No More Waiting to Catch a Thief: Real-Time Financial Crime Prevention Solutions for Fintech Lenders

Every second counts when it comes to stopping financial crime. With the cost of fraud and identity theft in digital lending soaring, a proactive approach to security has become essential. Fintech lenders, with their digital-first, instant-approval models, are under attack more than ever. Why? Because criminals go where the money moves fast and the loopholes are bigger.

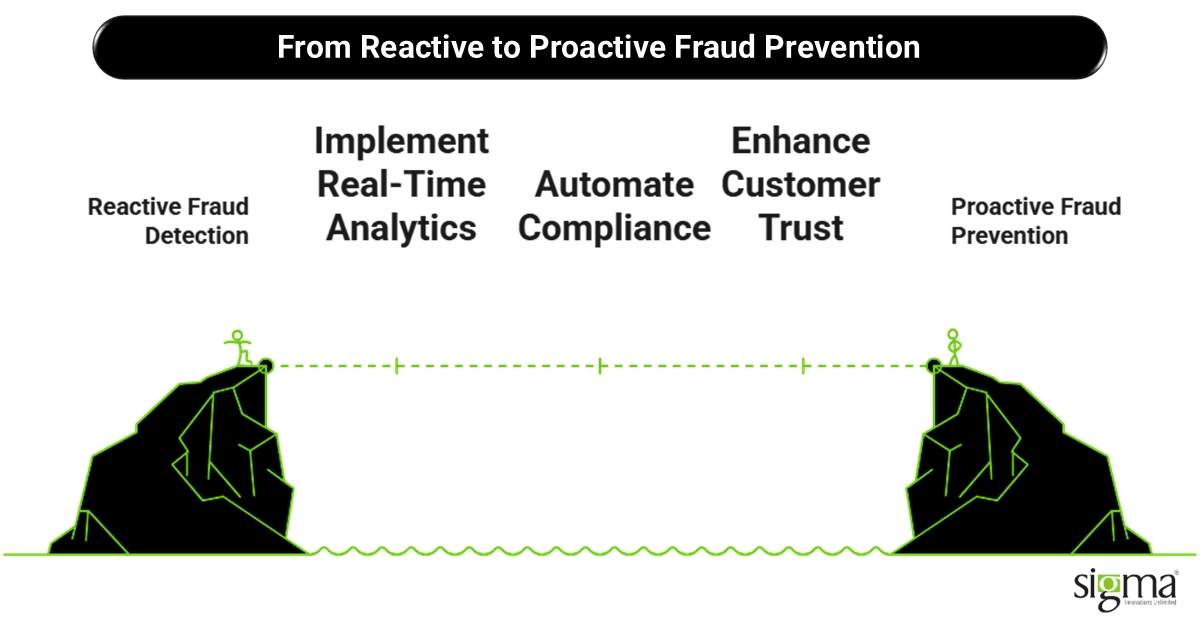

The real danger lies in the lag—waiting for audits, reviews, or reports before acting. That’s like locking your doors after the thief has already left with your valuables.

Modern fintech lenders need real-time solutions. From digital lending fraud detection to real-time alerts for suspicious lending behavior, today’s Financial Crime Prevention Solutions can stop fraud before it damages your bottom line—or your reputation.

This guide is for decision-makers at fintech companies who are serious about protecting their digital lending operations. Whether you’re building a new digital lending solution or scaling up an existing one, we’ll walk you through the latest tools, strategies, and technologies—like financial crime detection software, digital underwriting with fraud controls, and real-time compliance automation.

We’re not just talking about theory. We’re talking about tactical moves you can implement right now to stay ahead of the bad guys.

The Growing Financial Crime Risk in Digital Lending

Digital lending has revolutionized how we access and disburse capital—fast, paperless, and on-demand. But here’s the flip side: as convenience increases, so does the exposure to financial crime risk.

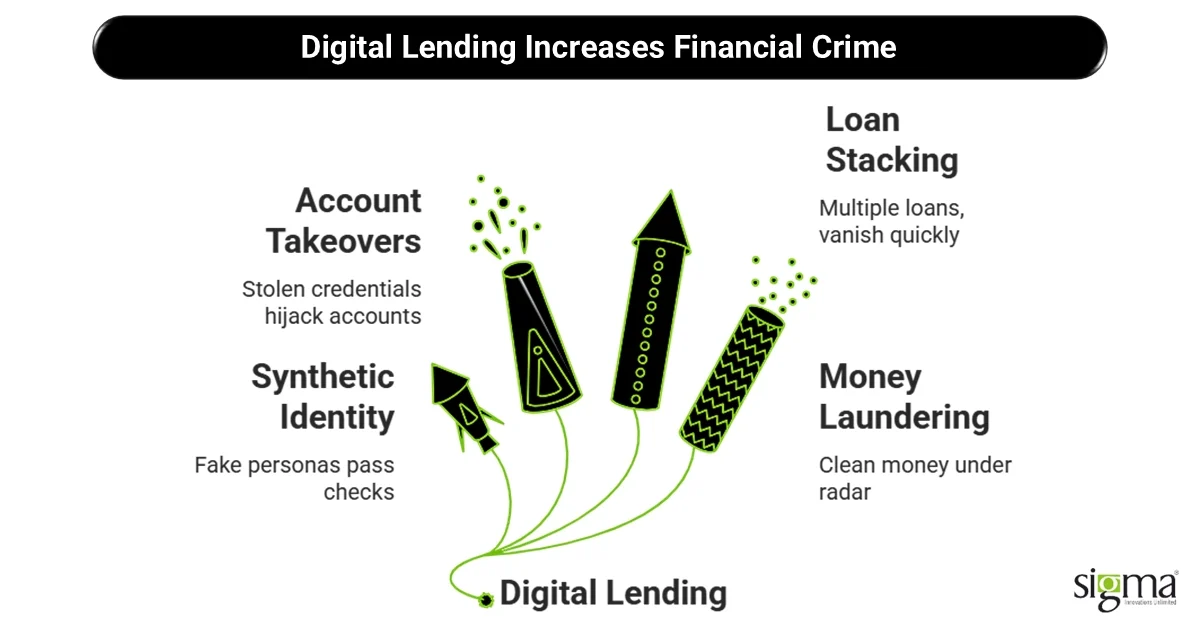

Let’s break down some of the most common types of financial crimes currently targeting digital lending platforms:

- Synthetic Identity Fraud: This is where fraudsters create fake personas using a mix of real and fabricated data. These identities pass basic credit checks and go undetected until it’s too late.

- Account Takeovers: Hackers use stolen credentials to hijack borrower accounts and apply for new loans or reroute disbursements.

- Loan Stacking and Bust-Out Fraud: In this scenario, bad actors take out multiple loans from different platforms simultaneously, exploiting the gap in real-time data sharing. They vanish before any red flags are raised.

- Money Laundering: With digital lending and digital payment software solutions operating across borders, it becomes easier for criminals to clean dirty money under the radar, bypassing traditional KYC/AML checks.

What’s fueling this fire? Speed.

Real-time digital transactions, while great for the borrower experience, widen the attack surface for criminals. The same technologies that enable instant approvals and fund transfers also give fraudsters more ways to act—faster and smarter.

That’s why modern fintechs are shifting focus toward real-time fraud analytics and financial crime prevention solutions that catch fraud as it happens—not after. For example, integrating financial crime detection software into your digital lending solution can help prevent fraud before the loan is disbursed.

Smart lenders are also turning to digital underwriting with fraud controls, layered identity verification, and real-time alerts for suspicious lending behavior. These tools don’t just improve financial crime compliance—they protect your brand and bottom line.

The takeaway? Digital lending is no longer a “launch and forget” platform. If you’re not proactively managing financial crime risk, you’re already behind.

Also Read: Power Up Your Platform with a Digital Payment Solution Built for You

Why Real-Time Financial Crime Prevention Is Critical

In today’s ultra-fast lending environment, speed without safety is a liability. The longer you take to detect fraud, the more damage it can do—not just to your finances, but to your brand and regulatory standing.

Let’s be real: most fraud in digital lending happens in the blink of an eye. If your system catches it a day—or even an hour—later, it’s too late.

Delayed Detection = Massive Financial Losses

Fintech lenders disburse loans in seconds. That’s exactly how fast fraudsters act. Without real-time fraud analytics, you could end up approving dozens—or even hundreds—of fraudulent loans before anything seems off.

- Research insights suggest that every $1 lost to fraud actually costs financial firms $4 when you factor in recovery, legal, and reputational costs.

- Bust-out fraud and loan stacking can wipe out large parts of a digital lending portfolio in hours if left unchecked.

Tightening Regulatory Expectations

Regulators aren’t waiting around either. Compliance frameworks like BSA (Bank Secrecy Act), AML (Anti-Money Laundering), and KYC (Know Your Customer) now expect real-time detection and proactive action.

- The era of quarterly audits is over. Regulators expect real-time compliance automation and flagging of suspicious transactions before the damage is done.

- Without a strong financial crime compliance strategy, fintechs risk fines, audits, and even shutdowns.

Evolving Consumer Expectations

Today’s digital-savvy borrowers demand more than speed—they demand security and transparency. A single fraud incident can shatter customer trust and tank app ratings.

- Borrowers want to know that their data is protected and their identities are safe.

- Real-time alerts for suspicious lending behavior reassure customers and show you’re actively watching out for them.

Why Real-Time Matters for Fintech Lenders

Real-time financial crime prevention solutions allow you to:

- Prevent loan fraud before disbursement

- Meet global regulatory standards without manual checks

- Avoid costly loan write-offs

- Boost borrower trust and confidence

- Enhance operational efficiency with digital underwriting and fraud controls

Whether you’re offering Digital Lending Software Solutions, Digital Payment Software Solutions, or Investment Software Development Solutions, the need for real-time fraud detection is non-negotiable.

Your fraud risk doesn’t wait. Why should your detection?

Real-World Insight

A U.S.-based lender worked with Sigma Infosolutions to build a real-time email and SMS communication system with integrated tracking for fraud alerts and compliance notifications. This automation ensured timely borrower verification and fraud signal delivery, improving both customer experience and compliance readiness.

Read the full case study: Automating Email and SMS Communication Systems with Real-time Tracking for a Lender

Core Components of Real-Time Financial Crime Prevention Solutions

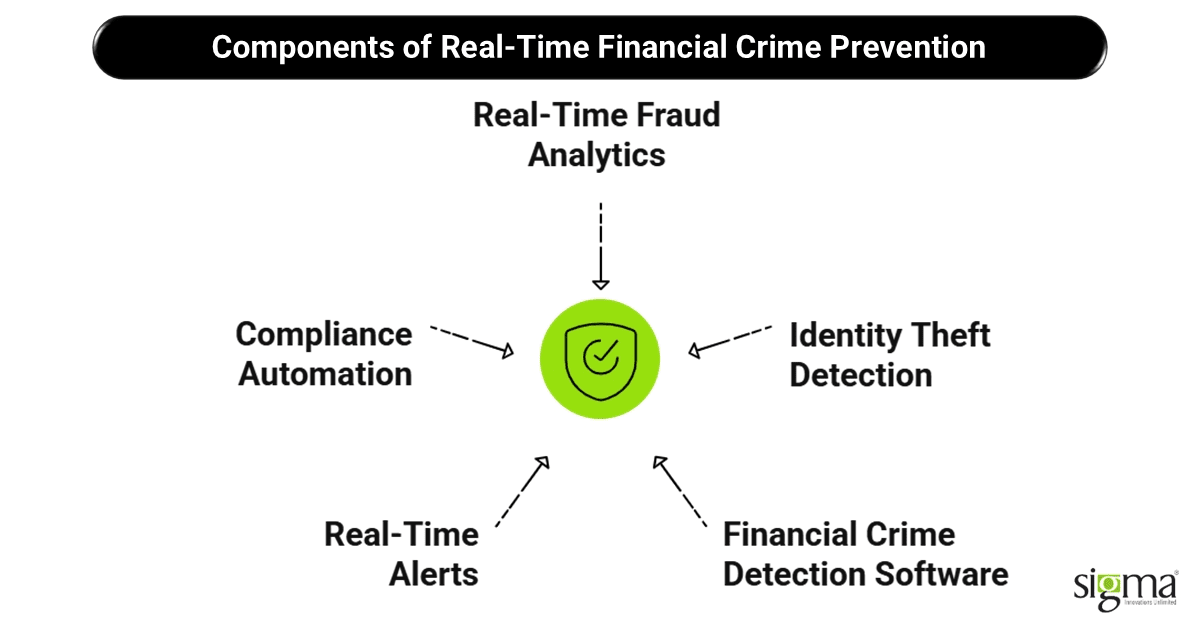

Financial crime doesn’t happen in isolation—it’s a moving target. That’s why effective Financial Crime Prevention Solutions must be real-time, dynamic, and deeply integrated into your lending workflows. Let’s break down the essential components that help fintech lenders outsmart fraudsters while staying compliant and competitive.

1. Real-Time Fraud Analytics

Modern fraudsters don’t always leave a clear trail. That’s where real-time fraud analytics steps in, using behavioral analytics and anomaly detection to flag unusual activities the moment they happen.

- Example: A borrower who always applies from a California IP suddenly logs in from overseas and requests a $50K loan? That’s suspicious—and instantly flagged.

- Many Digital Lending Software Solutions today embed these analytics directly into the application flow.

2. Identity Theft Detection in Digital Lending

One of the top threats today is synthetic identity fraud. Combatting it means going beyond basic logins and OTPs.

- Sigma’s digital lending software solutions use biometric verification, device fingerprinting, and historical identity graphs to catch imposters.

- For instance, a device showing a mismatch in typing patterns or geolocation vs. prior sessions can trigger instant denial.

This is a must-have in top-rated lending fintech solutions, ensuring financial crime risk is mitigated before the loan is ever issued.

3. Financial Crime Detection Software

Behind every fraud catch is a smart system trained to recognize suspicious behavior.

- These tools use pattern matching and transaction monitoring to scan thousands of data points in real time.

- For example, detecting multiple loan applications with near-identical email formats or IP locations can trigger deeper review.

They form the core of any Financial Software Development Services offering fraud defense as part of digital lending or payments.

4. Real-Time Alerts for Suspicious Lending Behavior

The key to stopping fraud? Notifying the right teams at the right time.

- Adaptive scoring engines assign dynamic risk scores based on real-time borrower activity.

- Rule-based triggers can be customized to your workflow—for example, flagging multiple applications from a single device.

Smart Digital Lending Software Solutions use these real-time insights to pause, escalate, or auto-decline high-risk transactions before money moves.

5. Compliance Automation

Regulations are evolving fast—and manually keeping up is no longer viable.

- Automated SAR filing, AML rules configuration, and AI-based checks help you meet financial crime compliance benchmarks without added headcount.

- These features are critical across Digital Payment Software Solutions, investment tools, and lending workflows alike.

With real-time compliance automation, you’re not just avoiding fines—you’re future-proofing your fintech business.

Each of these components plays a unique role, but together they create a powerful, real-time shield for any fintech lender seeking to offer secure, scalable, and compliant Digital Lending Software Solutions.

How Fintech Lenders Can Implement These Solutions

You’ve seen the threats, you know the tools. Now comes the real question—how can fintech lenders put all of this into action? The answer: with a methodical, tech-driven approach tailored to real-time lending environments. Here’s your step-by-step guide to implementing robust Financial Crime Prevention Solutions inside your Digital Lending Software Solutions or Digital Payment Software Solutions.

1. Audit Your Current Risk Landscape

Start with a reality check. You can’t fix what you can’t see.

- Review your current fraud detection coverage. Are there alerts for identity anomalies? Do your systems catch loan stacking before disbursement?

- Examine your digital underwriting and loan disbursement workflows—look for areas where fraud could sneak through unnoticed.

- Assess how well your Financial Software Development Services support real-time data flow and compliance monitoring.

Why it matters: You need a clear view of gaps in detection, financial crime compliance, and operational controls to build your roadmap.

2. Integrate Real-Time Monitoring Tools into Digital Lending Solutions

Your fraud protection should run in lockstep with your loan origination system (LOS) and loan management system (LMS).

- Embed real-time fraud analytics and transaction monitoring at every key decision point—application, verification, approval, and funding.

- Use APIs or pre-built modules that easily integrate with your existing digital lending solution or tech stack.

- Choose platforms that offer real-time alerts for suspicious lending behavior and connect directly with your internal risk teams.

Example: A spike in applications from one IP? The system pauses disbursement until further checks clear it.

3. Choose the Right Vendors

Not all fraud tools are created equal. Go for partners who move as fast as the threats do.

- Evaluate vendors that are specialized in agile, scalable financial crime prevention solutions.

- Consider:

- Integration with existing LOS/LMS

- Accuracy and speed of anomaly detection

- Support for AML rules and real-time compliance automation

- AI and ML-based adaptability

Pro tip: Run pilot programs with 2–3 vendors to compare real-world results before full rollout.

Case in Point: A leading digital lender partnered with Sigma Infosolutions to build scalable communication workflows using microservices architecture—enabling faster fraud detection, compliance flagging, and borrower interaction within the lending lifecycle. The modular system also allowed seamless integration with their existing LOS, LMS, and analytics stack.

See how this was done!

4. Establish Continuous Learning Loops

Fraud evolves. Your systems should too.

- Feed confirmed fraud cases into your machine learning models to refine future predictions.

- Update risk scoring rules regularly based on new patterns.

- Sync this intelligence with underwriting decision engines, so learning flows from detection to action.

Real-world value: A fraud pattern seen in merchant cash advance loans could inform decisions in small business lending before losses occur.

5. Train Internal Teams and Improve Incident Response Readiness

Even the best tools need human oversight.

- Build a cross-functional task force involving compliance, tech, and risk teams. Align them on alerts, escalation paths, and investigation protocols.

- Run mock scenarios to test how fast you can react to fraud attempts.

- Use internal dashboards and alert systems to keep everyone in the loop in real time.

Implementing real-time Financial Crime Prevention Solutions is no longer optional for fintech lenders. It’s a strategic necessity. By combining smart audits, powerful integrations, vendor partnerships, and adaptive learning systems, you can future-proof your operations against even the most advanced fraud threats.

Also Read: Friction-Free Digital Lending Starts with NLP and OCR

Best Practices to Prevent Loan Fraud Before Disbursement

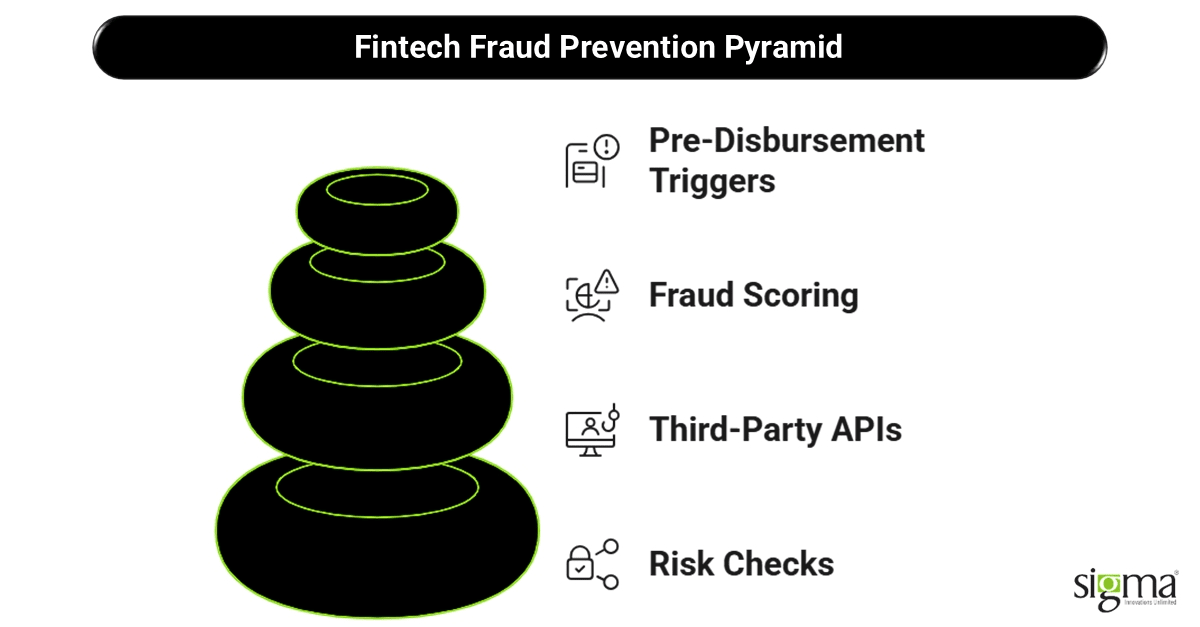

Fraud doesn’t start at the disbursement stage—it begins much earlier, often during onboarding or pre-approval. That’s why fintech lenders need to embed prevention tactics before the money ever leaves the system.

Here are the most effective, real-world strategies to prevent loan fraud before disbursement, keeping both your capital and customer trust intact.

1. Embed Risk Checks at Every Stage of Underwriting

Think of fraud prevention like airport security—it needs multiple checkpoints, not just one at the gate.

- Introduce real-time fraud analytics during borrower onboarding, KYC, and document uploads.

- Cross-check identity documents and application data during digital underwriting, not after approval.

- Set dynamic risk thresholds that trigger enhanced checks when risk indicators are high (e.g., inconsistent income claims or mismatched location/IP data).

This layered approach ensures your Digital Lending Software Solutions don’t just approve quickly—but also safely.

2. Integrate Third-Party APIs and Fraud Intelligence Networks

Why fight fraud alone when you can crowdsource your defense?

- Use external fraud data providers like Socure, LexisNexis ThreatMetrix, etc, to verify identities and catch anomalies.

- Tap into fraud intelligence networks that pool data from other fintechs to identify known fraud rings or repeat offenders.

- Automate these checks via APIs within your loan origination lifecycle so that they’re part of the normal application flow.

Real-life example: A new applicant’s device fingerprint matches one used in a recent fraud incident across another lender. Your system auto-rejects the application in seconds.

3. Use Smart Fraud Scoring Models

Traditional credit scores don’t always catch fraud. You need a parallel system: fraud scores.

- Assign a fraud risk score based on behavioral patterns, geolocation, device integrity, and data consistency.

- Use adaptive scoring engines to evaluate new types of fraud signals over time.

- Feed fraud scores into decision engines to adjust approval conditions or flag for manual review.

This ensures your top-rated lending fintech solutions stay nimble without compromising trust.

4. Flag Fraud Early with Pre-Disbursement Triggers

Timing is everything. The earlier you catch fraud, the less it costs you.

- Set up rule engines that flag anomalies before disbursement—like unusual IP patterns, email structures, or repetitive banking details.

- These real-time alerts should immediately pause the loan process for further validation.

- Customize rules based on loan type—e.g., shorter approval windows for merchant cash advances vs. personal loans.

Example: An applicant with a clean application triggers a high-risk flag due to suspicious bank account activity. Your LOS pauses disbursement for further review.

Preventing fraud before the money moves is your best shot at preserving revenue, staying compliant, and building a high-trust brand. Embedding these practices into your Digital Lending Software Solutions and Digital Payment Software Solutions isn’t just smart—it’s necessary in today’s fraud-heavy landscape.

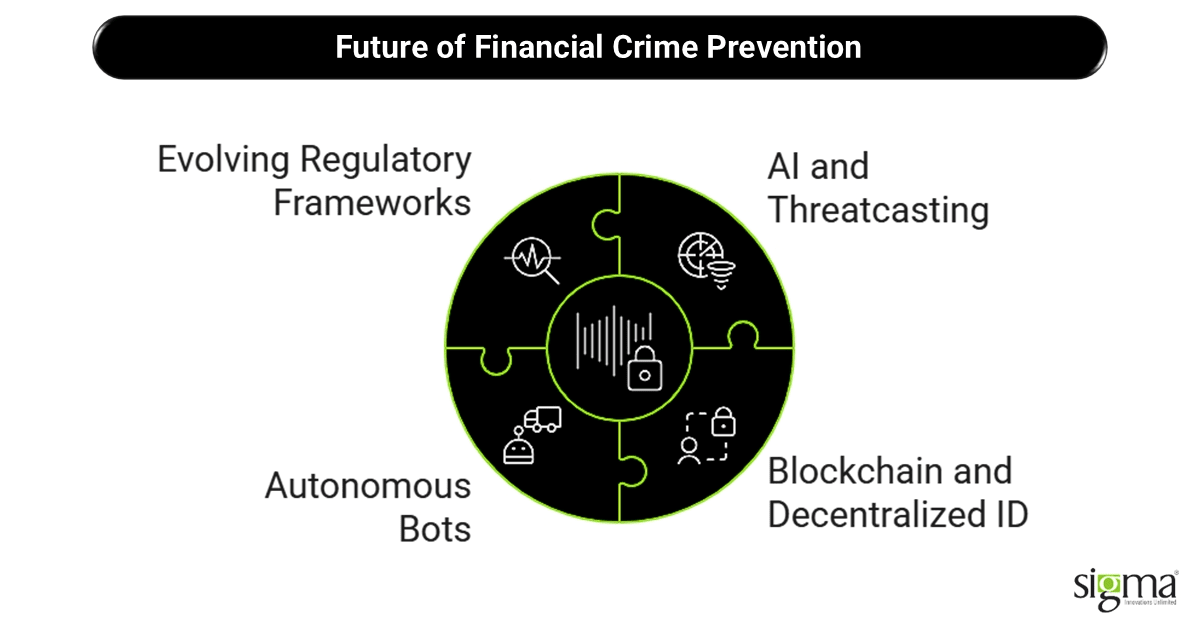

Future Trends in Financial Crime Prevention for Fintech Lenders

The battle against fraud is constantly evolving—and so are the tools and tactics used by fintech lenders. Tomorrow’s Financial Crime Prevention Solutions will look very different from today’s manual-heavy, rule-based systems. Let’s explore what’s coming next.

Rise of AI and Threatcasting

Artificial intelligence will dominate the future of financial crime risk prediction. AI models are moving from reactive detection to predictive compliance—forecasting when and where fraud might happen based on evolving digital behavior.

- AI isn’t just scoring risk—it’s simulating fraud scenarios before they happen, helping fintechs adjust policies in advance.

Blockchain and Decentralized ID in KYC/AML

The days of centralized identity databases may be numbered. Decentralized Identity (DID) powered by blockchain can give borrowers full control over their identity while providing lenders with tamper-proof verification.

- Imagine onboarding a borrower in seconds with pre-verified credentials—no redundant uploads or fake documents.

- This strengthens AML/KYC compliance while making onboarding smoother and safer.

Autonomous Bots for Investigations

AI-powered bots will soon handle tasks like filing SARs, updating AML rules, and conducting real-time investigations autonomously. These bots will enable real-time compliance automation at a scale not humanly possible.

- They learn from past fraud cases, adjust scoring logic, and even recommend escalations.

Evolving Regulatory Frameworks

Regulators are pushing fintechs toward real-time transaction monitoring as a standard, not a bonus. This means Digital Lending Software Solutions must come built-in with fraud and compliance layers—not as add-ons, but as core features.

The future belongs to fintechs who can move faster than fraudsters. And that means embracing AI, automation, and smart compliance today—not tomorrow.

Conclusion & Key Takeaways

Financial crime is no longer a distant threat—it’s a real-time challenge that demands real-time responses. As fintech lenders scale operations and embrace digital agility, they must also prioritize proactive fraud detection and intelligent compliance frameworks to stay ahead of evolving threats.

Embedding financial crime prevention solutions throughout the lending lifecycle—from onboarding and underwriting to servicing and collections—ensures faster decisions, reduced fraud losses, and sustained customer trust. It’s not just about defense—it’s about gaining a competitive edge by being secure, transparent, and regulatory-ready.

Key Takeaways:

- Fraud prevention must start before disbursement, not after.

- Real-time data, AI, and third-party integrations are non-negotiable for modern lenders.

- Future-ready lending platforms must support blockchain IDs, autonomous bots, and evolving regulations.

The fintech leaders of tomorrow will be those who embed security and compliance as part of their core DNA—not as afterthoughts.

Partner with a technology service provider like Sigma Infosolutions to future-proof your lending operations. From digital underwriting to real-time transaction monitoring, we enable you to outpace fraud while scaling with confidence.