Turning Data Chaos into Business Confidence with Data Quality Management

Key Takeaways

- From static to symphony – Data chaos is like noise; DQM turns it into harmony, letting businesses orchestrate decisions with confidence.

- From compass to GPS – Quality data doesn’t just guide; it gives leaders real-time navigation for growth, compliance, and innovation.

- From fog to clear skies – With DQM, businesses can cut through the haze of bad data and see opportunities with crystal-clear clarity.

The business world runs on data. Every decision, transaction, and customer interaction leaves behind a trail of information. But here’s the hard truth: when that data is inaccurate, inconsistent, or incomplete, it quickly turns into chaos. And chaos in business data doesn’t just create confusion—it chips away at trust, delays decisions, and exposes companies to unnecessary risks

This challenge is even more pressing today. Artificial intelligence (AI), business intelligence (BI), and stricter regulatory landscapes have magnified the cost of poor data. A flawed dataset can distort an AI model’s prediction, mislead a BI dashboard, or trigger compliance red flags. For fintechs, banks, insurers, and lenders, where trust and accuracy are non-negotiable, data quality management (DQM) is no longer a nice-to-have—it’s mission-critical.

Think of DQM as a business’s quality control system for information. Just as financial audits protect assets and build investor confidence, a robust data quality framework ensures that every report, insight, and decision is built on reliable data. It’s not only about fixing errors; it’s about creating a culture of trust, governance, and accountability around data.

Here’s the thought leadership perspective: Businesses that tame data chaos unlock confidence—confidence in decisions, compliance, customer trust, and future growth. In a digital economy where every competitive edge matters, the organizations that embrace financial data quality management are the ones that turn uncertainty into opportunity.

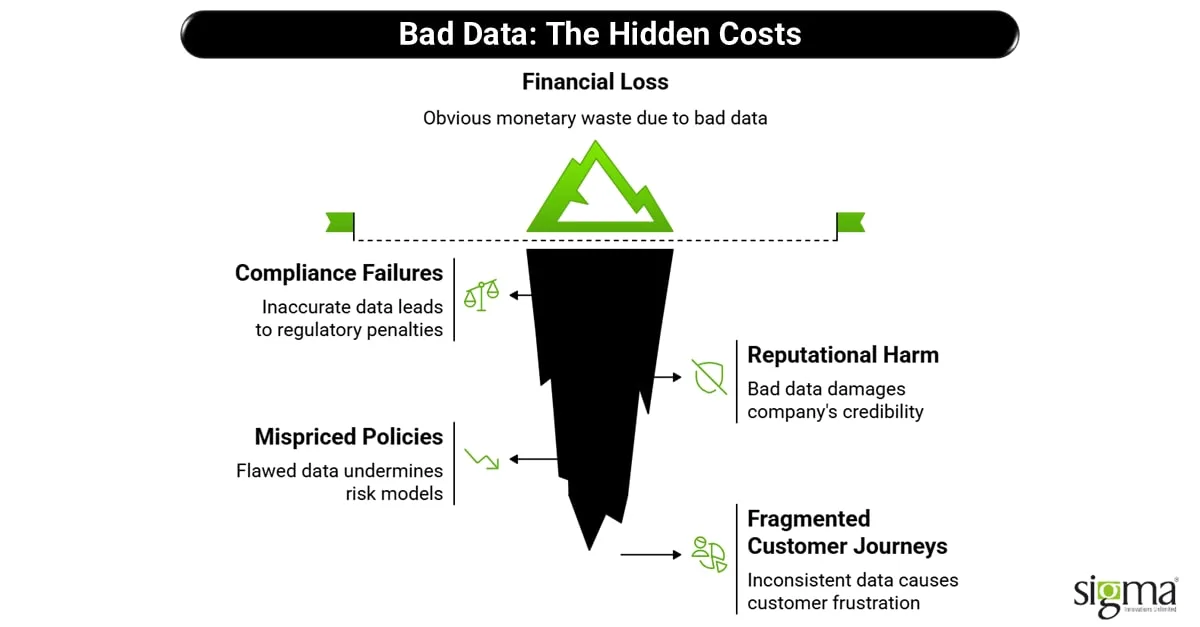

The Cost of Bad Data: Hidden Chaos in Plain Sight

Bad data is expensive—far more expensive than most leaders realize. Gartner’s research estimates poor data quality costs organizations at least $12.9 million per year on average. That’s not just a minor dent; it’s billions in wasted resources, compliance slip-ups, and missed opportunities across industries.

For fintechs and lenders, the risks are glaring. Inaccurate or incomplete datasets can lead to compliance failures and regulatory penalties. One wrong entry in KYC (Know Your Customer) records or loan applications can snowball into fines, reputational harm, and even loss of operating licenses.

Insurers and investment firms face a different type of risk. Flawed or fragmented data undermines risk models, leading to mispriced policies, poor underwriting, and inaccurate financial forecasts. In an industry built on prediction and trust, one weak link in data quality can ripple into massive financial exposure.

Banks, too, are not immune. When customer data is spread across silos and riddled with inconsistencies, it results in fragmented customer journeys. The result? Frustrated customers who lose faith in the bank’s ability to understand and serve them, eroding long-term loyalty.

Take the case of a fintech struggling with inaccurate KYC data. Instead of speeding up onboarding, the company faced repeated verification failures, frustrated applicants, and compliance red flags. What should have been a smooth customer experience turned into a credibility crisis.

The message is clear: data chaos isn’t abstract—it’s costing your business real money and credibility. Without strong data quality management and a structured data quality framework, every decision made on faulty data is a gamble.

Why Data Quality Matters in the Age of AI, BI & Cloud

Artificial Intelligence (AI) and Business Intelligence (BI) have redefined how organizations compete. They promise predictive insights, automated decision-making, and smarter operations. But here’s the reality: AI and BI are only as good as the data they consume. If you feed them unreliable information, you’ll get unreliable outputs. In other words—garbage in equals garbage out.

Cloud ecosystems like AWS, Azure, and Salesforce have made data more accessible than ever. They’ve created opportunities for real-time analytics, seamless integrations, and customer personalization at scale. But these same ecosystems also amplify the risks of poor data. A flawed record in one system can cascade across connected platforms, multiplying errors instead of insights.

This is why data quality management (DQM) has become non-negotiable. Think of digital transformation as building a skyscraper. According to Market Research Future, the data quality management market is valued at approximately $4.5 billion in 2024 and is projected to reach $9.78 billion by 2034, with a compound annual growth rate (CAGR) of around 9.2%. Without a solid data quality framework, you’re constructing it on sand—it might look impressive from the outside, but cracks will eventually show, and the foundation won’t hold.

For lenders, insurers, and fintechs, the stakes are even higher. A bad dataset doesn’t just delay decisions; it threatens compliance, erodes customer trust, and weakens risk management. In industries where precision and accountability are everything, poor data isn’t just an operational hiccup—it’s an existential threat.

At Sigma, we believe financial data quality management is the backbone of successful AI, BI, and cloud adoption. Businesses that get this right don’t just unlock efficiency; they unlock confidence—the confidence to innovate, scale, and grow without second-guessing the reliability of their data.

Also Read: AWS Cloud Solutions for Building Enterprise-Grade Data Lakes

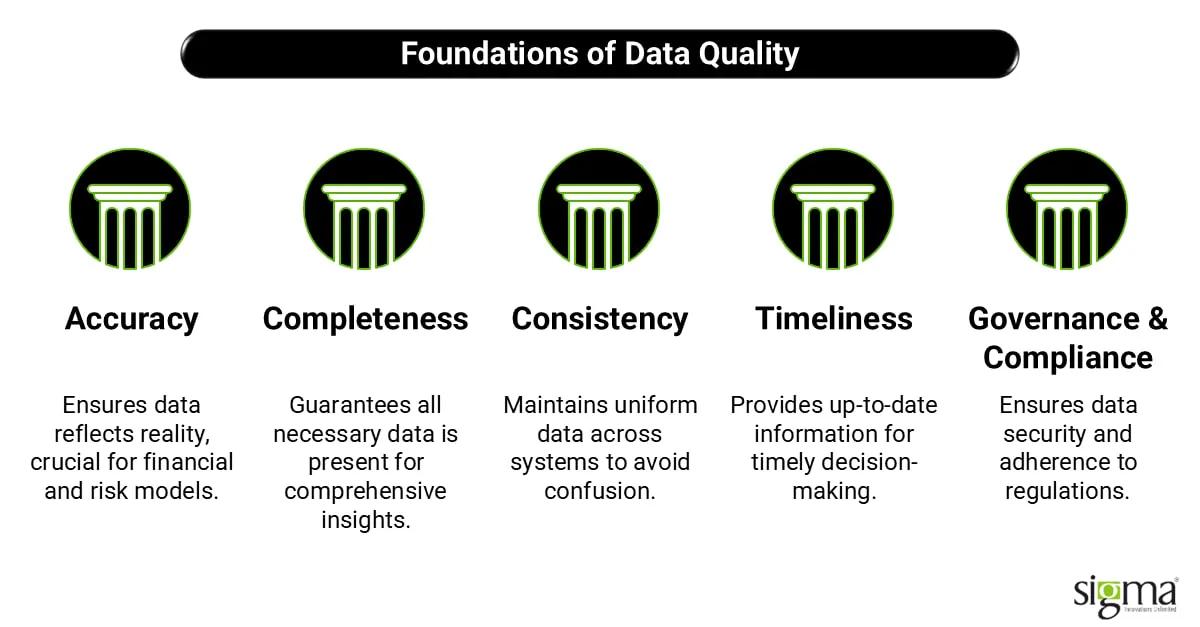

The Pillars of Data Quality Management

Clean data doesn’t just happen—it’s built on a solid foundation. At the heart of every strong data quality framework are five pillars that ensure businesses can trust, use, and protect their information.

1. Accuracy – Trust in Facts: If the numbers don’t reflect reality, everything else crumbles. Accuracy ensures financial transactions, risk models, and customer records reflect the real world. For fintechs and insurers, accurate data can mean the difference between approving a loan responsibly and mispricing a policy.

2. Completeness – No Missing Pieces: Imagine trying to solve a puzzle with pieces missing. That’s what incomplete data feels like. Missing borrower information, incomplete transaction histories, or half-filled customer profiles lead to poor insights and increased risk. Completeness makes sure the whole picture is visible.

3. Consistency – One Truth Across Systems: When borrower data looks different in a CRM, underwriting platform, and BI dashboard, it creates confusion and slows down decisions. Consistency ensures data tells the same story no matter where it lives, avoiding costly contradictions.

4. Timeliness – Right Data, Right Time: Stale data is as harmful as wrong data. In fast-moving industries like lending and payments, yesterday’s numbers won’t cut it. Timeliness ensures decision-makers act on up-to-date information—whether it’s approving a loan, detecting fraud, or reporting to regulators.

5. Governance & Compliance – Secure, Auditable, and Reliable: With regulations tightening across financial services, data governance is more than a best practice—it’s a survival strategy. Strong governance ensures data is secure, auditable, and compliant with evolving laws like GDPR, CCPA, or local lending regulations.

Take, for example, a lender ensuring consistent borrower profiles across CRM, underwriting, and BI systems. With strong data quality management services, they not only reduce errors but also strengthen compliance and build customer trust.

Together, these pillars transform financial data quality management from a technical task into a business advantage—turning chaos into clarity and confidence.

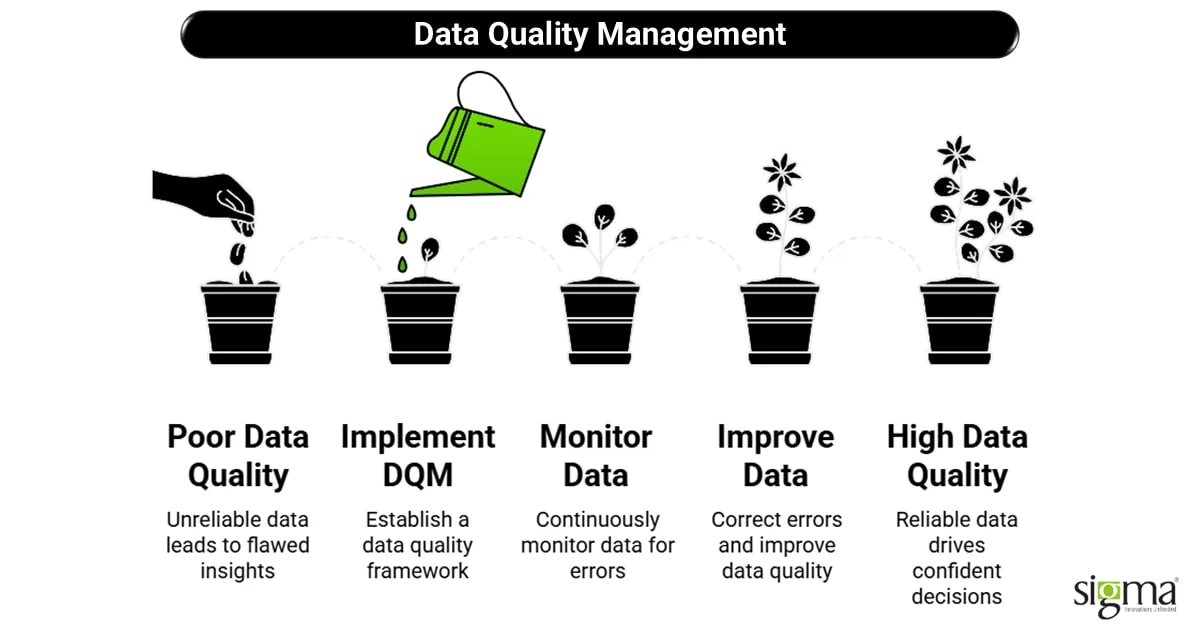

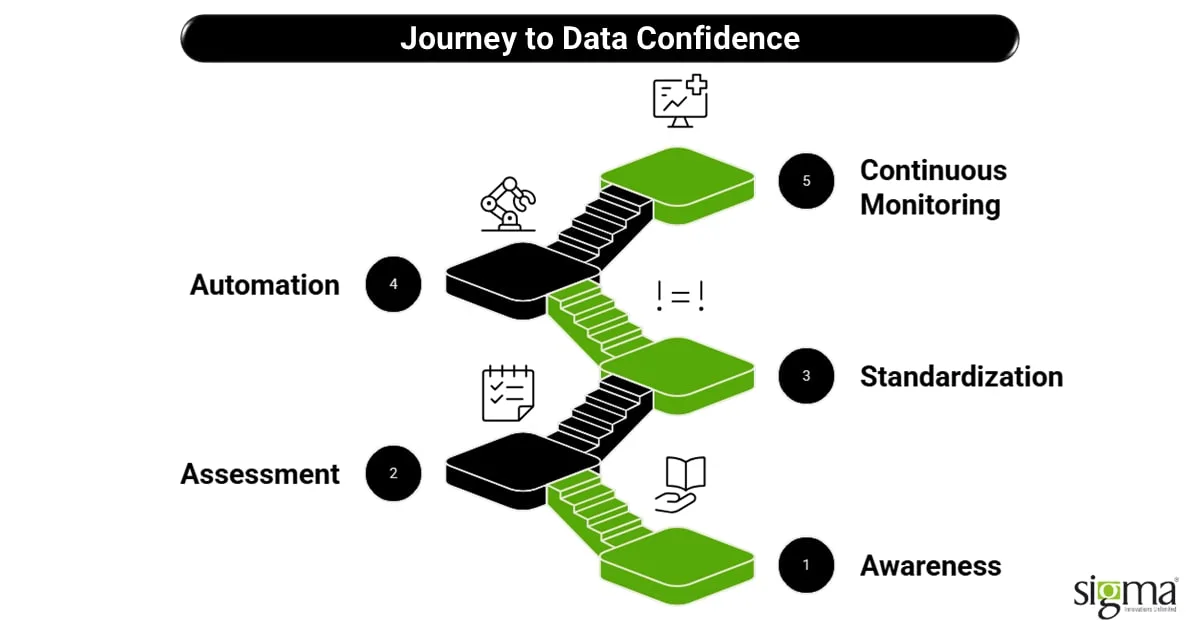

From Chaos to Confidence: The DQM Journey

Turning messy, unreliable data into a trusted business asset doesn’t happen overnight. It’s a journey—a path that moves from chaos to clarity and finally to confidence. And like any meaningful transformation, data quality management (DQM) works best when it’s approached as an ongoing cycle, not a one-time project.

Here’s what the journey looks like:

1. Awareness – Recognizing the Problem: The first step is acknowledging the chaos. Businesses often live with data errors without realizing the scale of the problem. Awareness comes when compliance risks, reporting errors, or customer complaints start making the cracks visible.

2. Assessment – Measuring Gaps: Once the issues are clear, organizations need to measure them. A structured data quality framework helps identify inaccuracies, missing fields, duplicates, and inconsistencies across systems. This baseline sets the stage for real improvement.

3. Standardization – Applying Rules & Governance: Next comes discipline. By creating data standards—rules for how information is collected, stored, and shared—companies bring consistency to chaos. Strong data governance ensures that every system speaks the same language.

4. Automation – AI-Powered Cleansing & Validation: Manual fixes won’t scale. Modern AI-powered data quality solutions use machine learning to detect anomalies, flag duplicate records, and automate cleansing. For financial services, this means fewer manual errors in KYC, loan applications, or risk assessments.

5. Continuous Monitoring – Embedding DQM into Business DNA: The real payoff comes when DQM becomes part of everyday business. Continuous monitoring ensures issues are caught early, compliance is maintained, and insights remain reliable. This is where data stops being a liability and becomes a source of business confidence.

At Sigma Infosolutions, we see financial data quality management as a journey that never truly ends. Organizations that commit to this cycle don’t just eliminate chaos—they build a culture of trust and agility that powers smarter decisions and sustainable growth.

Real-World Impact: Data Quality in Action

The best way to understand the power of data quality management (DQM) is to see it in action. Across industries, companies are transforming outcomes simply by cleaning, governing, and standardizing their data.

Take the case of a fintech lender. By improving the accuracy and completeness of applicant data, the lender reduced loan defaults significantly. Cleaner borrower profiles meant smarter underwriting, sharper risk models, and a healthier loan portfolio. With financial data quality management embedded into their BI dashboards, decisions shifted from reactive to proactive.

In the insurance world, duplicate records have long been a silent killer of efficiency. One insurer tackled this by applying a structured data quality framework to claims data. By eliminating redundancies and applying AI-powered data quality solutions for real-time validation, they not only accelerated claims processing but also improved customer trust—fewer delays, faster payouts, and happier policyholders.

Banks, too, have seen measurable ROI. One example: improving compliance reporting by standardizing transactional data across multiple systems. With accurate, timely, and governed data flows, reporting cycles became smoother and error-free. This not only reduced compliance risk but also freed up internal teams from firefighting audits to focusing on strategic initiatives.

At Sigma, we enable these transformations by combining BI & Analytics development services, AI/ML-powered automation, Salesforce integrations, AWS cloud solutions, and custom development. Our approach ensures organizations don’t just fix today’s data quality issues—they future-proof their entire data ecosystem.

The measurable benefits are clear: better decision-making, reduced compliance risk, faster operations, and improved customer experiences. That’s the ROI of turning data chaos into clarity with strong data governance and continuous monitoring.

Also Read: Emerging trend of self-service analytics and the best tools available to you

Latest Trends in Data Quality Management

The way businesses manage data is evolving rapidly, shaped by AI, cloud ecosystems, and heightened regulations. What once felt like a back-office IT task has now become a boardroom-level conversation. Today, data quality management (DQM) is seen as a direct driver of business growth, risk reduction, and customer trust.

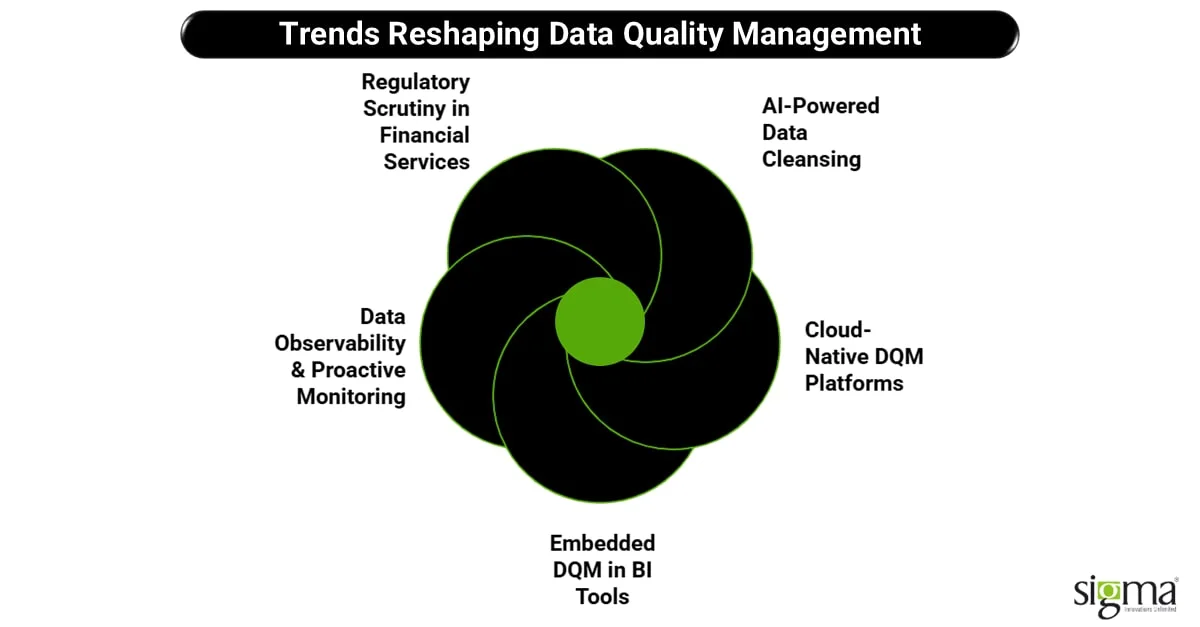

Here are the latest trends reshaping the landscape:

- AI-Powered Data Cleansing & Anomaly Detection: Machine learning models are being used to automatically identify duplicates, missing fields, and suspicious patterns. These AI-powered data quality solutions reduce manual intervention and speed up decision-making.

- Cloud-Native DQM Platforms (AWS, Azure, Salesforce): As more enterprises move to the cloud, cloud data governance and scalable DQM frameworks are becoming essential. A single error in the cloud can ripple across multiple systems if not managed.

- Embedded DQM in BI Tools (Tableau, Power BI): Companies are integrating DQM directly into BI & Analytics development services. This ensures dashboards and reports reflect accurate, real-time data—building trust in every business insight.

- Data Observability & Proactive Monitoring: Instead of waiting for problems to surface, organizations are investing in tools that continuously monitor data pipelines, catching issues before they escalate.

- Increasing Regulatory Scrutiny in Financial Services: For fintechs, banks, and insurers, compliance standards are tightening. Regulators now expect auditable, governed, and accurate data flows as a baseline—not an afterthought.

At Sigma, our perspective is clear: DQM is no longer a back-office IT concern—it’s a boardroom-level growth enabler. By embracing these trends, organizations position themselves for smarter innovation, smoother compliance, and lasting competitive advantage.

Why DQM Is the New Competitive Edge

Too often, organizations see data quality management (DQM) as a cost—another box to check in compliance or IT budgets. At Sigma, we see it differently. DQM is not an expense; it’s a competitive advantage. In an era where AI, BI, and cloud platforms define industry leaders, clean and governed data is the foundation that separates winners from laggards.

Here’s how we help our ICPs turn data into a strategic edge:

- Fintechs & Lenders → With accurate, complete, and consistent applicant data, lenders make cleaner credit decisions, reduce loan defaults, and keep their data AI-ready for predictive analytics.

- Insurers → Strong financial data quality management ensures risk models are accurate, underwriting is reliable, and claims are processed faster with fewer errors.

- Banks → With robust data governance and real-time validation, banks achieve smoother compliance reporting, reduce regulatory risk, and rebuild customer trust through consistent, reliable experiences.

Our expertise spans BI & Analytics development services, AI/ML-powered automation, Salesforce integrations, cloud-native solutions, and product engineering. We don’t just fix data problems—we embed data quality frameworks into business DNA, ensuring long-term clarity and confidence.

Our vision is simple yet powerful: Confidence is not just knowing your data is clean—it’s knowing your business decisions are future-ready.

At Sigma, we help fintechs, insurers, and banks turn data chaos into business confidence—unlocking not just compliance, but growth, innovation, and competitive advantage.

Final Thoughts

In today’s digital-first world, data chaos is inevitable—but business confidence is a choice. And that choice is enabled by strong, continuous data quality management (DQM).

We’ve seen how poor data can derail compliance, misguide decisions, and erode customer trust. But we’ve also seen how businesses that embrace a structured data quality framework gain sharper insights, smoother operations, and a stronger competitive edge.

The truth is simple: every great decision, every bold innovation, begins with quality data. Whether it’s a fintech approving loans with confidence, an insurer pricing risk accurately, or a bank earning customer trust through reliable experiences—data quality is the foundation that powers it all.

At Sigma, we help organizations go beyond fixing errors. We design systems and strategies that embed financial data quality management, BI & Analytics development services, AI/ML, Salesforce, and cloud-native governance into the core of your business. The result? Smarter decisions today, and future-ready growth tomorrow.

Now is the time to move from chaos to clarity and confidence. Discover how Sigma can future-proof your data and decisions!

With Sigma Infosolutions as your trusted partner, data isn’t just an asset—it’s your competitive edge.