What is Co-lending and How Does It Work?

Co-lending is changing the way businesses and individuals access credit. Simply put, it’s a lending model where banks and non-banking financial institutions (NBFCs) collaborate to fund loans. This approach helps traditional lenders expand their reach while allowing FinTechs to leverage their technology for faster, more efficient loan processing.

With the rise of FinTech solutions, co-lending has become a game-changer in credit access and risk management. By using advanced algorithms, AI-driven underwriting, and automated workflows, co-lending platforms ensure seamless loan origination, risk sharing, and better decision-making.

In the USA and Canada, co-lending is gaining traction, driven by alternative lending models, embedded finance solutions, and evolving regulatory frameworks. As more lenders embrace financial software development services, this model is set to redefine the lending landscape, offering more inclusive and tech-driven financing solutions.

Understanding Co-lending: Definition and Market Trends

What is Co-lending?

Co-lending is a risk-sharing lending model where traditional financial institutions, such as banks, partner with FinTech companies to issue loans. While banks provide capital, FinTechs contribute technology-driven underwriting, automation, and customer engagement. This collaboration enhances loan accessibility, speeds up approvals, and distributes credit risk more effectively.

Key Market Trends Shaping Co-lending

- Rise of Digital Lending Partnerships – More banks and credit unions are teaming up with FinTechs to leverage AI-powered underwriting and automation, leading to faster loan approvals and enhanced borrower experiences.

- Regulatory Influence – In the USA, regulators like the Office of the Comptroller of the Currency (OCC) and the Consumer Financial Protection Bureau (CFPB) are shaping co-lending frameworks to ensure compliance and fair lending practices. In Canada, the Office of the Superintendent of Financial Institutions (OSFI) is overseeing risk mitigation for digital lending models.

- AI-Driven Credit Underwriting & Embedded Finance – The adoption of AI-powered credit scoring and embedded finance solutions is growing. Lenders are integrating financial software development services to streamline loan origination, improve risk assessment, and provide seamless financing within eCommerce and digital platforms.

Co-lending is reshaping modern finance, making credit more accessible while reducing risks for lenders.

Also Read – How FinTech & Technological Innovations Are Shaping the Future of eCommerce

How Co-lending Works: Key Components

Co-lending blends traditional banking capital with FinTech innovation, creating a streamlined and efficient lending process. Here’s how it works:

The Co-lending Process

- Digital Loan Origination & Automated Underwriting – Borrowers apply through a FinTech-powered lending platform, where AI-driven underwriting assesses risk in real-time. This ensures faster approvals and personalized loan terms.

- API-led Credit Assessment & Compliance Management – APIs connect banks, NBFCs, and FinTechs, enabling seamless data sharing, risk evaluation, and regulatory compliance in line with OCC, CFPB, and OSFI guidelines.

- Loan Disbursal, Repayment Structuring & Portfolio Management – Once approved, funds are co-disbursed by both lending partners. FinTech solutions manage repayment schedules, monitor loan performance, and optimize collections.

The Role of FinTechs in Co-lending

- Seamless Integrations with Banks & NBFCs – FinTechs act as technology bridges, facilitating co-lending arrangements through cloud-based platforms and AI-powered credit decisioning.

- AI & Blockchain for Security & Transparency – Advanced AI algorithms enhance borrower risk assessment, while blockchain ensures tamper-proof transaction records, increasing trust and efficiency.

Main Terms of a Co-Lending Arrangement

A co-lending arrangement defines how banks and FinTechs collaborate, share risk, and manage compliance. Here are the key terms:

Loan Structuring & Risk-Sharing Models

- Parallel Lending – Each lender contributes a fixed percentage to the loan. For example, a bank funds 80% while a FinTech covers 20%. This allows banks to maintain capital efficiency while FinTechs drive borrower engagement.

- First-Loss Default Guarantee (FLDG) – To mitigate risk, FinTechs may provide an FLDG, covering a portion of defaults. This gives traditional lenders more confidence in funding high-risk borrower segments.

Revenue-Sharing Agreements

- Co-lenders split interest income and service fees based on their contribution and risk exposure.

- The profit-sharing ratio is structured to incentivize both parties while ensuring borrower affordability.

Regulatory & Compliance Considerations

- KYC & AML Compliance – Co-lenders must comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) laws to prevent fraud.

- Data Privacy & Security – Co-lending platforms adhere to CCPA (California), GDPR (EU), and OSFI (Canada) mandates to protect borrower data.

Technology-Driven Contracts

- Smart Contracts powered by blockchain enable automated loan execution, disbursements, and risk tracking, ensuring transparency and reducing disputes.

With financial software development services, lenders can implement robust, automated co-lending arrangements that scale with regulatory changes and market demands.

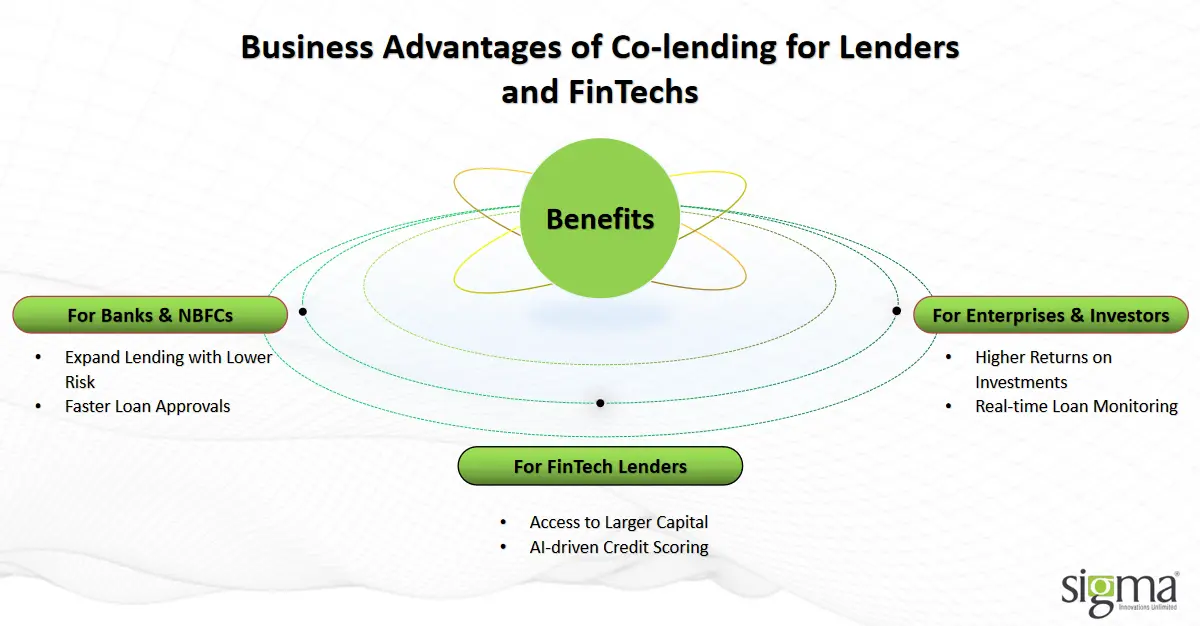

Business Benefits of Co-lending for Lenders and FinTechs

Co-lending is transforming the lending landscape by bridging traditional banks and FinTech lenders, enabling smarter credit distribution. Here’s how different stakeholders benefit:

For Banks & NBFCs

- Higher Loan Origination with Lower Risk – Co-lending allows banks and NBFCs to expand their lending portfolio without taking on full credit risk. By partnering with FinTechs, they gain access to new borrower segments while mitigating defaults through risk-sharing models.

- Faster Loan Disbursal with API-driven Processes – Traditional lenders can integrate FinTech Software Development Services to automate underwriting, streamline compliance, and accelerate loan approvals. This improves borrower experience and reduces operational costs.

For FinTech Lenders

- Access to Larger Capital Reserves – FinTechs partnering with banks gain access to institutional funds, allowing them to scale lending operations without relying solely on venture capital or private investors.

- AI-powered Risk Modeling – By leveraging AI-driven credit scoring and alternative data analytics, FinTechs can assess borrower risk more accurately, reducing delinquencies while maintaining profitability.

For Enterprises & Investors

- Higher Returns on Structured Credit Investments – Investors and enterprises can diversify portfolios by investing in co-lending models, which offer higher returns compared to traditional fixed-income investments.

- Real-time Portfolio Monitoring – With financial software development services, lenders and investors can track loan performance, optimize collections, and adjust strategies using AI-driven dashboards.

Co-lending is reshaping the future of finance, offering a win-win for lenders, FinTechs, and investors alike.

Also Read – Tableau: Is It The Business Intelligence Solution For You?

Co-lending Technology Stack

The success of co-lending arrangements depends on cutting-edge technology that enhances credit assessment, automation, and security. Here’s a look at the core technologies shaping the future of co-lending:

Core Technologies Enabling Co-lending

- AI/ML-powered Alternative Credit Scoring – Traditional credit scores don’t always capture a borrower’s true financial health. AI-driven models use alternative data sources like cash flow analysis, utility bill payments, and digital transaction history to improve credit decisions.

- Blockchain-based Smart Contracts – These self-executing contracts ensure secure, tamper-proof agreements between banks and FinTechs, automating loan disbursal, risk-sharing, and repayment tracking.

- API-driven Lending Platforms – APIs facilitate real-time data sharing between traditional lenders and FinTechs, enabling seamless credit approvals, compliance checks, and loan servicing.

Custom FinTech Solutions for Co-lending

- Cloud-native Lending Platforms – Scalable cloud-based solutions allow banks and NBFCs to handle high loan volumes, automate workflows, and optimize risk management without infrastructure constraints.

- Embedded Finance Integrations – With real-time analytics and AI-driven risk monitoring, co-lenders can assess borrower behavior dynamically, improving underwriting precision and fraud detection.

Partnering with a FinTech app development company ensures smooth technology adoption, unlocking new revenue opportunities in the digital lending ecosystem.

Overcoming Co-lending Hurdles with Technology

While co-lending is revolutionizing the lending ecosystem, it comes with its own set of challenges. Fortunately, technology-driven solutions help mitigate these issues and create a seamless lending experience.

Regulatory Compliance Hurdles

- Lenders must comply with OCC, CFPB, and OSFI regulations covering KYC, AML, fair lending, and borrower data protection.

- Solution: AI-driven compliance monitoring automates regulatory reporting, flagging anomalies in real-time to ensure adherence to legal requirements.

Data Security & Fraud Risks

- The rise of digital lending increases risks like identity theft, synthetic fraud, and data breaches.

- Solution: AI-powered fraud detection uses behavioral analytics and machine learning to identify suspicious transactions, fake identities, and unauthorized access before fraud occurs.

Interoperability Between Traditional Banks and FinTechs

- Legacy banking systems struggle to integrate with agile FinTech platforms, slowing loan approvals and risk assessments.

- Solution: API-driven lending platforms enable seamless collaboration, allowing banks and FinTechs to share credit data, automate loan processing, and streamline borrower onboarding.

By leveraging financial software development services, lenders can overcome these challenges and build a secure, compliant, and scalable co-lending infrastructure, bridging the gap between traditional and digital lending models.

Future of Co-lending and Emerging Trends

The co-lending landscape is rapidly evolving, driven by AI, blockchain, and embedded finance innovations. Here’s what the future holds:

AI-powered Risk Assessment for Hyper-personalized Lending

- Traditional risk models are being replaced by AI-driven credit scoring, which analyzes alternative data like spending behavior, employment patterns, and real-time financial transactions.

- This enables hyper-personalized loan offers, allowing lenders to serve more borrowers while maintaining profitability.

The Rise of DeFi-based Co-lending and Tokenized Credit

- Decentralized Finance (DeFi) is reshaping lending by eliminating intermediaries and using smart contracts for trustless lending.

- Tokenized credit, powered by blockchain, allows lenders to fractionalize and securitize loans, opening new investment opportunities.

Expansion of Co-lending in BNPL (Buy Now, Pay Later) Markets

- The BNPL sector is booming, with co-lending partnerships enabling risk-sharing and faster approvals for installment-based financing.

- AI-driven real-time affordability checks and embedded finance integrations will further scale BNPL lending, improving financial inclusion.

As FinTech app development companies continue innovating, financial software development will play a critical role in building next-gen co-lending ecosystems. Banks and FinTechs embracing these trends will gain a competitive edge in the evolving credit market.

Conclusion

Co-lending is reshaping the digital lending landscape, allowing banks and FinTechs to expand credit access while minimizing risk. With AI-driven credit models, API-led integrations, and blockchain-powered smart contracts, co-lending enables faster loan disbursals, better risk management, and increased financial inclusion.

For lenders, staying ahead in this evolving ecosystem requires cutting-edge technology. From automated underwriting to real-time compliance monitoring, the right financial software development services can streamline operations and enhance lending efficiency.

Looking to implement co-lending solutions? Connect with our experts for a tailored FinTech development strategy that aligns with your business goals. Let’s build a scalable, secure, and future-ready co-lending platform today!