From Compliance to Confidence: Security by Design in Fintech Cybersecurity

Key Takeaways:

- From Locks to Launchpads: Move beyond treating security as a padlock to make it your launchpad for faster go-to-market and customer trust.

- From Firefighting to Future-Proofing: Stop patching leaks after the storm; build systems that weather every compliance and cyber challenge.

- From Cost Center to Confidence Engine: Reimagine security not as an expense, but as the engine driving fintech credibility and growth.

The fast pace of fintech innovation often prioritizes speed, leading to a critical oversight where security is relegated to playing catch-up. Many fintechs race to launch new products, only to treat cybersecurity and compliance as items to tick off at the end. This reactive mindset creates a dangerous paradox: while fintechs push boundaries of digital banking, they leave the backdoor open for cyber threats and compliance failures.

According to the IBM report, the global average cost of a data breach saw a 5-year low at $4.44 million in 2025, yet the U.S. average surged by 9% to an all-time high of $10.22 million. The urgent speed of AI adoption has created a critical security deficit. The stark reality is that 97% of organizations breached through AI systems lacked fundamental access controls.

The truth is simple: compliance done late is compliance done wrong. Fintech cybersecurity can no longer be a defensive tactic; it must become a strategic differentiator. That’s where Security by Design comes in, embedding cyber threat protection, encryption, identity management, and fraud detection right from the first line of code.

This article examines how forward-thinking fintech leaders are redefining their approach, from fearing audits to embracing confidence. We’ll unpack the pitfalls of reactive compliance, show how proactive design builds trust and agility, and reveal how Sigma Infosolutions helps financial organizations build resilience through secure, compliant, and scalable fintech software development practices.

Why Traditional Fintech Cybersecurity Fails

In many fintech organizations, cybersecurity is still treated like a final inspection before launch, a necessary evil rather than a core design element. This “checkbox compliance” mindset means that teams often scramble to meet regulations after development is done. The result? Delayed go-lives, costly reworks, and systems that feel more patched together than protected.

For CTOs and CIOs, this is an everyday struggle. They’re expected to innovate fast and keep users safe, but when compliance enters late, it acts more like a roadblock than a safeguard.

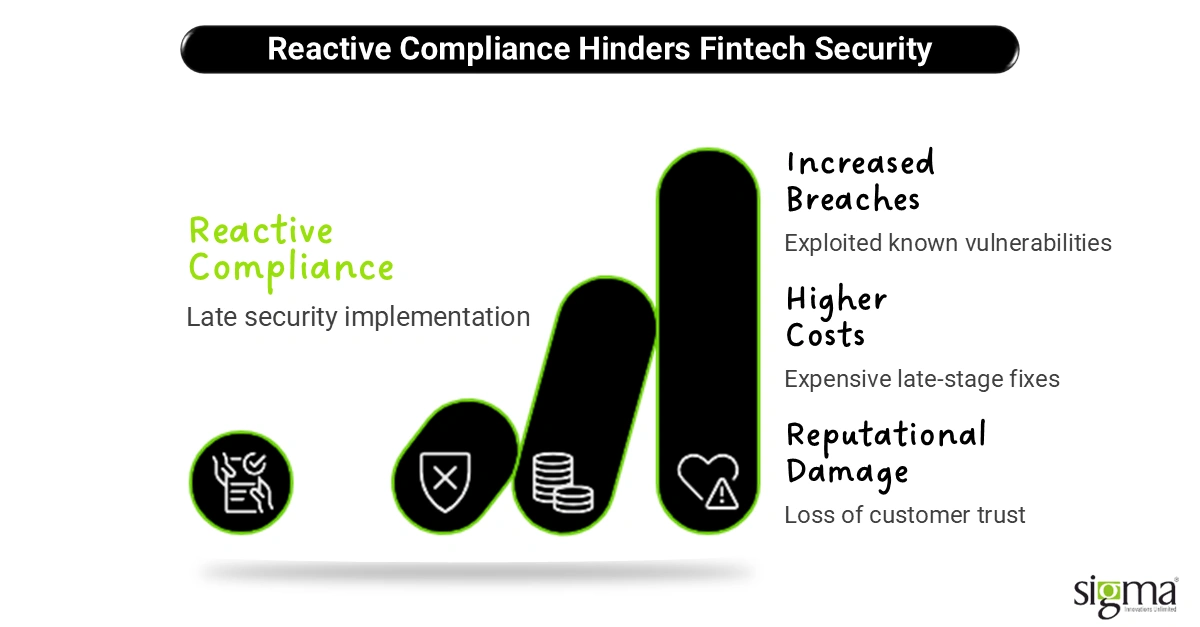

According to Verizon’s study, third-party involvement in data breaches has doubled year-over-year, now accounting for a staggering 30% of all incidents. This surge is primarily fueled by the exploitation of known vulnerabilities, the lack of cybersecurity reviews that happen only after products are built, not during design, and the subsequent business interruptions. This reactive approach is why fintech cybersecurity continues to lag behind the speed of innovation.

The consequences go far beyond compliance penalties. Patchwork security leaves cracks for attackers to exploit. A recent report found that 74% of financial breaches involved human or process errors tied to weak development practices. That means most risks aren’t coming from hackers; they’re baked into the code from the start.

Reactive compliance also eats into profits. A late-stage security fix can cost up to 30x more than one addressed during early development. Beyond the financial cost, reputation damage is harder to repair. In fintech, once trust is lost, customers and investors are quick to move on.

That’s why modern fintech leaders are rethinking their strategy, shifting from compliance-by-fear to confidence-by-design. In the next section, we’ll explore how Security by Design transforms fintech compliance into a catalyst for innovation, not a constraint.

The New Paradigm: Security by Design

Imagine building a house without locking the doors, and adding them only after the neighbors complain about safety. That’s what traditional fintech cybersecurity looks like. But the industry is now waking up to a smarter approach: Security by Design!

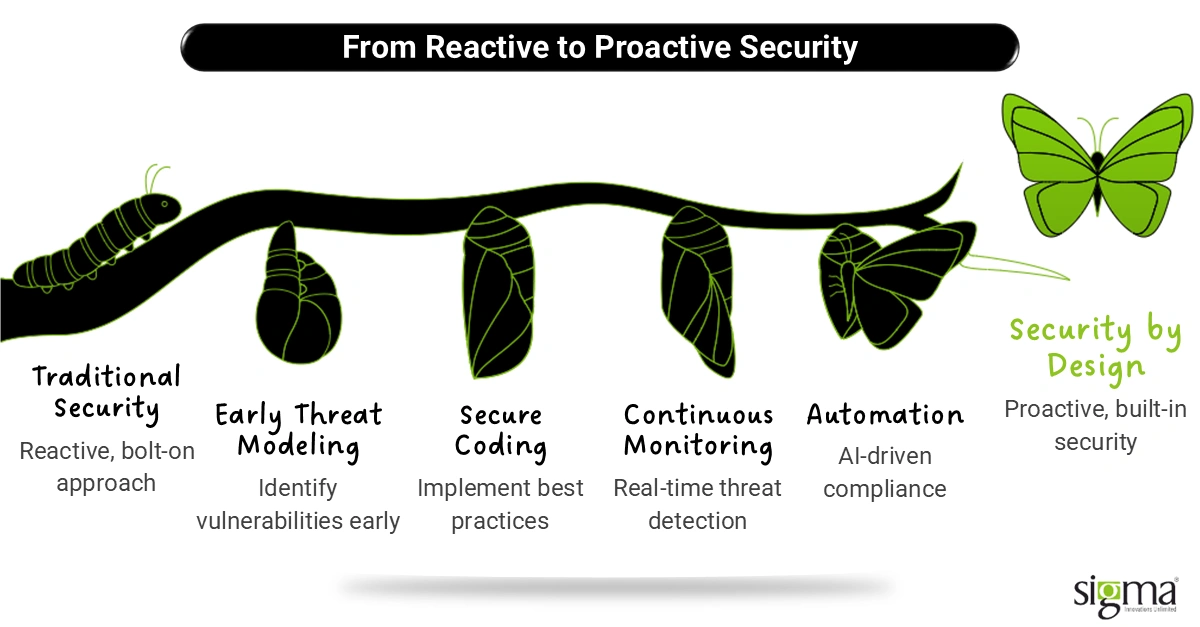

Security by Design means embedding security measures at every stage of the fintech software development process, from concept to deployment. Instead of reacting to threats or compliance gaps after launch, development teams bake in protection right from the first line of code. In this approach, compliance isn’t the goal; it’s the outcome of strong design.

At its core, Security by Design focuses on four key pillars:

- Early Threat Modeling: Identifying potential vulnerabilities and attack surfaces before development begins, reducing the risk of late-stage surprises.

- Secure Coding Standards: Following best practices like encryption, identity and access management (IAM), and multi-factor authentication (MFA) to ensure data integrity and fintech data protection.

- Continuous Monitoring: Implementing real-time threat detection, fraud detection and prevention technologies, and performance checks to maintain digital banking security.

- Automation in Testing & Compliance: Leveraging AI-driven RegTech compliance automation solutions to streamline audits and ensure that security and compliance are always in sync.

Globally, this proactive model is gaining traction fast. The World Economic Forum’s 2024 Cybersecurity Outlook reports that 73% of financial institutions are prioritizing “security by design” strategies as part of their digital transformation initiatives.

As fintech ecosystems expand, Security by Design seamlessly connects with modern Governance, Risk, and Compliance (GRC) frameworks, AI-driven RegTech platforms, and continuous security validation tools. Together, they create a resilient ecosystem where compliance happens naturally, and innovation moves without friction.

For CTOs, CIOs, and technology leaders, the takeaway is clear: security can no longer be bolted on; it must be built in. When your development culture shifts this way, compliance becomes effortless, and your fintech platform evolves from vulnerable to virtually unshakable.

Also Read: Banking-as-a-Service (BaaS) Solutions Driving Growth in Embedded Finance

Building Blocks of Proactive Fintech Security

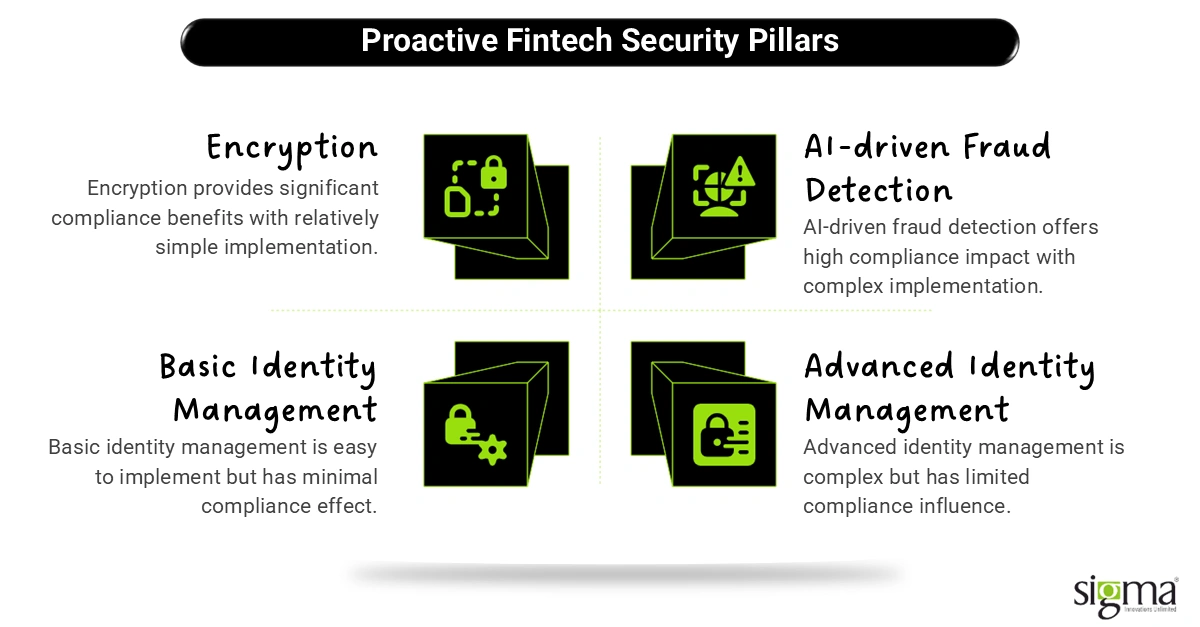

While regulations define the minimum bar for fintech cybersecurity, real resilience comes from going beyond checklists. Proactive fintech security means anticipating threats before they strike through encryption, identity management, and AI-driven fraud detection. These three pillars not only safeguard systems but also transform compliance into a seamless, automated outcome.

Encryption: Protecting Data at Every Layer

Data is the new currency, and like currency, it needs to be protected in every vault and transaction.

- Encryption in Transit and at Rest: By encrypting sensitive data both while it’s stored and while it’s moving, fintech platforms ensure full fintech data protection.

- Global Standards Alignment: Modern encryption protocols such as AES-256 and TLS 1.3 align with SOC 2, PCI DSS, and ISO 27001 standards, ensuring fintech compliance in the USA and beyond.

- Sigma’s Secure Development Practice: At Sigma, encryption is woven into every stage of financial software development services, from design to deployment. Our developers integrate encryption libraries, key management systems, and automated checks that prevent weak configurations before they become liabilities.

Encryption doesn’t just guard data. It builds trust, ensuring customers feel safe every time they interact with a fintech product.

Identity Management: Beyond Access Control

Traditional access control is like locking one door in a building full of open windows. Modern fintechs need a Zero Trust approach where every user, device, and API must prove legitimacy continuously.

- Role of IAM: Identity and Access Management (IAM) frameworks and Multi-Factor Authentication (MFA) ensure that only verified entities access sensitive resources.

- Auditability and Trust: Embedded identity management improves audit trails, makes compliance reporting easier, and reinforces customer confidence.

- Sigma’s Strength: Sigma designs secure authentication and authorization workflows customized for fintech software development in the USA by integrating IAM platforms and identity governance systems into clients’ digital ecosystems.

Fraud Detection: AI-Driven, Real-Time Defense

Fraud detection is where proactive security truly meets intelligence.

- Machine Learning Models: AI models identify unusual patterns in transaction behavior, helping detect fraud before it causes financial or reputational damage.

- Compliance & Customer Safety: Proactive fraud detection helps financial institutions avoid compliance breaches and reduce customer loss rates.

- Sigma’s Edge: Sigma leverages advanced analytics, predictive models, and AI frameworks to deliver AI-driven RegTech compliance automation solutions, providing continuous monitoring and real-time alerts for emerging risks.

By integrating these proactive measures into the DNA of fintech software development, Sigma helps CTOs, CIOs, and VPs of Technology turn cyber threat protection from a burden into a business advantage.

Also Read: 5 Ways Open Banking API Integrations Are Powering Modern Financial Solutions

Sigma’s Secure Development Framework: From Code to Compliance

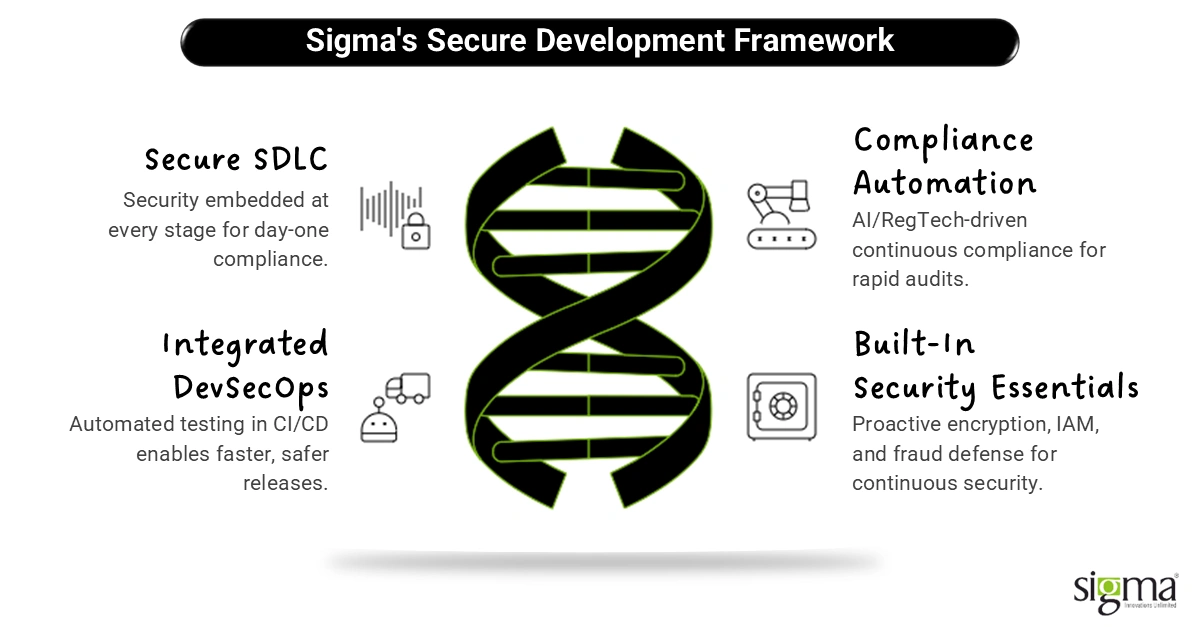

Fintech innovation thrives on speed, but true leadership comes from combining speed with security. That’s exactly where Sigma Infosolutions steps in. Our Secure Development Framework transforms security from a reactive necessity into a proactive growth engine by operationalizing Security by Design across the entire fintech software development lifecycle.

Our approach ensures that every line of code, process, and deployment is built with trust, compliance, and resilience at its core. Here’s how we make it happen:

1. Secure SDLC (Security from Design to Deployment)

We embed security at every stage of the Software Development Life Cycle (SDLC). From early architecture planning to final deployment, each phase includes vulnerability assessments, encryption protocols, and secure coding reviews. This prevents weak links and ensures your fintech compliance posture in the USA stays strong from day one.

2. Continuous Compliance Automation (Powered by AI and RegTech Expertise)

Manual compliance checks slow innovation. That’s why Sigma leverages AI-driven RegTech compliance automation solutions to turn compliance into a continuous, effortless process.

- Automated policy mapping aligns your processes with frameworks like SOC 2, PCI DSS, and ISO.

- Real-time dashboards offer complete visibility into compliance health.

- Continuous risk assessments trigger instant alerts for potential violations.

This means fewer surprises during audits and faster go-to-market cycles.

3. Integrated DevSecOps (Faster, Safer Releases)

Sigma integrates DevSecOps into every project, combining agility with robust security checks. Automated testing, threat modeling, and code scanning happen simultaneously within CI/CD pipelines. This enables fintech companies to launch faster, stay secure, and reduce security incidents by design, not by chance.

4. Security Essentials Built In (Encryption, IAM, and Fraud Detection)

Our framework incorporates encryption, identity & access management (IAM), and fraud detection & prevention technologies directly into development cycles. With this proactive layer of protection, fintech platforms stay resilient against evolving cyber threats and ensure continuous digital banking security.

The Results: Compliance Without Compromise

Sigma’s secure development and RegTech compliance solutions deliver measurable outcomes:

- Reduced audit fatigue through automation

- Faster product rollouts with built-in security validation

- Consistent, demonstrable compliance posture

With Sigma Infosolutions, CTOs, CIOs, and technology leaders can move from reactive checklists to confident, secure innovation, proving that compliance and agility can thrive together in modern fintech software development.

Competitive Advantage Through Security Confidence

Today, security in the Fintech landscape is not just a requirement; it is the clearest signal of trustworthiness. Investors, regulators, and customers all want the same thing: assurance that their data and transactions are protected. That’s why Security by Design is no longer a nice-to-have; it’s the foundation for long-term business growth.

Fintechs that build cybersecurity into their DNA don’t just prevent breaches; they accelerate success. By integrating encryption, identity management, and fraud detection early in the development process, organizations can move faster and with greater confidence. Products reach the market sooner, post-launch vulnerabilities are minimized, and compliance is achieved automatically through strong architecture.

According to a 2025 Accenture Financial Cyber Resilience Study, only one in ten companies worldwide possesses the mature cybersecurity defenses required to counter AI-augmented attacks. Still, a clear majority of organizations (58%) are failing to achieve an adequate balance between aggressive AI development and essential security investment.

This shift redefines the role of security from a cost center to a growth enabler. Instead of slowing innovation, security becomes the backbone that allows fintechs to scale with confidence that is backed by investor trust, regulatory credibility, and customer loyalty.

At Sigma, we help fintechs transform security into a strategic advantage, empowering leaders to innovate boldly while maintaining unwavering protection through our AI-driven RegTech compliance automation solutions in the USA.

Final Thoughts: From Reactive to Resilient

The fintech world is moving too fast for reactive security. What once felt like endless compliance anxiety can now become a source of operational confidence. By embracing Security by Design, fintech leaders can ensure that protection, compliance, and innovation move hand in hand, not in conflict.

Security isn’t just about meeting regulations; it’s about enabling growth, trust, and speed. When encryption, identity management, and fraud detection are built into every layer of development, compliance becomes a natural outcome, not an afterthought.

Partner with Sigma Infosolutions to embed Security by Design into your fintech software development. Together, we’ll help you move beyond checklists and audits to achieve true resilience through our AI-driven RegTech Compliance Automation Solutions in the USA, turning compliance into confidence and cybersecurity into your next competitive edge.