Financial Software Development Services: The Magic Bullet for Limited Access to Credit and Lending Options

Despite exponential advances in lending technologies, many businesses and fintech lenders still struggle to effectively extend credit to small and medium-sized businesses (SMEs), credit newcomers, and gig workers. Traditional bank requirements, outdated processes, and rigid systems create unnecessary barriers, leading to slow, biased, and inefficient lending experiences that hinder growth and innovation.

That’s where the magic of digital transformation steps in. Traditional lending is getting a much-needed upgrade, and Financial Software Development Services are leading the charge. Think of it as switching from a flip phone to a smartphone—it just makes everything easier, smarter, and faster.

With Financial Services Software Development, lenders can finally break through the outdated mold. It’s helping institutions build smarter, fairer ways to evaluate borrowers, especially the ones who’ve been left behind for far too long. Whether it’s a smart Finance Planning Software, automated decisioning tools, or full-on Finance Management Systems, this new wave of tech is changing the credit game.

In this blog, we’ll unpack how this “magic bullet” is helping businesses and people access credit more easily—and why now is the time to get on board.

The Current Credit Landscape: Problems and Gaps

Hold on a minute. Let’s look at the whole thing, not just this little bit. According to the JPMorgan Chase 2024 Annual Report, credit access in the U.S. still isn’t evenly spread. Millions of people, especially those in underserved communities, like startups, gig workers, and small business owners, face real challenges in getting the financial support they need. Over 40% of small businesses reported being unable to access the credit they applied for in 2023. That’s a huge red flag.

Traditional lending systems haven’t caught up with how fast the world moves. Old-school underwriting takes too long, relies on outdated metrics, and often overlooks good borrowers simply because they don’t check all the “right” boxes. Add in the clunky loan management processes, and it’s no wonder many businesses feel stuck.

On top of that, compliance regulations are tighter than ever. Lenders are juggling risk, paperwork, and audits—all while trying to keep their operations running smoothly. These bottlenecks slow down approvals and drive up costs.

This is exactly where Financial Software Development Services and modern Financial Services Software Development come into play. With the right tools, lenders can ditch the friction and focus on what matters—helping people. Whether it’s through smarter Finance Management Systems or agile Wealth Management Platforms, tech is stepping in to close the credit gap.

The Role of Technology in Bridging the Credit Access Gap

You know how things change over time? Well, technology ain’t just changing things a little bit here and there. It’s like it’s taking the whole book of rules and writing a brand new one from scratch. The rise of fintech ecosystems and embedded finance is creating brand-new ways to make lending more inclusive and efficient. It’s no longer about sitting across from a loan officer and waiting weeks for an answer. Now, it’s about tapping into smart, connected platforms that bring financial services right where people need them—on their phones, in the apps they already use, and in real time.

At the heart of this shift are Financial Software Development Services. These aren’t just fancy tools—they’re powerful solutions that help lenders make faster, smarter decisions. With Financial Services Software Development, companies are embracing automation, AI, and cloud-based tech to cut down loan processing times, reduce manual errors, and open up credit access to people who’ve long been overlooked.

Discover how cloud banking solutions are further empowering this evolution and unlocking new efficiencies. Read more here!

Take Robotic Process Automation (RPA), for example. In loan origination and KYC (Know Your Customer) processes, RPA can handle repetitive tasks—like document verification, data entry, and compliance checks—in minutes, not days. Think about a helper robot that’s on the job all the time – day and night. It never gets sleepy or worn out, and it does everything just right, every single time. That’s what we’re talking about.

Cloud-driven platforms also mean that financial institutions don’t have to rely on bulky, outdated systems anymore. They can scale quickly, update easily, and deliver better service without breaking the bank. Whether it’s through Finance Planning Software, a dynamic Finance Management System, or modern Wealth Management Platforms, tech is filling in the gaps where traditional lending falls short.

And if you’re wondering who makes this all possible? That’s where a trusted FinTech App Development Company steps in—crafting tailored solutions that bring financial access to the masses.

So, yes—technology is more than just a buzzword. It’s the real deal when it comes to levelling the playing field in lending.

Credit Scoring & Risk Forecasting in the Digital Era

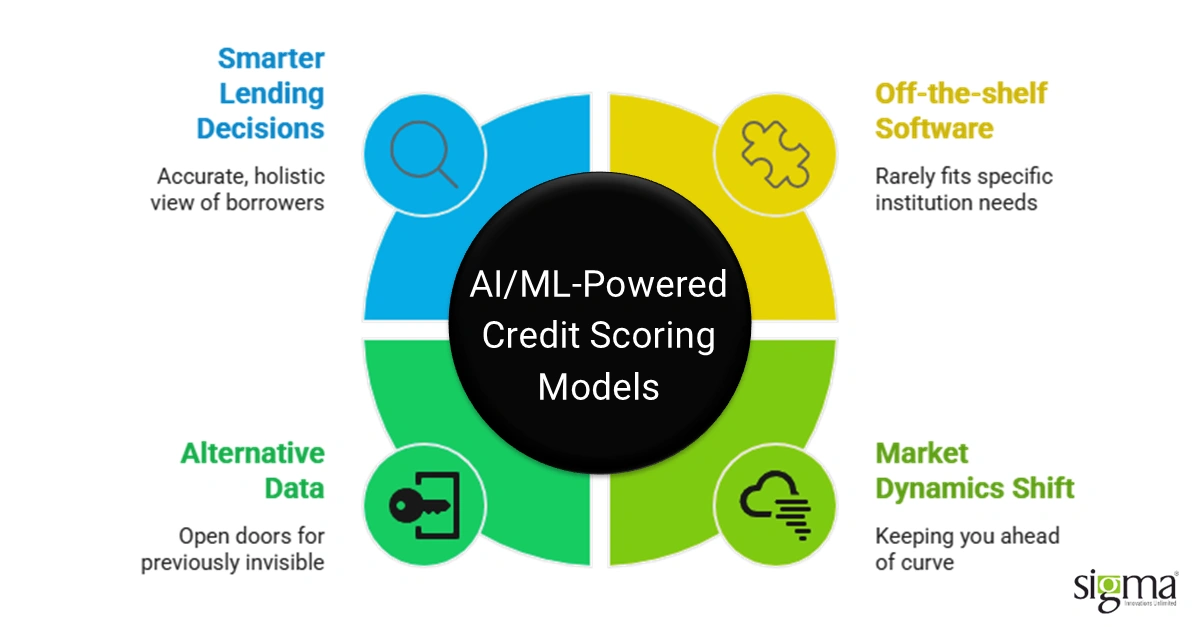

Traditional credit scoring? It’s kind of like judging someone’s driving skills based only on their parking record—it misses the full picture. In today’s world, lenders need a broader lens. Now, AI/ML-powered credit scoring models are changing how we decide if someone can borrow money.

With the help of Financial Software Development Services, lenders can now analyze everything from payment history to mobile phone usage and even social behavior (yes, really!) to make smarter, more inclusive lending decisions. This is what we mean by alternative data—and it’s becoming the secret sauce behind real-time credit.

By tapping into this wider data pool, lenders can open doors for borrowers who were previously invisible to the system—gig workers, freelancers, and others without traditional credit histories. And the best part? It doesn’t mean taking on more risk. These AI models reduce default risk by giving a much more accurate and holistic view of borrower behavior.

Listen, it’s like this—not every tool is the same. Some are good, some ain’t so good. Off-the-shelf software might be a quick fix, but it rarely fits the specific needs of fintechs. Lenders need custom-built scoring engines—designed through expert Financial Services Software Development—that align with their risk appetite, compliance framework, and growth goals.

This is where a smart Finance Planning Software solution or an advanced Finance Management System becomes a game-changer. When built by an experienced FinTech App Development Company, these systems can adapt, learn, and evolve as market dynamics shift—keeping you ahead of the curve.

Custom Financial Software: Why Off-the-Shelf Is Not Enough

When it comes to building modern lending solutions, grabbing a generic, off-the-shelf tool is like trying to fit into a one-size-fits-all t-shirt—it might go on, but it’s never going to be a perfect fit. That’s why more lenders are turning to custom Financial Software Development Services to build solutions that are tailored, secure, and scalable from the ground up.

Custom Financial Services Software Development gives you the freedom to grow without limits. Need to scale up your operations or pivot to a new market? No problem. Custom-built platforms grow with you. You’re not locked into the limitations of someone else’s code.

Integration is another big win here. Today’s lending environment runs on a network of systems—core banking platforms, CRM tools, payment gateways, third-party APIs, and more. A cookie-cutter solution struggles to bring these moving parts together. But with a custom Finance Management System, everything connects smoothly, making your workflows more efficient and your data more powerful.

And let’s talk about compliance—because it’s a huge deal in finance. From the CFPB (Consumer Financial Protection Bureau) to the OCC (Office of the Comptroller of the Currency), regulatory requirements change constantly. Off-the-shelf platforms usually lag when it comes to adapting. But a custom solution built with compliance in mind? It can evolve with the rules. Plus, you get tighter security and better control over sensitive customer data.

Whether you’re managing personal finance through Finance Planning Software or offering services through modern Wealth Management Platforms, the smart move is going custom. And when you team up with the right FinTech App Development Company, you don’t just get a tool—you get a competitive edge.

In short, if you’re serious about lending, off-the-shelf just won’t cut it.

Key Modules and Features of Financial Software for Lending

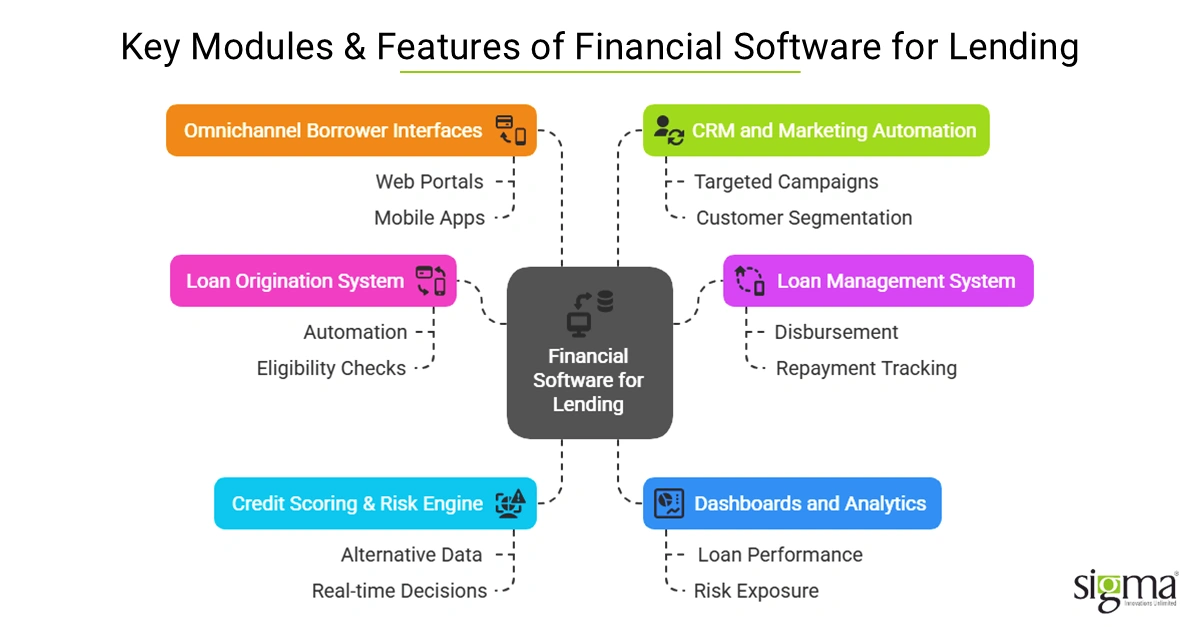

When you peel back the layers of high-performing lending platforms, you’ll find a set of core modules that make it all run like clockwork. These aren’t just features—they’re the foundation of a future-ready lending business. And the magic lies in how Financial Software Development Services bring all these pieces together seamlessly.

Let’s break down the essential building blocks of effective Financial Services Software Development for lenders:

1. Loan Origination System (LOS)

This is where everything begins. A smart Loan Origination System simplifies the entire application process—from intake to initial risk checks—making it faster, more accurate, and way less frustrating for borrowers and lenders alike. Thanks to automation, eligibility checks, document verification, and KYC can happen in minutes, not days.

2. Loan Management System (LMS)

Once a loan is approved, the Loan Management System takes over. This handles everything from disbursement and repayment tracking to notifications and compliance reporting. A well-built Finance Management System ensures smooth operations, fewer errors, and a much better borrower experience.

3. Credit Scoring & Risk Engine

Custom-built scoring engines powered by AI and machine learning are essential. These engines dig into alternative data and deliver real-time credit decisions. It’s not just about approving loans—it’s about reducing default risk while expanding the reach to underserved segments.

4. Dashboards and Analytics

Imagine a cockpit for your lending business. That’s what a good dashboard does. It gives decision-makers real-time insights into loan performance, customer behavior, risk exposure, and operational efficiency. Smart Finance Planning Software includes built-in analytics so you can make data-driven decisions on the fly.

5. Omnichannel Borrower Interfaces (Web, Mobile)

Today’s borrowers expect the same experience from their lender as they do from their favorite shopping app. That’s why Financial Software Development must include intuitive, mobile-friendly borrower portals. Whether on desktop or phone, the experience should be consistent, secure, and simple.

6. CRM and Marketing Automation

You can’t grow your lending business without knowing your customers—and staying in touch. A good CRM system paired with marketing automation tools helps segment borrowers, run targeted campaigns, and keep the communication flowing. Integrated tools like these are a must for scaling any Wealth Management Platform or lending service.

By developing these modules through a seasoned FinTech App Development Company, lenders gain agility, efficiency, and a serious edge in today’s fast-moving credit landscape.

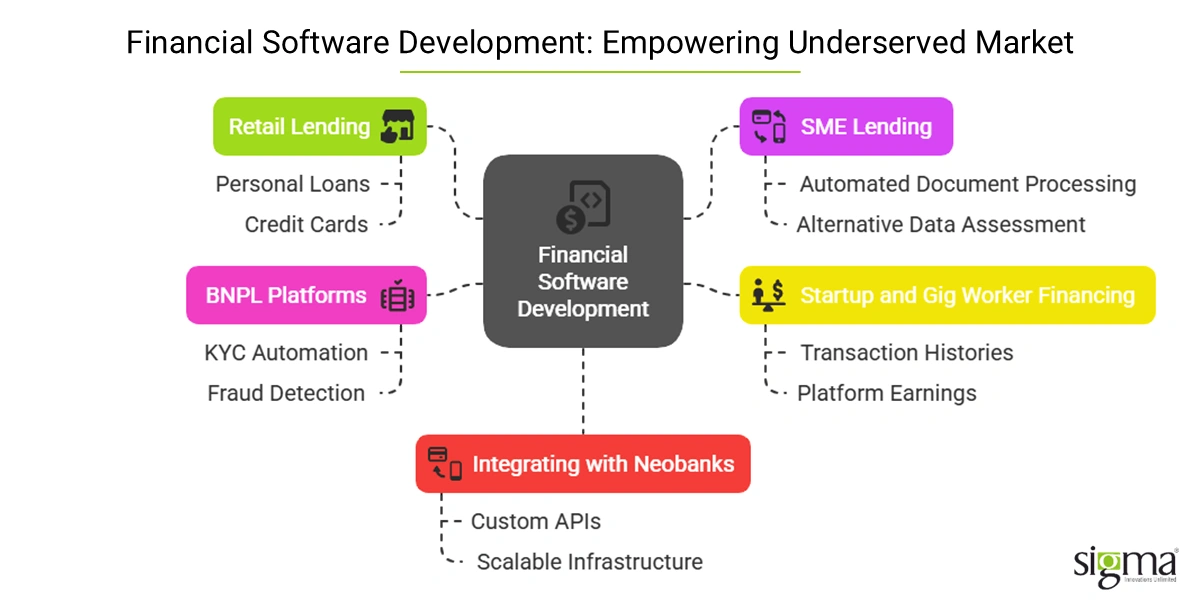

Use Cases: Enabling Access for Underserved Markets

There’s no denying it—Financial Software Development Services are ensuring fairness when it comes to access to credit. Whether you’re an SME, a startup, or a gig worker, today’s smart financial tools are opening doors that traditional banks have long kept shut. Let’s take a closer look at how Financial Services Software Development is empowering underserved markets and driving real change.

1. Retail Lending

Consumers today want credit that’s fast, fair, and available at their fingertips. Custom Finance Planning Software helps lenders offer personal loans, credit cards, and microloans through sleek, user-friendly web and mobile platforms. With embedded AI and real-time decision-making, even borrowers without perfect credit histories get a fair shot. This is the new face of retail lending—driven by digital, backed by data, and powered by custom Financial Software Development.

2. SME Lending

Small and medium-sized businesses are often the backbone of local economies, but they’re also the most credit-starved. With a flexible Finance Management System, lenders can streamline SME loan applications, automate financial document processing, and use alternative data to assess business viability. These systems are especially useful in reducing manual overhead and providing faster approvals, so entrepreneurs can focus more on growing and less on waiting.

3. Startup and Gig Worker Financing

Freelancers, gig workers, and new entrepreneurs often fall outside the boundaries of traditional credit scoring. However, modern financial services software development allows lenders to assess these individuals using behavior-based scoring, transaction histories, and platform earnings (like from Uber, Etsy, or DoorDash). For these borrowers, smart Wealth Management Platforms can even help with budgeting, goal tracking, and managing repayments.

4. Buy Now Pay Later (BNPL) Platforms

BNPL is transforming how consumers make purchases—and it requires lightning-fast decisioning, seamless merchant integration, and crystal-clear repayment tracking. Financial Software Development Services help create highly secure and scalable BNPL platforms. These solutions include everything from KYC automation to fraud detection, keeping users safe and the process smooth.

5. Integrating with Neobanks and Alternative Lenders

Unlike traditional banks, neobanks and alt-lenders are born digital. They need flexible software solutions that can integrate with core banking, payment gateways, credit bureaus, and more. That’s where working with a specialized FinTech App Development Company pays off. Custom APIs, scalable infrastructure, and compliance-ready features make integration with partners effortless, expanding reach without increasing risk.

From mobile-first platforms for gig workers to robust underwriting tools for SMEs, these use cases prove that the right Financial Software Development isn’t just helpful—it’s transformational. It brings credit to those who need it most, with speed, accuracy, and transparency.

Building with the Right Technology Partner

When it comes to building reliable, future-ready Financial Software Development Services, choosing the right technology partner can make or break your vision. You need more than a team of coders—you need collaborators who understand the nuts and bolts of lending, live and breathe compliance, and know how to scale.

So, what should you look for in a Financial Services Software Development partner? Here’s a quick checklist:

Domain Expertise in Lending and Finance

It’s not enough to know tech—you need a team that understands underwriting, borrower risk, regulatory frameworks, and how digital lending ecosystems work. A partner with domain depth can help build smarter solutions, from Finance Management Systems to Wealth Management Platforms that truly support business goals.

Compliance-First Engineering Practices

In the financial world, compliance isn’t optional—it’s foundational. From GDPR to CFPB and OCC guidelines, your technology partner must engineer platforms that bake in security, privacy, and audit-readiness from day one. Think role-based access, encryption, audit trails, and real-time alerts.

API-First, Modular Architecture

Your tech stack shouldn’t box you in. Look for a partner who builds with an API-first mindset, enabling seamless integration with core banking systems, CRMs, third-party data providers, and payment gateways. A modular design means you can evolve without having to start from scratch every time.

Why Sigma Infosolutions?

At Sigma Infosolutions, we’ve helped global lenders and fintech innovators bring their visions to life. As a leading FinTech App Development Company, we combine deep industry expertise with modern engineering to create scalable, secure, and compliance-ready software.

Here’s what sets us apart:

- Decades of experience in Financial Software Development across North America, Europe, and Asia.

- Proven track record building Finance Planning Software, custom scoring engines, Loan Origination Systems, and real-time dashboards.

- Agile, collaborative teams that prioritize your business outcomes, not just code delivery.

Our solutions are trusted by fintechs, digital banks, and credit-first platforms because we speak the language of lending and know how to translate it into high-performing digital experiences.

So, whether you’re looking to build a new lending platform or modernize your existing Finance Management System, we’ve got the skills and passion to help you do it right.

Ready to Transform Your Digital Journey? Build Your Next-Gen Lending Platform with Us!

Future Trends Shaping Financial Software for Lending

Financial services are evolving faster than ever. And if you’re not staying ahead of the curve, you’re falling behind. The next wave of Financial Software Development Services is bringing smarter, more responsible, and more real-time lending to life—and it’s happening right now. Let’s break down the trends that are reshaping the future of credit access.

Blockchain for Credit Verification

Blockchain isn’t just for crypto. In lending, it can play a huge role in verifying borrower identities and histories in a secure, tamper-proof way. Imagine cutting down onboarding time with instant credit verification, all while ensuring full transparency. That’s a win-win for lenders and borrowers alike—and a big step forward for trust in Financial Services Software Development.

Real-Time Data Analytics

Forget those old credit reports that don’t change much. Now, we can look at what’s happening with the money in real-time. The next-gen Finance Planning Software uses live data feeds to track spending behavior, business cash flows, and even market conditions. This real-time approach helps lenders adjust terms on the fly and make smarter decisions without the lag time. It’s like switching from a Polaroid to a livestream of your borrower’s financial life.

Predictive Risk Modeling

With predictive analytics and machine learning, lenders can now anticipate risk instead of reacting to it. These tools go beyond basic credit scores to detect early warning signs and uncover new lending opportunities. From reducing defaults to expanding into new markets, custom-built predictive engines are becoming must-haves in any modern Finance Management System.

ESG-Aligned Credit Decisioning

Environmental, Social, and Governance (ESG) factors are no longer fringe—they’re front and center. Lenders are now weaving ESG criteria into their credit models to support socially responsible financing. Whether you’re supporting green startups or inclusive microloans, Financial Software Development can help align your systems with values that matter to today’s borrowers—and investors.

Today’s FinTech innovations aren’t just trends—they’re redefining how ambitious financial services leaders operate and grow. If you’re a forward-thinking founder, CTO, or product leader aiming to scale efficiently, drive customer loyalty, and stay competitive, you need a future-ready tech stack. Partnering with the right FinTech App Development Company can accelerate your innovation roadmap and deliver real business outcomes.

Time to Build What’s Next

At the end of the day, Financial Software Development Services aren’t just about writing code—they’re about rewriting the future of lending. If you’re serious about closing the credit access gap, you need more than off-the-shelf tools. You need special tech tools made just for you. These tools gotta match what you’re trying to do, who you’re trying to help, and what you see for the future.

From smarter credit scoring to full-stack Finance Planning Software, the path forward starts with tailored innovation. And that means working with a partner who understands lending inside out.

Let’s make lending more inclusive, scalable, and future-ready—together!

Talk to our team at Sigma Infosolutions—a trusted FinTech Software Development Services provider—and explore how we can build powerful, compliant, modern lending solutions just for you.