How Digital Technologies Are Transforming the Financial Sector?

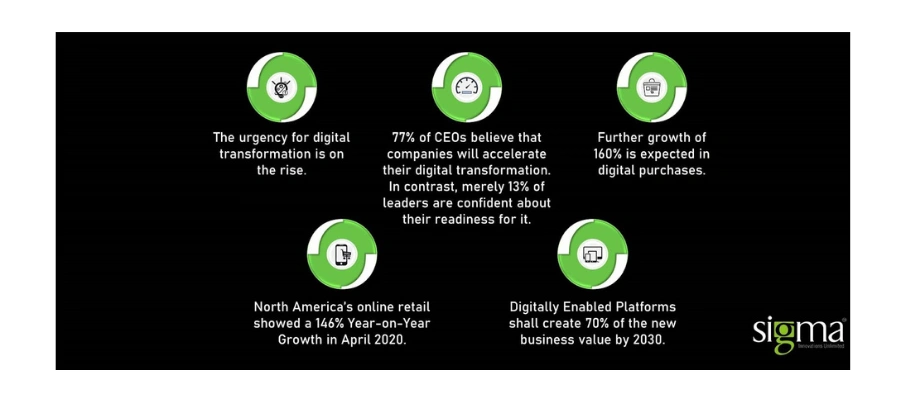

For better or worse, the pandemic resulted in the “new normal” for individuals, communities, and businesses. Amidst all the adversity, industry-wide digital transformation has emerged as the better part of the post-Covid world. While many experienced digital transitions like work from home, telemedicine, remote education, etc. the impact of Digital Financial Services across these changes is undeniable. A recent report by World Economic Forum, observes that:

In a nutshell, statistics and experts expect rapid sustainable growth in digital consumers & digital businesses. All this digitization will be designed built & tested for ease of digital transactions i.e. Netbanking & Fintech. It is safe to say that there will be massive growth in Digital Transformation in Financial Services in 2021.

Benefits of Digital Transformation for Finserv Businesses:

54% of CEOs firmly believe that digital technology was instrumental in improving the revenues of the company. While technology-agnostic business tries to play catch up, many experts see four distinct benefits of digital technologies, namely:

1. Better Value to Customers at Greater Margins in Business: According to McKinsey digital technologies helped banks improve approval rates for loan applications at a reduced cost of 60%. On the other hand, customers could apply for loans within minutes & get the amount within 24 hours. Elsewhere, many businesses saved costs by migrating from retailing to e-tailing. Multiple reports assert that digitization has made businesses more compliant, efficient in finance & accounting, and risk management.

2. Competitive Advantages of Seamless & Swift Customization: Participants in EY Financial Leadership Summit noted that the maturity of a firm’s digital capabilities will play a critical role in differentiating financial institutions from their competitors, i.e. technology will drive competitive advantage in financial services. For example, higher margins have made companies adaptive and able to gain a cost advantage. On the other hand, human-centered designs have improved the ability of a business to bundle, segregate, and customize offerings for users.

3. Customer-Centric Experience with Lower Risks of Errors: Technology has allowed the customer greater power to intervene & influence the overall consumer experience. Digital technology has upgraded intervention to intuitive interaction, making business services more customer-centric, and less vulnerable to errors, especially miscommunication.

4. Data-Rich Decisions for Credibility & Adaptability: Even after upholding the privacy of stakeholders, digital technology can capture enough real-time data about all business functions. Businesses with poor financials can present evidence-based operating profits to improve their market credibility. On the other hand, analytical tools can empower businesses to adapt to changing consumer behaviors.

Eventually, the benefits of digital transformation are so groundbreaking that businesses no longer question its adoption. Instead, they evaluate the best strategies to become part of the market trends, or even establish them.

Digital Technology Trends in the Financial Sector:

Apart from chatbots, budgeting apps & trading platforms, Finserv has not only diversified across countless avenues of economic activities, but it has also become a prominent trend in many of them. Some significant trends are as follows:

- Digital Disruption: Digitization has transformed markets too. The current norm of digital payments is usually born in a disruption that occurred a few months or years back. For example, digital transactions are no longer about plastic cards or mobile wallets. New forms of contactless payments have disrupted the market, ranging from IoT & NFC-based transactions to cryptocurrencies & pseudo-currencies.

- Increase in Collaboration: Most Fintechs are collaborating across the entire business landscape. While some are partnering with banking and retail giants, others are aggregating SMBs to enhance user experience on their platforms. Additionally, payment Fintechs are collaborating with lending fintech, cryptocurrencies, social networks, etc. This is why Fintech is often called an Ecosystem in itself.

- Organizational Agility: Fujitsu, in its multi-industry survey including Finserv, states that 89% of its respondent businesses possessed a culture of agility after digitization. This improves their business continuity during an economic crisis, especially in commercial transactions. For example, Fintech helped businesses adapt to contactless payments during the Covid-19 lockdowns.

- Risk Assessment: Businesses today have dashboards that make it easy to view user-friendly layouts of business data of performance, compliance, and customer relations. Thanks to digitization, businesses have huge amounts of information at their fingertips. This helps them assess risk and mitigate it in real-time.

- Digital Banking: A recent Forbes Article predicts rapid digitization in the banking sector. It notes that Bain’s Global survey estimates 95% of consumers to use digital banking in the post-pandemic era. It also cites Accenture’s prognosis that within 2 years, transactions worth 7 trillion USD shall shift from cash to digital. No wonder, digital banking is a trendsetter.

- Fintech: Fintech has outgrown ATMs and plastic money. It is all-pervasive today. In fact, a favored topic among industry experts seems to be “Digital Transformation Fintech 2021”. KPMG equated the 2020s global fintech investments with 105.3 billion USD, including many fintech unicorns. It was also optimistic about continuous growth in B2B digital transactions, including Blockchain, Insurtech, Wealthtech, and Regtech.

- BlockChain: Netizens are usually aware of cryptocurrencies, but very few realize that it is blockchain technology. In its latest Global Blockchain Survey, Deloitte suggests that 55% of leaders figure Blockchain in their top 5 business priorities, and 88% expect it to go mainstream. No wonder businesses like Tesla agreed to accept Bitcoin payments. Blockchain is also gaining traction in tokenized securities.

- Machine Learning & Artificial Intelligence: Machine learning is an intuitive part of Artificial Intelligence. By 2025, the Global Fintech Market may reach USD 22.6 billion. 54% of Finserv companies with 5000+ employees have already adopted AI. Deployment of AI may not be as hard as people imagine, especially when 86% of Finserv executives aim to invest in AI-related tech.

Conclusion:

Digital transformation can be a massive upgrade on current business practices, customer relations, & even products. Experts and influencers prefer to call it future proofing. Skeptics may say that economies that claimed to be future-proof got disrupted by Covid-19, but they cannot deny the resilience of digitally equipped enterprises during the pandemic. Today, almost every industry is inclined to get digitized, and all their plans shall rely heavily on Fintech and digital Finserv partners, especially those who can adapt to fast-changing markets.