment Software Solutions, driving both inclusion and profitability.

Think of data analytics as the GPS of financial inclusion: guiding every decision, adjusting to new roads, and helping fintechs reach underserved destinations safely.

Sigma’s Fintech Software Development Services in the USA have helped fintechs, lenders, and payment providers engineer inclusive, scalable, and compliant systems that truly make an impact in diverse markets. By combining cloud-based fintech platforms, embedded finance platforms, and scalable fintech architecture, we help you turn financial inclusion into measurable growth.

Also Read: Banking-as-a-Service (BaaS) Solutions Driving Growth in Embedded Finance

Sigma Infosolutions’ Experience: Building Inclusive Fintech for Diverse Markets

At Sigma, we don’t just build software; we engineer trust, access, and opportunity. Our journey in fintech software development services has taken us from urban tech hubs in North America to underserved regions in Africa, Latin America, and Southeast Asia. In each market, the story is the same: people want access, businesses want scale, and both need technology that bridges the gap.

We’ve helped fintech innovators, lenders, and payment facilitators design solutions that bring financial inclusion to life. Whether it’s enabling microloans for small business owners or building API-first payment ecosystems, our work reflects one belief: inclusion thrives when technology listens before it speaks.

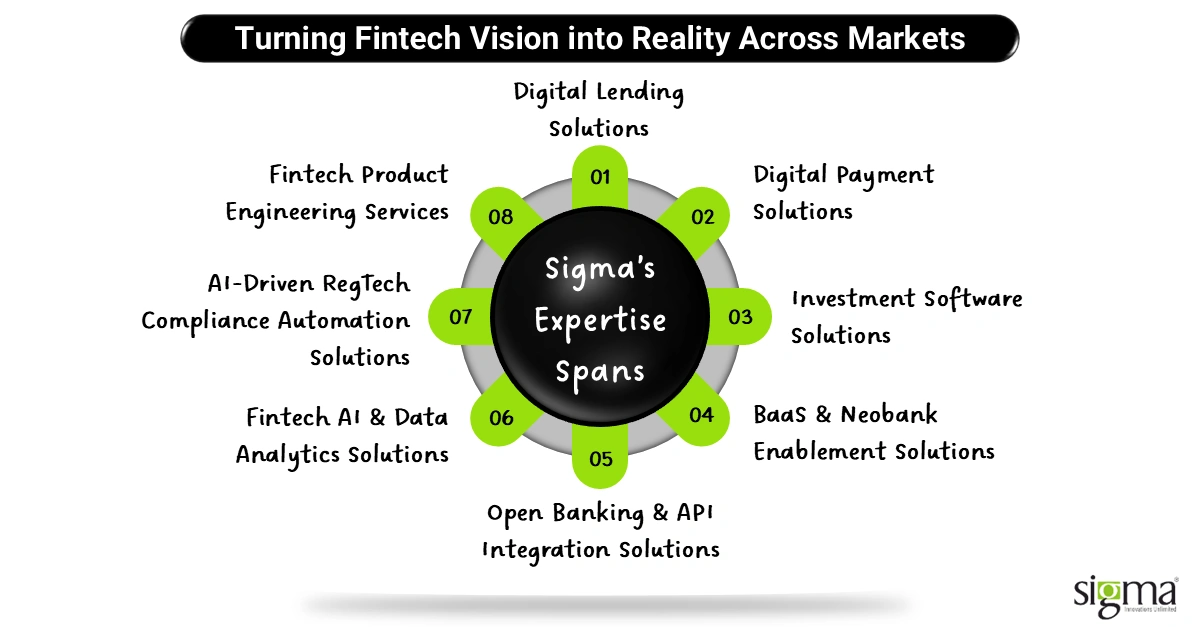

Our Core Fintech Software Development Capabilities

Our end-to-end custom fintech software development framework covers every major innovation pillar that defines today’s inclusive finance landscape:

- Digital Lending Solutions: Platforms that simplify microloan origination, credit scoring, and repayment tracking for business and personal lenders. Sigma has built cloud-ready systems that helped lenders reduce loan turnaround time and expand to new borrower segments efficiently.

Explore our digital lending solutions to improve your loan conversion!

- Digital Payment Solutions: From QR code payments to UPI and digital wallets, our API-first systems support secure, real-time payment experiences. One of our clients, a cross-border payment facilitator, scaled operations across three countries with zero downtime during peak transaction hours.

Launch tailored payment flows with digital payment solutions!

- Investment Software Solutions: We develop data-driven wealth management and investment automation platforms that democratize access to capital markets. Our platforms empower users to start small, invest wisely, and build long-term financial resilience.

Redefine wealthtech management with our investment management software expertise!

- BaaS & Neobank Enablement Solutions: Sigma helps traditional players and startups alike launch embedded banking products faster through modular APIs, robust security, and scalable cloud infrastructures.

Discover our BaaS & Neobank enablement solutions today!

- Open Banking & API Integration Solutions: With expertise in PSD2-compliant APIs and cross-platform interoperability, we help fintechs deliver unified user experiences while meeting complex regional compliance requirements.

Begin your secure API journey with open banking & API integration solutions!

- Fintech AI & Data Analytics Solutions: Using AI and predictive analytics, we transform raw data into actionable insights. Our solutions help lenders assess risk in real time, enabling smarter and faster decision-making.

Unlock intelligence-driven insights with AI-powered data analytics solutions for Fintech!

- AI-Driven RegTech Compliance Automation Solutions: Designed for multi-market operations, our RegTech systems automate KYC, AML, and reporting processes, reducing compliance costs and human error while improving speed-to-market.

Automate your compliance workflows with RegTech compliance automation solutions!

- Fintech Product Engineering Services: From concept to code, Sigma’s agile engineering teams co-create with your technology leaders to deliver secure, scalable, and performance-optimized products that adapt as your business grows.

Leverage the best fintech product engineering services for your remarkable business outcomes!

Experience That Speaks Through Impact

- Leveraging Fintech AI & data analytics for lenders: We’ve built digital lending systems for small business lenders serving gig workers and merchants. By integrating digital KYC and alternative credit scoring, they achieved loan approvals 40% faster and a 25% higher conversion rate.

- Seamless Salesforce Integration: We enabled a major national banking association to transform government check verification from a manual process to a centralized, real-time platform built on Salesforce, ensuring instant, secure, and compliant validation of checks and payee details.

- API-First lead integration & customization via AWS ecosystem: Leveraging an AWS cloud foundation, we provided a leading lender with the “digital backbone” needed for future-proof scalability and operational elasticity, enabling seamless integration of critical systems like Amazon Connect and exclusive lead sources.

Engineering Empathy at Scale

Inclusive fintech isn’t just about writing code; it’s about understanding people. Our engineering philosophy centers on empathy. We build for bandwidth constraints, multi-lingual UI/UX, and secure digital onboarding experiences that respect cultural and regional nuances. Every product is field-tested for performance in real-world conditions, ensuring that inclusivity is not just theoretical, it’s tangible.

Collaborative Model for Continuous Innovation

Sigma’s collaboration model is built around partnership, not outsourcing. We work closely with VPs of Technology, CTOs, Product Heads, and Engineering Directors to ensure compliance, speed, and innovation stay aligned. Through continuous engagement, transparent sprints, and scalable DevOps practices, we make sure your fintech vision doesn’t just launch, it lasts.

Because building for inclusion takes more than technology, it takes a team that understands both the complexity of global finance and the simplicity of human needs. And that’s exactly what Sigma delivers through its Fintech Software Development Services in the USA, bridging opportunity and access, one platform at a time.

Also Read: US FinTech Market Growth, Trends, and Forecast

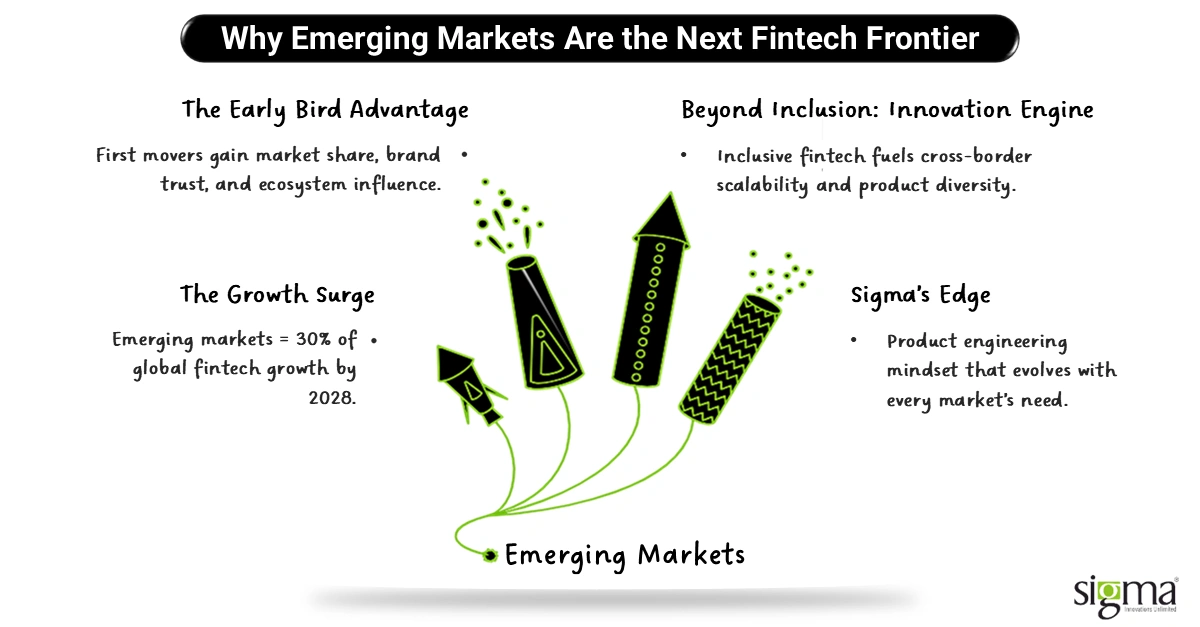

Why Emerging Markets Are the Next Fintech Growth Engine (The Strategic Advantage)

The next decade of fintech innovation won’t be written in New York or London; it’ll be written in Lagos, Mumbai, and São Paulo. Emerging markets are fast becoming the beating heart of fintech growth, fueled by mobile connectivity, digital wallets, and young, tech-savvy consumers ready to embrace change.

According to McKinsey, emerging markets like Africa, Asia–Pacific (excluding China), Latin America, and the Middle East are projected to contribute more than 30% of global Fintech revenue by 2028. That’s not just growth, it’s transformation. For North American fintech leaders, this presents a once-in-a-generation opportunity to expand reach, accelerate innovation, and deliver meaningful social and financial impact at the same time.

Here’s why it matters now more than ever:

- First-Mover Advantage: Early adopters are already building market share, brand trust, and ecosystem partnerships that late entrants will struggle to match.

- Cross-Border Scalability: Inclusive fintech solutions built for underserved regions can be easily adapted for other markets, creating a flywheel of innovation and efficiency.

- Product Diversification: Custom fintech software development allows companies to test, localize, and launch new financial products, from micro-savings to BNPL, without heavy infrastructure investments.

- Continuous Evolution: Sigma’s product engineering mindset ensures that every platform grows with market realities through modular upgrades, API integrations, and agile compliance frameworks.

This shift reframes financial inclusion not as charity, but as the smartest way to scale. Fintechs that invest today in digital financial services for emerging markets are essentially building the future backbone of global finance; one that’s mobile, inclusive, and built to last.

How Sigma Infosolutions Powers Inclusive Growth

At Sigma Infosolutions, we understand that scaling inclusion requires equal parts technology precision and human empathy. Our fintech software development services in the USA are built for fintechs, lenders, and financial innovators that want to deliver secure, compliant, and high-performing digital platforms across borders.

Deep Domain Expertise

We specialize across key fintech domains, lending, payments, and wealth tech, bringing over a decade of experience building digital lending solutions, digital payment solutions, and investment software solutions that power real-world inclusion.

Technology Stack

From .NET and ReactJS to AWS, Salesforce, Power BI, and Magento, Sigma builds cloud-ready ecosystems that enable embedded finance, analytics, and real-time decisioning.

Delivery Framework

Our approach is Agile, API-first, and compliance-ready, helping fintechs integrate Open Banking & API Integration Solutions, BaaS & Neobank Enablement Solutions, and AI-Driven RegTech Compliance Automation Solutions without disrupting existing systems.

Business Impact

Our clients consistently see:

- Faster go-to-market speeds by up to 40%

- Scalable architectures that handle millions of transactions with ease

- Reduced operational risk through continuous compliance and data visibility

By combining Fintech AI & Data Analytics Solutions with Fintech Product Engineering Services, Sigma turns inclusion into measurable business value. For North American technology leaders, we are not just your development partner; we are your co-architects for building scalable fintech architecture that connects opportunity with impact.

Tech-Enabled Financial Inclusion as a Catalyst for Global Prosperity (The Future)

The future of fintech isn’t just digital, it’s inclusive. As billions of people in emerging markets come online, tech-enabled financial inclusion is unlocking access to credit, savings, and insurance for those once excluded from traditional finance. This shift is shaping a more resilient, equitable, and borderless global economy.

For North American technology leaders, this is not a distant opportunity; it’s a call to lead. By investing in inclusive fintech platforms, they have the power to build ecosystems that fuel entrepreneurship, empower small businesses, and strengthen communities worldwide.

At Sigma Infosolutions, we believe innovation has purpose when it bridges access with opportunity. Our mission goes beyond developing software; we engineer growth with empathy, precision, and purpose. Whether it’s modernizing lending infrastructures, building API-first banking solutions, or deploying AI-driven compliance automation, we help fintechs scale securely and inclusively across borders.