Future-Proofing Portfolio Management Through Investment Software Solutions

Key Takeaways:

- Outdated systems are like driving with one eye closed. This blog shows how modern investment software development companies are bringing clarity, speed, and automation to portfolio management.

- From chaos to control: Learn how AI, automation, and investment API integration solutions are reshaping how investment firms make faster, smarter decisions.

- Future-ready portfolios run on intelligence, not intuition. Discover how scalable, secure, and data-driven investment management software solutions future-proof financial operations.

The investment and wealth management industry is in the middle of a digital storm. From fast-changing investor expectations to tightening compliance demands, firms are under constant pressure to make smarter, faster portfolio decisions. Yet, many are still relying on legacy systems and spreadsheet-driven workflows to handle today’s complex portfolios.

Here’s the truth: these outdated tools can no longer sustain real-time decision-making. Markets move in milliseconds, and investors expect personalized, data-backed insights on demand. When your data lives in multiple disconnected systems, every trade, forecast, or compliance update feels like a guessing game.

In the age of AI and automation, data overload without actionable insights has become a competitive risk. Firms that continue to operate this way risk missing market opportunities, exposing themselves to errors, and losing client confidence.

That’s why future-proofing portfolio management isn’t just about upgrading software; it’s about transforming how your firm thinks, acts, and grows. The key lies in AI-driven investment software solutions that simplify workflows, connect systems, and empower decision-makers with real-time analytics.

Sigma Infosolutions helps firms modernize their portfolio management infrastructure through automation, predictive intelligence, and real-time analytics for your teams to spend less time reconciling data and more time maximizing returns.

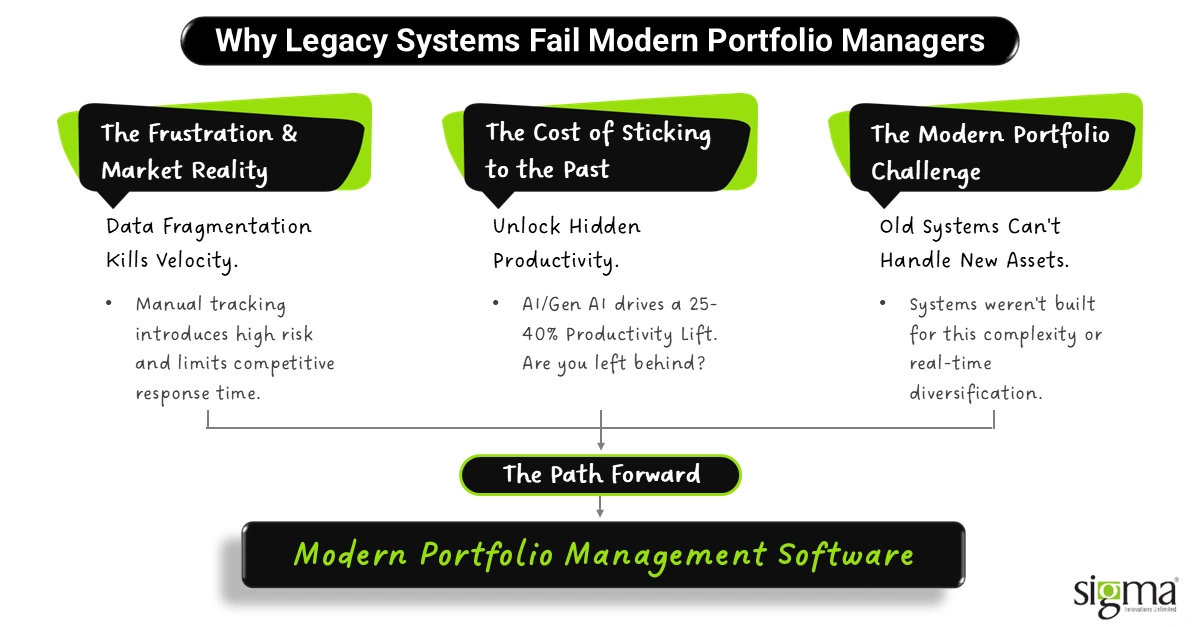

Why Legacy Systems Are Failing Modern Portfolio Managers (The Market Reality)

Every modern portfolio manager knows the frustration of data scattered across systems, manual reconciliations eating up hours, and dashboards that feel like they belong in 2005. This fragmented approach creates data silos, slowing decision-making and delaying your response to fast-moving market shifts.

According to a McKinsey report, firms that embed AI, gen AI, and agentic AI into their investment processes can unlock productivity lifts of 25 to 40 percent. Yet, many wealth and asset management firms still rely on manual processes that introduce human error, reduce compliance accuracy, and limit scalability.

Modern portfolios now include a broader range of assets (private equity, digital assets, and ESG-linked instruments), demanding systems that can handle real-time diversification and analytics. But legacy systems simply weren’t built for this level of complexity.

ven most of the recent outlooks warn that “digital disruption is reshaping the future of wealth management, and firms that fail to modernize risk being left behind.”

If you’re spending more time reconciling data than strategizing investments, you’re already feeling the pinch. The old way of managing portfolios, such as manual tracking, disconnected software, and reactive decisions, can’t compete in an AI-first world. It’s time to replace the patchwork with modern portfolio management software in the USA that drives agility, accuracy, and automation.

What “Future-Proofing” Really Means in Portfolio Management

When we talk about future-proofing portfolio management, we’re not talking about predicting the next market crash or crypto boom. We’re talking about building resilient systems that can adapt instantly, no matter what the markets throw your way.

Agility is key. With real-time data and automated investment management, firms can respond to volatility faster than ever before. Interoperability ensures that your system’s CRMs, custodians, trading platforms, and digital asset management platforms all communicate with each other, creating a unified, 360-degree view of every client and position.

Then comes automation. By streamlining workflows, you reduce manual errors while freeing your team to focus on strategy and client engagement. Add AI-powered intelligence, and you’re not just tracking assets, you’re predicting performance. Predictive analytics and portfolio optimization tools guide smarter allocations, while built-in compliance features ensure regulatory adaptability from day one. To be precise, future-proofing isn’t about predicting every market turn; it’s about building systems smart enough to adapt instantly. That’s what modern investment software solutions achieve. They turn complex portfolio management processes into seamless, scalable, and insight-driven ecosystems.

Also Read: Fintech Software Development Services Powering Inclusive Growth in Emerging Markets

How Investment Software Solutions Are Transforming Portfolio Management (The Shift)

The old ways of managing portfolios (spreadsheets, manual reconciliations, and disjointed tools) simply can’t keep up with today’s digital economy. Modern investment software has flipped the script, turning slow, reactive processes into fast, intelligent, and automated systems. For wealth management and FinTech leaders, this transformation isn’t optional anymore; it’s the key to staying competitive.

Here’s how Investment Software Solutions are reshaping the entire portfolio management process:

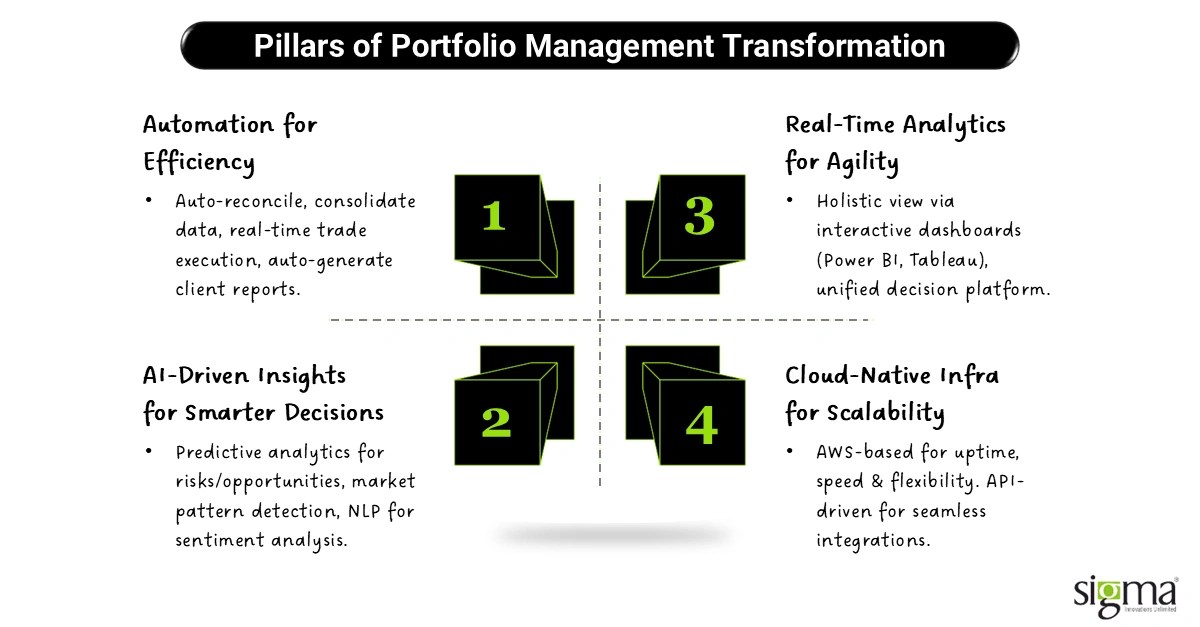

Automation for Operational Efficiency

Imagine a world where trade reconciliations, data aggregation, and performance reporting happen automatically; no late nights, no error-prone spreadsheets. That’s the power of digital portfolio management.

Automation helps firms clean and consolidate data from multiple sources, execute trades in real time, and auto-generate client reports. For instance, advanced investment portfolio management tools can perform real-time portfolio rebalancing based on pre-defined triggers like market volatility, asset deviation, or risk exposure.

The result? Operations that once took days now finish in minutes, freeing teams to focus on high-value strategy instead of repetitive tasks. It’s the ultimate productivity multiplier for modern financial firms.

AI-Driven Insights for Smarter Decision-Making

In an era where milliseconds matter, AI and machine learning give portfolio managers an edge that human intuition alone can’t match. Predictive analytics models identify risks and opportunities before they surface, helping firms manage exposure and optimize asset allocation.

By leveraging automated investment management capabilities, firms can detect market patterns and forecast price movements. Meanwhile, Natural Language Processing (NLP) engines track market sentiment across global news, social platforms, and analyst reports, converting raw data into actionable insights.

This is where Sigma’s Fintech Software Development Services shine. We build intelligent systems that learn from your data, helping you make faster, smarter, and more confident investment calls.

Real-Time Analytics for Visibility and Agility

When market conditions change by the second, visibility is everything. Tools like Power BI and Tableau enable real-time, interactive dashboards that deliver a holistic view of portfolio performance.

By integrating multiple data streams (trading, CRM, and portfolio analytics & reporting tools), managers get a unified decision-making platform. Think of it as having a “mission control center” for your investments, where every metric, asset, and alert is visible at a glance.

This level of transparency drives agility, allowing teams to pivot faster, minimize risk, and seize emerging opportunities without missing a beat.

Cloud-Native Infrastructure for Scalability

Scalability and reliability are the backbone of future-ready portfolio management systems. AWS-based architectures provide the perfect foundation, ensuring uptime, speed, and flexibility as your business grows.

Sigma’s engineers leverage API-driven integrations that connect seamlessly with trading platforms, data warehouses, and analytics tools. This architecture doesn’t just meet today’s needs; it’s ready for the next decade of innovations, from real-time investment tracking dashboards to digital asset management platforms.

Simply put, the future of investment management technology lies in cloud-native, AI-driven systems that evolve with your firm, not against it.

Modern Investment Software Solutions are no longer a luxury; they’re the infrastructure of competitive advantage. By combining automation, analytics, AI, and scalability, firms can move from reactive to proactive and from maintaining portfolios to mastering them.

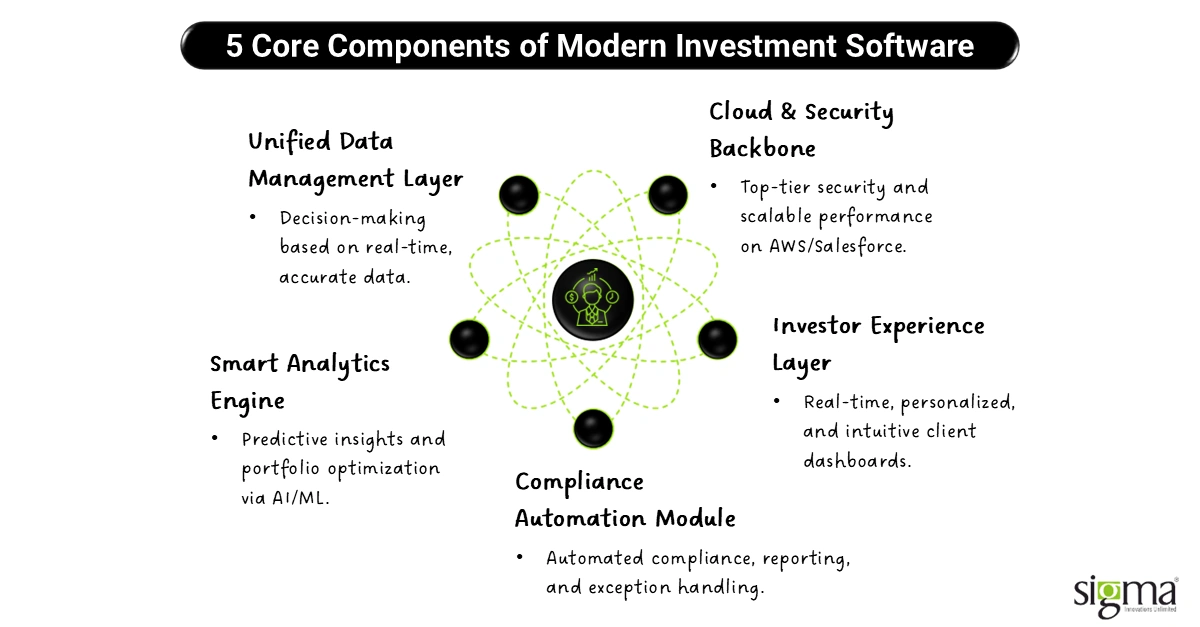

Core Components of a Future-Ready Investment Software Platform

Think of your portfolio management system as a high-performance engine — data is the fuel, automation is the transmission, and AI is the driver. Every part must work together seamlessly to deliver precision, performance, and speed. That’s what modern investment technologies are built for: efficiency without compromise.

Let’s break down what a truly future-ready investment software platform looks like:

- Unified Data Management Layer: Modern portfolio systems thrive on connected data. A unified data management layer eliminates silos using secure APIs, cloud data lakes, and investment software integration frameworks. It ensures your investment software systems pull accurate, real-time data from trading platforms, CRMs, and custodians, so decisions are made on truth, not assumptions.

- Smart Analytics Engine: This is where intelligence takes over. Powered by AI and machine learning, the smart analytics engine uncovers insights hidden in massive data sets, enabling portfolio optimization, performance benchmarking, and predictive analytics. This capability sits at the heart of investment management software solutions, turning raw data into a competitive advantage.

- Compliance Automation Module: With regulators tightening the ropes, compliance can no longer be an afterthought. The compliance automation module ensures your platform remains adaptable to evolving SEC, FINRA, and ESG standards. Here, investment management regtech software comes into play, automating audit trails, reporting, and exception handling while maintaining transparency and traceability.

- Investor Experience Layer: An intuitive, data-rich user interface defines the modern investment experience. Built with UI/UX best practices, this layer improves investor trust and engagement through real-time dashboards, transparent analytics, and personalized insights. It’s where design meets data-driven storytelling, empowering clients to understand their portfolios at a glance.

- Cloud & Security Backbone: Behind every scalable platform lies a powerful foundation. With AWS and Salesforce ecosystems, firms achieve top-tier scalability, performance, and data security. This backbone supports investment API integration solutions, ensuring interoperability with emerging technologies while safeguarding sensitive financial information.

Future-proof platforms aren’t stitched together; they’re engineered as ecosystems. Each component fuels the next, together defining the future of investment management technology that drives agility, security, and growth.

How Sigma Infosolutions Helps FinTechs and Investment Firms Future-Proof Their Portfolio Management

At Sigma, we understand that every FinTech or investment firm operates differently. That’s why our approach to building investment software solutions is never one-size-fits-all. As a leading investment software development company in the USA, we specialize in engineering tailored platforms that align with each client’s business model, regulatory needs, and data architecture.

Tailored Technology, Measurable Results

Our expertise spans .NET, ReactJS, Power BI, AWS Cloud, and AI/ML, enabling us to build investment software systems that are both intelligent and scalable. We don’t just develop features; we design frameworks that evolve with your business. These quantifiable results demonstrate the tangible business value and strategic advantages clients gain when partnering with us for modern, data-driven investment and lending solutions.

Building the Backbone of Boutique Capital Formation Firm. Read the full case study here!

- Reduced manual transaction processing time by 80% through automated investment workflows.

- Centralized investment data across all deals, cutting reporting time for partners from days to minutes.

- Streamlined investor reporting and portfolio valuation processes for timely, auditable decision-making.

Read the full case study here! Empowering Due Diligence with Power BI Integration

- Consolidated over 15 disparate data sources into a single dashboard, saving 65% in data aggregation time for due diligence.

- Accelerated the investment decision-making cycle by 40% by providing real-time portfolio analytics via Power BI.

- Enhanced data governance and audit readiness for due diligence findings across all assets.

Read the full case study here!

Revolutionizing Home Improvement Financing (Marketplace Integration)

- Reduced loan application processing time by 50% through seamless lender-marketplace API integrations.

- Improved lead conversion rates by 25% by enabling real-time, automated underwriting decisions at the point of sale.

- Achieved 99.8% data accuracy between the lender and marketplace systems for compliant funding.

Read the full case study here!

A Lender’s Blueprint for Maximizing Capital Disbursement

- Automated eligibility and fund disbursement logic, cutting post-approval funding time by 60%.

- Enabled incremental capital access 3x faster for clients using performance-based software rules.

- Ensured full regulatory compliance through automated checks deployed at every disbursement stage.

Read the full case study here!

By embedding automation, analytics, and investment software integration, Sigma transforms complex investment operations into efficient, insight-driven ecosystems.

Deep Domain Knowledge Meets Seamless Connectivity

With experience across FinTech, WealthTech, and Investment platforms, our team knows what it takes to deliver real-world results. From CRM and trading platform integrations to regulatory dashboards, we design systems that unify every touchpoint of the portfolio management process.

Our engineers also specialize in investment API integration solutions, enabling smooth data flow between external partners, custodians, and analytics platforms to ensure scalability, accuracy, and real-time intelligence.

Design That Inspires Trust

UI/UX is not just design, it’s experience. We craft interfaces that simplify complexity, allowing decision-makers to see what truly matters. From customizable dashboards to predictive insights, every visual is engineered to empower action.

“At Sigma, we don’t just build software, we engineer financial intelligence.”

In short, Sigma delivers investment management software solutions that help firms automate, scale, and stay compliant today and tomorrow.

Also Read: From Compliance to Confidence: Security by Design in Fintech Cybersecurity

Real-World Applications (The Impact of Modern Investment Software)

Investment software is no longer just a back-office enabler; it’s a strategic advantage that transforms how decisions are made, portfolios are balanced, and client trust is earned. Across roles and responsibilities, its impact is tangible and measurable.

For Portfolio Managers:

- Real-Time Portfolio Rebalancing: Automated algorithms rebalance portfolios dynamically, aligning them with investor objectives as market conditions shift.

- Proactive Risk Alerts: AI-powered monitoring detects deviations from risk thresholds and triggers instant notifications, helping managers respond before issues escalate.

- Streamlined Reporting: Unified data pipelines reduce manual effort and deliver error-free performance reports in minutes, not days.

For CTOs and Tech Leaders:

- Modular Architecture: Microservices and APIs make it easy to plug in new analytical tools or reporting systems without disrupting existing workflows.

- Enhanced Scalability: Cloud-native platforms like AWS ensure performance and uptime even as data volumes grow exponentially.

- Rapid Deployment: Automated testing and containerized environments cut development cycles and speed up go-live timelines.

For Clients:

- Greater Transparency: Interactive dashboards let clients view asset allocations, returns, and risk exposure in real time.

- Enhanced Confidence: Continuous updates and transparent performance analytics foster long-term trust in wealth management strategies.

- Personalized Experience: Tailored insights and recommendations create a more engaging and client-centric investment journey.

Before vs. After Modernization

- Aspect

- Data Access

- Portfolio Rebalancing

- Risk Alerts

- Client Engagement

- Before Modernization

- Fragmented across systems

- Manual, time-intensive

- Reactive

- Static reports

- After Modernization

- Unified through APIs and dashboards

- Automated, real-time

- Predictive and proactive

- Interactive, on-demand insights

Investment firms that have embraced this transformation are witnessing not only improved operational metrics but also stronger client retention and faster decision-making cycles, a combination that sets leaders apart in a hyper-competitive market.

Trends Shaping the Next Generation of Portfolio Management (The Road Ahead)

The future of portfolio management is being redefined by technology that thinks, learns, and adapts. As the industry evolves, five emerging trends are setting the stage for the next era of intelligent investing.

- AI-Driven Personalization and Robo-Advisory Integration: Tomorrow’s platforms will deliver hyper-personalized investment strategies powered by AI, blending human expertise with robo-advisory precision to serve diverse client profiles at scale.

- Predictive Analytics for Market Turbulence: Machine learning models will increasingly anticipate volatility, enabling investors to reposition assets proactively rather than reactively. Predictive alerts will help mitigate exposure and optimize portfolio resilience.

- Blockchain for Transparent Trade Settlements: Distributed ledger technology promises real-time, tamper-proof settlement records by reducing reconciliation delays and enhancing trust between counterparties.

- API-Driven Ecosystems: Seamless integrations will continue to unify investment tools, CRM systems, and compliance modules, creating connected ecosystems that improve collaboration and operational agility.

- Sustainability (ESG)-Driven Analytics: With ESG becoming central to investment strategies, software will evolve to quantify sustainability metrics, assess social impact, and align portfolios with investor values.

These innovations are not just shaping workflows; they’re shaping mindsets. Investment leaders are moving from data accumulation to data activation, using intelligence to gain foresight rather than hindsight.

“The firms that master data, automation, and AI today will define the investment landscape tomorrow.”

In the coming years, the lines between technology, strategy, and sustainability will blur. Firms that embrace this convergence will not just survive disruption, they will lead it.

Conclusion

The financial landscape is transforming at an unprecedented pace, and staying competitive means evolving even faster. In an era defined by real-time data, intelligent automation, and investor expectations for transparency, portfolio management can no longer rely on legacy systems or manual oversight.

Future-proofing your investment operations isn’t a one-time technology upgrade; it’s an ongoing innovation mindset. It’s about building an ecosystem that adapts to market shifts, regulatory demands, and client goals without compromising speed or accuracy.

At Sigma Infosolutions, we help financial institutions and investment firms reimagine their portfolio management systems through the perfect balance of engineering precision, financial intelligence, and scalable technology. From AI-powered analytics and automation frameworks to cloud-native architectures and seamless integrations, Sigma enables you to achieve greater agility, resilience, and performance.

Whether your goal is to modernize data flows, enhance client reporting, or unlock new insights through predictive analytics, our FinTech expertise ensures your technology evolves in lockstep with your business vision.