Managing Virtual and Physical Cards with Banking-as-a-Service Solutions

Key Takeaways:

- Virtual + Physical = Two Wings of the Same Plane: To soar in the digital economy, businesses need both working in sync—BaaS is the pilot that keeps the flight steady.

- Scalability is the Engine: Without the right tech stack, growth sputters. BaaS fuels smooth takeoff and helps businesses climb higher.

- Compliance is the Seatbelt: It may not be flashy, but it’s non-negotiable. With BaaS, businesses strap in safely while navigating complex regulations.

- Customer Experience is the Runway: A clunky card program makes for a bumpy landing. BaaS clears the path for seamless experiences that keep users coming back.

- Sigma Infosolutions as the Co-Pilot: From APIs to analytics, Sigma helps fintechs, banks, and enterprises chart the right course and land smoothly in the competitive payments landscape.

Digital payments are no longer just about swiping a card or tapping a phone—they’ve become the foundation of modern business. From consumer purchases to B2B transactions, companies today are under pressure to offer flexible, fast, and secure card solutions that keep pace with customer expectations. Whether it’s a virtual card instantly provisioned for online purchases or a physical card for day-to-day expenses, the demand for smarter financial tools is growing rapidly.

This is where Banking-as-a-Service (BaaS) comes in. Acting as the backbone of modern financial solutions, a banking-as-a-service platform allows businesses to launch and manage scalable card programs without having to build costly infrastructure from scratch. By tapping into embedded finance solutions and API-based banking services, organizations can not only issue prepaid, debit, or credit cards but also integrate features like real-time expense tracking tools, digital wallet integration, and advanced fraud prevention.

In this blog, we’ll explore how businesses can manage both virtual and physical cards with BaaS—unlocking new revenue opportunities and creating seamless customer experiences.

The Rise of Virtual and Physical Cards in the Digital Economy

The way businesses handle payments has undergone significant changes in the last few years. Virtual cards, once seen as a niche product, are now becoming mainstream. The virtual card market is booming. A Juniper Research study found its value will grow 235% by 2029, from $5.2 trillion to a massive $17.4 trillion. For companies, issuing virtual cards through a banking-as-a-service platform means real-time provisioning, automated limits, and easier reconciliation—something traditional card programs have always struggled with.

That said, physical cards still hold a strong place in the digital economy. They offer something virtual cards can’t replace just yet: consumer trust, brand visibility, and utility in offline transactions. From corporate expense cards to branded loyalty programs, physical cards remain an essential part of the payment experience.

For modern enterprises, the answer isn’t choosing one over the other—it’s adopting a hybrid card strategy. Employees need secure virtual cards for digital purchases, customers still value branded physical cards in their wallets, and partners often require both. Leading players like Stripe Issuing, Marqeta, and JPMorgan Chase have already proven how businesses can leverage this mix to streamline payments and build new revenue models.

In short, the future isn’t about virtual or physical cards. It’s about managing both effectively with embedded finance solutions powered by BaaS.

Also Read: Reimagining Digital Payment Solutions in a Multi-Channel World

What is Banking-as-a-Service (BaaS) and Why It Matters?

At its core, Banking-as-a-Service (BaaS) is the technology infrastructure that allows fintechs, enterprises, and even non-financial brands to embed financial products directly into their offerings. Instead of building a bank from the ground up, companies can plug into a banking-as-a-service platform and launch products like checking accounts, lending services, or card programs in a fraction of the time.

This is very different from traditional banking partnerships, where companies had to rely on slow-moving processes, heavy compliance overhead, and limited customization. With BaaS, businesses get the flexibility of API-based banking services that connect directly into existing systems and apps, enabling them to deliver seamless customer experiences.

When it comes to card issuance and management, the building blocks of BaaS include:

- APIs for card issuing and lifecycle management (activate, suspend, replace in real time)

- KYC/AML compliance tools to onboard users safely and meet regulations

- Payment network integrations with Visa, Mastercard, and others to ensure global acceptance

- Fraud monitoring, tokenization, and dispute handling to protect customers and maintain trust

What makes BaaS so powerful is speed. Instead of taking years to launch a new financial product, companies can go live in weeks or months. For organizations that want to roll out virtual or physical card programs, BaaS is simply the fastest and most scalable route to market—unlocking opportunities in embedded finance solutions like expense management, loyalty programs, and digital wallets.

Virtual Cards with BaaS: Benefits and Business Use Cases

If physical cards are the steady workhorses of payments, virtual cards are the agile sprinters. They’re designed for speed, control, and digital-first business needs—and when powered by banking-as-a-service solutions, their potential multiplies.

Key Benefits of Virtual Cards with BaaS

- Instant Issuance & Provisioning: Through API-based banking services, companies can generate and distribute virtual cards in seconds—ideal for employee expenses or vendor payments.

- Improved Security: Virtual cards reduce fraud by using dynamic card numbers, tokenization, and built-in spend controls. Even if details are compromised, they become useless quickly.

- Cost Savings: Unlike physical cards that involve printing and shipping, virtual cards are entirely digital, making them more cost-effective for large-scale programs.

- Real-Time Tracking & Reconciliation: Businesses gain access to real-time expense tracking tools, enabling automated reconciliation and better budget control.

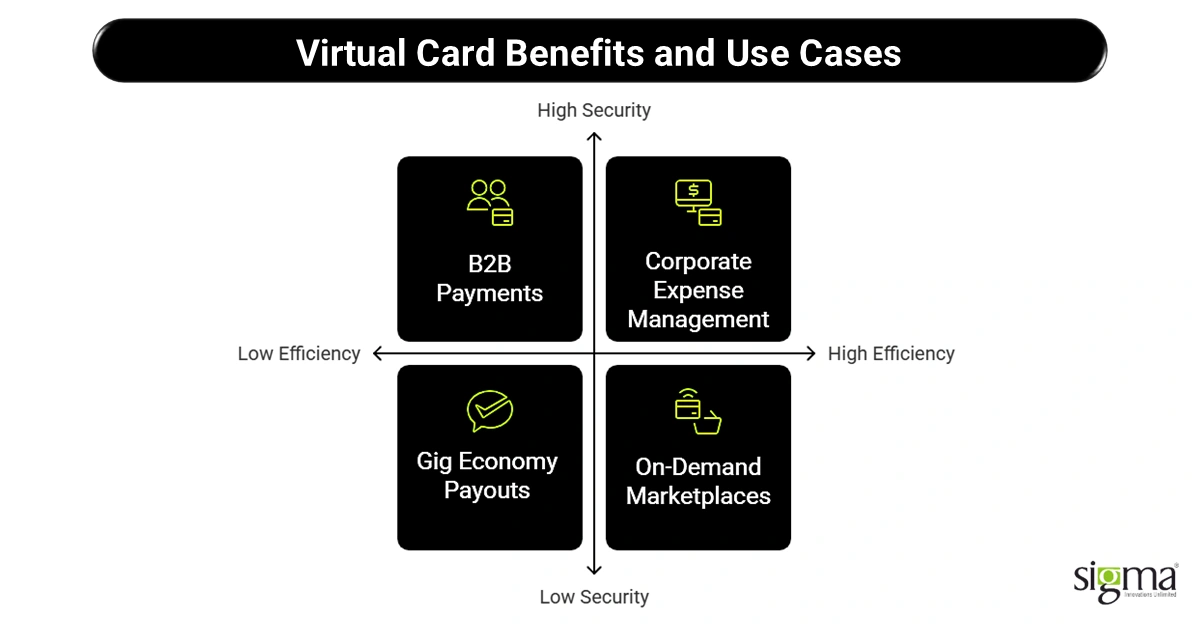

Business Use Cases

- Corporate Expense Management: Enterprises can issue virtual cards for travel, procurement, or SaaS subscriptions. Finance teams gain full visibility while reducing misuse.

- Gig Economy & Contractor Payouts: Platforms serving freelancers or delivery workers can instantly issue cards for same-day payments, removing delays tied to traditional banking.

- On-Demand Marketplaces: Ride-sharing, food delivery, and service marketplaces can use embedded finance solutions to offer virtual cards, ensuring partners are paid securely and quickly.

- B2B Payments: Virtual cards streamline supplier and vendor transactions, offering businesses the flexibility of single-use or recurring cards while enhancing fraud prevention.

For decision-makers, the appeal is clear: virtual cards bring speed, security, and efficiency into the heart of financial operations. And with BaaS platforms, companies don’t need to reinvent the wheel—they simply plug into a ready-to-go infrastructure and scale their fintech card program management with confidence.

Physical Cards with BaaS: Beyond Plastic

In a world that feels increasingly digital, you might think physical cards are losing ground. But the reality is, they still play a vital role in the payments ecosystem—especially when backed by modern banking-as-a-service solutions.

Why Physical Cards Still Matter

- Consumer Trust & Brand Visibility: A card in a customer’s hand is more than a payment tool—it’s a brand reminder. Companies use physical cards to build loyalty and reinforce trust in ways a virtual number on a screen can’t always match.

- Offline Payments: From restaurants and hotels to airports and retail stores, physical cards remain the go-to for in-person transactions. While virtual cards power the digital world, plastic is still king for travel and on-the-ground spending.

- Loyalty & Rewards Programs: Enterprises continue to use branded cards for employees, partners, and customers. A tangible, well-designed card can make a loyalty program feel more valuable and lasting.

How BaaS Transforms Physical Card Programs

With BaaS platforms, physical cards are no longer just static pieces of plastic—they’re dynamic tools connected to digital ecosystems. Businesses can:

- Offer personalized branding and co-branding opportunities, turning cards into mini billboards.

- Enable real-time spend controls, linking physical cards with virtual wallets for better expense visibility.

- Integrate cards with Apple Pay, Google Pay, and other mobile wallets, blending offline usability with digital-first convenience.

Challenger banks have already shown what’s possible here. Providers like N26 and Chime issue sleek, branded debit and credit cards through BaaS partners, creating a seamless mix of trust, innovation, and usability.

For companies building embedded finance solutions, the message is clear: physical cards are not relics of the past. They’re evolving with technology, giving businesses a chance to deliver financial solutions that combine tradition with innovation.

Also Read: Real-Time Financial Crime Prevention Solutions for Fintech Lenders

Managing Virtual and Physical Cards Together: The Unified Approach

For many organizations, card management has become a balancing act. Virtual cards are handled in one system, physical cards in another, and reconciliation happens somewhere else entirely. This disjointed approach often leads to inefficiencies, higher costs, and limited visibility. In today’s fast-paced economy, businesses can’t afford to operate in silos when it comes to payments.

This is where Banking-as-a-Service (BaaS) platforms change the game. By unifying virtual and physical card management into a single framework, businesses gain control, scalability, and the ability to respond to customer and employee needs in real time.

What a Unified BaaS-Powered Platform Delivers

- Centralized Dashboards: One control hub for issuers and administrators, making it easier to track active cards, monitor usage, and issue replacements instantly.

- Flexible Spend Rules & Limits: Whether it’s setting caps on employee travel expenses or restricting vendor payments, companies can design card policies that adapt to business goals.

- Real-Time Fraud Detection: With card tokenization, dispute handling, and AI-driven monitoring, businesses stay ahead of fraud attempts, ensuring secure transactions across both card types.

- Data-Driven Insights via BI & Analytics: This is where Sigma Infosolutions adds value. By integrating business intelligence tools like Power BI and Tableau, companies can turn card usage data into actionable insights—spotting spending patterns, predicting future needs, and optimizing financial operations.

A unified card management approach isn’t just about efficiency—it’s about unlocking new opportunities. Enterprises that consolidate their virtual and physical card programs under one embedded finance solution can reduce overhead, improve compliance, and create better customer and employee experiences.

Think of it as moving from juggling multiple remotes to using a single smart controller—smoother, smarter, and far more effective. And with BaaS platforms as the backbone, businesses can future-proof their payment strategies while focusing on growth.

Security, Compliance, and Trust in Card Management

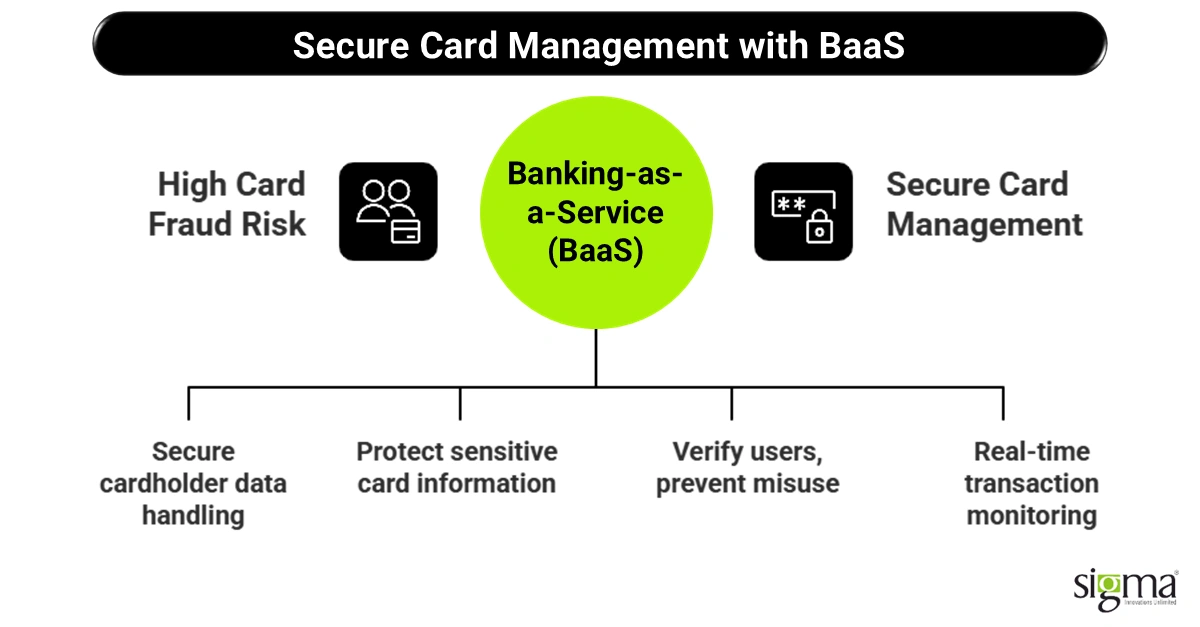

When it comes to payments, trust is the real currency. Whether it’s a virtual card used for SaaS subscriptions or a physical card swiped at a restaurant, fraud remains a top concern for businesses. Virtual cards reduce some risks with single-use numbers and dynamic controls, while physical cards still face threats like skimming or theft. Managing both effectively requires more than good policies—it requires a secure infrastructure.

That’s where Banking-as-a-Service (BaaS) solutions providers step in, building banking-as-a-service platforms on industry-grade safeguards, including:

- PCI DSS compliance to ensure secure cardholder data handling

- Tokenization and encryption for protecting sensitive information at every stage

- KYC/AML processes that verify users and prevent misuse before it even starts

Security isn’t just about compliance, though—it’s about staying one step ahead. That’s why many BaaS solutions embed AI-driven fraud detection systems that monitor transactions in real time. Machine learning models can flag anomalies—like a sudden overseas charge or multiple small-dollar attempts—long before they escalate into losses. Here, Sigma Infosolutions’ expertise in AI and ML adds an edge, helping businesses strengthen fraud prevention strategies with predictive analytics.

The regulatory environment is also shaping how cards are managed. In Europe, PSD2 and Open Banking rules emphasize security, transparency, and consumer control. In the U.S., compliance models focus on strong KYC standards, anti-money laundering checks, and evolving state-level guidelines. BaaS solution providers act as bridges, helping companies stay compliant without slowing innovation.

At the end of the day, businesses need more than just financial solutions—they need one-stop-solution providers who can help them manage risk, maintain compliance, and build trust. And that’s exactly what modern BaaS platforms, backed by AI and regulatory expertise, make possible.

Leverage BaaS & Neobank Enablement Solutions to gain a digital banking edge!

Future Trends in Card Management with BaaS

The future of payments is not just digital—it’s deeply embedded into everyday business and consumer experiences. With embedded finance solutions, even non-financial companies—think retailers, logistics platforms, or gig marketplaces—are stepping into payments by issuing their own cards through banking-as-a-service platforms.

One major driver of this shift is the rise of programmable payments via APIs. Imagine being able to set automated rules for when, how, and where money moves—down to restricting a card to a specific vendor or transaction type. This level of precision, powered by API-based banking services, is quickly becoming the new normal.

Artificial Intelligence and Machine Learning are also playing a bigger role. Beyond fraud detection, AI is enabling personalized card controls, such as spending recommendations and predictive limits based on user behavior. Sigma Infosolutions’ expertise in AI/ML development helps businesses prepare for this data-driven future.

Another frontier is blockchain and digital asset integration. Forward-thinking BaaS providers are already experimenting with cards that bridge traditional currencies with stablecoins and digital wallets, expanding the scope of payments even further.

Looking ahead, the next five years could bring a unified “card + wallet” ecosystem—where physical cards, virtual cards, and digital wallets work together seamlessly. Businesses that adopt this unified approach early will not just manage payments; they’ll shape the future of financial solutions itself.

How Technology Partners like Sigma Infosolutions Enable Success

While the promise of Banking-as-a-Service (BaaS) is huge, the path to launching and managing modern card programs isn’t always straightforward. Many organizations face hurdles that slow down innovation and impact customer experience.

Common Challenges Businesses Face

- Integration Complexity: Connecting legacy systems with new API-based banking services can feel like forcing puzzle pieces that don’t quite fit.

- Compliance Hurdles: Navigating PCI DSS, KYC/AML, and regional rules like PSD2 in Europe or U.S. regulatory models requires both expertise and constant vigilance.

- Scalability & Customer Experience: Card programs often start small but need to scale quickly—while delivering seamless, secure, and personalized experiences.

This is where having the right technology partner makes all the difference.

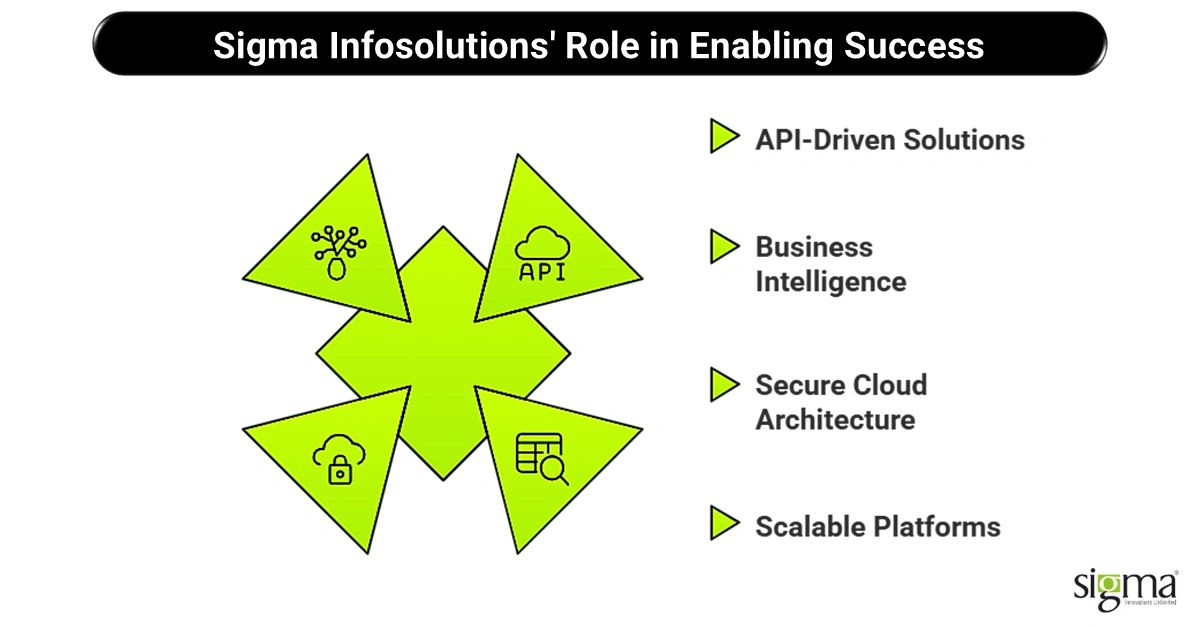

How Sigma Infosolutions Supports Fintechs, Banks, and Enterprises

At Sigma Infosolutions, we enable digital-first organizations to bring virtual and physical card management to life with scalable, secure, and data-driven platforms. Our capabilities include:

- API-Driven Fintech Solutions: We build and integrate custom APIs for card issuing, real-time transaction tracking, and fraud monitoring.

- Business Intelligence & Analytics: With tools like Power BI and Tableau, we help businesses gain expense visibility, uncover patterns, and optimize spend across card programs.

- Secure Cloud-Native Architecture: Leveraging AWS, Salesforce, .Net, and ReactJS, we design platforms that are compliant, resilient, and future-ready.

- Scalable eCommerce & Fintech Platforms: From Magento and Shopify to Hyvä-powered storefronts, we bring proven expertise in building customer-facing platforms that integrate seamlessly with embedded finance solutions.

At our core, Sigma Infosolutions acts as an innovation enabler. We help fintechs, banks, and enterprises move faster—launching new card products in weeks instead of years, while maintaining compliance and keeping customer trust intact.

For decision-makers, the takeaway is clear: you don’t have to navigate the complexity of card management, financial solutions, and BaaS integration alone. With the right partner, you can transform payments into a competitive advantage and future-proof your business in the digital economy.

Final Thoughts

In today’s digital-first economy, businesses can no longer treat virtual and physical cards as separate strategies. The real competitive edge comes from unifying both through Banking-as-a-Service (BaaS)—delivering scalability, security, and flexibility at every level.

The future is hybrid. Companies that embrace BaaS-enabled card management platforms will not only keep pace with evolving payment demands but also unlock new revenue streams, improve compliance, and deliver superior customer and employee experiences. From instant virtual card provisioning to branded physical cards integrated with digital wallets, the winners will be those who build an ecosystem that is agile, intelligent, and future-ready.

At Sigma Infosolutions, we help forward-thinking businesses transform card programs into growth engines. With deep expertise in Financial Software Development Services, embedded finance solutions, BaaS & Neobank Enablement Solutions and enterprise-grade platforms, we partner with fintechs, banks, and enterprises to design and scale next-gen BaaS-powered solutions.

If you’re ready to reimagine how your organization manages cards, connect with Sigma Infosolutions today. Together, we’ll build a card management platform that doesn’t just support your business—it accelerates it.