7 Ways Digital Lending is Revolutionizing US Lending

Key Takeaways:

- AI-driven automation is cutting loan processing times from weeks to minutes, improving efficiency and accessibility for individuals and small businesses.

- Personalized, transparent, and user-friendly platforms are expanding financial inclusion and building borrower trust.

- Innovations and integrations (e.g., with e-commerce and accounting tools) plus strong security measures are streamlining SME lending while safeguarding data.

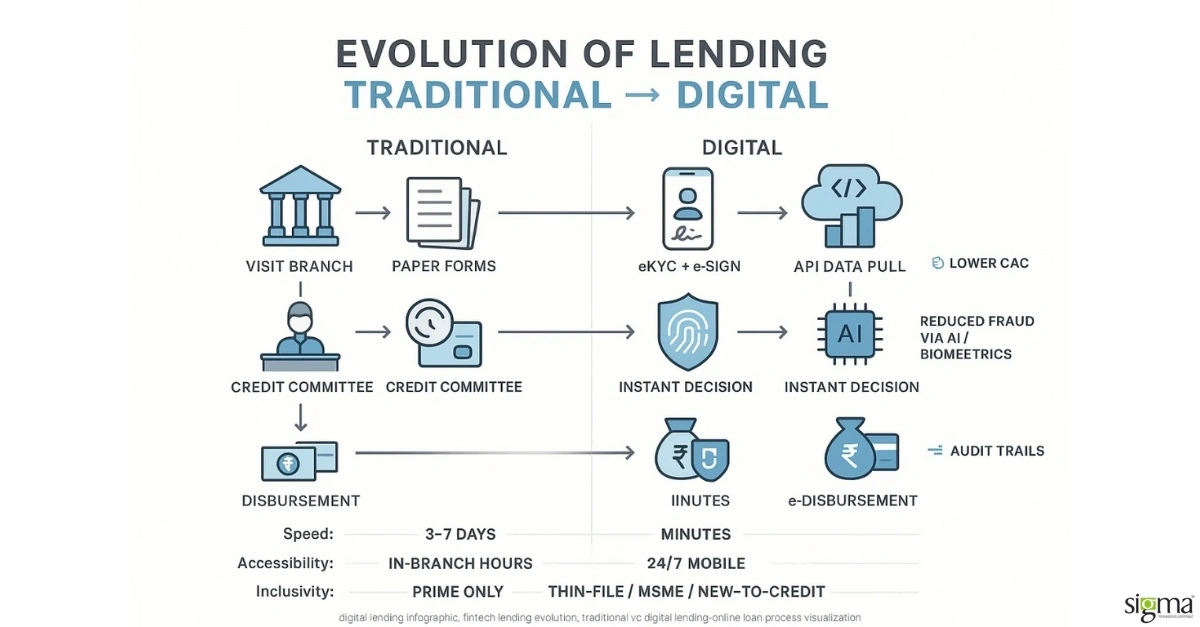

Digital lending is fundamentally revolutionising US finance, moving beyond traditional banks with fast, online platforms that streamline the entire borrowing process. Leveraging AI and automation, it offers speedy approvals and expands access to credit for individuals and small businesses. This transformative shift is making borrowing simpler, quicker, and more inclusive across the US lending landscape.

Revolutionize your lending with Sigma’s Digital Lending Solutions, fast approvals, smarter credit decisions, and seamless borrower experiences.

Understanding Digital Lending: The New Frontier in US Lending

What happens when legacy banking meets digital transformation? Digital lending is fundamentally transforming how individuals and businesses access credit, moving away from the cumbersome, paper-intensive processes of traditional banks toward fast, online solutions. Our FinTech Solutions are built on the premise that borrowers need to apply anytime, anywhere, and receive approvals not in weeks, but in minutes.

This profound shift is largely driven by FinTech companies, who leverage automation and data analytics to offer personalized loan options with unparalleled transparency. This approach drastically reduces friction and operational costs while significantly broadening access to capital, particularly for underserved consumers and small businesses, both domestically and internationally. Imagine a small business in a remote location securing working capital through a dedicated FinTech application, entirely bypassing the typical delays associated with conventional bank loans.

Key features of this new frontier include:

- Fully online application and approval processes

- Minimal paperwork and significantly faster disbursement

- Customized loan offers derived from real-time data analysis

This isn’t just a trend; it’s a strategic evolution reshaping the global financial ecosystem, making borrowing simpler, quicker, and more inclusive for enterprises everywhere.

1. Accelerated Loan Approval Processes Through Advanced Lending Technology

How quickly can your legacy systems truly respond to market demands? Advanced lending technology, particularly AI-powered automation, is drastically accelerating loan approvals. We’re talking about cutting processing times from weeks to mere minutes. Our internal AI-powered tools, such as AccelTest for QA automation and MatchSmart for resource management, demonstrate our commitment to leveraging AI for efficiency. By analysing vast data sets instantly, AI systems within a comprehensive lending technology system can assess creditworthiness far more accurately and swiftly than any manual review process. This not only speeds up decisions but also substantially reduces human error and inherent biases.

Here’s what we’ve learned from over two decades in this space: the key benefits for international enterprises are immense:

- Real-time loan approval or denial, critical for fast-moving markets

- Dynamic interest rate adjustments based on intricate borrower profiles

- Enhanced fraud detection through sophisticated pattern recognition, vital for cross-border transactions

For instance, major financial institutions that have implemented AI-driven workflows have reported up to a 70% reduction in loan processing times, directly translating to improved customer satisfaction and operational efficiency. Borrowers now expect, and often receive, near-instant decisions, positioning digital lending solutions as exceptionally more accessible and responsive than traditional methods.

2. Enhanced Accessibility to Online Loans and Business Loans

Are your existing systems limiting your global reach and client base? Digital lending solutions have dramatically increased accessibility to various online loans and business loans for both individuals and enterprises, effectively breaking down traditional barriers. Unlike conventional banking hours, our online lending solutions operate 24/7, allowing borrowers to apply anytime, from any location with internet access. This flexibility is particularly beneficial for small to medium-sized enterprises (SMEs) and even larger corporations that require rapid, reliable funding without being constrained by office hours or geographical limitations.

Our expertise consistently highlights key accessibility benefits:

- Simplified application processes requiring minimal paperwork, streamlining global operations

- Broader eligibility criteria, enabling a more inclusive approach for underserved borrowers and emerging markets

- Faster funding turnaround, often within days or even hours, which is crucial for agile business operations

FinTech business loans providers, for example, have significantly expanded credit access to entrepreneurs and companies that were historically overlooked by traditional banks, offering competitive rates and highly tailored loan products. This inclusivity is not just socially responsible; it actively helps businesses grow and supports economic diversity on a global scale.

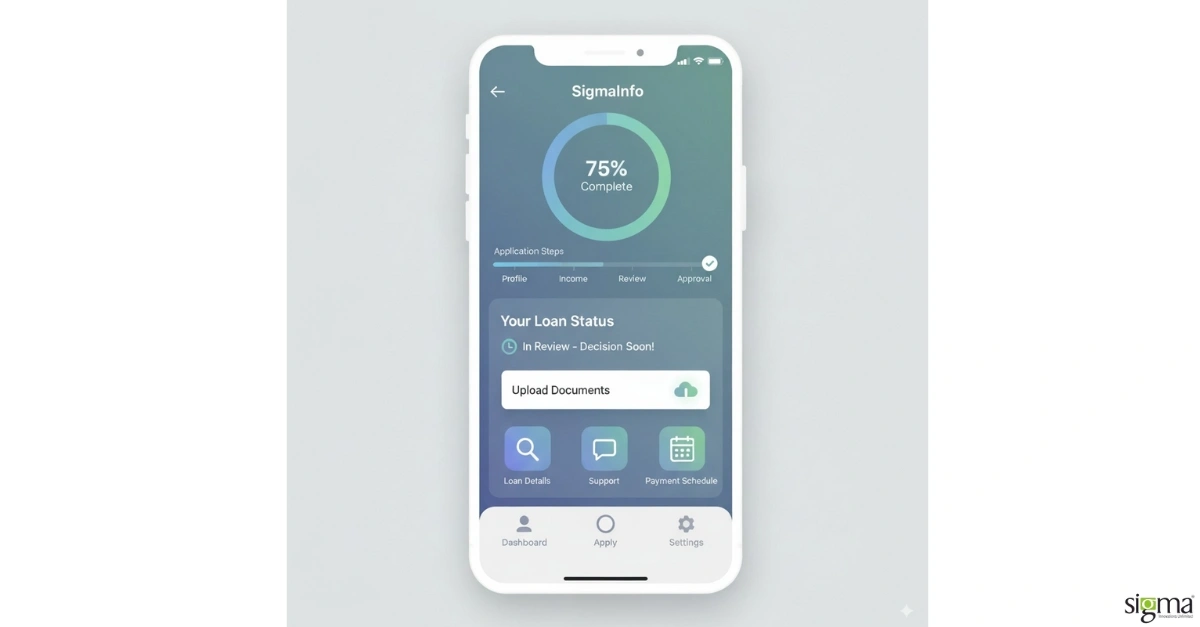

3. Innovative Lending Solutions Offering Seamless User Experiences

In today’s competitive landscape, how are you ensuring your lending systems deliver an unparalleled user experience? Innovative lending solutions from firms like ours prioritize user-friendly interfaces and smooth digital journeys, making borrowing not just efficient but genuinely effortless and transparent. These systems integrate intuitive design with real-time updates, enabling borrowers to track applications, upload documents, and receive decisions instantly, regardless of their location.

Here’s how we, with our 20+ years of expertise, define key features driving seamless experiences:

- Easy navigation with clearly articulated loan terms, crucial for international clarity

- Mobile-friendly applications for on-the-go access, supporting a global workforce

- Automated notifications and comprehensive self-service portals, enhancing operational efficiency

Consider how AI- driven digital lending systems, like those we help develop, empower lenders to manage applications anytime, vastly improving turnaround times and borrower satisfaction. Such innovations not only reduce friction but also build immense trust, setting new global standards for digital lending convenience.

4. Improved Transparency and Trust in Lending Solutions

When dealing with international finance, how do you guarantee unwavering transparency and absolute trust? Transparency is undeniably a cornerstone of trust in digital lending, and modern solutions excel by providing clear, upfront loan details from the very beginning. Borrowers gain immediate access to interest rates, fees, repayment terms, and eligibility criteria early in the application process. This openness drastically reduces uncertainty and empowers informed decisions, which is particularly vital in a complex global regulatory environment.

For a Fortune 500 CTO, the integrity of data and the security of transactions are paramount. As a company that holds ISO/IEC 27001:2022 certification, we understand that robust information security management is non-negotiable, particularly when handling sensitive financial data across borders, adhering to standards like GDPR and SEC compliance. This certification, alongside ISO 9001:2015 for quality management, underpins our ability to deliver highly secure and reliable lending solutions.

Key ways digital lending boosts transparency and trust:

- Early disclosure of all loan costs and conditions, promoting fairness across markets

- Real-time updates on application status, fostering consistent communication

- Strong data security protocols protecting sensitive information, critical for global operations

- Combining AI efficiency with expert human support for personalized guidance

Our clients have seen that when borrowers feel informed and secure, they are significantly more likely to trust and recommend digital lenders, fostering long-term relationships and ultimately boosting customer retention by up to 70% in related digital initiatives.

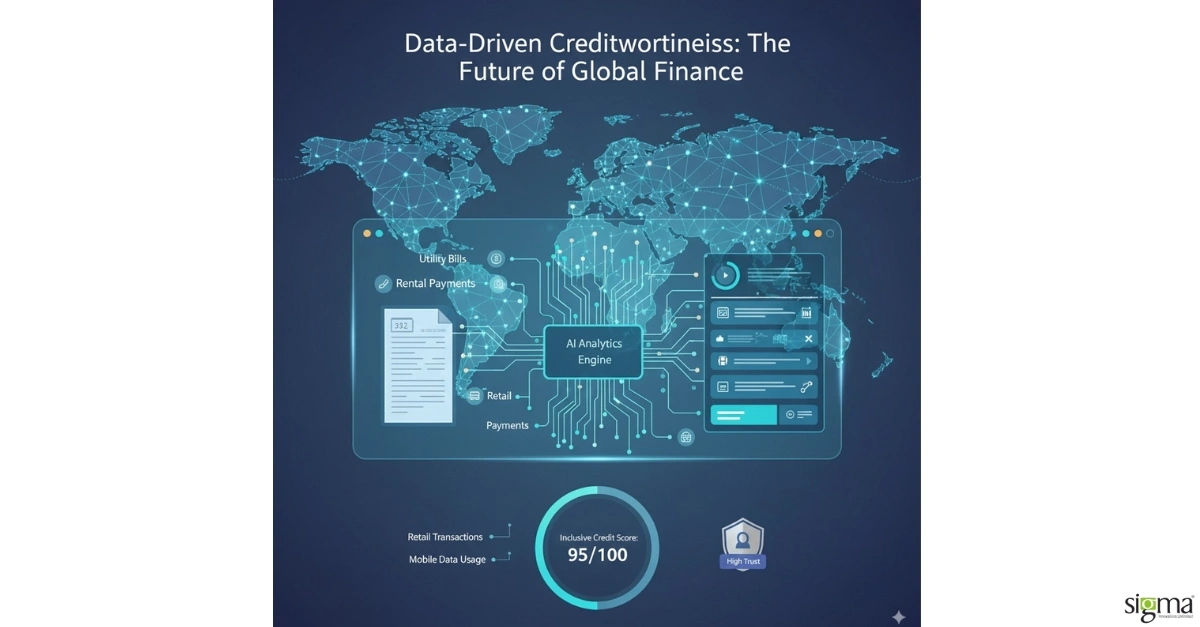

5. Data-Driven Decision Making Enhancing Creditworthiness Assessment

Are your credit assessment methods truly inclusive and accurate enough for diverse, international markets? Data-driven decision-making is revolutionizing creditworthiness assessment by incorporating alternative data and AI analytics to create more accurate, inclusive evaluations. Traditional credit scores, especially when applied globally, often fail to capture key financial behaviours. However, sophisticated lending technology now leverages diverse data sources—such as utility payments, rental history, and point-of-sale transactions—to gain a more comprehensive understanding of borrower risk, transcending traditional credit limitations.

This advanced approach, which we integrate into our lending technology solutions, helps to:

- Identify creditworthy borrowers who might be overlooked by conventional models, expanding your addressable market

- Reduce bias by relying on objective, comprehensive data sets, ensuring fair practices worldwide

- Enable faster, more precise loan approvals, crucial for competitive agility

For example, reports show that a significant portion of US lenders are already utilising alternative credit data for new applicants, improving both access and risk pricing. By integrating AI-driven analytics, lenders can make fairer, more informed decisions, expanding credit availability while managing risk effectively, which is paramount for international financial institutions.

6. Cost-Effective Lending Solutions Benefiting Both Lenders and Borrowers

How can you achieve significant operational cost reductions without compromising service quality? Digital lending solutions deliver substantial cost reductions for both lenders and borrowers by fundamentally streamlining processes and significantly cutting overhead. Automation and AI eliminate much of the manual work inherent in traditional lending, reducing operational expenses by up to 30%. This heightened efficiency allows lenders to process a far greater volume of applications without needing to increase staff, and these savings are then passed on to borrowers through lower interest rates and reduced fees.

Key cost benefits we consistently observe:

- Reduced need for expensive physical branches and cumbersome paperwork

- Faster loan processing that directly lowers administrative costs

- Competitive rates achieved through leaner, more agile operations

This win-win scenario makes credit more affordable and broadly accessible, particularly for small businesses and underserved borrowers globally, fostering economic growth and stability.

7. Future Trends: How Digital Lending Will Continue to Shape US Lending Beyond 2025

What strategic innovations are critical for your lending operations to thrive beyond the current decade? Digital lending will increasingly leverage AI, embedded finance, and sustainability to redefine US and international lending beyond 2025. AI-powered solutions will continue to enhance credit risk assessment and fraud detection, enabling even more accurate, faster, and fairer lending decisions across diverse demographics. Embedded lending will experience significant growth, seamlessly integrating financing options directly into e-commerce, SaaS, and other non-financial systems for instant access at the crucial point of need.

Here’s our projection for the key future trends:

- AI-driven hyper-personalization and dynamic loan pricing, adapting to real-time market conditions

- Expansion of green and sustainable lending products, aligning with global ESG initiatives

- Increased use of alternative data to further broaden credit access, especially in emerging markets

- Greater regulatory adaptation to support digital innovation, ensuring compliance across jurisdictions

Our experience shows that lenders adopting embedded finance and AI solutions report improved customer retention and operational efficiency, strategically positioning themselves for competitive advantage in a rapidly evolving market.

Conclusion: The Transformative Impact of Digital Lending on US Lending in 2025 and Beyond

How will your organisation position itself as a leader in this evolving digital financial landscape? Digital lending is fundamentally reshaping the US and global lending landscape by delivering speed, accessibility, and personalization at unprecedented levels. As 2025 unfolds, lenders who proactively embrace advanced automation, AI-driven analytics, and seamless digital experiences will undoubtedly stand out by consistently meeting evolving borrower expectations. This transformation not only accelerates approvals but also critically expands credit access to underserved markets, including small businesses and individuals with limited traditional credit history internationally.

For your organisation to thrive, here are key takeaways based on our 20+ years of FinTech expertise:

- Prioritize data-driven, personalized loan offers to cater to diverse client segments

- Invest in robust automation to significantly reduce operational costs and mitigate human errors

- Enhance transparency and security to build unshakeable borrower trust, adhering to global standards like ISO/IEC 27001:2022 and GDPR

- Strategically explore embedded finance to integrate lending into broader business ecosystems, creating new revenue streams.

By adopting these strategies, international enterprises can create future-proof operations that foster sustainable growth and comprehensive financial inclusion well beyond 2025. The digital lending market value is expected to grow at a CAGR of 15.2% by 2032! If you are a fintech or a lender, partner with the best digital lending solution provider in the US and explore the robust dollar opportunities the market growth has created.

Digital Lending vs. Traditional Lending: A Comparison

| Feature | Traditional Lending Approach | Digital Lending Solution |

|---|---|---|

| Application Process | Lengthy, often in-person, extensive paperwork | Fully online, mobile-friendly, minimal paperwork, accessible 24/7 |

| Approval Speed | Weeks to months, manual review | Minutes to days, AI-powered automation |

| Accessibility | Limited by physical branches, strict criteria, office hours | Broadened access, inclusive criteria, location-independent |

| Credit Assessment | Primarily traditional credit scores, limited data points | Big data, AI analytics, alternative data sources (utility, rental history) |

| Transparency & Trust | Loan terms often complex, less real-time updates | Clear, upfront disclosure, real-time status updates, strong data security (ISO 27001:2022) |

| Operational Costs | High due to manual processes, physical infrastructure | Significantly reduced through automation, leaner operations |

| User Experience | Can be cumbersome, limited self-service | Seamless, intuitive design, personalized offers, self-service portals |

Leverage Sigma’s Digital Lending Solutions and scale your business right away!

Frequently asked questions (FAQs)

1. What is digital lending, and how does it work?

Digital lending enables loan applications and approvals through online platforms, using AI and automation for faster, paperless, and more accessible borrowing.

2. How does AI improve the digital lending process?

AI accelerates loan approvals, improves credit assessments, and reduces fraud by automating processes and personalizing loan offers.

3. What are the benefits of digital lending for small businesses?

Digital lending provides small businesses and users with quick, flexible funding and broader eligibility, bypassing the delays of traditional bank loans.

4. How do digital lending platforms ensure security for borrowers?

Digital lending platforms use encryption, biometric authentication, and robust data protection measures to secure borrower information.

5. What are the future trends in digital lending?

Future trends include AI-powered personalization, expanded use of alternative data, and embedded finance, integrating lending into non-financial platforms.