How Are APIs Helping Financial Institutions in Becoming More Cost-Effective?

APIs have played a major role in digitizing the banking and financial sector at large. With the mere act of connecting platforms and services, making banks more accessible, and their information shareable with their partners, APIs have turned a closed industry like banking and finserv into an open and connected one.

What caused this shift?

Massive digitization at all levels, across geographies, right from access to smartphones to governments being more open to create smart cities is responsible for this shift. With the increasing need for quick services and easier access, people are now demanding a seamless user experience across all industries. Financial services being of the most crucial industries that people interact with multiple times during their lifetime, needed to bring about this change, as well.

Apart from this, APIs in banking and financial services allow financial institutions to become more secure, agile, and most importantly, future-proof.

The role of APIs in financial services

APIs play a crucial role in connecting applications used by banks and financial institutions. Often, banks integrate new applications into their existing legacy infrastructure. Given the traditional structure of the same, applications often find it difficult to communicate with each other. This leads to lower efficiencies, increased errors, and higher spending to keep ensuring these integrations work.

Before we find out how and what kind of integrations can help catapult financial services to a super-growth trajectory, let us find out a bit about APIs.

An API (Application Programming Interface) is a set of codes and protocols that enable and direct communication between various applications. In short, they help applications to exchange information amongst each other without any manual facilitation.

This easily solves the issue of internal applications in banking software not being able to communicate with each other. The good thing about APIs is that they also enable banks to integrate various third-party services, as well, thereby adding more to their existing infrastructure and service portfolio.

As customers want of increased ease of banking, seamless transactions, and fast approvals, banks are under heightened pressure to provide them with the kind of fluid user experience and the breadth of services that they expect.

How do APIs in the banking industry work?

API integration in banks work in the following 3-step way:

- Banks extend secured and restricted access to their CBS (Central Banking System) to third-party platforms.

- The third-party institution will then integrate the respective bank APIs.

Finally, the third-party institution will send out API calls to request data from the bank servers to carry out various functions such as transactions and balance queries.

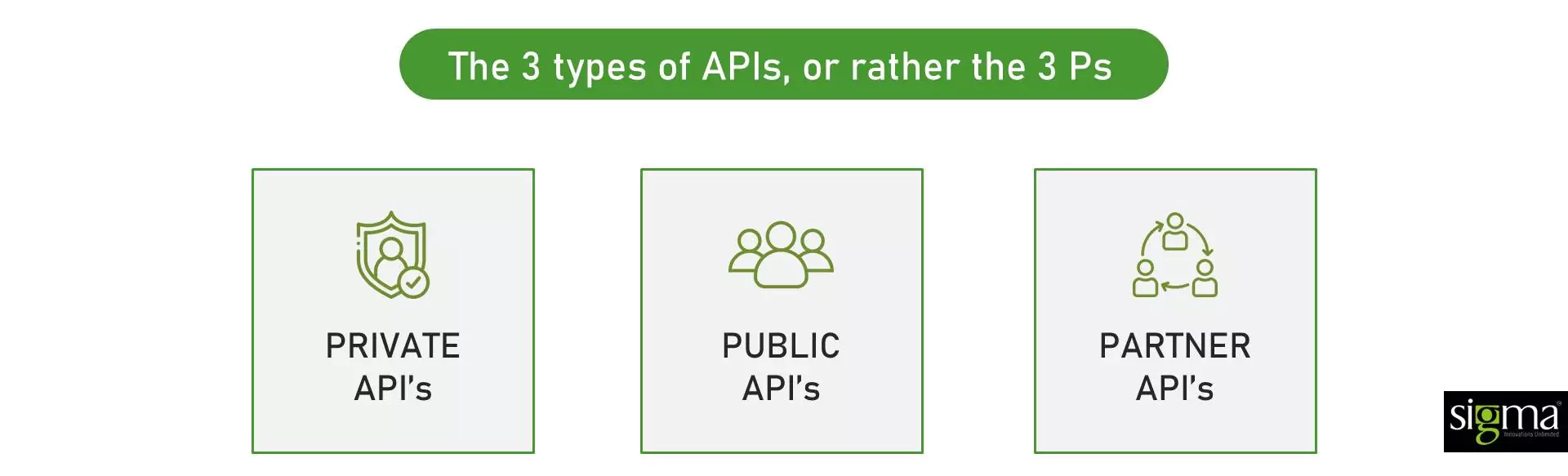

What are the different kinds of APIs in financial institutions?

Private APIs – These APIs are used within an enterprise. They help in saving costs through seamless automation, enable teams to collaborate smoothly, and ensure better security while exchanging data.

Public APIs – These APIs are used by developers and a third party to build a new product. The reason why this kind of API is not preferred by most of the institutions is because of the chances of data security and customer privacy threats. This is caused by entire sets of business data that are made available to third parties. However, there are a few benefits of having public APIs in places, such as the ability to innovate and access new markets.

Partner APIs – One of the most popular choices for banks and third-party collaborations is the partner API. These APIs let banks extend their services through new channels and products. Some of the benefits of partner APIs include more efficient collaborations, monetization of API, and finally, a greater degree of security in data exchange as compared to public APIs.

Finding the right APIs in the financial services industry

Following are some of the features that need to be considered while looking for API integrations:

Zeroing down on the objective

Ascertaining which service domain is the API going to be integrated with and whether it will be added to an existing service or a new one.

Auditing current CRM

Identifying which services are preferred by the target audience will help banks to create a targeted list of vendors.

Evaluating documentation of APIs

It’s preferable to go for APIs that have elaborate documentation and FAQs.

Regulatory compliance

Since data security is crucial when it comes to API, having legal counsel go through the process of data sharing to ensure that it meets legislative requirements is advisable, as well.

Remarkable APIs in the financial services industry

PayPal-Siri Integration – The PayPal-Siri integration has been one of best-regarded examples of API integration whereby users could just ask Siri (on their iOS devices) to make a PayPal transfer. PayPal recently announced its financial results for Q1, 2021 at a whopping $285Bn.

Robinhood Integration – Investment and trading platform Robinhood, requires its users to link their bank accounts. They use Plaid’s banking API which helps them onboard users and establishes the integration easily.

Facebook Messenger – Facebook through its Messenger feature has enabled users to send money to each other without leaving the app. The social media giant has collaborated with major players in the payment processing industry like PayPal, Stripe, Braintree, Mastercard, Visa, and AMEX.

Banking chatbots – Chatbots employed by banks help them handle a larger number of customer queries more efficiently using natural language. These AI-enabled chatbots can access bank databases to retrieve information as needed and help customers with their queries. They help move the more difficult queries to actual human agents, thereby ensuring every issue is resolved in the best way possible. Some of the most notable bank API/Chatbot integration are Mastercard’s KAI and Bank of America’s Erica.

Conclusion

Given the rapid rate of API adoption across the banking and financial services industry, the future for APIs seems bright and promising. API integration is now common knowledge for individuals dabbling into multiple platforms at the same time, hence adoption is not an issue anymore.

One of the best places where banking APIs can reap lots of gains is collaborating with eCommerce websites, whereby users can make easy online payments using net banking gateways using the bank of their choice.

Banks can also integrate APIs on partner sites and provide lending alternatives at the point of sale thereby increasing chances of a sale, easing payment for the client, while also gaining a new client in the process.

Banking and financial APIs are a win-win for all parties involved. Fintech lenders have now become conscious of API integration as one of the major “much-needed” features in their loan origination software. They want to make the lending experience as smooth as possible for their customers.

It’s only a matter of time that we will be living in an API-fueled society, and this is just the beginning.