From Legacy to Leading Edge: The InsurTech Revolution That’s Reshaping Insurance

Insurtech, a neologism of “insurance and technology,” is a force to reckon with within the insurance industry. Utilizing cutting-edge technologies, InsurTech innovation is revolutionizing processes and creating win-win strategies for both insurance providers and consumers. Initially leveraged by online aggregators, insurtech played a vital role in heralding a new growth phase in the insurance industry. Since then, it has progressed through phases like digital insurance, data-driven decision-making, IoT adoption, blockchain implementation, and AI-driven automation. In the present scenario, insurtech’s significance lies in its ability to enable insurance providers to enhance customer experience, refine risk assessment, reduce overhead costs, fuel innovation, and combat fraud. Insurtech has become a pivotal driver of change, promising continued disruption and innovation in the insurance sector. This blog delves into the nitty-gritty details of how InsurTech is changing insurance delivery, causing the disruption of legacy insurance systems, and how insurance providers are improving customer experience with InsurTech

Insurtech: The Insurance Industry’s Digital Tipping Point

Emphasizing stability and risk aversion, the insurance industry has operated heavily reliant on legacy models, denoted by paper-heavy workflows, sluggish claims processing, and a one-size-fits-all approach. However, this approach has bred inefficiencies, poor customer experiences, and limited innovation. Owing to the changing and evolving consumer needs, the insurance landscape has changed, making tech intervention imperative.

From instant claims approvals, hyper-personalized coverage, and digital-first experiences that mirror the seamlessness of eCommerce and fintech platforms, consumers’ needs have evolved. These needs make speed, convenience, and transparency not a luxury but a baseline expectations. Online aggregators jumped on the bandwagon, spearheading a revolution. From empowering users to compare quotes with a few clicks to AI-driven underwriting and on-demand micro-insurance, insurtech was a disruption waiting to happen! Bringing a new wave of innovation, insurtech is redefining what insurance models can and should be. Becoming a catalyst for reinvention, insurance technology is no longer experimental but an essential for insurance providers trying to stay relevant and stay afloat in the business turfs.

What is Insurtech?

Insurtech is the integration of technology into the insurance sector to make processes more efficient and customer-focused.

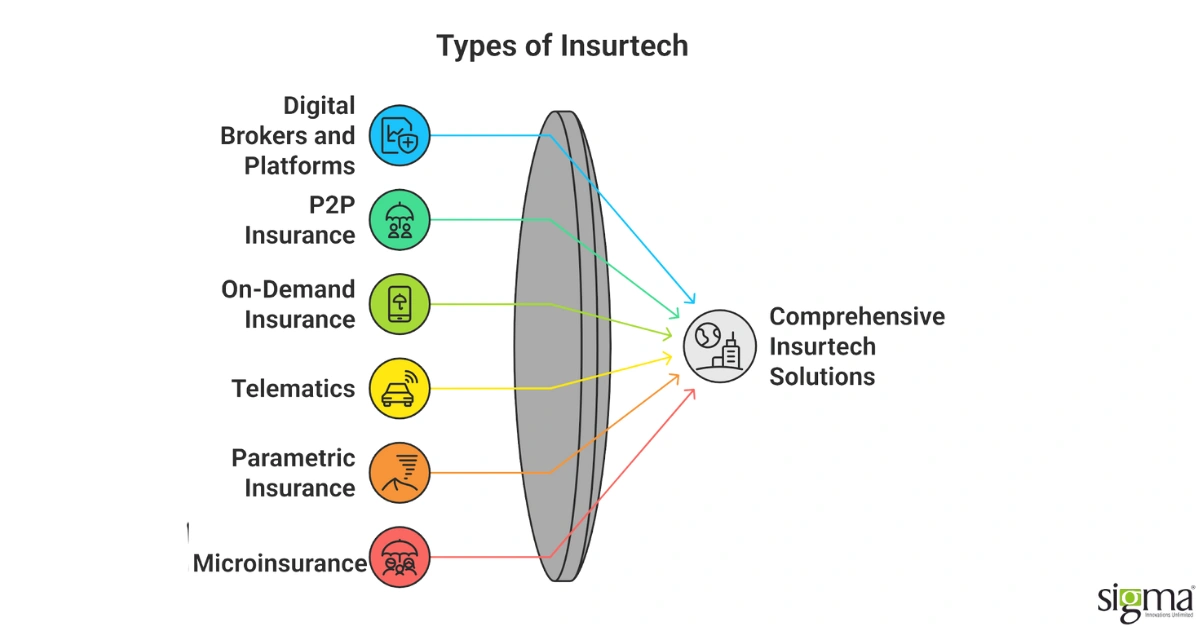

Types of Insurtech

- Digital brokers and platforms offer insurance products online, simplifying comparison and purchasing through user-friendly interfaces and personalized recommendations.

- P2P insurance is a peer-to-peer model that allows premium pooling from groups of individuals to insure against shared risks.

- On-demand insurance allows customers to purchase coverage instantly for specific durations.

- Telematics and usage-based insurance are models that adjust auto premiums based on actual usage or behavior.

- Parametric insurance- a modern insurance model—provides pre-agreed payouts when defined conditions or events—such as specific weather thresholds—are triggered, eliminating the need for traditional claims assessments.

- Microinsurance is designed for low-income individuals, offering affordable protection through low-cost premiums and limited coverage tailored to smaller-scale risks.

- Blockchain-based insurance model leverages blockchain for transparency, fraud prevention, and efficient claims processing.

- Cyber insurance tech model offers coverage for data breaches, cyber-attacks, and digital risks.

- Health and wellness tech insurance models integrate with wellness apps and devices, offering incentives for healthy behaviors and personalized health plans.

How is the Insurtech market faring?

The global Insurtech market estimated at USD 5.45 billion is projected to reach USD 152.43 billion by 2030, growing at a CAGR of 52.7% .

Source: Grand view research

From Outdated to Outstanding: Insurance in the Age of Insurtech

Several insurance providers are still anchored to legacy core systems. These decade-old platforms were never designed for speed, scale, or customer-centricity, creating rigid workflows, siloed data, and long development cycles, eliminating the scope for innovation and slowing down response times. Clinging to outdated infrastructure comes at a cost! The result is slow and error-prone claims processing that relies heavily on manual intervention.

Outdated infrastructure also impacts underwriting, as there is no real-time data; it leads to generic risk models and missed personalization opportunities. Disconnected systems causing long wait times, resulting in inconsistent customer experiences, negatively impacting the insurance provider’s business growth. Inefficiencies inflate operational costs, eroding trust and satisfaction. With digital native brands taking centre stage in the insurance sector, consumers benchmark their experiences against such brands and navigate towards them. On account of this, businesses that do not adopt insurtech lose customers and opportunities to grow their profit margins. It is self-evident that insurtech brings in agility, and scalability and empowers insurance providers to enhance customer satisfaction.

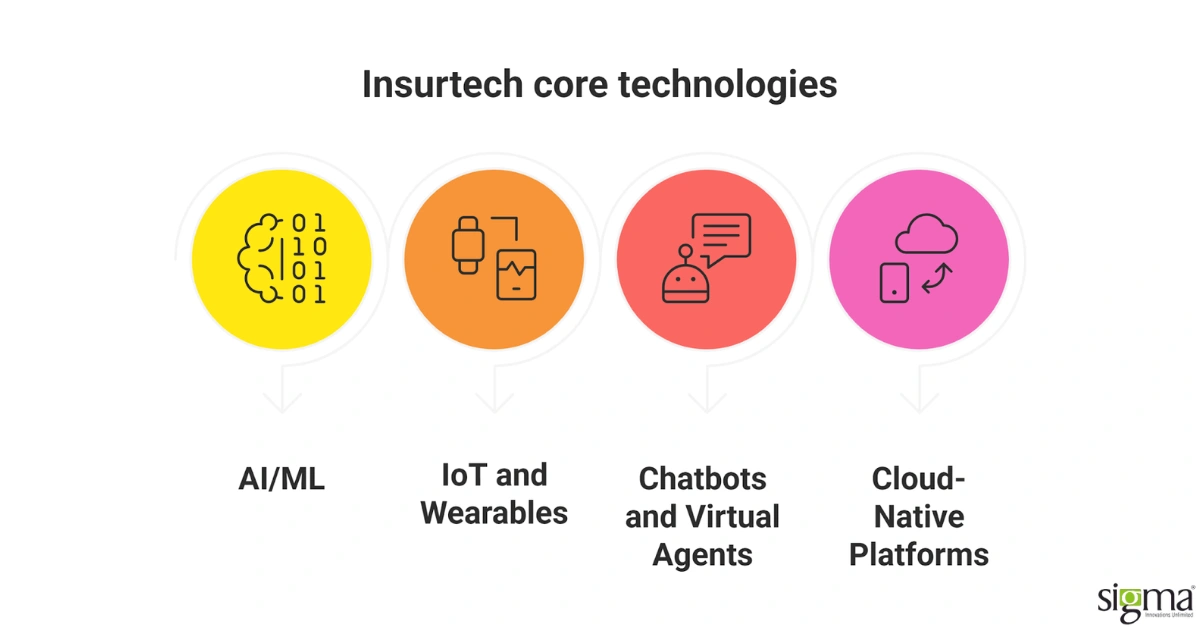

Core technologies fueling an Insurtech surge

AI/ML: Smarter Underwriting and Fraud Detection

In the past, underwriting has relied on rigid, rule-based models, evaluating applicants using a limited set of historical data. Owing to such a static approach, insurance businesses had to deal with delayed decisions, failure to provide customized insurance offerings to users, inability to detect fraud, and miscalculated business moves. Insuretech solutions through AI and machine learning is fundamentally changing the game.

Modern underwriting engines, powered by ML algorithms, can now analyze, real-time behavioral data (driving habits, health tracker inputs), social signals, digital footprints, third-party data from credit bureaus, or e-commerce activity, and historical claims and risk data to identify patterns that may be overlooked by human underwriters. This enables insurance providers to digress from broad risk pools and accurately offer the right pricing models and insurance solutions to users. Thus, owing to AI/ML, 62% of insurers are ditching gut feeling and rewriting insurance risk with due diligence and reducing fraud by relying on AI/ML models.

With AI/ML in insurtech, insurance companies have dynamic risk models in action, continuously learning and adapting, classifying consumers under various risk categories. As a result of this insurers can customize premium amounts in real-time. Additionally, AI-ML-powered systems become linchpins, empowering insurance providers to keep fraud at bay by detecting unusual claim patterns across multiple data sources and flagging inconsistencies in information. Using image recognition to detect tampered evidence and monitoring customer behaviour post-claim, AI/ML helps insurers safeguard their financial pursuits and avoid reputational damage.

IoT and Wearables: Effective Risk Assessment

Prevention is always better than cure; similarly, insurance technology leveraging IoT allows insurance providers to move from reactive claims processing to proactive risk prevention. With IoT becoming a core technology of insurtech, insurers are efficiently and swiftly assessing and managing risks. Through connected ecosystems like smart home sensors, telematics devices, fitness wearables, and more, IoT provides continuous, real-time data streams that insurers can tap into for dynamic pricing and tailored policy offerings. Access to such dynamic data empowers insurers to update risk models in real-time and offer micro-personalized experiences that precisely address their users’ needs. IoTs in Insurtech has transformed policies from static documents to living agreements, adapting as the consumer’s behavior and environment change.

Chatbots and Virtual Agents: 24/7 Support

Today’s policyholders expect instant answers, seamless support, and consistent service across every channel, at any time of day. Traditional contact centers with long wait times and working-hour limitations fail to cater to this need. It is where AI-powered Chatbots and virtual agents, which are a core part of disruptive technology in insurance, come into the picture. Delivering 24/7, omnichannel support at scale, these intelligent assistants are revolutionizing how insurers interact with customers.

Modern insurance chatbots go over and above FAQs, lending onboarding & KYC support, sending out premium and payment reminders to users, and providing real-time claim status updates. Via AI-powered Chatbots and virtual agents, insurance companies are leveraging insurtech to instantly resolve queries in chat, voice, or even via WhatsApp or Alexa without human intervention. With bots handling the bulk of repetitive inquiries, human agents can focus on complex cases, decreasing the issue resolution time, paving the way for more efficient, profitable, and scalable business models. And because bots never sleep, insurers can now deliver “always-on” engagement—no call queues, no lunch breaks.

Cloud-Native Platforms: Agility and Scalability

Businesses striving to make a mark for themselves in the competitive and ever-evolving landscape of the insurance sector cannot be stuck with legacy systems, that are monolithic, on-premise, and maintenance-heavy. To meet the needs and expectations of modern-day consumers, insurance providers must switch from legacy systems to cloud-native platforms that bestow scalability and agility. Cloud-native, which is one of the cornerstones of insurtech, does not let insurance providers be weighed down by legacy systems. Instead, through cloud-native platforms, insurance providers can have scalable infrastructure, modern data warehousing, and agile development cycles. The outcomes? Insurance companies can swiftly launch products without delay, scale on demand with zero downtime, and respond to market needs in real time.

API-driven insurance architecture + Microservices = Infinite Flexibility

Insurers trying to work their way within the legacy frameworks often hit a wall. Cloud-native architecture removes that wall entirely allowing a modular approach by design. Microservices break down core insurance functions into loosely coupled services. APIs enable seamless integration with external platforms—payment gateways, data enrichment providers, and regulatory tools. This empowers insurance providers to introduce new distribution channels (e.g., embedded insurance, mobile-first policies) and improve digital experiences while avoiding the vendor lock-in trap. Cloud-native platforms aren’t just operational upgrades for insurance companies—they are the enablers of faster time-to-market, lower IT overhead, and a face of digital resilience in case of a cyber threat.

InsurTech: No Longer Optional but Essential for Insurers

Is insurtech a mere futuristic buzzword? The answer is no, this disruptive insurance technology is a survival strategy. InsurTech is the engine powering insurance 2.0, with digital-first experiences, hyper-personalized offerings. Insurance providers embracing it will lead to those who don’t risk being left behind. Here is an overview of the top-of-the-bunch benefits insurance providers will get with Insurtech

Clear, effortless compliance with Insurtech

Insurance providers have to navigate through a complex regulatory compliance landscape. Any minor deviation from the compliance framework costs the insurance providers. InsurTech, with robust tech capabilities, simplifies the complex landscape of regulatory compliance by leveraging automation, real-time data analytics, and digital record-keeping. Enabling automated workflows, insurtech ensures on-time filings, audits, and report generation in the correct format, minimizing manual errors and eliminating compliance risk. With the inclusion of blockchain and AI technologies, insurtech brings transparency into audit trails, facilitating predictive risk. Via insurtech, insurance providers can establish a robust compliance posture and stay ahead of evolving regulations with confidence.

Outpacing competitors with Insurtech

Several disruptive entrants and other digital-first insurers are riding high on the success of insurtech. They are rewriting the rules in the insurance sector by streamlining onboarding, instant quotes, AI-powered underwriting, and rapid claim settlements. While disruptive entrants are making a mark for themselves, big tech companies are entering in a big way into insurance sector, trying to harness the potential of their vast data resources and customer bases. This situation is putting traditional insurers in a quandary. Hence, failing to embrace insurtech will put them at risk of losing market share to these agile, tech-native competitors.

Seamless Integration with Insurtech

Gone are the days when insurance products operated in isolation. Today, they’re part of broader financial, healthcare, and wellness ecosystems. As insurance blends with various ecosystems, it makes the role of insurtech more prominent. Insurtech enables open API-driven integration with banks, health apps, wearable tech, telematics providers, and government systems. Owing to such interconnectedness, insurance companies can offer contextual, real-time products, like usage-based insurance or embedded insurance solutions. Offering insurance products that are in sync with the pace of customers’ digital lives empowers insurance companies to stay relevant and optimise their user acquisition strategies.

Winning customers with Insurtech

Seamless, personalized experiences are par for the course in eCommerce and entertainment. Value-seeking customers are seeking similar offerings from the insurance industry, and insurtech has the full potential to make this possible. InsurTech enables hyper-personalized products, real-time interactions via chatbots, mobile self-service portals, and predictive support through AI analytics. Speed is critical—whether it’s getting a quote, filing a claim, or receiving a payout. Insurance companies that fail to digitize these touchpoints risk eroding trust and losing customers to more responsive alternatives or businesses.

The unmissable impact of insurtech on the insurance industry

InsurTech is helping insurers do more with less—automating processes, reducing manual effort, and cutting operational costs. At the same time, data-driven tools like AI, IoT, and predictive analytics in insurance are opening new revenue streams through smarter pricing, personalized products, and improved customer retention. Here is an overview of the positive impact of technology on the insurance industry :

Mimimizing overhead costs

InsurTech significantly enhances operational efficiency by automating key processes like underwriting, claims handling, and policy issuance, ultimately resulting in faster turnaround times. With AI-powered chatbots managing routine customer queries and claims processing, reducing human intervention, insurance companies can avoid overspending on operational costs. Additionally, digitized workflows minimize paperwork and manual errors, streamlining internal operations and improving overall service delivery.

New avenues of revenue growth

By embracing insurtech, insurance companies will have advanced data capabilities for smarter, and faster decisions at their behest. Insurers can leverage big data and analytics to gain valuable insights into user behaviour and risk profiles, ultimately leading to more accurate underwriting and product personalisation. Telematics and IoT devices empower insurance companies to formulate dynamic pricing models that are appropriate for their consumers. Additionally, predictive analytics enhances fraud detection, improving customer retention, and identifying cross-selling opportunities, creating immense new avenues of revenue growth and profitability for insurance providers.

Real-World Impact of Insurtech

- Rapid claim resolution: Insurance providers reinventing claims with AI are moving away from slow traditional insurance models, ditching manual claims processes and going fully digital with AI-powered platforms and behavioral economics. Such insurance providers are reaping the benefits of incorporating insurtech by witnessing a drastic decrease in claim resolution time and being able to increase customer satisfaction.

- Rapid issue of policies: Multinational insurance corporations are enhancing underwriting accuracy with data-driven automation. By implementing AI/ML-based predictive underwriting and data analytics, they are sidelining manual underwriting with inconsistent accuracy across risk segments. Owing to adopting insurtech, multinational insurance corporations are witnessing a reduction in time to issue policies and an increase in fraud detection rate.

Challenges Insurers Face When Embracing Insurtech

Are there any challenges insurance providers face while adopting insurtech?

- Change management and internal resistance.

- Data integration across silos.

- Vendor lock-in and the need for interoperability.

- Security and compliance concerns in cloud transitions.

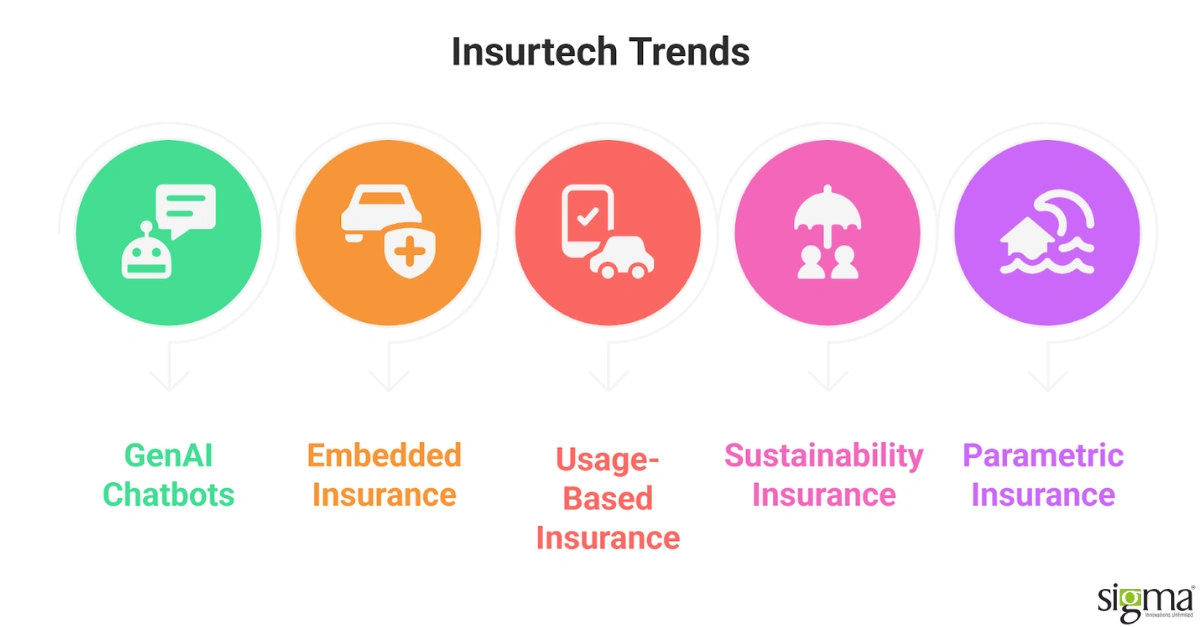

Latest Insurtech Trends: Futureproofing Insurance

AI adoption is set to accelerate in 2025, with agentic AI platforms becoming a cornerstone of insurance operations. These systems will autonomously manage complex tasks alongside human teams, transforming both workflows and customer engagement. Unlike earlier AI tools that required prompts, agentic AI will proactively take initiative, leading to major gains in efficiency and redefining how insurers handle their core processes. A few of the prominent insurtech trends include:

- GenAI-powered chatbots and virtual agents offer hyper-personalised, human-like interactions for policy servicing.

- Seamlessly embedded insurance into non-insurance digital experiences for contextual, just-in-time coverage in a single click.

- Usage-Based & On-Demand Insurance powered by IoT, telematics, and wearables, offering flexible, pay-as-you-use models aligning with real-time user behavior and risk.

- Sustainability & climate risk insurance models that use climate analytics and geospatial data to assess environmental risks and build insurance products aligned with ESG goals.

- Parametric insurance helps close the protection gap with fast, trigger-based payouts tied to specific events like floods or rainfall.

Insurtech vs Traditional Insurance

- Aspect

- Technology Stack

- Customer Experience

- Underwriting

- Claims Processing

- Product Offerings

- Distribution

- Data Utilization

- Customer Engagement

- Speed to Market

- Cost Structure

- Security & Compliance

- Traditional Insurance

- Legacy systems (COBOL, mainframes, on-prem servers)

- Paper-based, agent-led, slow processes

- Rule-based, manual, limited data use

- Manual, multi-week cycles, paperwork-heavy

- Static, one-size-fits-all policies

- Branch networks, intermediaries, brokers

- Historical data, actuarial models

- Annual policy reviews, low interaction

- Slow product rollout, regulatory bottlenecks

- High operational overheads

- Manual audits, physical records

- InsurTech

- Cloud-native platforms, microservices, APIs

- Digital-first, self-service portals, AI-driven chatbots

- Automated, AI/ML-powered, real-time risk scoring

- Instant FNOL (First Notice of Loss), automated workflows

- On-demand, usage-based, personalized policies

- Direct-to-consumer (D2C), mobile apps, embedded insurance

- Real-time data from IoT, wearables, telematics

- Continuous, digital engagement across lifecycle

- Agile development, faster experimentation

- Lean models, automation-led savings

- Real-time compliance checks, audit trails

Enabling the InsurTech Ecosystem: Sigma’s Technology Playbook

- AI/ML: Sigma’s AI and machine learning capabilities can be utilized to transform underwriting and optimize claims. Sigma Artificial Intelligence Development Services can be leveraged for initiating smarter risk scoring and automated decision-making.

- Data engineering and analytics: Sigma’s BI & Analytics Development Services can be leveraged to build robust data lakes and pipelines to support predictive modeling and real-time analytics.

- Cloud-native platforms: Sigma’s cloud-native solutions, built on AWS, Azure, or GCP, can be leveraged to modernize IT infrastructure with flexibility, scalability, and cost-efficiency and for launching digital insurance products. Our deep expertise in cloud architecture and DevOps best practices plays a vital role in deploying and managing applications seamlessly across multiple cloud environments.

- Connected integrations: Sigma’s custom development services ensure frictionless integration across the insurance value chain. Its robust library of 80+ pre-built connectors help in integrations spaning a wide range of platforms—including CRMs, ERPs, credit bureaus, payment gateways, and more—allowing hassle-free data syncing, workflow automation, and enabling real-time decision-making. Sigma’s integration-ready infrastructure accelerates time to market and boosts innovation without the complexity of custom builds.

- RAG (Retrieval-Augmented Generation) + GenAI: Sigma’s Gen AI development and large language model capabilities can be leveraged to create enterprise-grade chatbots that facilitate knowledge retrieval and faster claims communication.

- Fintech solutions: Sigma’s Financial Software Development Services form a strong foundation for building next-gen InsurTech solutions. With deep domain expertise in finance, Sigma enables digitization of core operations, accelerating time-to-market, and empowering insurance providers to deliver seamless digital experiences. From scalable policy management platforms and claims automation engines to API-driven integrations with banks, credit bureaus, and fintech ecosystems, Sigma’s custom-built software solutions empower insurers to stay ahead in a rapidly evolving digital landscape.

Insurers today grapple with increasing regulatory pressures and the need for agile, future-ready technology. Sigma Infosolutions, with its tech capabilities, addresses these challenges by building secure, auditable platforms that minimize tech debt and support long-term sustainability.

Read the blog to know how to steer away from technical debt.

Through agile delivery models and DevOps practices, Sigma ensures continuous innovation and zero downtime—crucial in an always-on insurance environment. With deep domain expertise in regulatory compliance, actuarial models, and digital customer experiences, Sigma combines technical excellence with industry insight. Its focus on reusable components, low-code platforms, and scalable data architecture enables faster go-to-market, reduced operational costs, and a streamlined path to digital transformation.

Wrapping up:

The insurance industry is at a defining moment. What was once dominated by manual processes, outdated systems, and slow innovation is now rapidly transforming into a tech-driven, customer-centric powerhouse, thanks to InsurTech. From AI and IoT to cloud-native platforms, GenAI, and parametric models, the shift is no longer optional but inevitable. If you are a CTO, CEO of an insurance company striving to navigate toward insurtech, choose Sigma Infosolutions as your strategic tech partners and realize your business objectives for an upward growth trajectory.