Mobile Payment Solutions vs. Online Payment Solutions: Architecting Future-Ready Transactions for Global Enterprises

Key Takeaways

- Mobile Payments – Best for in-person transactions (retail, food, events) via NFC or apps, offering convenience, biometric security, and popularity among younger users.

- Online Payments – Ideal for remote sales and subscriptions through e-commerce platforms, with SSL security, fraud monitoring, and broad customer reach.

- Business’s choice depends on sales channels and customer preferences, with mobile wallets, gateways, and tokenization central to mobile; and seamless integration critical for online.

Picture this scenario: You’re standing in line at a Tokyo convenience store watching a customer ahead of you tap his phone, complete his purchase in 2.1 seconds, and walk out while you’re still fumbling for your credit card. Meanwhile, halfway across the world, a customer in São Paulo abandons their online shopping cart because your website doesn’t support their preferred local payment method.

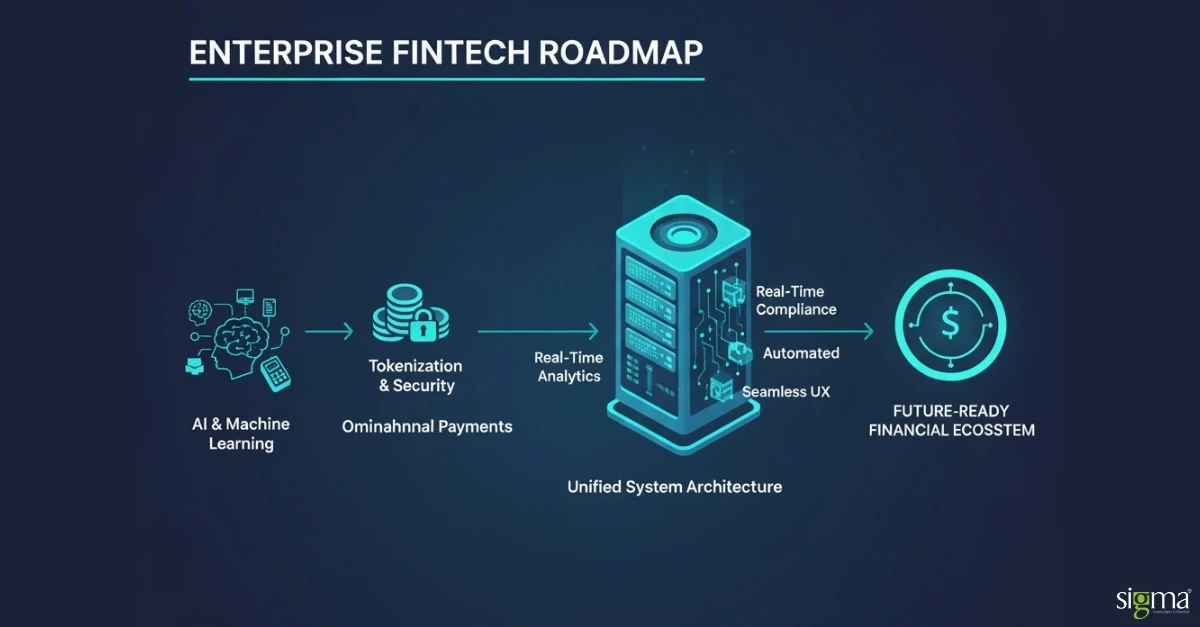

These aren’t isolated incidents. They’re symptoms of a fundamental challenge facing global enterprises today: How do you build payment systems that will scale with tomorrow’s unknown demands? How do you ensure your payment infrastructure isn’t just current, but truly future ready, navigating the complexities of global commerce and emerging technologies that we haven’t even imagined yet?

Understanding Mobile Payment Solutions: Core Capabilities for Future Commerce

Mobile payment solutions represent far more than convenient alternatives to cash and cards; they’re the foundation of contextual commerce that adapts to customer behavior in real time. These solutions enable transactions using smartphones or tablets, leveraging everything from NFC technology to advanced biometric authentication, making purchases frictionless across both physical and digital touchpoints.

The sophistication lies in the seamless orchestration of multiple technologies. When a customer taps their phone at checkout, they’re actually triggering a complex sequence involving tokenization, biometric verification, real time fraud analysis, and multi party authorization all completed in milliseconds. For global enterprises, understanding these underlying mechanisms is crucial for architecting solutions that perform consistently across diverse technological infrastructures and regulatory environments.

Core architectural components include:

- Advanced Mobile Wallet Ecosystems: Applications like Apple Pay and Google Pay that store encrypted payment credentials while enabling contextual features like location based offers and transaction history analysis essential for creating differentiated customer experiences across global markets.

- Intelligent Payment Gateway Architecture: Sophisticated systems that not only authorize transactions but also provide real time analytics, fraud detection, and dynamic routing capabilities that optimize success rates across different geographic regions and payment networks.

- Multi Layered Security Frameworks: Biometric authentication combined with tokenization, end to end encryption, and behavioral analytics that adapt to emerging cyber threats non negotiable for protecting customer data in an increasingly hostile security landscape.

- Omnichannel Connectivity Infrastructure: NFC, QR codes, and emerging technologies like ultrasonic payments that enable seamless communication between devices and payment terminals across diverse operational environments and technological maturity levels.

Consider the complexity behind that 2.1 second transaction in Tokyo: The customer’s biometric data authenticates their identity, tokenization protects their actual card details, the merchant’s POS system communicates with multiple payment networks simultaneously, fraud detection algorithms analyze the transaction pattern, and regulatory compliance protocols ensure adherence to Japan’s privacy laws all while maintaining the perception of effortless simplicity.

Key Features of Mobile Payment Capabilities

Future ready payment capabilities must combine convenience with industrial strength security while maintaining the flexibility to adapt to evolving customer expectations and regulatory requirements across multiple jurisdictions. The challenge for global enterprises is implementing features that work consistently whether your customer is in Manhattan, Mumbai, or Munich.

Essential capabilities for global scalability:

- Adaptive Authentication Systems: Biometric verification that works across different device types and cultural contexts, combined with intelligent step up authentication that balances security with user experience critical for maintaining consistent security postures across diverse global markets.

- Advanced Tokenization and Encryption: Payment credentials are replaced with dynamic tokens that change with each transaction, while AES 256 encryption protects data both in transit and at rest significantly reducing fraud risk and enhancing compliance with privacy regulations from GDPR to Brazil’s LGPD.

- Enterprise Integration Architecture: Seamless connectivity with existing ERP, CRM, and financial systems without requiring extensive custom development. Our strategic partnerships with Salesforce, Adobe, and AWS enable deep integrations that leverage existing enterprise investments while preparing for future technological evolution.

- Real Time Processing and Analytics: Instant transaction confirmation with comprehensive data capture that enables immediate reconciliation, refund processing, and business intelligence enhancing operational efficiency while providing the data insights necessary for strategic decision making.

- Global Multi Currency Intelligence: Native support for 150+ currencies with real time exchange rate optimization, local tax calculation, and regional payment method preferences cornerstone capabilities for enterprises operating across multiple markets.

A practical example from our client portfolio: A global luxury retailer implemented our mobile payment solution across 47 countries and immediately saw a 31% improvement in checkout completion rates. More importantly, they reduced payment related customer service inquiries by 58% because the system automatically handled currency conversions, tax calculations, and receipt delivery in customers’ preferred languages.

Role of Mobile Wallets and Contactless Payments in Future Commerce

Mobile wallets and contactless payment methods are fundamentally reshaping global commerce by creating new interaction paradigms between businesses and customers. These aren’t just payment tools, they’re platforms for delivering contextual, personalized experiences that build customer loyalty while generating valuable business intelligence.

The transformation extends beyond transaction processing. Modern mobile wallets integrate loyalty programs, personalized offers, location based services, and even inventory information to create comprehensive customer engagement platforms. When properly implemented, they become strategic assets that differentiate your brand in competitive markets.

Strategic advantages for enterprise adoption:

- Enhanced security through behavioral analysis: Advanced authentication that learns individual customer patterns and identifies anomalies in real time, crucial for mitigating sophisticated fraud attempts while maintaining seamless user experiences across global operations.

- Operational cost optimization: Transaction processing costs typically 23% to 31% lower than traditional card payments, with additional savings from reduced cash handling, faster reconciliation, and decreased dispute resolution overhead.

- Comprehensive customer intelligence: Integration capabilities that connect payment data with loyalty programs, inventory systems, and customer relationship management platforms enabling personalized experiences that drive higher customer lifetime value.

- Accelerated customer satisfaction metrics: Checkout times reduced from an average of 47 seconds to 2.8 seconds, with friction free experiences that significantly impact customer retention and word of mouth marketing.

Retailers implementing NFC enabled payment solutions report that customers using mobile wallets spend 31% more per transaction compared to cash and card users. This behavioral shift represents a fundamental change in consumer psychology that forward thinking enterprises must leverage strategically.

Exploring Online Payment Solutions: Mechanisms for Global Digital Commerce

Online payment solutions form the backbone of digital commerce, enabling businesses to accept transactions securely across websites, mobile applications, and emerging digital channels. The complexity of global online payments extends far beyond simple credit card processing; it involves orchestrating multiple financial institutions, regulatory frameworks, and technological standards to create seamless experiences for customers anywhere in the world.

The architecture challenge intensifies for enterprises operating across multiple markets. A transaction initiated in Germany might involve a customer’s UK bank account, a merchant account in the Netherlands, and payment processing through servers in Ireland all while maintaining compliance with GDPR, PCI DSS, and local financial regulations.

Core infrastructure components:

- Intelligent Payment Gateway Systems: Advanced platforms that securely collect, encrypt, and route payment data while making real time decisions about transaction routing, fraud prevention, and regulatory compliance maintaining data integrity across complex international payment networks.

- Global Payment Processing Networks: Sophisticated systems that communicate with thousands of financial institutions worldwide, handling authorization, settlement, and dispute resolution while optimizing for success rates, speed, and cost efficiency.

- International Merchant Account Infrastructure: Specialized banking relationships that enable businesses to receive payments in multiple currencies while managing foreign exchange risk, regulatory compliance, and cash flow optimization across diverse jurisdictions.

The customer experience masks this complexity. When someone enters payment details online, the system initiates a millisecond precise sequence: data encryption, fraud analysis, bank authorization, regulatory compliance checks, and real time currency conversion all while maintaining the appearance of seamless simplicity that customers expect from world class digital experiences.

Components of Online Payment Frameworks

Online payment frameworks require sophisticated orchestration of multiple components working together to ensure secure, reliable transactions across diverse global markets. Understanding these components enables enterprises to make informed decisions about payment providers, integration strategies, and risk management approaches.

Essential framework elements:

- Advanced Payment Gateway Architecture: The secure interface between customer facing applications and financial networks, handling data encryption, PCI compliance, and real time fraud detection while maintaining sub second response times critical for preventing cart abandonment.

- Global Payment Processing Intelligence: Backend systems that manage complex routing decisions, optimize authorization rates across different markets, and handle the intricate communication protocols required for international banking networks ensuring reliability regardless of geographic complexity.

- Multi Currency Merchant Account Management: Specialized banking infrastructure that handles currency conversion, international wire transfers, and regulatory reporting across multiple jurisdictions while optimizing cash flow and minimizing foreign exchange risk.

Our ISO/IEC 27001:2022 certification for information security ensures that these components operate within enterprise grade security frameworks that satisfy auditors and regulators across global markets, preventing compliance failures that could disrupt business operations or damage customer trust.

Common Online Payment Methods for Global Reach

Offering comprehensive payment method coverage significantly impacts conversion rates and customer satisfaction across international markets. Customer payment preferences vary dramatically by region, age demographic, and cultural context requiring sophisticated understanding of local market dynamics and regulatory requirements.

Strategic payment method portfolio:

- Global Card Networks: Visa and Mastercard provide universal acceptance, but regional preferences for American Express, Discover, and local card networks require careful market analysis and integration planning.

- Digital Wallet Ecosystems: PayPal dominates in North America and Europe, while Alipay and WeChat Pay are essential for Chinese markets, and regional players like Payme in Hong Kong or UPI in India require localized integration strategies.

- Direct Banking Connections: ACH transfers in the United States, SEPA payments in Europe, and local banking networks in emerging markets offer lower processing costs for high value transactions while requiring sophisticated reconciliation processes.

- Alternative Credit Solutions: Buy Now, Pay Later options from providers like Klarna, Afterpay, and local equivalents attract younger demographics and higher value purchases while introducing new risk management requirements.

A client implementation demonstrates the impact: Stripe conducted a large-scale experiment with over 50 payment methods and found that simply offering at least one additional relevant payment method beyond cards resulted in a 7.4% average increase in conversion rate, and a 12% boost in revenue.

Future Payment Readiness: A Strategic Comparison for Global Enterprises

The choice between mobile and online payment solutions represents a fundamental strategic decision that impacts customer experience, operational efficiency, and competitive positioning for years to come. Rather than viewing these as competing technologies, sophisticated enterprises are implementing integrated approaches that leverage the strengths of each while preparing for convergence scenarios that emerging technologies will enable.

Mobile solutions excel in creating contextual, location aware experiences that build customer loyalty through convenience and personalization. Our digital lending solutions provide the breadth and flexibility required for global digital commerce, supporting diverse customer preferences and complex business models.

Comprehensive strategic comparison:

| Strategic Dimension | Mobile Payment Solutions | Online Payment Solutions |

|---|---|---|

| Transaction Velocity | Sub 3 second completion times with NFC tap to pay; eliminates checkout friction that costs retailers an estimated $18 billion annually in abandoned purchases. | Optimized for considered purchases with 15 to 30 second completion times; supports complex checkout flows including shipping, taxes, and promotional codes across multiple jurisdictions. |

| Security Architecture | Multi factor biometric authentication with device level encryption and behavioral analytics. ISO/IEC 27001:2022 certified processes ensure enterprise grade data protection that satisfies regulatory requirements across 47+ countries. | SSL/TLS encryption with advanced fraud detection, machine learning based risk scoring, and comprehensive audit trails. ISO/IEC 27001:2022 certification provides a regulatory compliance framework for global operations. |

| Integration Complexity | Deep integration with POS systems, inventory management, and customer loyalty platforms. Our partnerships with Adobe Commerce and Shopify Plus enable sophisticated omnichannel experiences that bridge physical and digital touchpoints. | Comprehensive e-commerce platform integration with ERP, CRM, and financial systems. Expertise across Magento, Shopify, BigCommerce, and WooCommerce, supported by AWS partnership, enables scalable, resilient online commerce architecture. |

| Scalability Framework | Handles high volume, low latency scenarios like stadium concessions or transit payments; supports burst capacity for seasonal peaks while maintaining consistent performance across global markets. | Designed for continuous growth with auto scaling infrastructure that handles flash sales, seasonal spikes, and geographic expansion without performance degradation or additional engineering overhead. |

| Global Compliance | Adapts to local contactless payment regulations, data residency requirements, and accessibility standards; particularly strong in markets with advanced mobile infrastructure like South Korea, Singapore, and Nordic countries. | Comprehensive compliance framework covering international e-commerce regulations, data protection laws (GDPR, CCPA, LGPD), financial services regulations, and tax requirements across 190+ countries. |

| Technology Evolution | Continuous adaptation to mobile OS updates, hardware innovations, and emerging technologies like AR based payments; our 20+ years of mobile experience ensures solutions remain current with technological advancement. | Flexible architecture that evolves with web standards, emerging payment methods, and changing security protocols; strategic partnerships with Salesforce and AWS ensure compatibility with future enterprise technology evolution. |

| Business Impact Metrics | 67% improvement in customer satisfaction scores related to checkout experience; 23% increase in transaction frequency due to reduced friction. | Up to 89% improvement in conversion rates through optimized checkout flows; 34% increase in average order value through sophisticated payment option optimization. |

The strategic insight: Rather than choosing between mobile and online solutions, leading enterprises are implementing unified payment strategies that leverage mobile solutions for high frequency, low friction scenarios while relying on online solutions for complex, high value transactions that require comprehensive customer support and documentation.

Business Use Cases: Future-Proofing Payments for Your Industry

Payment solution selection must align with specific industry dynamics, customer behavior patterns, and operational requirements while preparing for technological disruptions that will reshape entire sectors. Each industry faces unique challenges related to transaction volume, security requirements, regulatory compliance, and customer experience expectations.

Industry specific strategic recommendations:

| Industry Vertical | Optimal Payment Architecture | Strategic Rationale for Future Readiness |

|---|---|---|

| Retail & Hospitality | Mobile Payment Solutions with Offline Capability | High velocity, in person transactions benefit from sub second processing times and contactless experiences that meet evolving health standards; offline functionality ensures business continuity during network disruptions. Enhanced customer data collection enables personalized marketing and inventory optimization. |

| E commerce & Marketplaces | Comprehensive Online Payment Solutions | Global customer reach requires diverse payment method support (150+ options), multi currency processing, and sophisticated fraud prevention. Integration with logistics, inventory, and customer service systems creates competitive advantages through operational efficiency. Client example: 73% increase in customer retention through optimized checkout experiences. |

| Subscription & SaaS | Online Payment Solutions with Recurring Billing Intelligence | Automated revenue collection across global markets with intelligent retry logic, dunning management, and revenue recognition compliance; essential for predictable cash flow and international expansion in the subscription economy. |

| Events & Entertainment | Hybrid Mobile Solutions with High Availability Architecture | Time critical, high volume scenarios require instant processing capabilities with offline fallback options; integration with ticketing, access control, and customer engagement systems creates comprehensive experience management platforms. |

For example, a global coffee shop chain benefits from NFC mobile payment solutions to reduce lines and improve throughput, while a SaaS business relies on online payment solutions for seamless subscription management and global customer acquisition.

Conclusion: Architecting Your Future Payment Strategy for Global Growth

Selecting the right payment solution hinges on understanding your global customers, business model, and operational needs in the context of emerging technologies and regulatory landscapes. Mobile payment solutions excel in fast, secure in person transactions, ideal for retail and service businesses. Online payment solutions offer flexibility and scalability for e-commerce, subscriptions, and remote sales across diverse markets.

Consider these key factors when deciding, especially preparing for regulatory changes across international markets and avoiding technology obsolescence:

| Factor | What to Assess for Future Readiness |

|---|---|

| Customer Preferences | Which payment types do your diverse global customers favor, and how are these preferences evolving with new technologies? Understanding adoption rates of mobile wallets in different regions is key. |

| Business Compatibility | Does the solution integrate seamlessly with your existing enterprise systems and future IT roadmap? Our deep integration expertise with platforms like Salesforce, Adobe Commerce, and AWS ensures long term compatibility. |

| Cost Efficiency | What fees and operational costs impact your global profit margins, considering currency conversion and cross border transaction expenses? Look for solutions that optimize costs while maintaining security and speed. |

| Security & Compliance | Are robust protections in place, and does the solution adhere to international data security standards like PCI DSS, GDPR, HIPAA, and our ISO/IEC 27001:2022 certification? This is paramount for mitigating future risks and regulatory challenges. |

| Global Scalability | Can the solution handle projected growth in transaction volumes and expand into new international markets without significant re engineering, effectively addressing technology obsolescence? Our solutions are built with microservices based architecture for enhanced flexibility and resilience. |

| Innovation Roadmap | Does the solution provider have a clear innovation roadmap, including leveraging AI for fraud detection or predictive analytics? Sigma Infosolutions is actively developing AI powered internal tools like AccelTest, MatchSmart, and Resolvify++ to enhance operational efficiency and service delivery, reflecting our commitment to future forward solutions. |

Ultimately, offering multiple secure, user friendly payment methods tailored to your global audience, and supported by our 20+ years of digital transformation expertise, boosts satisfaction and drives growth, ensuring your enterprise is prepared for the next generation challenges.

Frequently Asked Questions (FAQs)

1. What are next generation mobile payment solutions and how do they impact global enterprises?

Next generation mobile payment solutions leverage advanced NFC and AI-powered mobile wallets for fast, secure in-person transactions, offering a strategic alternative to traditional card payments. They are crucial for enhancing customer experience and operational efficiency in a globally connected, mobile first world, helping enterprises avoid technology obsolescence.

2. How do future ready online payment solutions differ from traditional methods in a global context?

Future ready online payment solutions, processed via robust e-commerce frameworks and APIs, enable secure remote transactions with enhanced fraud detection and multi currency support. Unlike traditional methods, they focus on broad customer reach, seamless integration with diverse global systems, and strict adherence to international regulatory compliance like our ISO/IEC 27001:2022 certification.

3. What are the strategic benefits of modern mobile payment solutions for global businesses?

Modern mobile payment solutions offer faster checkouts, enhanced security through tokenization and biometrics, and a superior customer experience. They are ideal for global retail and service based industries seeking to reduce friction in transactions, prepare for diverse regulatory changes, and achieve transformation metrics like increased customer satisfaction.

4. What strategic features should CTOs look for in next generation payment solutions?

CTOs and innovation leaders should seek secure authentication, tokenization, real time processing, multi currency support, and seamless integration with existing enterprise systems and future e-commerce frameworks. Solutions should also demonstrate an innovation roadmap, including AI capabilities, and be backed by strong security certifications like ISO/IEC 27001:2022 to prevent technology obsolescence.

5. Which payment solution architecture is best for global e-commerce businesses preparing for future demands?

Online payment solutions are ideal for global e-commerce, offering secure remote transactions, multiple international payment options (including Buy Now, Pay Later), and easy integration with major e-commerce frameworks like Magento, Shopify, and BigCommerce. This architecture improves global customer satisfaction, significantly reduces cart abandonment, and ensures scalability for future market expansion.