How FinTech & Technological Innovations Are Shaping the Future of eCommerce

The world of online shopping (eCommerce) is changing fast, thanks to financial technology (FinTech). From quick digital payments to smart AI recommendations, FinTech is making online businesses better and easier to use. Customers today want fast, safe, and simple payment

methods. To meet these expectations, eCommerce businesses are using the latest financial technologies.

In this blog, we will explore how FinTech is shaping eCommerce, the key trends driving these changes, and how businesses can leverage financial software development services to stay ahead of the competition.

The Connection Between FinTech & eCommerce

FinTech and eCommerce go hand in hand. With digital payments, online loans, and AI-driven financial tools, shopping on the internet has never been easier. Here’s how FinTech is improving eCommerce:

- Easy Payments – Digital wallets, one-click payments, and real-time transactions make buying online smooth and hassle-free.

- Embedded Finance – Some eCommerce platforms now offer built-in financial services like “Buy Now, Pay Later” (BNPL) and instant loans to improve customer experience.

- Better Security – AI and blockchain technology help prevent fraud and protect online payments, making shopping safer.

Customers today expect more than just great products. They also want a secure, fast, and personalized payment experience. Businesses that use FinTech solutions will have a better chance of success in the competitive eCommerce world.

Key FinTech Innovations That Help eCommerce Grow

1. AI-Powered Security & Fraud Detection

Online shopping comes with risks, but AI is helping to prevent fraud. Smart computer programs analyze customer behavior and detect suspicious activity in real-time. This helps businesses reduce fraud, avoid financial losses, and gain customer trust.

2. Buy Now, Pay Later (BNPL)

Services like Afterpay and Klarna let customers buy products now and pay later in small installments. This makes it easier for people to afford what they need, leading to higher sales for online stores.

3. Cryptocurrency & Blockchain Payments

More businesses are starting to accept Bitcoin, Ethereum, and other cryptocurrencies. Blockchain technology ensures secure, low-cost, and fast international transactions without the need for banks.

4. Digital Wallets & Contactless Payments

Payment apps like Apple Pay, Google Pay, and PayPal make checkout faster and reduce abandoned carts. These digital wallets also improve customer experience by making transactions smooth and secure.

Also Read: Leveraging the Power of IoT Analytics in Today’s Digital World

AI & Machine Learning in eCommerce

Artificial Intelligence (AI) and Machine Learning (ML) are making online shopping more personalized and efficient. Here’s how:

- Smart Recommendations – Websites like Amazon suggest products based on what users have previously searched or purchased.

- Chatbots & Virtual Assistants – AI-powered chatbots answer customer questions and guide them through the buying process.

- AI-Based Credit Scoring – AI helps businesses offer instant credit approvals based on real-time data, making it easier for customers to get financing.

These technologies help eCommerce companies improve customer engagement and simplify financial operations.

The Future of eCommerce & FinTech

These new FinTech trends shape the future of online shopping:

- Decentralized Finance (DeFi) & Smart Contracts – Businesses can use blockchain technology to offer direct payments, automated loans, and digital rewards.

- 5G Technology – Faster internet speeds will make online transactions quicker and safer.

- AI-Powered Personalization – AI tools will suggest personalized financing options, predict spending habits, and offer smart savings plans.

- Global Payments – With businesses selling worldwide, multi-currency wallets and instant foreign exchange payments will simplify international transactions.

Also Read: Shopify Dawn Theme vs. Other Options: What Suits You?

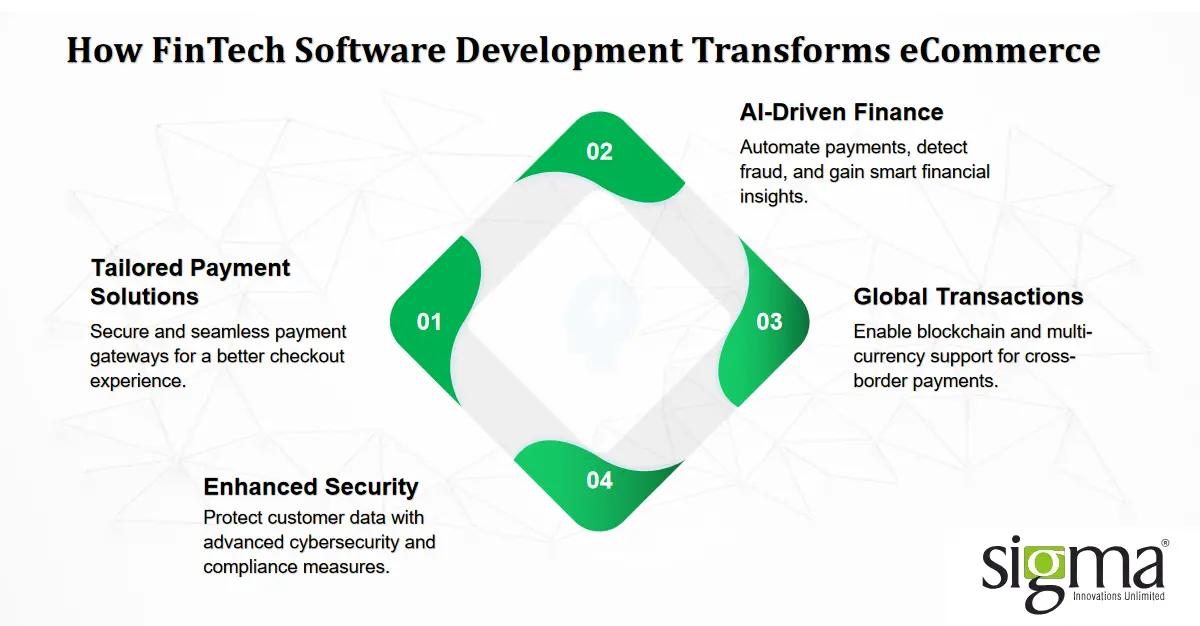

How FinTech Software Development Helps eCommerce Businesses

To take full advantage of FinTech, businesses need expert FinTech software developers who can:

- Create Custom Payment Solutions – Secure and user-friendly payment gateways.

- Use AI for Smarter Finances – Fraud detection, smart analytics, and automated payments.

- Support International Transactions – Blockchain-based and multi-currency payment options.

- Ensure Security & Compliance – Advanced cybersecurity measures to protect customer data.

By working with a FinTech software development company, eCommerce businesses can stay ahead in this fast-changing industry.

Conclusion

FinTech is changing the future of eCommerce with AI-driven fraud detection, blockchain payments, and smart financial solutions. Businesses that use these new technologies will improve customer experience and gain a competitive advantage in the digital marketplace.

Are you looking for expert financial software development services to upgrade your eCommerce platform? Our team of experienced FinTech software developers can help you build secure, scalable, and innovative solutions for your business.

Let’s future-proof your eCommerce business today! Contact us to explore custom FinTech solutions that drive growth and success.