The Future of Banking App Development: Digital Banking Innovations

Key Highlights

- Digital banking in 2026 will be driven by AI-powered hyper-personalization, blockchain transparency, and advanced biometric security.

- Banking apps will evolve into intelligent financial advisors offering predictive insights and tailored services beyond basic transactions.

- Super apps integrating payments, investing, and insurance will become mainstream, simplifying comprehensive financial management.

- Modular, scalable architectures will enable rapid feature updates and user-centric design to maintain competitiveness.

- Open banking and PSD3-compliant e-identity systems will enhance seamless third-party integrations and empower customer control over financial data.

- The evolution from ATMs to mobile apps highlights ongoing efforts to simplify access and improve user experience in digital banking.

Understanding Digital Banking and Its Evolution

Digital banking has transformed from basic automated teller machines (ATMs) in the 1960s to fully integrated online and mobile platforms today. The journey began with early electronic bookkeeping systems like ERMA, which automated manual processes, setting the stage for subsequent innovations. The 1990s introduced internet banking, allowing customers to access accounts remotely, while the smartphone revolution accelerated mobile banking adoption in the 2000s.

Key milestones include:

- Introduction of ATMs enabling 24/7 cash access

- Launch of online banking platforms for remote account management

- Mobile banking apps leveraging smartphones for on-the-go services

This evolution reflects the banking sector’s ongoing goal: simplifying customer interactions and enhancing accessibility. Understanding this history helps developers and banks anticipate future trends and user expectations, ensuring digital banking solutions stay relevant and user-friendly.

Current State of Banking App Development

Banking app development in 2024 centers on enhancing usability, security, and personalized financial management. With over half of users accessing apps multiple times weekly, banks prioritize intuitive interfaces and real-time insights to meet rising customer expectations. AI-driven features like voice-activated commands and predictive analytics are increasingly integrated, enabling personalized budgeting and spending alerts.

Security remains paramount, with biometric authentication and advanced encryption becoming standard to combat growing cyber threats. Open banking APIs facilitate seamless third-party integrations, expanding service ecosystems while maintaining compliance.

Key focus areas include:

- User-friendly design for effortless navigation

- AI-powered personalization for tailored advice

- Robust security measures including biometrics

- Integration with fintech services via open APIs

These trends highlight a shift from basic transaction apps to comprehensive financial management platforms.

Key Digital Banking Innovations to Watch

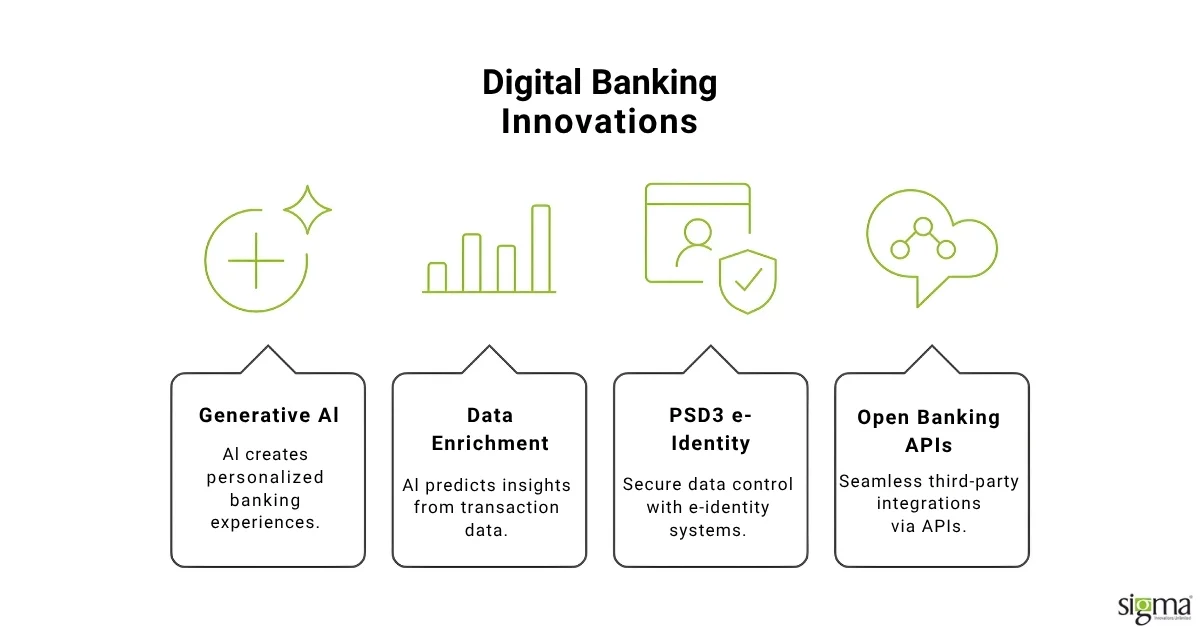

In 2026, digital banking innovations will focus on enhancing personalization, security, and seamless integration through advanced AI, blockchain, and open banking technologies. Generative AI will transform customer interactions by delivering emotionally engaging, tailored financial advice, restoring the human touch in digital experiences. Transaction data enrichment powered by AI and machine learning will enable banks to predict customer needs and offer customized products proactively.

Additionally, PSD3-compliant e-identity systems will provide stronger, user-controlled data sharing, enhancing security and compliance. Open banking APIs will foster interconnected ecosystems, allowing customers to access diverse financial services effortlessly. Mobile wallets and embedded finance will further simplify payments and credit access.

Key innovations include:

- Generative AI for personalized, empathetic banking

- AI-driven transaction data enrichment for predictive insights

- PSD3 e-identity systems enhancing secure data control

- Open banking APIs enabling seamless third-party integrations

These trends will reshape banking apps into intelligent, customer-centric platforms.

Artificial Intelligence and Machine Learning Enhancements

AI and machine learning (ML) are revolutionizing banking apps by delivering smarter security and personalized experiences. These technologies analyze vast transaction data in real time to detect fraud patterns that traditional methods might miss, enabling instant alerts and adaptive authentication measures. For example, AI-powered systems can flag unusual spending behavior and prompt additional verification only when necessary, balancing security with user convenience.

Additionally, ML algorithms enhance financial forecasting and budgeting tools by learning from user habits, offering tailored advice and predictive insights. Banks use AI-driven chatbots and virtual assistants to anticipate customer needs, improving engagement and satisfaction.

Key benefits include:

- Real-time fraud detection reducing financial losses

- Personalized financial recommendations boosting user loyalty

- Automated risk management enhancing operational efficiency

Leverage Sigma’s Artificial Intelligence Development Services for a positive growth trajectory.

Blockchain and Distributed Ledger Technologies

Blockchain and distributed ledger technologies (DLT) are revolutionizing digital banking by enhancing transparency, security, and efficiency. Unlike traditional centralized databases, DLT allows multiple participants to maintain synchronized records, reducing errors and fraud risks. Banks leverage blockchain for faster cross-border payments, cutting transaction costs and processing times significantly. For example, partnerships with providers like Ripple enable near-instant international transfers at minimal fees.

Key benefits include:

- Immutable transaction records enhancing trust

- Reduced operational costs through automation

- Improved compliance with transparent audit trails

- Smart contracts enabling automated, conditional transactions

However, integrating blockchain requires careful regulatory compliance and infrastructure alignment. Banks must balance innovation with security and cost-effectiveness to unlock blockchain’s full potential in digital banking.

Biometric Authentication and Enhanced Security Features

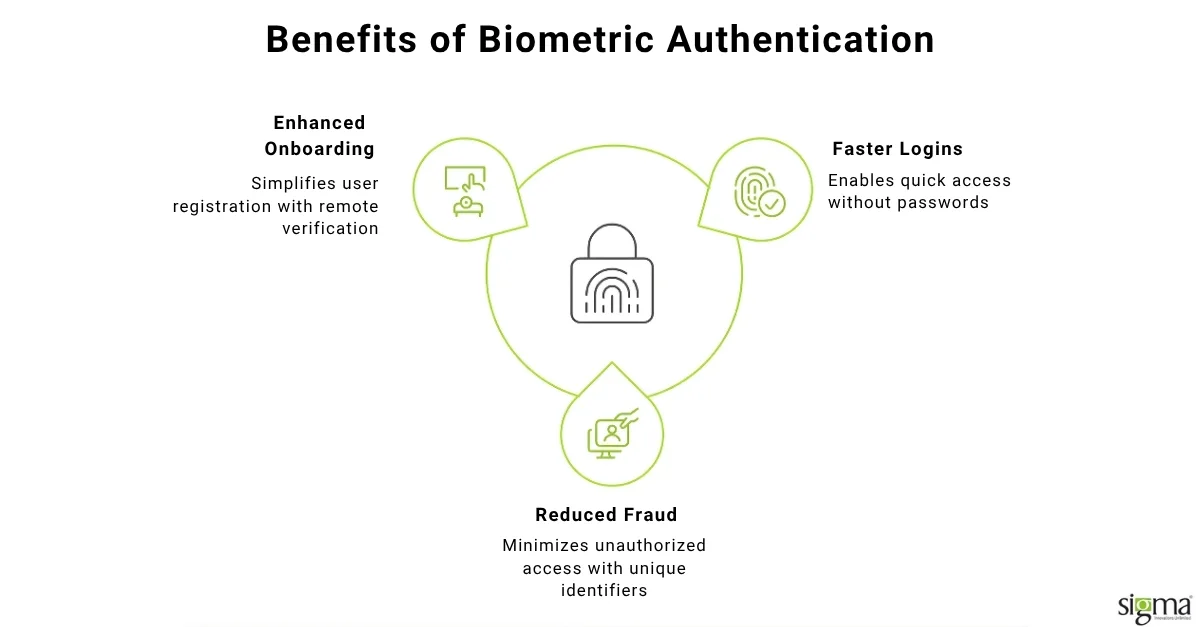

Biometric authentication is rapidly becoming a cornerstone of secure, user-friendly banking apps. By leveraging unique physical traits like fingerprints, facial recognition, and iris scans, banks can offer seamless access while significantly reducing fraud risks. Unlike traditional passwords, biometrics provide a robust defense against identity theft and unauthorized access, enhancing customer trust.

Key benefits include:

- Faster, password-free logins and transactions

- Reduced fraud through unique, hard-to-replicate identifiers

- Enhanced onboarding with remote biometric verification

For example, many banks now integrate device-level biometrics with app-specific security layers, ensuring multi-factor protection without sacrificing convenience. As biometric technologies evolve alongside AI and blockchain, they promise even greater security and personalization, making banking safer and more accessible for all users.

Open Banking and API-Driven Ecosystems

Open Banking APIs are transforming banking by enabling secure, real-time data sharing between financial institutions and third-party providers. This API-driven ecosystem fosters innovation, allowing fintechs to build personalized financial services like budgeting apps and payment initiation tools that aggregate data across multiple accounts. Banks benefit by expanding their service offerings without heavy infrastructure changes, while customers enjoy seamless, integrated experiences.

Key advantages include:

- Real-time access to diverse financial data

- Enhanced personalization through aggregated insights

- New revenue streams from API-enabled partnerships

- Improved compliance with standardized security protocols

For example, companies offering open banking and API integrations help banks scale securely while complying with regulations like PSD2 and PSD3. Embracing API ecosystems is essential for banks aiming to stay competitive and meet evolving customer expectations.

Accelerate your digital banking innovation with Sigma’s Fintech Software Development Services

Real-Time Payments and Instant Services

Real-time payments (RTP) are reshaping banking by enabling instant, secure fund transfers 24/7, meeting modern consumer and business demands for speed and convenience. Unlike traditional batch processing, RTP settles transactions in seconds, improving liquidity and cash flow management for users. This immediacy enhances customer experience by eliminating payment delays, fostering trust and loyalty.

To fully leverage RTP, banks must integrate APIs and open banking frameworks that support seamless interoperability across platforms. For example, Sweden’s Swish app revolutionized P2P payments by enabling instant transfers backed by strong bank collaboration. Similarly, U.S. banks are expanding RTP networks to cover more users and services.

Key benefits of RTP include:

- Instant settlement reducing payment uncertainty

- Enhanced cash flow for businesses and consumers

- Lower transaction costs compared to card networks

- Support for innovative services like bill pay and merchant settlements

Read our success story: US-based B2C mobile app and admin portal for digital payments.

Adopting RTP infrastructure is crucial for banks aiming to stay competitive and deliver superior digital experiences.

Streamline your RTP ecosystem with Sigma’s digital payment software solutions

Hyper-Personalization and Customer Experience Improvements

Hyper-personalization is transforming banking apps into proactive financial companions by leveraging AI-driven insights and real-time data analytics. This approach tailors every interaction—from personalized product recommendations to customized financial advice—based on individual behaviors, goals, and preferences. For example, several banks’ virtual assistants use advanced analytics to deliver timely spending insights and alerts tailored to each user’s habits.

To implement hyper-personalization effectively, banks should:

- Enhance data capture and behavioral analytics capabilities

- Prioritize transparent privacy policies to build trust

- Use AI to anticipate customer needs and offer “next best” experiences

By focusing on these areas, banks can significantly improve customer satisfaction and loyalty while addressing privacy concerns.

Transform Customer Experience with Sigma’s Fintech AI & Data Analytics

Conclusion: Embracing Innovation to Shape the Future of Banking Apps

Embracing innovation is essential for banks to stay competitive and deliver exceptional digital experiences. As banking apps evolve, integrating AI, blockchain, biometrics, and open banking APIs will transform them into holistic financial ecosystems that anticipate user needs and enhance security. Institutions that adopt modular, scalable architectures can rapidly adapt to emerging trends while maintaining compliance and usability.

Key takeaways for banks:

- Prioritize continuous innovation to meet rising customer expectations

- Focus on seamless integration of new technologies for richer user experiences

- Balance security and personalization to build trust and loyalty

- Invest in customer education to maximize adoption and satisfaction

By embracing these strategies, banks can not only future-proof their apps but also redefine how customers engage with financial services.

Launch, Scale, and Modernize with Sigma’s BaaS & Neobank Enablement Solutions

Frequently asked questions (FAQs)

1. What are the top digital banking trends to watch in 2026?

Key trends include AI-powered hyper-personalization, blockchain-based transparency, biometric authentication, real-time payments, and open banking APIs. These innovations will transform banking apps into full-service financial ecosystems that offer predictive insights and seamless user experiences.

2. How will AI and machine learning improve banking apps?

AI and ML will deliver smarter fraud detection, personalized financial advice, and predictive budgeting tools. They analyze real-time transaction data to flag risks, recommend products, and create a more engaging, human-like digital experience for users.

3. Why is blockchain important for the future of digital banking?

Blockchain enables faster, more secure transactions, eliminates intermediaries, and ensures transparent, tamper-proof records. Banks use it to cut cross-border payment costs, streamline compliance, and enable smart contracts for automated, conditional transactions.

4. How do biometric security features make banking safer?

Biometrics like fingerprint, facial recognition, and iris scans provide password-free authentication, reducing fraud and identity theft. Combined with AI-driven risk detection, they deliver multi-layered security without sacrificing user convenience.

5. What role does open banking play in banking app development?

Open banking APIs allow secure data sharing between banks and third-party providers, enabling services like budgeting apps, investment tools, and instant payments. This creates an interconnected financial ecosystem that puts customers in control of their data and improves overall user experience.