The Complete Guide to Fintech Software Development: Build Secure, Compliant, Scalable Financial Platforms

Introduction:

Financial technology has reshaped how people borrow, save, invest, and pay. From digital lending and neobanks to open-banking APIs and real-time analytics, fintech solutions today power the backbone of modern financial ecosystems.

Security, compliance, and reliability are at the foundation of building fintech products. Every system must balance agility and regulation to deliver seamless experiences for the consumer.

This guide explains how to design, build, and scale world-class fintech platforms across lending, payments, neobanking, and data analytics. We at Sigma visit it all – from architectural best practices, to regulatory guardrails, and implementation strategies drawn from years of fintech engineering experience.

Looking for a trusted fintech technology partner? Explore Sigma’s Fintech Development Services.

Why Fintech Needs Specialized Software Development

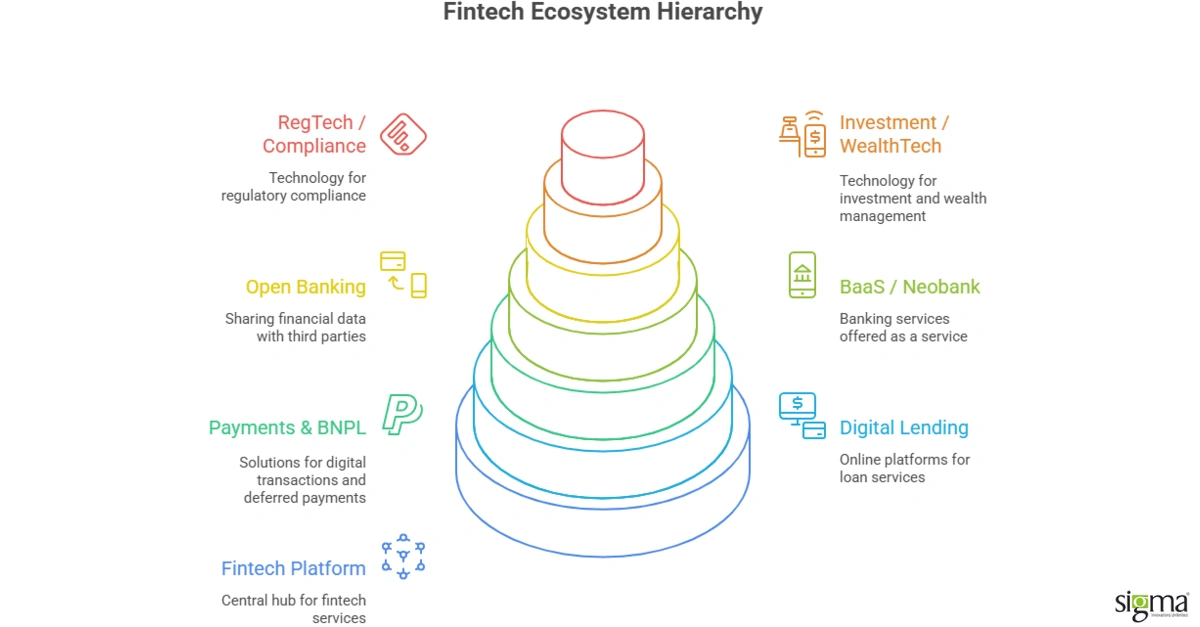

Each domain in fintech platforms – digital lending, BaaS, payments, or RegTech – have their own technical and compliance complexities and requirements.

Stringent Regulation and Security-by-Design

Whether it’s PSD2, PCI-DSS, SOC 2, or GDPR, fintechs must maintain complete audit trails, data-retention policies, and transparent API documentation. This is very important to maintain both reputation and revenue. End-to-end encryption, tokenization, secure authentication, and continuous vulnerability scanning are mandatory.

Seamless Integration

Fintech platforms rely on dozens of integrations: KYC vendors, payment gateways, banks, CRMs, and analytics systems. The challenge lies in building API-first, composable architectures that remain stable under constant change.

Rapid Market Evolution

Consumer behavior, financial regulations, and technologies evolve rapidly. Software must be modular and upgradable to accommodate new business models such as BNPL, embedded finance, and cross-border payments.

Core Fintech Platforms & Use Cases

Each fintech category addresses specific financial pain points but shares common priorities: compliance, reliability, and speed. Let’s look at the core use cases and how software development supports them.

Digital Lending

Digital lending platforms streamline borrower journeys through automated KYC, AI-driven credit scoring, and real-time loan disbursement. Modern lending software integrates:

- Loan Origination Systems (LOS) for document and workflow automation.

- Underwriting Engines powered by ML models to assess credit risk.

- Loan Management Systems (LMS) for repayment scheduling and compliance reporting.

Well-architected lending platforms shorten approval cycles from days to minutes while maintaining full traceability.

Learn more on Sigma’s Digital Lending Solutions.

Payments & BNPL

Payment systems require near-zero downtime and millisecond-level performance. Developers must implement:

- Payment gateway orchestration for routing across multiple acquirers.

- Wallet management and tokenized card storage for user convenience.

- BNPL modules integrated with credit bureaus and risk engines.

In this segment, compliance with PCI-DSS, anti-fraud analytics, and data encryption are non-negotiable.

BaaS & Neobank Enablement

Banking-as-a-Service abstracts regulated banking infrastructure into consumable APIs – allowing fintechs to build banking products without owning a license.

Key engineering priorities include:

- Secure partner onboarding using OAuth 2.0 / OpenID Connect.

- Modular core banking adapters supporting real-time transaction posting.

- KYB/KYC microservices to comply with AML directives.

A well-built BaaS platform enables new neobanks to go live in months instead of years.

Read the blog Banking-as-a-Service (BaaS) Solutions Driving Growth in Embedded Finance

Open Banking & API Ecosystems

Open-banking models encourage innovation through interoperability. Engineering challenges revolve around:

- API gateways with throttling, versioning, and sandbox environments.

- Consent management and secure data-sharing under PSD2/OBIE frameworks.

- Plug-and-play integrations with third-party data providers, CRMs, and core banks.

The result: seamless user experiences and a growing network of ecosystem partners.

Investment, WealthTech & Analytics

Wealth-management platforms combine data visualization, portfolio optimization, and AI-based recommendations.

Essential features include:

- Goal-based investment modules with algorithmic rebalancing.

- Data aggregation APIs to pull real-time market feeds.

- Personalized dashboards using predictive analytics.

These solutions are increasingly cloud-native and rely heavily on data-driven UX.

Reimagine wealth management with Sigma’s Investment Software Solutions

Architecture & Tech Stack Best Practices

Successful fintechs rely on modern, flexible, and secure architectures that evolve with regulatory and user demands.

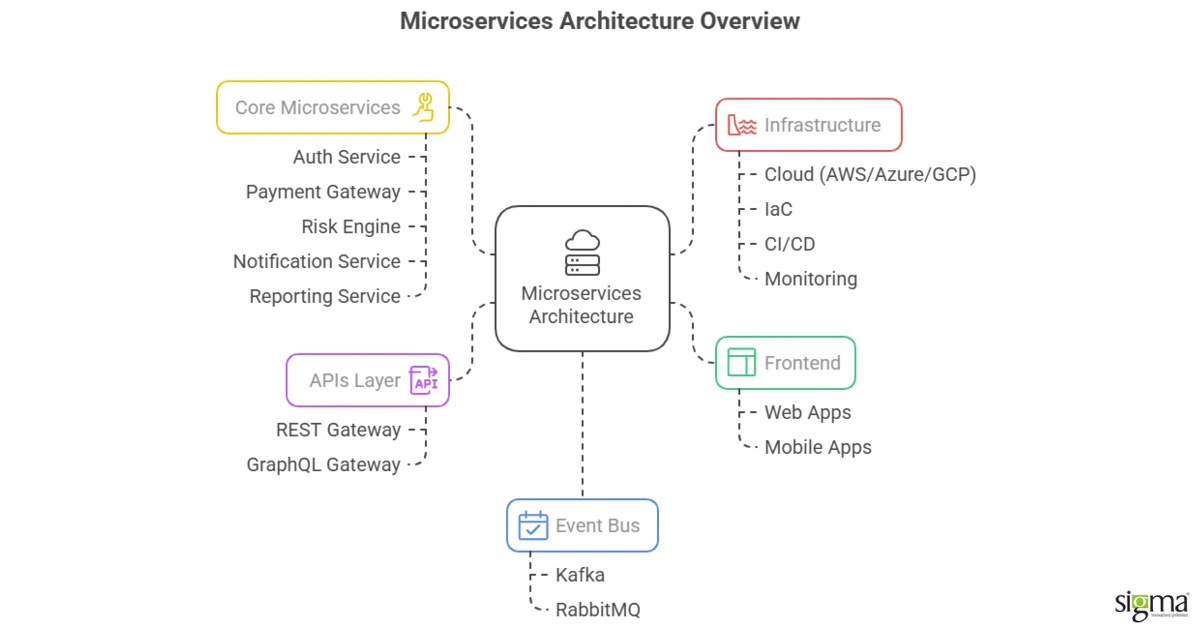

Microservices Architecture

Breaking large applications into independent microservices enables parallel development, better scalability, and fault isolation.

Typical components:

- Auth Service

- Payment Gateway Service

- Risk Engine Service

- Reporting Service

- Notification Service

Event-Driven Communication

Message queues (Kafka, RabbitMQ) support asynchronous workflows such as transaction alerts, reconciliation events, and KYC updates.

API-First Development

Public-facing REST/GraphQL APIs with clear documentation let partners integrate easily. Use OpenAPI 3.0 for schema standardization and Postman/Swagger for testing.

Cloud-Native Infrastructure

AWS, Azure, or GCP with managed services (EKS, Cloud HSM, IAM) provide compliance-ready environments.

Infrastructure-as-Code (Terraform) ensures repeatability and compliance auditability.

DevSecOps

Security integrated into CI/CD pipelines – static code analysis, dependency scanning, automated penetration testing – keeps vulnerabilities in check before deployment.

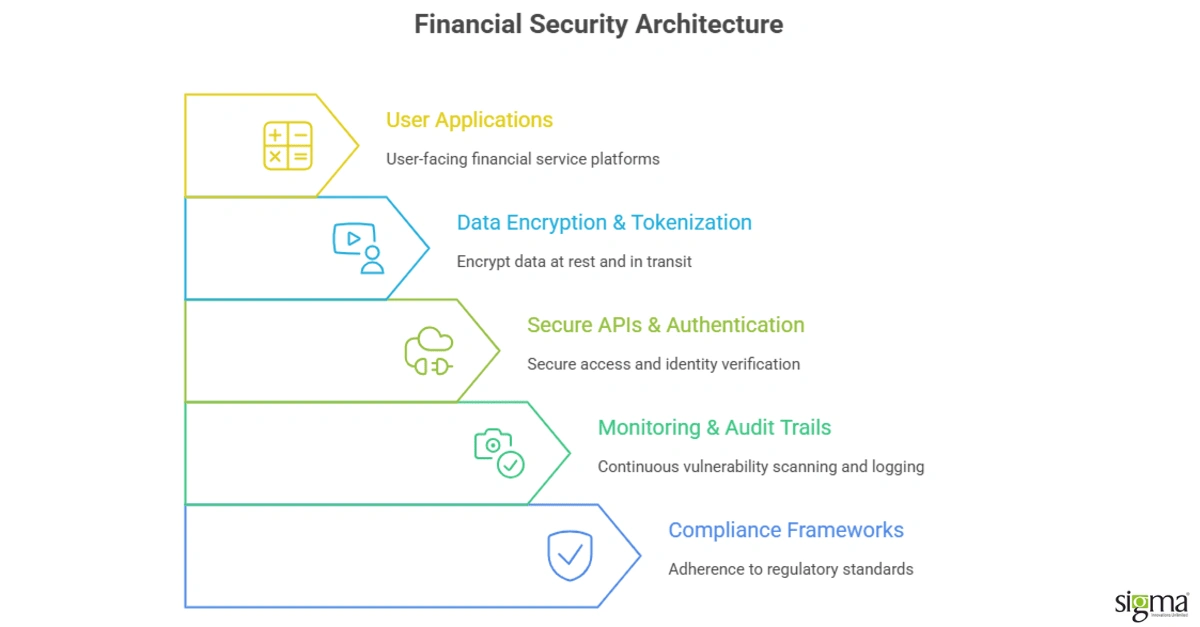

Security, Compliance & RegTech

Security in fintech is holistic: it covers data, application, infrastructure, and operations.

Data Protection

Encrypt data in transit (TLS 1.3) and at rest (AES-256). Implement tokenization for card and identity data. Use secure key management (AWS KMS or Vault).

Identity & Access Management

Adopt multi-factor authentication (MFA), role-based access control, and session-lifetime management to prevent misuse.

Compliance Automation

Automated KYC/AML workflows reduce manual review effort while maintaining accuracy. Rule-based engines flag suspicious activity, and reports are auto-generated for audits.

Audit Trails & Monitoring

Every transaction, login, and data change must be logged immutably – helping comply with SOC 2 Type II and ISO 27001 standards.

Third-Party & API Security

Perform regular penetration testing on open-banking APIs. Adopt OAuth 2.0 scopes, signed JWT tokens, and strict rate limiting.

Explore Sigma’s RegTech & Compliance Automation Services.

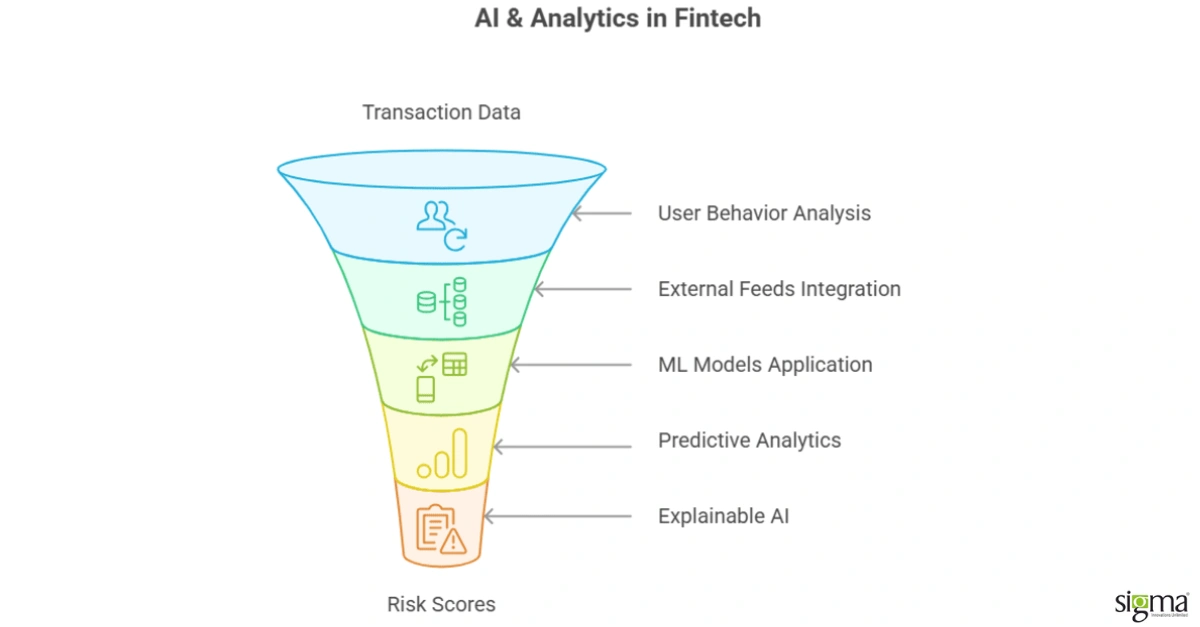

AI, Analytics & Fraud Prevention

Artificial intelligence is revolutionizing how financial systems assess risk and prevent fraud.

Credit Scoring & Risk Modeling

Machine-learning models analyze alternative data – like transaction history or behavioral signals – to produce more inclusive credit scores.

Fraud Detection

AI-driven monitoring systems identify anomalies in spending or transaction velocity in milliseconds, triggering real-time holds.

Predictive Analytics

From customer churn prediction to personalized loan offers, analytics turns raw data into actionable insights.

Explainable AI

Transparent algorithms ensure regulatory trust and compliance with emerging AI governance frameworks.

Explore Sigma’s AI & Data Analytics Solutions for Fintech Growth

Integrations & Open Banking

Interoperability defines successful fintech ecosystems.

- Standardized APIs: REST or ISO 20022 XML to align with banking systems.

- Sandbox Environments: allow partner developers to test safely.

- Data Synchronization: use webhooks or streaming APIs for real-time balance updates.

- Compliance Checks: enforce consent, scope, and traceability under open-banking directives.

Proper integration ensures faster go-to-market and minimizes manual reconciliation errors.

Unlock seamless connectivity and faster innovation with Sigma’s Open Banking & API Integration Solutions.

Product Roadmap: From MVP to Scale

1. Discovery & Compliance Assessment

Define user personas, core journeys, and regulatory boundaries. Early engagement with compliance experts prevents redesign later.

2. MVP Development

Start with minimal yet compliant functionality: KYC, basic ledger, and transaction workflows. Focus on rapid feedback loops.

3. Testing & Security Validation

Automate functional, penetration, and performance tests. Validate PCI-DSS and GDPR readiness before production.

4. Scaling & Optimization

Migrate to microservices, integrate analytics dashboards, and establish SRE practices for 24×7 uptime.

5. Continuous Innovation

Add new features – AI insights, embedded-finance modules, partner APIs – without compromising compliance or performance.

Explore Sigma’s Fintech Product Engineering Services

Cost & Vendor Selection

Cost Drivers

- Regulatory scope: more jurisdictions = higher compliance cost.

- Feature depth: lending + payments + analytics costs more than a single module.

- Security & audits: external certifications add 10–15 % of total cost.

Vendor Evaluation Checklist

- Proven fintech portfolio (digital lending, payments, neobanking).

- Security and compliance certifications (ISO 27001, SOC 2).

- Experience in cloud-native microservices.

- Ability to scale teams quickly.

Engagement Models

Dedicated teams, fixed-scope projects, or hybrid retainer models depending on roadmap flexibility.

Case Studies & Results

Case 1: AI-Enabled Lending Platform

A digital-lending client reduced approval time from 48 hours to 8 minutes using Sigma’s ML-driven underwriting engine and API-based KYC integrations.

Case 2: Payments Aggregation Platform

Sigma implemented a PCI-DSS-compliant, multi-gateway orchestration system, improving payment success rate by 18 % and reducing latency by 30 %.

Case 3: Core Modernization for Neobank

By migrating to a microservices-based BaaS stack, a client achieved 99.99 % uptime and expanded to three new markets within six months.

Explore more success stories on Sigma’s Fintech Portfolio.

How Sigma Approaches Fintech Projects

At Sigma, fintech engineering is not just about coding – it’s about translating financial logic into secure, scalable, user-centric platforms.

Our end-to-end framework covers:

- Discovery & Strategy – product definition and regulatory scoping.

- Design & Architecture – cloud-native, microservices, and API-first design.

- Development & QA – agile sprints with automated compliance gates.

- Security & Compliance – continuous vulnerability scanning and audits.

- Support & Scaling – 24×7 monitoring and feature acceleration.

With 20 + years in enterprise software and a dedicated fintech practice, Sigma helps banks, lenders, and startups deliver high-performance financial experiences faster.

Speak to a Fintech Architect: Contact Us

Conclusion

Fintech software development sits at the intersection of innovation, trust, and compliance. To succeed, organizations need a technology partner who understands both financial intricacies and engineering excellence.

From digital lending and payments to BaaS, AI, and open banking, the opportunities are immense – when backed by secure, scalable, and compliant platforms.

Start building your next-generation fintech solution with Sigma Infosolutions today. Contact Us

FAQ

What is fintech software development?

It’s the process of designing and building digital platforms that deliver financial services such as lending, payments, or banking through secure, compliant technology.

How long does it take to develop a fintech app?

A minimal viable fintech product typically takes 4-6 months; a full-scale platform can extend up to 12 months depending on integrations and compliance layers.

What tech stack is best for fintech development?

Common stacks include Node.js/Java (Spring Boot) for back-end, React / Angular for front-end, and AWS / Azure / GCP for cloud hosting with Kubernetes orchestration.

How do fintechs ensure compliance?

By embedding KYC/AML, encryption, and audit trails into every layer, and by aligning with standards like PCI-DSS, SOC 2, and GDPR.

What are the biggest challenges in fintech product development?

Security threats, evolving regulations, integration complexity, and balancing speed with compliance.