From Flawed to Future-Ready: How to Eliminate Inaccurate Credit Risk Models

High interest rates and real-time digital decisions define today’s lending landscape. This means accurate credit risk models are no longer a luxury but a necessity. Lenders and fintechs can face substantial financial hits from bad risk calls, ranging from customer defaults to regulatory penalties or even losing to more adept competitors.

But here’s the problem: many of the credit risk assessment models being used today are outdated. Built on legacy data and rigid rules, these models just can’t keep up with the complexity of modern lending. That’s where the real risk begins. Poor modeling leads to spikes in defaults, frustrated customers, and angry regulators.

It’s clear: the old way isn’t cutting it anymore. What’s needed is a future-ready approach—one that taps into AI, a wider variety of data sources, clear explainability, and strong governance. These aren’t just buzzwords—they’re the building blocks of smarter, safer credit risk management.

In this blog, we’ll explore what’s broken, what’s new, and how lending companies can evolve using modern credit risk management software and financial software development services built for speed, accuracy, and compliance.

Understanding the Root Causes of Inaccurate Credit Risk Models

If your credit risk model still leans heavily on FICO scores and old bureau data, it’s time for a reality check. In today’s fast-paced lending environment, sticking to outdated assumptions is like using a flip phone in the age of smartphones—limiting, risky, and totally out of sync with how modern borrowers behave.

Legacy data is one of the biggest culprits behind flawed models that prevent fintechs and other financial organizations from onboarding “thin-file” profiles as their clients. Relying solely on traditional scoring methods doesn’t reflect how diverse and digitally active borrowers are today. Gig workers, freelancers, immigrants, and even financially responsible young adults often fall into the “thin-file” or “no-file” category—not because they’re risky, but because old models simply don’t know how to evaluate them.

Read the blog to know more about the role of financial software development services in bridging the credit gap.

Add to that a lack of inclusive modeling, and what you get is a credit system that misclassifies entire groups. This can lead to missed opportunities for lenders and unfair outcomes for borrowers, ultimately hurting retention and reputation.

Another blind spot? Limited model validation in rapidly changing macroeconomic conditions. The pandemic, inflation surges, and interest rate spikes have all reshaped borrower behavior, but many models haven’t caught up. Without regular back-testing and recalibration, these systems can’t provide accurate insights—and bad data means bad decisions out.

Speaking of data, data siloing and quality issues continue to plague credit risk teams. When systems don’t talk to each other—CRM, loan origination software, transaction data, alternative sources—you end up with fragmented insights and blind spots. Clean, connected, and real-time data is the foundation of any effective credit risk management software.

Then there’s the AI paradox. Machine learning models can supercharge decisioning, but without proper governance, they introduce new risks. Bias and overfitting are major concerns, especially when models are trained on unbalanced or incomplete data. Without built-in explainability and fairness checks, lenders may be making decisions they can’t justify—something regulators are cracking down on hard.

All these challenges reveal one thing: to fix inaccurate credit risk models, lenders must go beyond surface-level tweaks. It requires a full-stack rethink—better data, inclusive design, regular testing, and robust governance.

That’s where modern credit risk assessment tools and custom financial software development come in. With the right tech stack and strategy, lenders can move from flawed to future-ready—and finally trust the risk scores that power their business.

Leverage the best investment software development solutions to turbocharge your trading recommendations

Trends Shaping the Future of Credit Risk Modeling

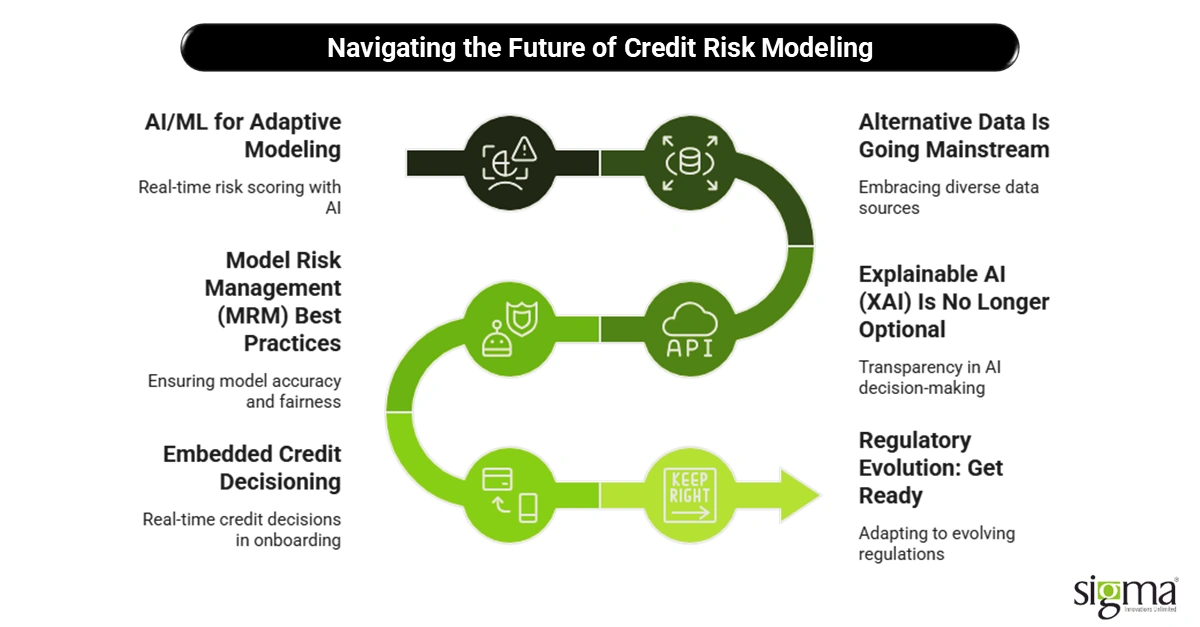

Credit risk modeling is getting a serious upgrade—and it’s not just about plugging in new tools. Lenders are moving away from static spreadsheets and old-school scorecards toward smarter, faster, and more inclusive credit risk management practices. Let’s break down the key trends pushing this evolution forward.

1. AI/ML for Adaptive Modeling

Modern credit risk models are increasingly powered by AI and machine learning, and for good reason. These technologies allow for real-time risk scoring based on changing signals—from income flows and spending patterns to macroeconomic shifts.

Instead of sticking to one-size-fits-all thresholds, ML models adjust dynamically. Think of it like having a GPS that reroutes as the traffic conditions change. This flexibility enables lenders to stay ahead of defaults while providing more accurate risk assessments across various borrower types.

Opt for Sigma Infosolutions’ Artificial Intelligence Development Services for predictive analytics and more

2. Alternative Data Is Going Mainstream

Say goodbye to relying on just FICO and bureau data. Today’s lenders are embracing alternative data like never before. From open banking insights and bank transaction data to mobile usage and behavioral patterns, the data pool is getting deeper and more dynamic.

This kind of credit risk assessment model is especially powerful for evaluating gig workers, immigrants, and others with thin credit files. Cash flow underwriting, for example, looks at real-time income and spending to gauge creditworthiness, offering a more complete picture than old-school models ever could.

3. Explainable AI (XAI) Is No Longer Optional

As machine learning takes the driver’s seat, there’s growing pressure for transparency. Explainable AI (XAI) isn’t just a tech buzzword—it’s a regulatory necessity. Both lenders and regulators want to know why a model made a certain decision.

Without this clarity, you risk non-compliance and eroded customer trust. The right credit risk management software will include built-in explainability tools, so decisions can be traced, audited, and justified—whether it’s to a regulator or an end customer.

4. Model Risk Management (MRM) Best Practices

Banks have long embraced Model Risk Management (MRM) frameworks to ensure their credit models are accurate, fair, and well-governed. Now, fintechs and digital lenders are catching up.

Best practices—such as independent model validation, stress testing, and documentation—are becoming standard, especially as lending platforms scale. Custom financial software development can help integrate these controls seamlessly into your systems, turning risk governance into a competitive advantage.

5. Embedded Credit Decisioning

Another exciting trend is embedding credit risk decisioning into onboarding workflows. It allows lenders to run background checks, KYC, and risk assessments during customer sign-up—all in real time.

This means users don’t have to wait days to know if they’re approved or eligible. For lenders, it speeds up onboarding, reduces drop-offs, and ensures that credit risk assessment tools are built right into the customer journey, not bolted on after the fact.

6. Regulatory Evolution: Get Ready

Globally, the regulatory landscape is evolving fast. The EU’s AI Act, the CFPB’s focus on AI transparency, and broader moves toward data accountability are reshaping how credit risk management must operate.

Lenders need to stay ahead of these shifts—not just to stay compliant, but to build trust with customers and partners. This is where working with a partner offering financial software development services can make all the difference. The right tech stack ensures your models are not just smart but also secure, transparent, and regulation-ready.

Looking for a scalable and secure technology infrastructure to deliver innovative and flexible products?

Opt for Sigma Infosolutions’ Digital Lending Software Solutions to achieve positive outcomes.

FinTech’s Path to Next-Gen Credit Risk Models

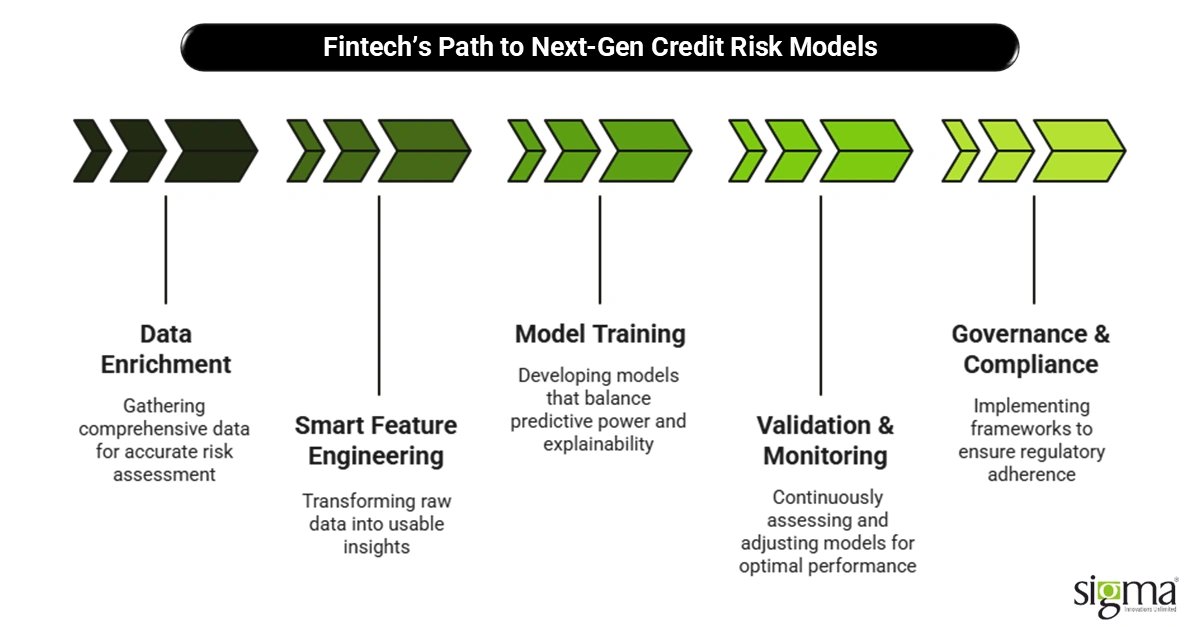

For fintechs and digital lenders aiming to stay ahead in a complex lending landscape, fixing the flaws in legacy credit risk models isn’t enough. It’s time to evolve—step by step—toward smarter, more inclusive, and compliant systems. Here’s a practical roadmap for building the next generation of credit risk management that actually delivers results.

Step 1: Data Enrichment – Feed the Model Right

Every great model starts with solid inputs. That’s why data enrichment is the first and most critical step. Modern credit risk management software must go beyond bureau data to integrate alternative and real-time signals. This includes transaction-level data, cash flow trends, payroll histories, rental payments, and even behavioral signals like app usage.

Partnering with modern data aggregators enables lenders to paint a more accurate picture of risk—even for thin-file or no-file applicants. This is where the magic of credit risk assessment tools truly comes alive. The more comprehensive your data, the more predictive your models can be.

This shift isn’t just about being inclusive—it’s about making smarter decisions, reducing defaults, and unlocking new markets with confidence.

Step 2: Smart Feature Engineering + Model Training – Keep It Simple, Keep It Smart

Once the data is in place, the next step is feature engineering—the process of turning raw data into usable insights for the model. Smart fintech teams leverage cloud-based data lakes to manage vast volumes of structured and unstructured data. And before pushing anything to production, they use synthetic data testing to spot potential weaknesses.

Here’s the twist: It’s not about building the most complex model in the room. Instead, focus on interpretability. If your underwriters, compliance officers, or auditors can’t explain why a model made a decision, you’ve got a problem.

The goal? Strike a balance between predictive power and explainability. In fact, that’s a core differentiator of well-built credit risk assessment models: They don’t just work—they’re understandable.

Step 3: Validation & Monitoring – Build the Feedback Loop

Even the best model can drift over time. That’s why continuous validation and monitoring are essential. Think of it like routine maintenance on a high-performance car—if you don’t tune it, performance drops and risk rises.

Modern credit risk management calls for

- Real-time performance tracking

- Stress testing under multiple economic scenarios (e.g., interest hikes, job market dips)

- Built-in fairness and bias detection

Lenders can’t afford to “set it and forget it.” With financial software development services that embed monitoring features, feedback loops keep your model sharp, compliant, and aligned with your evolving borrower base.

Step 4: Governance & Compliance – Lay Down the Law

In today’s regulatory environment, a smart model isn’t enough—it needs to be backed by strong governance. That means adopting formal Model Risk Management (MRM) frameworks, the kind traditionally seen at big banks.

Fintechs must now document every aspect of their model lifecycle—how data is sourced, how features are created, and how outcomes are validated. Everything needs to be traceable and audit-ready.

A robust governance layer also protects your business. When regulators come knocking, or if a customer challenges a credit decision, your ability to show how and why that decision was made is crucial.

Custom financial software development can ensure these capabilities aren’t just patched on—they’re designed into your systems from day one.

In short, the journey to better credit risk models isn’t one giant leap—it’s a series of smart, strategic steps. With enriched data, transparent modeling, continuous validation, and solid governance, fintechs can build risk systems that are ready for anything.

Common Pitfalls in Modernizing Credit Models—and How to Avoid Them

Modernizing credit risk models can feel like entering a new world of possibilities. But here’s the catch: without the right strategy, lenders can end up swapping one set of problems for another. Let’s talk about the most common mistakes fintechs and digital lenders make—and how to sidestep them before they cause damage.

Pitfall 1: AI/ML Without Domain Alignment

One of the most frequent mistakes? Jumping into AI or machine learning without involving credit risk experts. Data scientists alone can’t capture the complexities of lending. Without domain alignment, models may look good on paper but fail in the real world.

The fix? Encourage tight collaboration between credit analysts and data teams. Together, they can build models that are not only accurate but grounded in real lending behavior—turning advanced credit risk management software into a strategic asset, not just a tech experiment.

Pitfall 2: Ignoring Regulatory or Ethical Constraints

As powerful as AI is, it can quickly become a liability if it violates regulations or ethical standards. Regulatory bodies like the CFPB are watching closely. Black-box decisions with no clear justification are red flags.

Solution? Start with interpretable models and embed explainability right from the start. With clear documentation and traceable logic, you ensure your credit risk assessment model can stand up to both internal and external audits.

Pitfall 3: Data Overload, No Signal Filtering

It’s tempting to throw every data point into your model, especially with access to alternative data, open banking, and mobile metrics. But too much noise can blur the actual signal, leading to overfitting or wrong conclusions.

What works? Use signal filtering and feature selection techniques to isolate what truly matters. Remember, smart data beats big data—especially in custom financial software development.

Pitfall 4: Low Confidence in Black-Box Models

If your underwriting team, executives, or compliance officers don’t trust your model, they won’t use it. Period.

Avoid this by piloting in sandbox environments, where models can evolve in a controlled space. This allows for feedback, transparency, and stakeholder buy-in—crucial for successful model deployment.

Use Case Spotlight

Let’s bring this to life with a real-world transformation.

A mid-sized digital lender specializing in small business loans was hitting a wall. Their legacy credit risk model—primarily based on FICO scores and bureau data—produced an alarming number of false positives. Solid borrowers were getting declined, while approvals weren’t always paying off. The result? Lost revenue, frustrated applicants, and rising defaults.

To fix the issue, they partnered with a financial software development services provider to overhaul their risk engine. The first step? Moving from static credit data to cash-flow-based underwriting, integrating open banking data to evaluate real-time income and expense behavior. Thin-file borrowers—like freelancers and solopreneurs—were no longer invisible.

Next came explainable AI. Instead of using complex, black-box ML models, the new credit risk assessment model provided clear, human-readable justifications for every decision. This helped underwriters, execs, and auditors trust the system.

The results were impressive:

- 25% improvement in default prediction accuracy

- Increase in approvals among previously declined thin-file borrowers

- Full audit-readiness for regulatory reporting

Backed by internal validation and tested under stress scenarios, this modern credit risk management approach turned an outdated system into a competitive edge.

The takeaway? With the right tech stack and mindset, fixing flawed models isn’t just possible—it’s profitable.

Read our success story on Forex Trade Alert Software Day Trading Alerts & End of the Day Trade Alerts

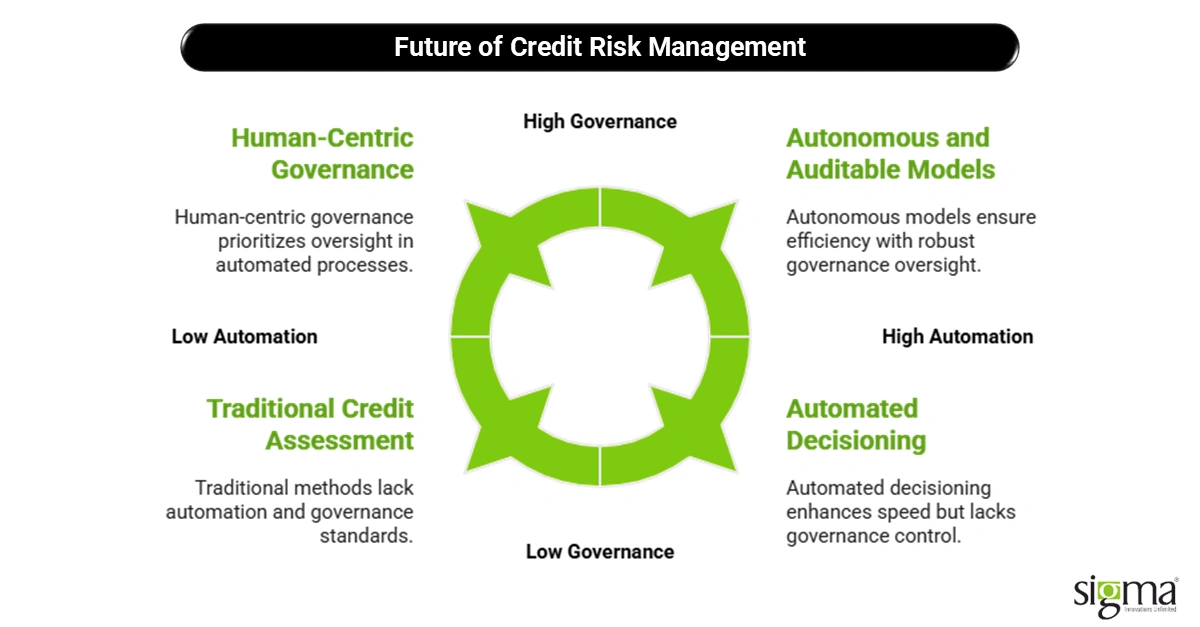

What the Future Holds: Autonomous, Inclusive, and Auditable Credit Modeling

The credit risk space is heading for a big shift—one that’s smarter, fairer, and more accountable. The future of credit risk management will be shaped by technologies that not only learn over time but also explain themselves clearly and operate under tighter governance. Let’s take a closer look at where we’re headed.

Self-Improving Models with Human Oversight

Imagine credit risk models that get sharper every day—not because someone manually tunes them, but because they learn from ongoing data in real time. That’s the power of self-improving models.

But don’t worry, humans won’t be cut out of the loop. The winning formula is a blend of automation and human judgment. Think of it as autopilot with a trained pilot always ready. This balance ensures models adapt to change while staying aligned with business strategy and risk appetite.

Unified Decisioning Across Products and Markets

Historically, lenders used different credit risk assessment models for different products or geographies. That creates friction, duplication, and inconsistent customer experiences. The future? Unified decision engines that can evaluate credit risk consistently across personal loans, credit lines, BNPL, and even cross-border lending.

With financial software development services, this kind of unified infrastructure becomes possible—letting you scale faster while maintaining consistent credit policies.

Inclusive Underwriting: Growth Without Recklessness

Future-ready lenders won’t sacrifice inclusivity for safety. Instead, they’ll use alternative data, cash-flow insights, and behavioral signals to underwrite thin-file, gig economy, and underbanked applicants—without adding more risk to their books.

This new era of credit risk assessment tools is about extending credit responsibly, not recklessly. With the right model logic and validations in place, lenders can approve more borrowers without compromising asset quality.

AI Governance Will Be a Must-Have

For VC-backed fintechs and digitally native lenders, AI governance is becoming non-negotiable. Investors and regulators alike want assurance that your models aren’t a black box.

Expect to see standardized documentation practices, version-controlled model repositories, and explainability-by-design baked into platforms. Having strong governance isn’t just about playing defense—it’s a signal to partners, customers, and regulators that your operation is built to last.

Embedded Compliance as a Product Feature

Compliance will no longer live in a separate department—it will live in the product. Tools like model cards, risk score explainers, and audit logs will become standard features in credit risk management software. That means every decision, threshold, and score can be explained—instantly.

With embedded compliance, fintechs can scale with confidence, knowing they won’t have to scramble if regulators come knocking.

The future of credit risk management is autonomous, inclusive, and fully auditable. Fintechs that embrace this shift—by adopting smarter models, building transparent systems, and investing in custom financial software development—won’t just survive. They’ll lead.

Final Thoughts

Moving from flawed to future-ready credit risk models isn’t just a technical upgrade—it’s a strategic transformation. FinTechs need to blend innovation, inclusivity, and compliance to stay competitive in today’s fast-evolving lending environment.

Here’s a quick checklist to guide your transformation journey:

- Upgrade data sources with real-time and alternative inputs

- Build explainable, dynamic models that balance accuracy with transparency

- Institutionalize Model Risk Management (MRM) frameworks for ongoing validation and governance

- Align your credit decisioning with evolving regulatory requirements to ensure audit readiness

If your current models aren’t ticking these boxes, it’s time to evaluate your risk strategy.

Partnering with experts in financial software development services can help you bridge gaps, reduce defaults, and unlock new growth opportunities. Don’t let outdated credit risk assessment hold your business back—reach out today and future-proof your lending with smart, scalable solutions tailored for the digital age.