Friction-Free Digital Lending Starts with NLP and OCR

Today’s borrowers aren’t waiting in line at the bank. The lending game has gone digital, fast. But while the front end may look slick with fancy dashboards and digital forms, the back end? It’s often held together with sticky notes, spreadsheets, and people manually flipping through PDFs.

That’s where the real friction hides.

Manual document checks, inconsistent data entry, and back-and-forth between departments lead to slow approvals, high error rates, and frustrated teams. And in a world where speed and accuracy are everything, those old-school processes just don’t cut it anymore.

Enter Natural Language Processing (NLP) and Optical Character Recognition (OCR)—two powerful technologies that are reshaping how digital lending software solutions work behind the scenes. Think of them as the eyes and brain of your lending process: OCR reads the documents, NLP understands what they mean, and together, they unlock real digital transformation in lending.

This blog dives into how these AI-driven tools are removing the friction from the end-to-end lending process, enabling smarter, faster, and more scalable digital lending solutions for businesses ready to step into the future.

The Rise of Friction-Free Digital Lending

In lending, “friction” is anything that slows down, confuses, or frustrates the process for both lenders and borrowers. And in today’s always-on, app-driven world, friction is a deal-breaker.

So, what does friction-free look like in digital lending?

Here’s a breakdown of the advantages and workings of digital lending automation:

- Accelerated Processing: Loan applications are processed in minutes, not days, leading to faster approvals.

- Reduced Manual Effort: Eliminates the need for manual chasing of missing documents and cross-checking data.

- Improved Accuracy: Significantly reduces errors in the loan approval process.

- Enhanced Customer Experience (CX): Provides a smoother and more efficient experience for borrowers from application to decision.

- Competitive Edge: Offers the kind of efficiency essential for modern lenders and fintechs to remain competitive.

- Meets Borrower Expectations: Addresses the growing demand for rapid loan approvals, with most borrowers expecting decisions within a day.

- Cost Reduction & Decision Precision: Lenders implementing comprehensive automation can achieve substantial cost savings and improve decision accuracy.

- Beyond Online Forms: True efficiency requires rethinking data, document, and decision handling, which is where digital lending automation excels.

- AI-Powered Document Processing: Smart AI, utilizing technologies like Natural Language Processing (NLP) and Optical Character Recognition (OCR), automates the reading, interpreting, and verifying of hundreds of documents.

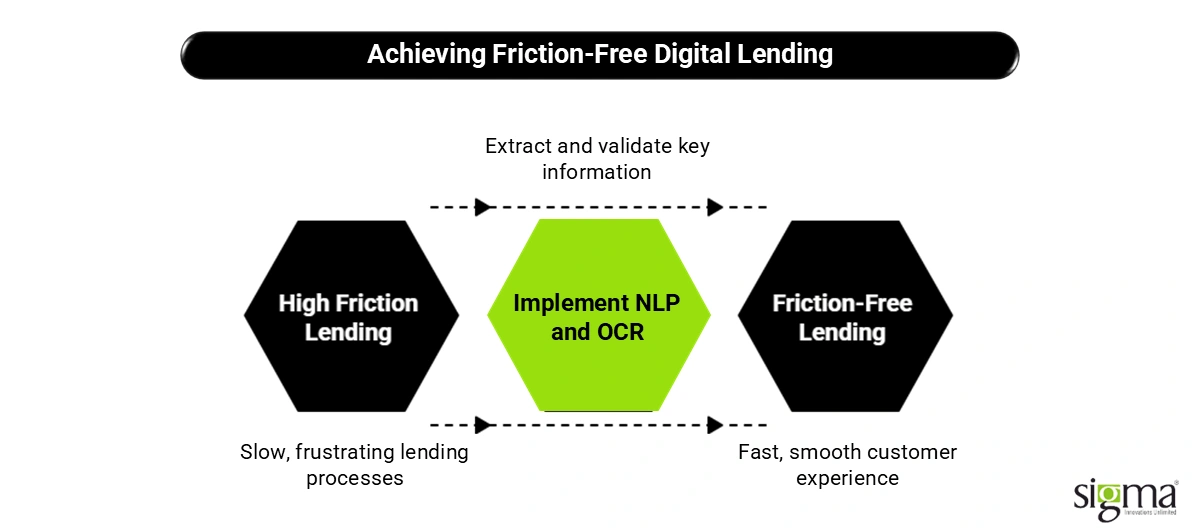

- Automated Data Extraction & Validation: NLP and OCR work together to extract and validate key information, feeding it directly into systems in seconds, eliminating typos, delays, and bottlenecks.

For lenders, this shift means more than just operational speed. It unlocks the ability to scale lending operations, reduce manual dependencies, stay compliant in an AI-driven lending environment, and deliver personalized experiences at scale.

And for decision-makers? It’s the difference between just surviving in the digital lending space and leading it.

As we explore deeper, you’ll see how NLP and OCR together form the backbone of truly friction-free digital lending software solutions, transforming traditional workflows into intelligent, automated ecosystems.

OCR & NLP – The Backbone of Lending Process Automation

At the heart of modern digital lending automation lies a powerful duo—OCR and NLP. These technologies are the unsung heroes behind the curtain, working 24/7 to clean up the messy, document-heavy world of lending.

Let’s break it down:

OCR (Optical Character Recognition) is like giving your software a pair of reading glasses. It scans text-heavy documents—think paystubs, driver’s licenses, W-2s, bank statements—and turns them into structured, searchable, and usable data. So instead of someone manually typing out an applicant’s income from a scanned PDF, OCR pulls it in instantly and sends it where it needs to go.

NLP (Natural Language Processing) is the brain that helps machines understand human language. It extracts insights from unstructured content like emails, notes from loan officers, application comments, or chatbot interactions. It picks up on meaning, context, and even sentiment—something traditional systems simply can’t do.

Together, OCR and NLP form the foundation of Intelligent Document Processing (IDP)—the tech stack that turns chaotic document intake into clean, machine-readable workflows. This is critical in automated digital lending, where speed and accuracy can make or break the experience.

Imagine a loan application that includes a scanned tax return, a few bank statements, and an email from the applicant explaining their freelance income. OCR digitizes the documents. NLP interprets the explanation. The system then uses that data to make intelligent decisions or flag issues for review—no more backlogs, no more copy-paste errors.

By integrating AI in lending application processing, lenders get more than automation. They get error reduction in loan processing using AI, they cut turnaround times, and they create a better borrower experience—without adding more headcount.

This is what true end-to-end lending process automation looks like—and it’s powered by OCR and NLP working hand in hand.

Use Cases in Lending – From Application to Approval

In lending, speed and precision are everything. From the moment an application hits your system to the final disbursal, every step offers an opportunity for friction or optimization. This is where OCR and NLP, the driving forces behind digital lending software solutions, bring serious value.

Let’s walk through the lending journey and see how these technologies transform it:

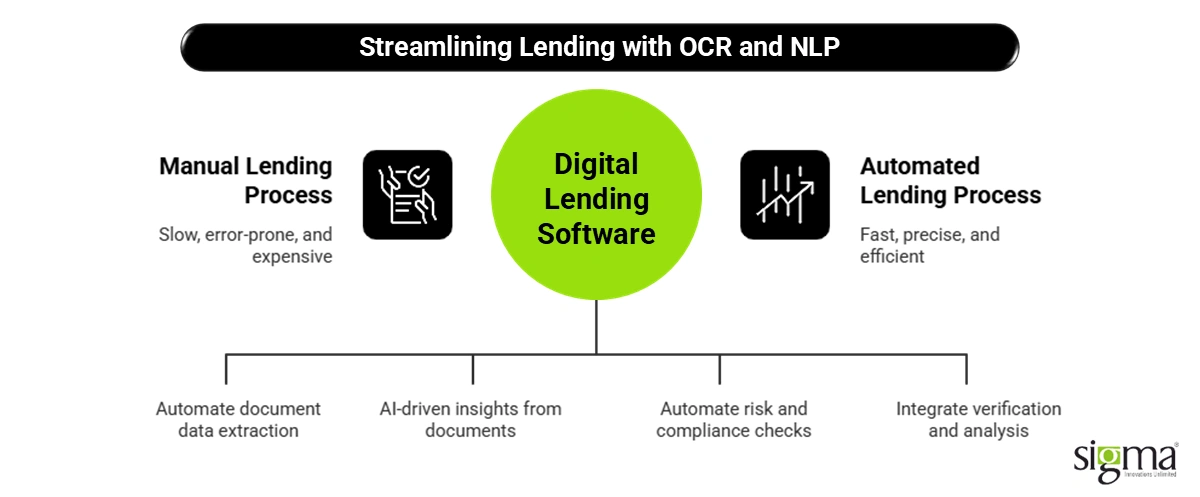

1. Loan Application Intake: Ditch the Manual Work

The process usually starts with a stack of documents—IDs, utility bills, income proofs, tax returns, and more. Manually entering this data? That’s slow, error-prone, and expensive.

With OCR, documents like Paystubs or scanned W-2s are instantly converted into machine-readable formats. No more typing out numbers or squinting at illegible scans.

Add NLP, and suddenly your system can verify addresses, match names, and flag mismatches or inconsistencies—all automatically. The result? Less manual data entry, faster file setup, and smoother starts to the loan journey.

2. Credit Underwriting: Smarter, AI-Driven Insights

Here’s where AI in lending application processing really shines.

NLP can scan through financial documents, extract key insights like income stability, employment history, or debt-to-income ratio trends, and feed that data into an AI-based credit scoring engine. This allows lenders to make more consistent, data-backed decisions—without drowning in paperwork.

For fintech lenders, especially, this is how personalized, dynamic credit models become possible.

3. Risk and Compliance Checks: Zero Tolerance for Gaps

Risk management is non-negotiable in lending.

NLP can parse names and keywords across documents to flag hits in PEP lists, sanctions databases, or AML-related content—automatically and in real time. No more manually comparing spreadsheets or missing compliance red flags.

Meanwhile, OCR ensures document completeness, timestamps, and traceable audit trails—crucial for ensuring compliance in AI-driven lending environments.

4. Decisioning and Disbursal: Speed Without Sacrifice

With Intelligent Document Processing (IDP)—powered by OCR + NLP—lenders can integrate document verification, data analysis, and rule-based decision engines into a single, seamless workflow.

This means quicker loan approvals, improved turnaround time (TAT), and a drastically better experience for both underwriters and borrowers.

The bottom line? With friction out of the way, you’re free to focus on growth—and your lending operations can finally move at the speed your customers expect. Elevate your operations even further with our AI development services, which leverage NLP and OCR for intelligent automation.

A glimpse of Sigma’s AI-powered capabilities: Revamping Resource Management with AI-Powered MatchSmart.

Business Benefits of NLP + OCR in Lending

For CTOs navigating the pressures of digital transformation in lending, the question isn’t whether to automate—but how fast you can do it while staying compliant, scalable, and customer-focused. That’s where NLP and OCR step in as the technology core of next-gen digital lending software solutions.

Let’s break down the business case:

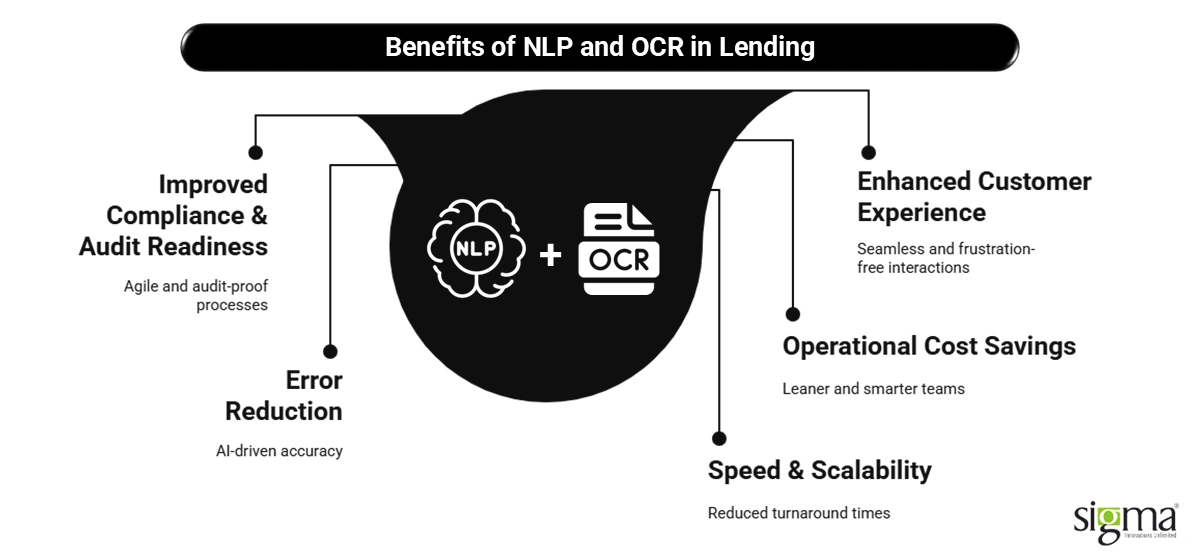

Speed & Scalability: From Days to Hours

With NLP and OCR embedded into your tech stack, lenders can reduce turnaround times (TAT) from days to mere hours. Incoming loan files no longer require manual triage—documents are read, interpreted, and routed in real-time. This isn’t just faster; it’s scalable.

When application volumes spike, your team doesn’t have to. Your infrastructure handles the load, enabling digital lending growth without a linear increase in headcount.

Error Reduction: AI That Catches What Humans Miss

Manual data entry and human review are both error magnets, especially under pressure. AI-driven parsing using OCR + NLP eliminates most of the slipups. Whether it’s a misread income figure or a missed red flag in a client note, intelligent systems reduce rework and enhance underwriting accuracy.

For CTOs focused on error reduction in loan processing using AI, this tech stack adds measurable ROI.

Operational Cost Savings: Leaner, Smarter Teams

By reducing dependency on manual reviews and repetitive checks, lenders can operate with fewer full-time employees (FTEs) in non-core roles. This means fewer resources spent on admin tasks and more focused on strategic functions like analytics, fraud detection, and customer growth.

The savings aren’t just in dollars—they’re in productivity and innovation velocity.

Improved Compliance & Audit Readiness

In highly regulated markets, OCR ensures every document is captured in full, timestamped, and ready for audit. NLP adds a layer of intelligence by flagging compliance risks in real-time, scanning content for terms related to AML, sanctions, or PEPs.

Together, they power end-to-end lending process automation that’s both agile and audit-proof.

Enhanced Customer Experience

A seamless, digital-first application process—with instant updates, no back-and-forth, and minimal friction—is no longer a nice-to-have. It’s the new benchmark. NLP and OCR ensure that every interaction is fast, clean, and frustration-free.

For tech leaders, this is how digital transformation in lending becomes a competitive advantage, not just an IT project.

Tech Stack Considerations for Implementation

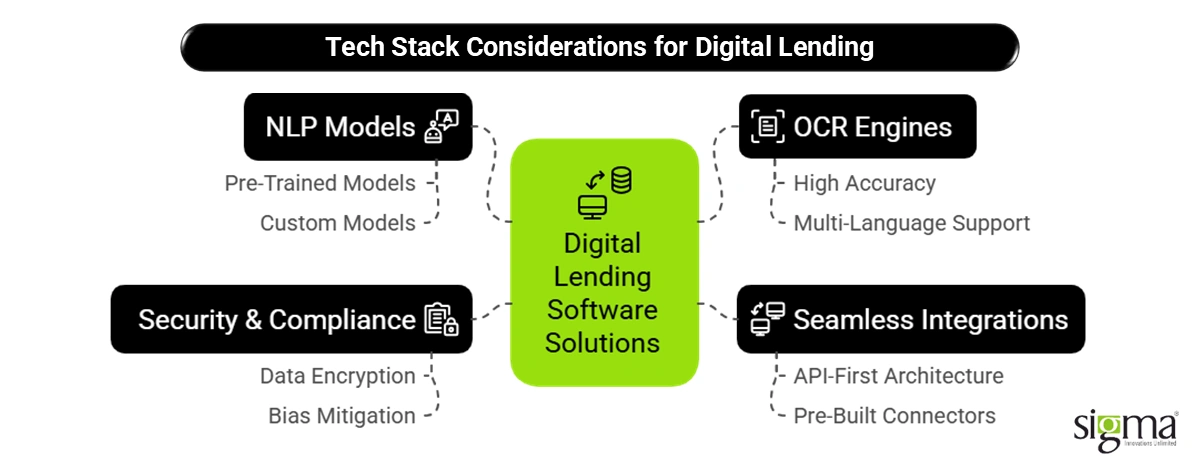

For tech leaders in lending, implementing digital lending software solutions powered by NLP and OCR isn’t just about picking the latest shiny tools—it’s about building a stack that’s smart, scalable, secure, and aligned with business goals.

Here’s what decision-makers should be evaluating:

Pre-Trained vs. Custom NLP Models

Start by deciding between pre-trained NLP models (like those from AWS, Google, or OpenAI) and custom models trained on your own lending data. Pre-trained models are fast to deploy and handle general language well, while custom models can be fine-tuned for niche lending terms, underwriting notes, or compliance triggers.

If you’re dealing with high document variability or need AI in consumer lending workflows, custom NLP may provide better accuracy and control.

OCR Engines: Accuracy is Everything

Not all OCR engines are created equal. Choose one with high accuracy for financial documents, ID cards, and handwritten forms. Look for features like auto-orientation, table detection, and multi-language support—especially if you’re scaling across geographies or dealing with diverse borrower profiles.

Seamless Integrations Matter

Any NLP/OCR solution must plug smoothly into your Loan Origination System (LOS), Loan Management System (LMS), and Customer Relationship Management (CRM) platform. API-first architecture is critical here.

Look for vendors offering pre-built connectors or well-documented APIs that enable smooth digital lending automation without disrupting your core systems.

Don’t Overlook Security, Compliance & Bias

With AI, data security and bias mitigation must be non-negotiable. Ensure that NLP models don’t inadvertently learn or reinforce discriminatory patterns. OCR outputs should be encrypted and audit-traceable.

Select vendors that are SOC 2, ISO 27001, or GDPR-compliant, and include explainability tools to track model decisions—this helps ensure compliance in AI-driven lending workflows.

Choosing the right tech stack isn’t just about features—it’s about future-proofing your automated digital lending capabilities while staying secure, compliant, and ready to scale.

Overcoming Challenges – Pitfalls to Watch Out For

As powerful as NLP and OCR are, implementing them in digital lending software solutions isn’t always plug-and-play. For CTOs and lending leaders looking to scale smartly, it’s important to navigate the bumps on the road to automation.

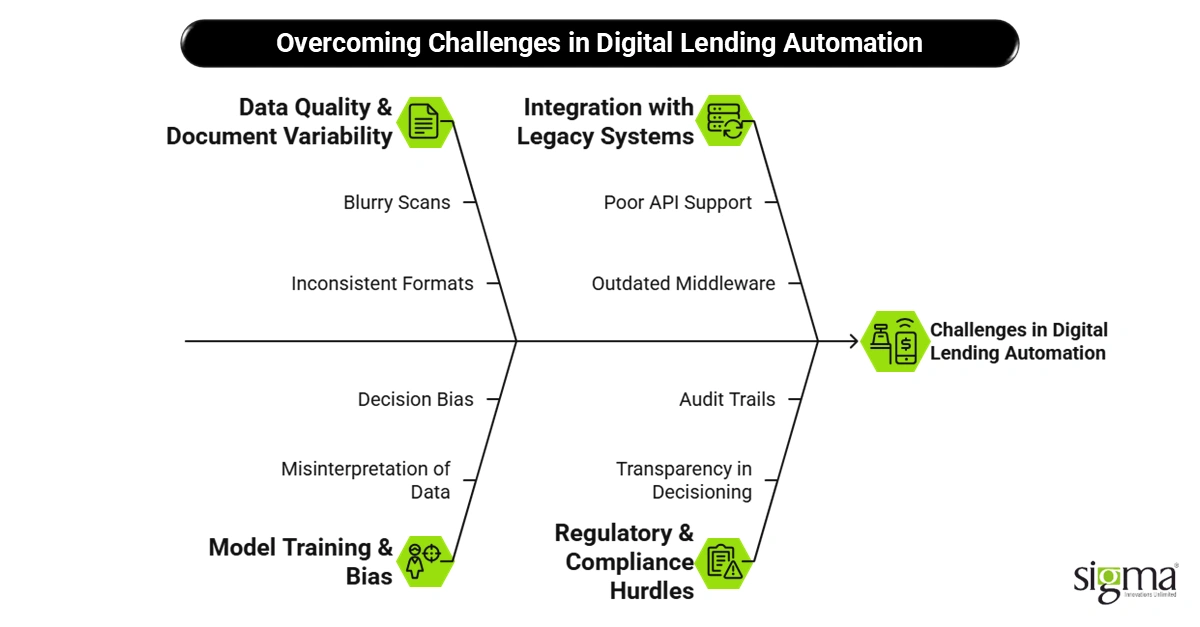

Data Quality & Document Variability

OCR accuracy is only as good as the documents it reads. Blurry scans, handwritten notes, or inconsistent formats can trip up even the best engines. That’s why investing in pre-processing tools—like image enhancers or form standardizers—is crucial for consistent digital lending automation.

Model Training & Bias

NLP models that aren’t trained properly can misinterpret critical data or, worse, introduce decision bias. For example, relying on historical loan data that reflects legacy practices can reinforce unintentional exclusion.

Lenders must actively monitor for fairness and transparency to ensure that AI in lending application processing supports ethical, data-driven decisions.

Integration with Legacy Systems

Let’s be real—most lenders don’t have the luxury of rebuilding from scratch. Integrating OCR/NLP into legacy LOS or LMS systems can get messy. Poor API support or outdated middleware can create serious delays and inefficiencies.

Look for solutions that support modular rollouts and offer IDP APIs that play nicely with what you already have.

Cost of Implementation

Mid-sized lenders often worry about the upfront investment. But here’s the good news: cloud-based platforms, pay-as-you-use pricing models, and pre-trained models make these technologies more accessible than ever.

Start small—optimize one part of the end-to-end lending process—and scale from there.

Regulatory & Compliance Hurdles

With AI-driven lending, regulators are watching closely. Ensure transparency in automated decisioning, maintain audit trails, and choose partners with built-in explainability features to avoid compliance risks.

The path may be complex, but avoiding these pitfalls sets the stage for success in a truly friction-free digital lending environment.

The Future of Digital Lending Automation

Today, OCR and NLP are driving real change in lending—but they’re just the beginning. The future? It’s all about AI orchestration: intelligent systems that not only read and interpret data but also predict outcomes, guide decisions, and automate actions across the entire digital lending software solution lifecycle.

Imagine loan decisions powered by real-time behavior, not just static credit scores. Predictive insights will flag potential defaults before they happen. Behavioral scoring models will understand spending patterns and financial signals far beyond traditional underwriting. Real-time underwriting engines will adapt dynamically as new data flows in.

The rise of Generative AI (GenAI) is also reshaping the customer experience. From handling FAQs to guiding borrowers through complex applications in plain language, GenAI enables scalable, human-like conversations without long wait times or confusing chatbot scripts. This is the foundation of next-gen CX: fast, friendly, and always-on.

But the ultimate vision goes even further.

We’re heading toward a future where lending becomes invisible—instant, intelligent, and fully compliant. Borrowers won’t fill out forms. Systems will know enough to initiate offers, complete verification, and fulfill compliance—all in the background.

For lenders, this means no more fragmented tech stacks or patchwork automation. It’s a shift from manual control to intelligent orchestration. A world where AI in consumer lending workflows isn’t just a tool—it’s the system itself.

And for forward-thinking organizations ready to lead that charge, the opportunity to redefine digital lending is here—and accelerating fast.

Conclusion

To truly unlock digital transformation in lending, technologies like OCR and NLP must be at the heart of your operations. They’re not just tools—they’re the foundation for faster approvals, error reduction, and seamless borrower experiences.

If you’re a digital lender or fintech looking to accelerate growth, now’s the time to audit your current workflows and identify where automation can make the biggest impact.

Explore how your organization can implement friction-free digital lending software solutions with a trusted technology partner like Sigma Infosolutions—bringing industry expertise, AI-driven innovation, and scalable solutions to your lending stack.

Ready to build a friction-free lending experience?

Partner with experts who understand your challenges and can tailor AI-driven solutions to your needs. Let’s transform your lending journey together!