Are APIs at the Heart of Digital-First Wealth Management Ecosystems?

Over the last few years, wealth management has undergone a major transformation. No longer confined to old-school offices and long-drawn quarterly reviews, today’s clients expect everything to be digital, fast, personalized, and available at their fingertips—just like ordering coffee from their phones. And for wealth management firms, meeting those expectations isn’t optional anymore—it’s table stakes.

A new breed of investors is driving this shift toward digital-first wealth management—tech-savvy, mobile-first, and always connected. They want real-time portfolio insights, seamless onboarding, tailored advice, and secure access to their financial data 24/7. For firms trying to keep up, this isn’t just about digitizing existing services; it’s about rethinking the entire wealth management ecosystem from the ground up.

Here’s where APIs step in as game changers. Think of APIs as digital bridges that connect different systems, apps, and data sources together—kind of like how airports connect travelers from all over the world. In the world of wealth management software, APIs make it possible to share data securely, automate tasks, and integrate best-in-class tools without rebuilding the whole tech stack.

So, are APIs just a “nice to have”? Absolutely not. APIs are the heartbeat of today’s most successful digital wealth management solutions. They enable interoperability, foster innovation, and lay the foundation for next-gen financial experiences that are fast, flexible, and client-centric.

In this blog, we’ll break down what is API integration, how wealth management APIs fit into the larger picture, and why embracing an API integration platform is a must for any modern firm looking to stay competitive in the era of open banking ecosystems.

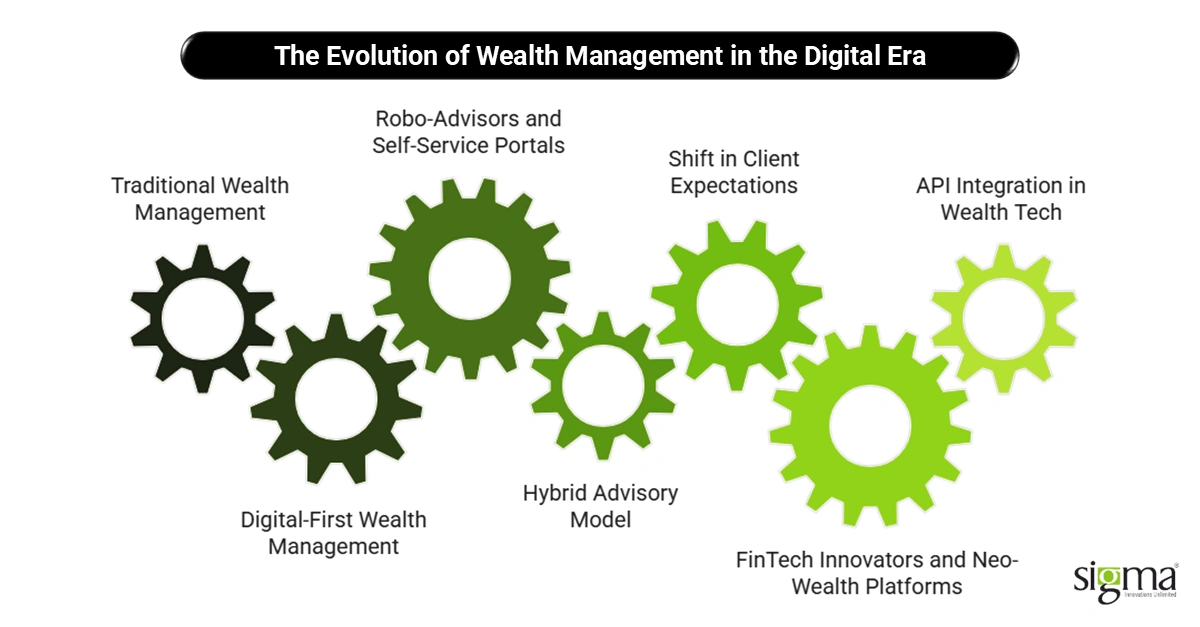

The Evolution of Wealth Management in the Digital Era

Let’s rewind a bit. Traditional wealth management used to be all about in-person meetings, paper-heavy documentation, and long wait times for portfolio updates. Advisors acted as gatekeepers, and everything—right from onboarding to rebalancing—was manual, time-consuming, and often opaque for clients.

But then came a new wave: digital-first wealth management. This modern model flips the old approach on its head. Instead of just digitizing paperwork, it focuses on creating a seamless, tech-powered experience for both clients and advisors. Think of it like switching from landline phones to smartphones—sure, both let you make calls, but one does a whole lot more, way faster, and from anywhere.

Today, robo-advisors and self-service portals are no longer futuristic concepts—they’re table stakes. Many investors prefer platforms where they can log in, see real-time portfolio performance, explore recommendations, and even adjust their strategies—all without having to book a meeting. And while human advisors haven’t disappeared, the model is shifting toward hybrid advisory, where digital tools handle the routine, and humans step in for higher-value advice.

At the heart of this evolution is a massive shift in client expectations. Wealthy clients now want always-on access, mobile-first design, real-time analytics, and services that feel as personalized as their favorite streaming apps. Whether it’s rebalancing a portfolio or exploring ESG investments, they expect it to be fast, intuitive, and secure.

Driving this revolution are FinTech innovators and neo-wealth platforms—fast-moving players that are reimagining how wealth is managed, delivered, and experienced. These disruptors thrive on flexibility, scalability, and agility, all of which are powered by deep API integration in wealth tech.

This evolution isn’t just a trend—it’s a clear signal: the firms that embrace APIs and digital transformation today will be the ones setting the pace tomorrow.

Also Read – Robo advisory: An opportunity or a threat for fintech?

Understanding APIs: The Connective Tissue of Digital Platforms

So, what is API integration, and why is it such a big deal in wealth management?

Let’s keep it simple. An API (Application Programming Interface) is like a waiter at a restaurant—it takes your order (a request), tells the kitchen what you want (talks to another system), and brings the food back to your table (returns a response). In tech terms, APIs allow two different software systems to talk to each other in a fast, secure, and structured way. They’re the connective tissue that binds modern platforms together, including in wealth management software.

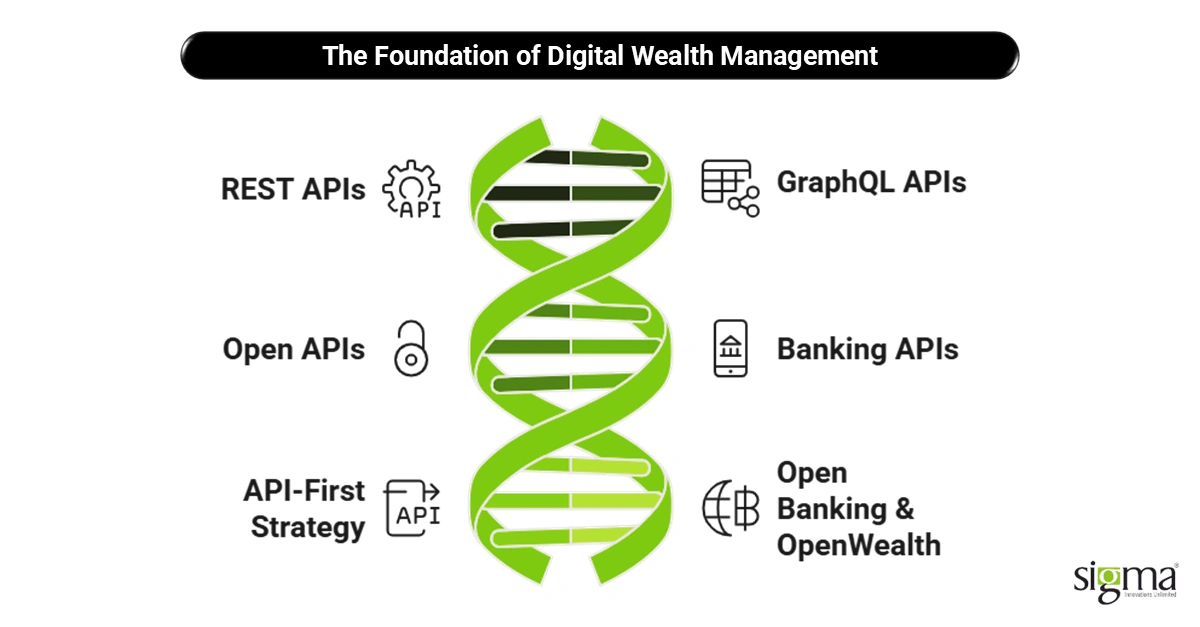

In the world of digital-first wealth, APIs do everything from pulling up real-time market data to connecting CRM systems with portfolio management tools. There are different types of APIs doing the heavy lifting:

- REST APIs are the most common—simple, scalable, and perfect for the web.

- GraphQL APIs let clients request exactly the data they need—nothing more, nothing less.

- Open APIs are accessible to third parties, enabling plug-and-play functionality.

- Banking APIs help connect wealth management platforms with banks for account aggregation, payments, and more.

Together, these APIs power seamless experiences across the wealth management ecosystem, enabling firms to deliver more value with less friction.

Now let’s talk strategy—specifically API-first and composable architecture. These approaches mean building your tech with APIs at the center, not bolting them on later. It’s like designing a house with open rooms and modular furniture—you can move things around, upgrade features, or plug in new systems as needed, without tearing down the whole structure.

Standards like Open Banking and frameworks such as OpenWealth are further accelerating this movement. They ensure APIs speak a common language, making API connectivity for wealth ecosystems safer, faster, and more predictable.

Bottom line? APIs aren’t just back-end tech—they’re the engine behind flexible, scalable, and personalized digital wealth management solutions.

Why APIs Are Vital for Modern Wealth Management Platforms

APIs aren’t just technical tools—they’re the power lines fueling every part of a smart, client-first wealth management software stack. In today’s digital-first world, APIs are what turn rigid legacy systems into agile, real-time, and personalized experiences that today’s investors demand. Let’s break it down.

Seamless Financial Data Aggregation

Imagine trying to advise a client without having their full financial picture—it’s like flying a plane with half the controls missing. APIs solve this by aggregating data from custodians, banks, market data providers, and third-party fintech apps. With financial data aggregation APIs, advisors can access everything from transaction history to account balances, all in one place. This real-time connectivity is what makes truly integrated wealth management ecosystems possible.

Real-Time Integrations for Dynamic Experiences

Static dashboards and delayed updates are relics of the past. With API integration in wealth tech, platforms can offer dynamic dashboards, live portfolio updates, and personalized alerts. APIs make real-time market feeds, risk analysis, and performance tracking feel instantaneous. It’s like turning your client portal into a Bloomberg Terminal—only more intuitive.

Automating the Heavy Lifting

From onboarding with KYC/AML checks to CRM updates, risk profiling, and compliance tracking—workflow automation through APIs means your advisors spend less time on repetitive tasks and more time building relationships. Whether it’s syncing compliance systems or auto-updating client profiles, API integration platforms take care of it behind the scenes.

Personalized, Segment-of-One Experiences

With client data flowing through APIs, platforms can power AI-driven advice, behavior-based insights, and tailored product recommendations. It’s personalization at scale. Want to recommend ESG portfolios to clients who favor sustainability? Or send alerts to those nearing retirement? That’s personalized wealth services via APIs in action.

Fueling Client-Centric Innovation

Need to roll out a new feature—like tax-loss harvesting or a robo-advisory tool? With an API-first design, it’s plug-and-play. No lengthy rebuilds. This agility gives firms the competitive edge to innovate faster and stay ahead in the open banking ecosystems race.

AI is set to revolutionize asset and wealth management, with 80% of managers expecting it to fuel revenue growth. Beyond direct AI adoption, ‘tech-as-a-service’ models are projected to boost revenues by 12% by 2028. This highlights a clear path for firms to drive significant financial expansion through advanced technological integration.

Key Use Cases of APIs in Wealth Management

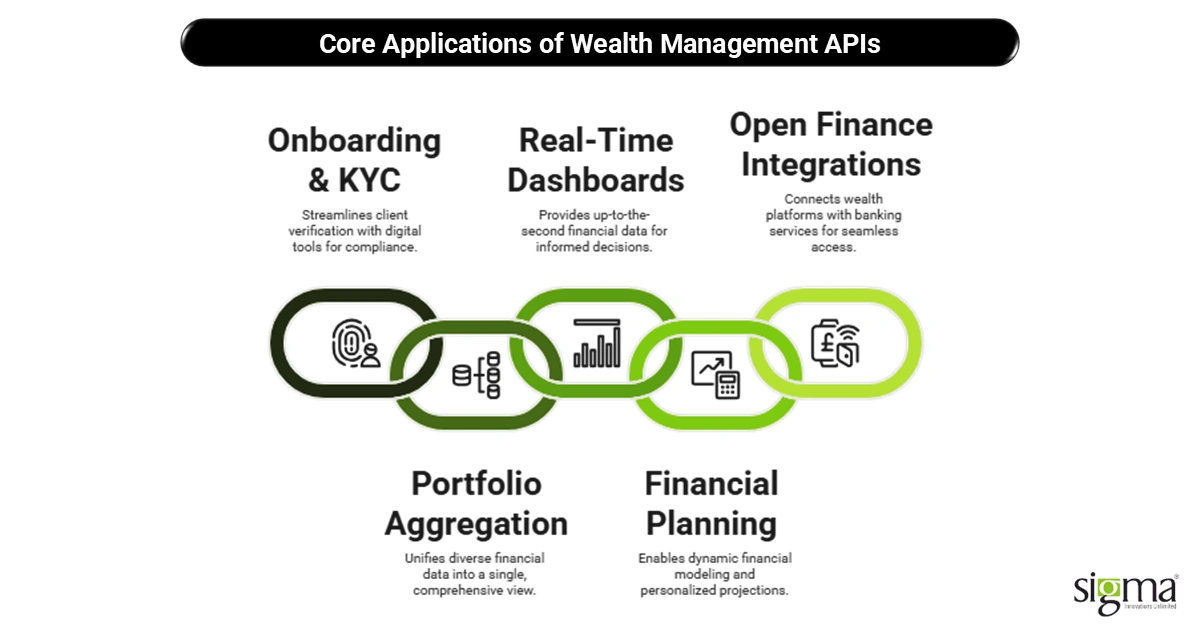

If you’re wondering how APIs show up in real-world wealth management workflows, here are five key use cases where wealth management APIs deliver serious value.

1. Onboarding & KYC

No more paperwork marathons. KYC APIs can automatically verify a client’s identity using government databases, facial recognition, and digital signatures—all in minutes. This not only speeds up the process but ensures compliance with AML regulations from day one. Onboarding becomes faster, smarter, and way less frustrating.

2. Portfolio Aggregation

Today’s investors often have accounts scattered across multiple custodians. Through multi-custodian API integration, firms can unify data into a single view. Whether it’s stocks, mutual funds, or alternative assets, APIs pull everything into one place, giving advisors and clients a 360-degree picture of net worth and performance.

3. Real-Time Client Dashboards

With real-time API feeds, dashboards become living, breathing platforms that reflect current data—down to the second. Clients can view up-to-date balances, recent trades, alerts, and market trends. It’s like having a private command center for their financial lives.

4. Financial Planning & Projections

Want to show a client how a decision today could impact their portfolio 10 years down the line? Third-party APIs make it possible to plug in sophisticated modeling tools, enabling dynamic “what-if” scenarios and personalized forecasts in seconds.

5. Open Finance Integrations

Banking APIs connect wealth platforms directly to checking, savings, loans, and credit accounts, offering a holistic financial view. This level of open finance integration is what powers digital wealth management solutions that feel truly seamless and intuitive.

These use cases aren’t just add-ons—they’re critical components of a modern wealth management software strategy designed for speed, security, and personalization.

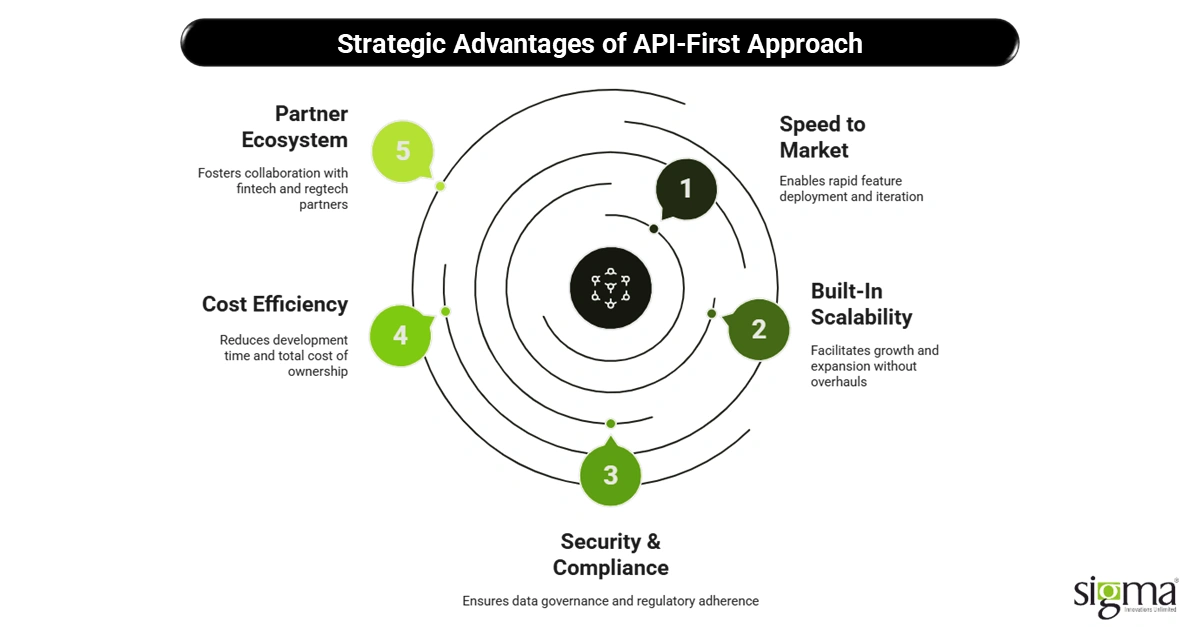

The Strategic Advantages of an API-First Approach

Choosing an API-first strategy for your wealth management platform isn’t just a tech decision—it’s a business move that delivers serious long-term gains. Let’s unpack why it matters.

1. Speed to Market

With modular, plug-and-play APIs, launching new features doesn’t require months of coding or platform overhauls. Whether you’re rolling out a new risk tool or integrating a third-party ESG scoring engine, APIs let you build fast and iterate faster. This speed is critical in a market where innovation cycles keep getting shorter.

2. Built-In Scalability

As your client base grows or your offerings expand—think crypto, alternative investments, or private markets—an API integration platform allows you to scale without starting from scratch. You simply plug in the new service, configure access, and you’re good to go. APIs future-proof your wealth management software against rapid growth.

3. Security & Compliance

APIs offer auditable, permissioned access to data, making it easier to enforce privacy, control roles, and stay compliant with evolving financial regulations. Whether it’s GDPR, SEC, or FINRA, APIs help ensure you’re not flying blind when it comes to data governance.

4. Cost Efficiency

Instead of building everything in-house, you can leverage best-in-class tools via APIs. That cuts down development time and significantly lowers your total cost of ownership—without sacrificing capability.

5. A Thriving Partner Ecosystem

An API-first approach makes it easy to partner with fintech startups, custodians, regtechs, and data providers. Want to integrate with a cutting-edge AI advisory tool or a new compliance API? You can—with zero disruption.

Ultimately, APIs don’t just enhance your tech—they empower your business to be faster, smarter, and more adaptable in a digital-first wealth environment.

Also Read: Accelerating Fintech Scalability Through Cloud-Based Solutions

Challenges in API Adoption in Wealth Management

While the benefits of APIs are clear, adopting them in the wealth management space isn’t without hurdles. The biggest roadblock? Legacy systems and technical debt. Many firms still run on outdated core infrastructure that wasn’t built with API integration in mind, making it tough to plug in modern solutions without serious rework.

Security and data privacy also raise major concerns. Wealth platforms handle sensitive financial and personal data, so firms need airtight protocols to protect against breaches and unauthorized access. Every API in investment advisory platforms must meet strict compliance standards to maintain trust.

Then there’s the complexity of integration—especially when dealing with multiple custodians, banks, and data providers. Without proper planning, API sprawl can become a maintenance nightmare.

Finally, regulatory challenges can complicate things. Data localization laws, GDPR, and SEC rules all place constraints on where data is stored, how it’s shared, and who can access it.

Despite these challenges, many firms are forging ahead—knowing that the long-term gains in agility, security, and client satisfaction make API adoption well worth the investment.

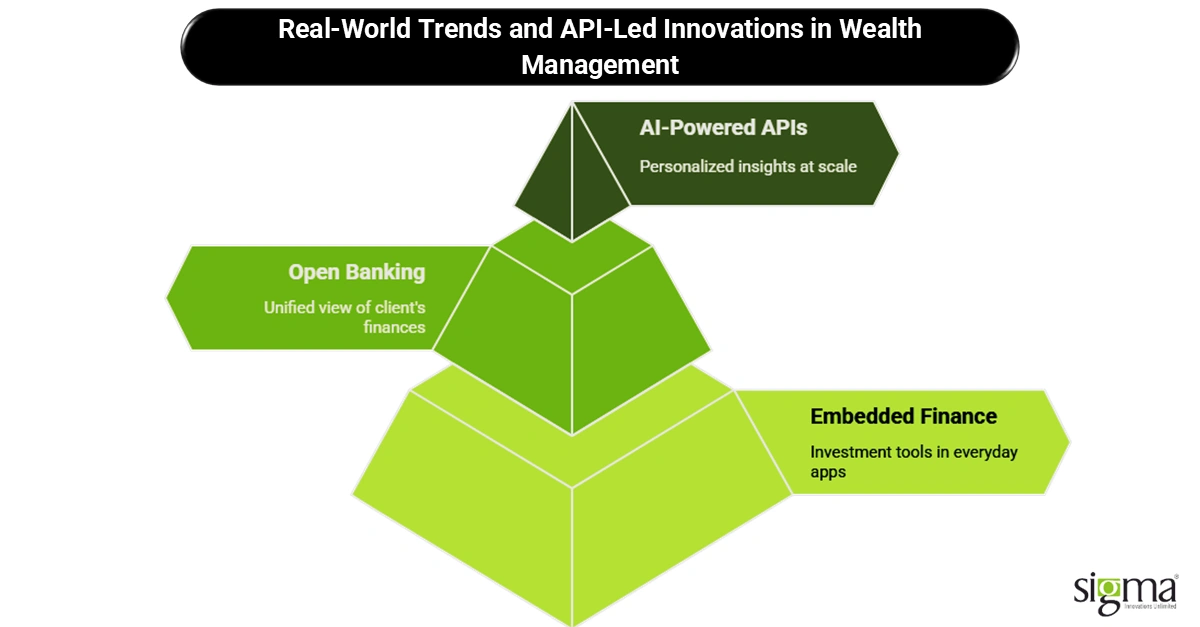

Real-World Trends and API-Led Innovations in Wealth Management

We’re not just talking about what’s possible—API-led innovation is already reshaping how wealth is managed, invested, and experienced. Here are some of the most exciting real-world trends where APIs are taking center stage.

Embedded Finance: Investing Where the Client Already Is

Think of embedded finance like putting investment tools inside apps people already use—like a ride-sharing app letting drivers invest part of their earnings in real-time. Wealth management APIs are making this happen. With plug-and-play APIs, firms can embed investment services directly into banking apps, payroll systems, or even eCommerce platforms. It’s frictionless and puts wealth-building tools where they matter most: right in the user’s daily journey.

Open Banking Meets WealthTech

The walls are coming down. Thanks to open banking ecosystems, wealth platforms can now tap into a unified view of a client’s finances—from savings and credit cards to investment accounts—regardless of where they’re held. APIs enable secure interoperability across financial institutions, turning fragmented data into cohesive, actionable insights. This isn’t just a tech upgrade—it’s a foundational shift in how firms can serve clients with holistic financial advice.

AI-Powered APIs: Smarter Advisors, Happier Clients

The next frontier? AI meets API. With AI-powered APIs, wealth platforms can deliver highly personalized insights at scale. Think real-time portfolio rebalancing suggestions, predictive alerts based on market movement, or behavioral nudges to help clients stay on track. These APIs feed machine learning models the data they need to surface intelligent, proactive recommendations—without a human having to dig through spreadsheets.

This is also where personalized wealth services via APIs shine. By using AI and behavioral data, platforms can tailor experiences to each client’s goals, habits, and risk tolerance. It’s no longer one-size-fits-all—it’s segment-of-one marketing in action.

As these trends accelerate, the role of APIs will only grow more central. Forward-thinking firms aren’t asking “What is API wealth management?” anymore—they’re asking, “What’s next?”

And what’s next is already here: a fully connected, intelligent, and intuitive wealth management ecosystem powered by APIs.

The wealth management software market is experiencing significant growth. Valued at $2.37 billion today, it’s projected to surge to an impressive $6.29 billion by 2029. This robust expansion highlights a clear trend towards digital solutions in financial planning and asset management.

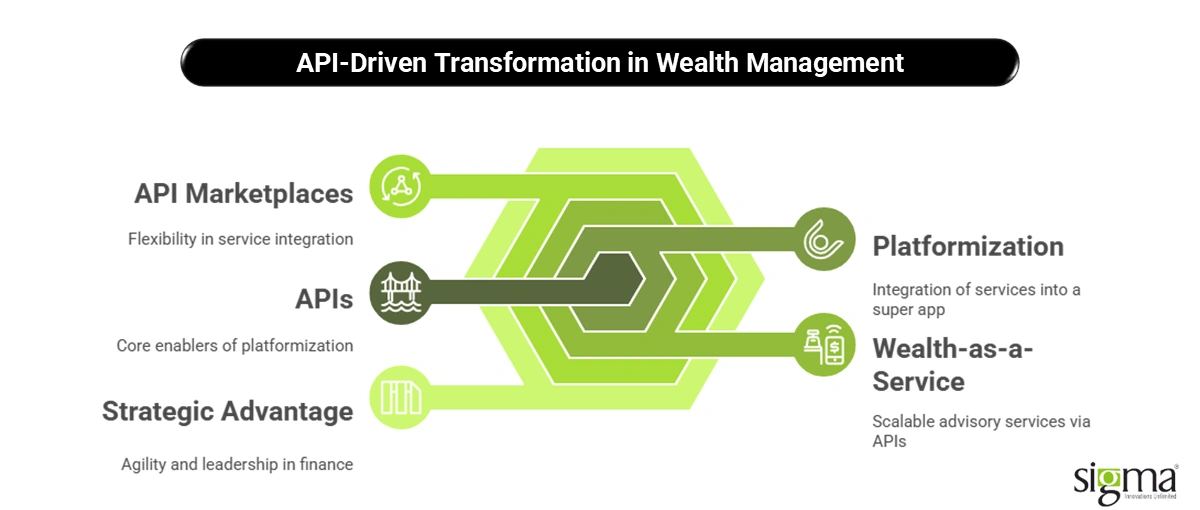

The Future: APIs as a Catalyst for Platformization

The future of wealth management isn’t about adding more tools—it’s about connecting them into a cohesive, client-first platform. And APIs are the engines driving this transformation, enabling what’s known as the platformization of wealth management services.

Think of this shift as moving from a toolbox to a super app—a single digital hub where clients can manage everything from investments and banking to insurance and tax planning. APIs make it all possible by linking various services into one seamless ecosystem, no matter where the data lives.

We’re also seeing the rise of Wealth-as-a-Service (WaaS)—a model where API-enabled platforms let banks, credit unions, and fintechs embed wealth management capabilities into their existing apps. It’s fast, scalable, and cost-effective—like having a fully built advisory service ready to deploy via plug-and-play APIs.

API marketplaces and Banking-as-a-Service (BaaS) models are fueling this movement. They allow wealth firms to pick and integrate the services they need—identity verification, tax reporting, payment processing—without building from scratch. It’s flexibility without the complexity.

Even the line between traditional finance and emerging tech is blurring. APIs are the bridge connecting legacy systems to digital assets, like crypto and tokenized securities. This means clients get a unified view of both traditional investments and next-gen assets—something that would’ve sounded futuristic just a few years ago.

In short, the API-led future is already unfolding. It’s faster, smarter, and radically more connected. Firms that embrace this API strategy for financial institutions will be well-positioned to lead in a world where platform agility is the new competitive advantage.

Final Thoughts

APIs have evolved past mere tech plumbing in the digital-first era; they’re now the strategic foundation for cutting-edge, client-centric, and scalable wealth management platforms. From real-time data aggregation to AI-driven personalization, APIs power the agility and innovation that today’s investors expect.

For wealth managers, CTOs, and FinTech leaders, adopting an API-first approach isn’t just smart—it’s mission-critical. It’s the key to future-proofing your business, scaling faster, and delivering experiences that build lasting client loyalty.

At Sigma Infosolutions, we specialize in building high-performance, API-enabled wealth management software tailored to your business goals. Whether you’re looking to modernize legacy systems or launch next-gen digital offerings, our wealth management software development services are here to help you lead with confidence.

Let’s build smarter, connected wealth experiences—together.