Re-engineering a Legacy LOS to Achieve a Single-Day Funding Record

Client Organization

Our partner is a veteran in the small business funding arena, dedicated to offering swift, transparent, and user-friendly financing. With a 20-year track record, they understand that for a small business, time is the ultimate currency. They provide a mix of self-service digital convenience and the reassurance of expert advice, positioning themselves as a catalyst for their clients’ continued growth and expansion.

Project Brief

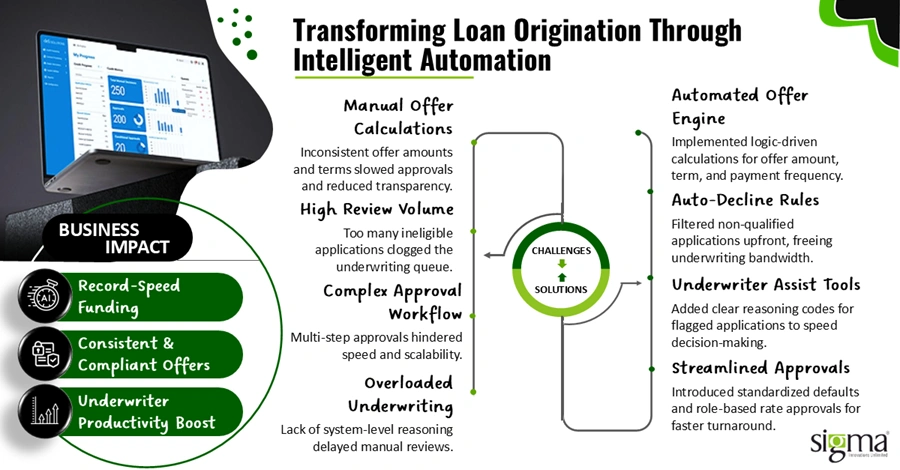

The challenge was clear: manual steps in the loan origination process were slowing down funding, creating inconsistencies, and reducing transparency for both customers and internal teams. We were brought in to completely overhaul the credit decisioning and offer generation process, shifting it toward a high-velocity, automated model. The goal was to accelerate funding while ensuring higher compliance and consistency.