Reimagining Digital Payment Solutions in a Multi-Channel World

Not too long ago, paying for something meant pulling out cash or swiping a card. Today, it’s a whole different ball game. We’ve moved into a digital-first payment ecosystem where transactions can happen anywhere — on your phone, through a smartwatch, inside an app, or even via a voice assistant. The way businesses accept money has transformed just as much as how customers choose to pay.

This shift is fueled by the rise of multi-channel commerce — think in-store counters, eCommerce websites, mobile apps, IoT-enabled vending machines, social media storefronts, and subscription-based models. With buyers moving seamlessly between these channels, companies need digital payment solutions that keep up, connect everything, and make transactions fast, secure, and frictionless.

For modern businesses, these solutions aren’t just convenient add-ons; they are the backbone of growth, customer trust, and operational efficiency. Choosing the right tools, whether it’s a payment gateway, a mobile wallet, or a fully integrated financial solution, can directly impact revenue and scalability.

That’s exactly what this article is here for: to help decision-makers compare leading platforms, tools, and strategies so they can build the right multi-channel payment strategy for their business.

As a trusted technology services partner in eCommerce and Fintech, Sigma Infosolutions works with organizations to design, develop, and integrate high-performance digital payment software solutions that fit seamlessly into today’s multi-channel world.

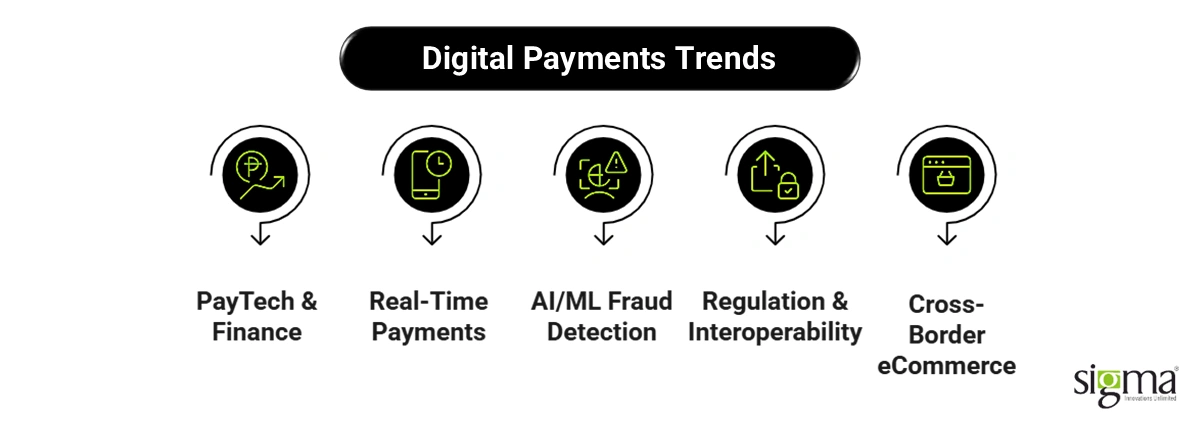

Digital Payments Landscape – Trends & Drivers for the Future Beyond

The world of payments is evolving at lightning speed. Here’s what’s shaping it today—and why decision-makers need to pay attention:

1. The Rise of PayTech & Embedded Finance

The global embedded finance market is expected to surge from $92 billion in 2024 to $228 billion by 2028. Multinational retail corporations are already teaming up with banks to offer embedded merchant payouts, signaling that this shift is happening now.

2. Real-Time Payments & Instant Settlements

Speed matters. Real-time payments are live in over 70 countries, with 226 billion transactions in 2023, a 42% YoY increase. In the U.S., real-time volume is projected to quadruple by 2026, hitting 8.9 billion transactions.

3. AI/ML in Fraud Detection & Smart Payments

Financial fraud is growing more sophisticated—and so is the fight back. Companies like Mastercard leverage AI to analyze 159 billion transactions, boosting fraud detection by up to 300%. Visa invests over $3 billion in AI/data infrastructure, with AI-driven risk prevention stacking across real-time and card-not-present payments.

4. Regulation Focus: Open Banking & Interoperability

Government and regulatory bodies are breaking down payment silos. India’s interoperable payment push via RBI and NPCI, including linking UPI across borders, reflects a global trend toward open, interoperable systems. Regional initiatives like the European Payments Initiative (Wero) aim to unify cross-border digital wallets by 2025.

5. Cross-Border & eCommerce Explosion

With a remarkable CAGR of 21.6%, the global cross-border eCommerce market is expected to skyrocket from a $2.8 trillion valuation in 2023 to $16.5 trillion by 2032. The growth is primarily driven by increasing globalization and the adoption of new payment methods like stablecoins, which simplify international payments.

What’s Driving These Trends?

- Consumer & B2B expectations: Expecting frictionless, B2C-like experiences even in B2B purchases pushes companies toward seamless cross-platform payment systems.

- Need for better cash flow: Instant settlements supported by smarter financial software development services, enabling near-real-time reconciliation, liquidity management, and predictable cash flow.

- Security compliance: With rising threats, businesses lean on Secure digital transactions, AI-powered fraud controls, and advanced KYC frameworks to foster trust.

Why This Matters for Decision Makers

For B2B brands and marketplaces, choosing the right digital payment software solutions isn’t just about accepting money—it’s a strategic decision that can:

- Speed up settlements—fueling better liquidity.

- Reduce fraud exposure (and compliance headaches).

- Support global sales with fewer friction points.

- Integrate with ERP/CRM for smoother operations.

Why Multi-Channel Strategy Demands Smarter Digital Payment Solutions

Running payments across multiple sales channels sounds simple—until you’re the one managing them. Point-of-sale systems in-store, checkout on your website, payments through mobile apps, marketplace integrations, IoT-enabled kiosks—each channel often comes with its own tech stack, rules, and reporting formats. Without the right digital payment solutions, it can feel like juggling chainsaws.

Common Pain Points Businesses Face

- Siloed payment systems – Channels that don’t “talk” to each other create data blind spots.

- Security gaps – More endpoints mean more opportunities for breaches in an omnichannel payment ecosystem.

- Inconsistent checkout experience – A smooth process on mobile but clunky on desktop? That inconsistency can hurt conversions.

- Lack of unified data – Disconnected systems make it hard to generate accurate analytics, delaying decisions.

The Case for Unified Digital Payment Solutions

Smarter, integrated systems address these problems head-on:

- Operational efficiency – One connected digital payment software solution reduces manual reconciliation and payment errors.

- Customer trust – Consistent, secure digital transactions across every channel reinforce credibility.

- Improved reconciliation & reporting – A unified dashboard simplifies accounting and gives real-time insight into sales.

- Better cash flow visibility – Instant settlement data helps finance teams make faster, more confident decisions.

With customers using multiple channels, businesses need to eliminate payment chaos to stay competitive. Unified, integrated financial solutions turn a fragmented payment landscape into a streamlined, insight-rich engine that not only processes transactions but also powers better strategic decisions.

Also Read: Real-Time Financial Crime Prevention Solutions for Fintech Lenders

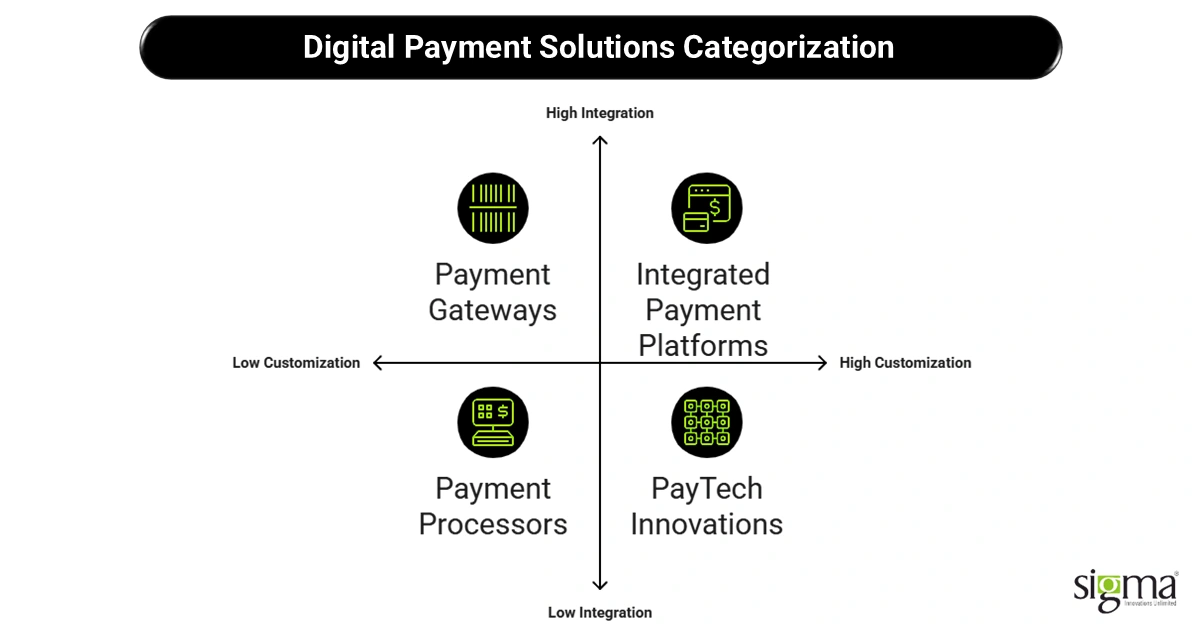

Comparative Framework – Categories of Digital Payment Solutions

Choosing the right digital payment software solutions isn’t just about picking the cheapest or most popular option—it’s about finding the one that fits your multi-channel strategy like a glove. Below, we break down the five major categories, their strengths, limitations, and who they’re best suited for.

A. Payment Gateways

Leading Players: Stripe, PayPal, Authorize.Net, Adyen.

Strengths:

- Quick and easy integration with most eCommerce platforms.

- Global reach for accepting multiple currencies.

- Strong developer tools for customization.

Limitations:

- Limited deep customization beyond what APIs allow.

- Transaction fees can add up for high-volume merchants.

Best For: SMEs, eCommerce-first businesses, and SaaS companies needing fast go-to-market payment solutions.

B. Payment Processors / Merchant Acquirers

Leading Players: Fiserv, Worldpay, Chase Paymentech.

Strengths:

- Established infrastructure with high reliability.

- Robust fraud prevention measures.

Limitations:

- Less flexibility for quick innovation or unique integrations.

Best For: Enterprises handling massive transaction volumes that need stability over rapid feature rollouts.

C. Integrated Payment Platforms (IPPs)

Leading Players: Square, Shopify Payments, Stripe Connect.

Strengths:

- Single vendor management simplifies operations.

- Unified reporting for a complete view of all transactions.

Limitations:

- Vendor lock-in can make switching costly.

Best For: Omnichannel retailers, subscription services, and businesses needing tight payment gateway integration with POS, online, and mobile systems.

D. Digital Wallets & Alternative Payments

Examples: Apple Pay, Google Pay, Amazon Pay, Venmo.

Strengths:

- High consumer adoption—especially among mobile-first shoppers.

- Enhanced security through tokenization and biometric authentication.

- Fast checkout process.

Limitations:

- Dependence on device ecosystem and customer tech adoption.

Best For: Retailers targeting mobile-savvy, tech-forward audiences, especially in markets with high smartphone penetration.

E. PayTech Innovations

Examples: Buy Now Pay Later (Affirm, Klarna), cryptocurrency acceptance, embedded lending, blockchain-based settlement systems.

Strengths:

- Creates new revenue streams through value-added services.

- Personalization using AI/ML, improving user experience.

- Potential for global reach without traditional banking intermediaries.

Limitations:

- Regulatory uncertainty in some markets.

- Adoption curve—customers may need education.

Best For: Innovative fintechs, cross-border commerce leaders, and businesses seeking differentiation in the future of the payment technology landscape.

Takeaway for Decision-Makers

Whether you’re a fast-scaling retailer or a global enterprise, the right choice depends on your channels, audience, and operational goals. For many, the sweet spot lies in combining two or more categories—like pairing a payment gateway with an integrated financial solution for analytics and fraud detection. That’s where having the right technology partner, like Sigma Infosolutions, can help architect a custom digital payment ecosystem tailored for growth and security.

Also Read: Power Up Your Platform with a Digital Payment Solution Built for You

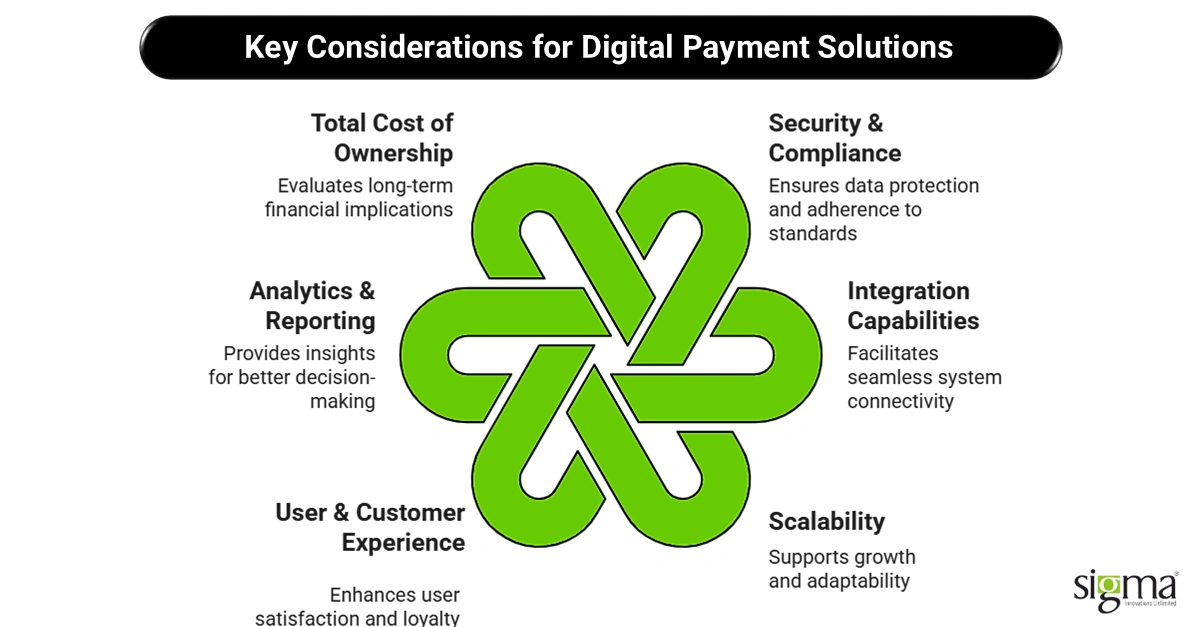

Key Evaluation Criteria for Choosing a Digital Payment Solution

When it comes to selecting the right digital payment software solution, it’s not just about “can it take money?”—it’s about how well it fits your business today and scales with you tomorrow. Decision-makers should weigh these factors before making the call:

1. Security & Compliance

Trust is everything in payments. Look for solutions that meet global standards like PCI DSS, PSD2, and GDPR. Strong encryption, tokenization, and payment compliance and KYC processes are essential for protecting customer data and avoiding costly breaches.

2. Integration Capabilities

Your payment system shouldn’t live in isolation. Choose solutions that integrate seamlessly with ERP, CRM, and your eCommerce platforms—whether it’s Adobe Commerce (Magento), Shopify, WooCommerce, or BigCommerce. Smooth payment gateway integration reduces manual work and syncs transaction data across the business.

3. Scalability

Can the platform handle seasonal spikes, new geographies, and evolving multi-channel payment trends? Scalability isn’t just about volume—it’s about supporting multiple currencies, local payment methods, and compliance in different regions.

4. UX & CX (User & Customer Experience)

From one-click checkout to mobile optimization, every friction point can mean lost revenue. Consistency across devices, markets, and channels builds confidence and loyalty. For B2B buyers expecting B2C-like payment flows, this is non-negotiable.

5. Analytics & Reporting

Data drives better decisions. Prioritize platforms that offer real-time dashboards, reconciliation tools, and insights into customer behavior. The ability to track secure digital transactions and monitor performance can directly improve cash flow and forecasting.

6. Total Cost of Ownership

Don’t just look at transaction fees—factor in setup costs, monthly subscriptions, and maintenance. The cheapest option up front may cost more over time if it lacks features that save you money elsewhere.

The “best” payment solution is the one that balances security, scalability, user experience, and integration—without blowing your budget. That’s why companies partner with Sigma Infosolutions to design integrated financial solutions tailored to their business goals and growth plans.

The Road Ahead – Emerging Innovations to Watch

The digital payment ecosystem is evolving so quickly that what feels cutting-edge today might be standard practice in just a few years. For businesses building a multi-channel payment strategy, keeping an eye on these innovations can mean staying ahead of competitors and capturing new revenue opportunities.

1. AI-Powered Dynamic Pricing & Fraud Detection

Artificial intelligence is no longer just about chatbots—it’s actively shaping how payments are priced and protected. AI-powered dynamic pricing tools can adjust product or service costs in real time based on demand, inventory, and even competitor activity. Meanwhile, machine learning models detect suspicious activity within milliseconds, reducing fraud without slowing down secure digital transactions.

2. Cross-Border Payments with Blockchain Rails

Blockchain is making cross-platform payment systems faster, cheaper, and more transparent. By bypassing traditional intermediaries, blockchain rails enable near-instant settlement for global trade, cutting costs for merchants while reducing errors in currency conversion. This has major implications for exporters, marketplaces, and B2B suppliers.

3. IoT-Driven Payments

From connected cars that pay for tolls automatically to smart refrigerators that reorder groceries, the Internet of Things is unlocking embedded finance solutions that process payments with zero user intervention. These “invisible” transactions will be a big part of the future of payment technology—but they’ll also require advanced authentication and compliance measures.

4. Central Bank Digital Currencies (CBDCs)

CBDCs promise a government-backed digital currency that can integrate seamlessly with existing financial software development services, potentially lowering transaction costs and increasing financial inclusion. For B2B payments, this could streamline account-to-account transfers and reduce reliance on card networks.

5. Pay-by-Bank & Account-to-Account Transfers

Real-time account-to-account payments are gaining traction, particularly in regions with strong open banking frameworks. These methods eliminate card fees, speed up settlement, and create a direct link between merchant and buyer accounts—ideal for recurring payments, subscriptions, and large-ticket B2B transactions.

Businesses that embrace these innovations early—while ensuring compliance, security, and seamless integration—will be better positioned to thrive in the next phase of digital payment solutions. Partnering with a tech expert like Sigma Infosolutions can help organizations adopt, integrate, and scale these capabilities without disrupting existing operations.

Conclusion & Strategic Takeaways

Payment systems have evolved from a simple back-end function into the lifeblood of business growth in today’s multi-channel commerce environment. Whether you’re selling in-store, online, through mobile apps, or across global marketplaces, a fragmented approach to payments can slow you down, hurt customer trust, and limit your ability to scale.

The right digital payment software solutions can do more than process transactions—they can unify channels, improve operational efficiency, strengthen security, and provide real-time financial insights. But with so many categories to choose from—gateways, processors, integrated platforms, digital wallets, and emerging PayTech—the key is matching the solution to your unique needs and growth goals.

Key takeaways for decision-makers:

- Unified strategy matters – Multi-channel success depends on a cohesive payment ecosystem.

- Right fit over hype – Choose solutions that align with your industry, transaction volumes, and geographic ambitions.

- Future-proof now – Emerging trends like AI, blockchain, IoT payments, and CBDCs will redefine the payment landscape.

- Expert integration is critical – The best solution is only as good as its implementation.

At Sigma Infosolutions, we specialize in financial software development services with capabilities in digital payment solutions, digital lending software solutions, and investment software development solutions that drive revenue and resilience for businesses of every scale. From payment gateway integration to full-scale integrated financial solutions, we make sure your payment ecosystem is built for today—and ready for tomorrow.