BI and Analytics Powering the Competitive Edge Playbook

The eCommerce, healthcare, FinTech, pharmaceutical, and other sectors move incredibly fast; playing it safe guarantees you’ll be left behind. The rules have changed. Consumers expect personalized experiences, lightning-fast service, and flawless digital interactions. And let’s not even talk about the competition—because it’s not just local anymore. You’re not just up against your neighbor; you’re up against global disruptors armed with data and ready to pivot at a moment’s notice.

So, how do you stay ahead? That’s where BI and Analytics step in.

What started as a back-office function—generating reports and dashboards—has now evolved into a strategic game-changer. Think of BI and Analytics like the GPS in your business vehicle. They don’t just show you where you’ve been; they guide your next turn, spot roadblocks before you hit them, and suggest better routes no one else is using yet. With the right business intelligence solutions, companies can tap into real-time insights, automate smarter decisions, and fuel innovation at scale.

This blog breaks down how BI and Analytics are no longer “nice-to-have” but must-have ingredients in the modern competitive playbook. We’ll look at the latest trends, industry facts, and success stories that show how BI and Analytics services can unlock sustained advantage across eCommerce and FinTech. Whether you’re a decision-maker, tech strategist, or just exploring BI and Analytics, you’re in the right place.

Let’s dive into how to play smarter—because winning today starts with knowing more than your competitors.

The New Age of Competitive Advantage: BI and Analytics to go Beyond the Gut Feeling

In the digital-first era, a “competitive edge” isn’t just about having the best product or the lowest price—it’s about being faster, smarter, and more responsive than everyone else in the game. In the B2B industry, where customer expectations evolve by the minute and markets shift overnight, gaining that edge means leaning heavily on data.

And let’s be honest: Gut feelings just don’t cut it anymore. Today’s leaders are replacing guesswork with dashboards and opinions with real-time insights. This shift from intuition-led to data-driven decision-making is rewriting the playbook. Businesses that once relied on experience are now using BI and Analytics to anticipate trends, understand behavior, and move faster than the competition.

Here’s where BI and Analytics services shine. They help businesses spot hidden patterns in consumer data, streamline internal processes, and adjust strategies before the market even blinks. In simple terms, it’s like switching from a rearview mirror to a front-facing radar.

Modern competitive advantage is all about:

- Agility: Quickly adapting to new trends, market shifts, and disruptions.

- Customer-Centricity: Knowing what customers want before they do—then delivering it flawlessly.

- Real-Time Responsiveness: Making decisions on the fly, backed by hard data, not hunches.

And the results speak for themselves. According to McKinsey and IDC’s research insights, companies that actively use BI and data analytics are 23% more likely to acquire customers, 19% more likely to retain them, and 36% more likely to increase revenue than their peers.

In sectors like FinTech and eCommerce, where margins are tight and speed is everything, business intelligence solutions are the engine that powers top performers. From Power BI development services to custom dashboards and predictive analytics, leading firms use BI and Analytics not just to keep up—but to leap ahead.

BI and Analytics: Foundational Pillars of Smarter Business

Let’s clear the air first—what is BI and Analytics, and how is it different from artificial intelligence (AI)? These terms often get tossed around like they’re interchangeable, but each has a unique role in driving smarter decision-making.

Business Intelligence (BI) is all about answering “what happened” and “why it happened.” Think dashboards, data reports, KPIs—stuff that helps businesses see where they stand.

Analytics digs deeper. It uses data models and algorithms to answer “what will happen” and “how can we make it happen.” This includes predictive and prescriptive analytics.

Artificial Intelligence (AI) goes a step further. It powers automation, self-learning, and decision-making with minimal human input. When combined with BI and data analytics, it becomes a turbocharged engine for insights.

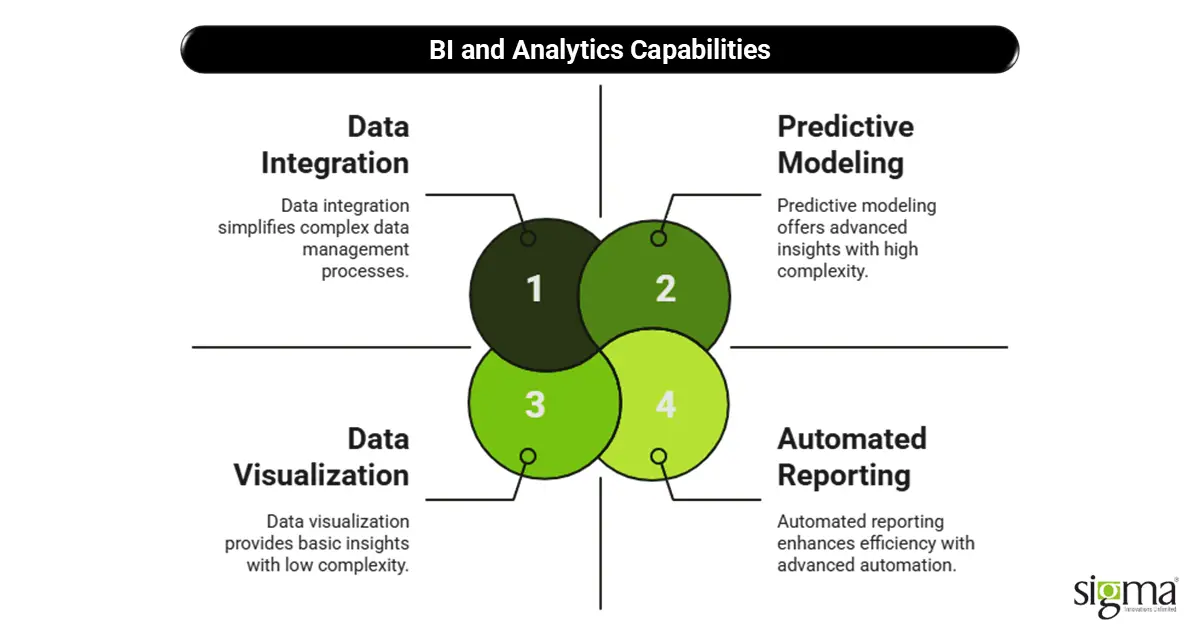

At the heart of BI and Analytics services are a few essential capabilities that help businesses move from confusion to clarity:

1. Data Integration

Pulling data from multiple sources—think CRM, ERP, POS systems—and merging it into one central view. No more data silos or spreadsheet chaos.

2. Data Visualization

Charts, graphs, heatmaps—visuals that help decision-makers quickly spot trends and patterns. Solutions like Power BI development services make this intuitive and scalable.

3. Predictive Modeling

This is the “crystal ball” of BI. Using historical data and machine learning, predictive models forecast customer behavior, demand spikes, risk patterns, and more.

4. Automated Reporting

Automating the flow of data to the right people at the right time. Say goodbye to outdated reports and hello to real-time updates that fuel quick decisions.

Now, let’s talk platforms. Tools like Power BI, Tableau, Looker, and ThoughtSpot are changing the game. They offer drag-and-drop simplicity paired with deep analytical muscle. For example, Power BI development services allow you to build rich, interactive dashboards in hours—not weeks. ThoughtSpot takes it even further with search-driven analytics, letting users ask data questions in plain English.

Whether you’re a FinTech exec analyzing fraud patterns or an eCommerce manager tracking cart abandonment, today’s business intelligence services & solutions are designed to meet you where you are—and take you further.

Simply put, modern BI and Analytics platforms don’t just help you look at the past. They help you shape the future.

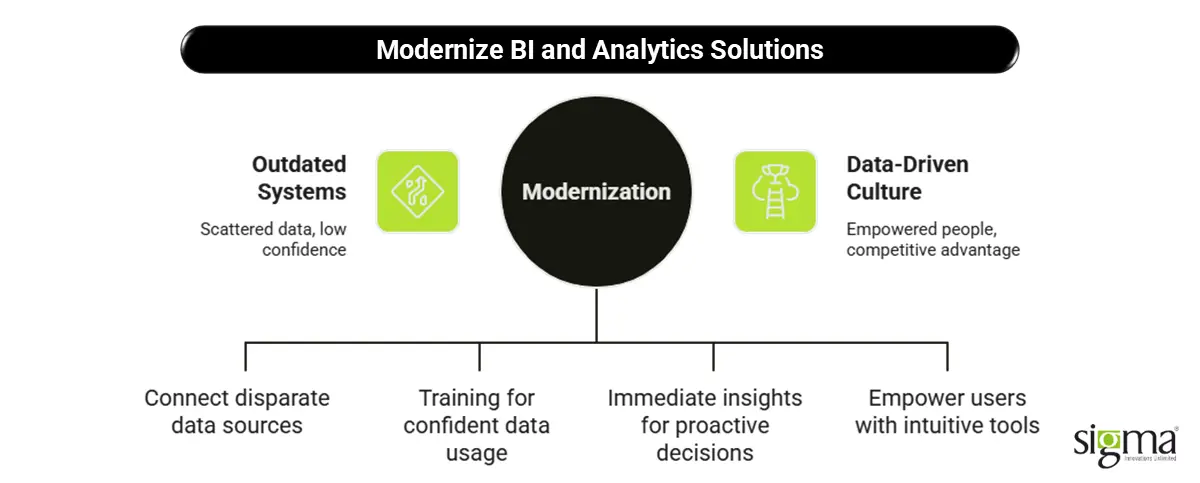

Common Challenges and Modernization Imperatives

Despite all the buzz around BI and Analytics, many companies still struggle to unlock their full potential. Why? Because outdated systems, scattered data, and low data confidence hold them back from making smarter moves. Let’s break down the roadblocks that keep businesses stuck—and how forward-thinking organizations are overcoming them.

1. Legacy Systems and Siloed Data

Many businesses still run on legacy platforms that weren’t built for today’s data volume or speed. Add to that a maze of siloed systems—CRM here, ERP there, and a dozen spreadsheets in between—and it’s no wonder decision-making gets delayed or derailed. Without proper data integration, even the most insightful report is just a shot in the dark.

2. Low Data Literacy

Here’s the deal: Not everyone on your team is a data whiz. Studies show that only 21% of employees feel confident using data to make decisions. That means valuable BI and Analytics services go underutilized simply because folks don’t know where to start—or what they’re looking at.

3. Lack of Real-Time Insights

Delayed insights are missed opportunities. Businesses that rely on batch processing or manual reporting often get stuck reacting to yesterday’s problems instead of preventing tomorrow’s. Without real-time analytics, it’s like trying to drive with your eyes on the rearview mirror.

4. Need for Self-Service and Cloud-Native Tools

Today’s businesses need agility—and that means ditching the old IT bottlenecks. Self-service BI tools like Power BI, Tableau, and Looker let business users pull their own insights without waiting on the data team. And cloud-native solutions offer scalability, security, and speed that on-prem systems simply can’t match.

Modernization in Action

The new wave of business intelligence services & solutions includes cloud migrations, intuitive dashboards, and embedded analytics that live inside the tools teams already use. FinTech firms, for example, are using SaaS business intelligence solutions to monitor risk in real time. Healthcare providers are leaning on healthcare business intelligence solutions to track patient outcomes and optimize resource allocation.

The bottom line? Modern BI and data analytics solutions aren’t just about fancy charts—they’re about breaking down barriers, empowering people, and building a data-driven culture that fuels competitive advantage.

Also Read: Is Embedded Analytics Ushering a New Wave in Healthcare?

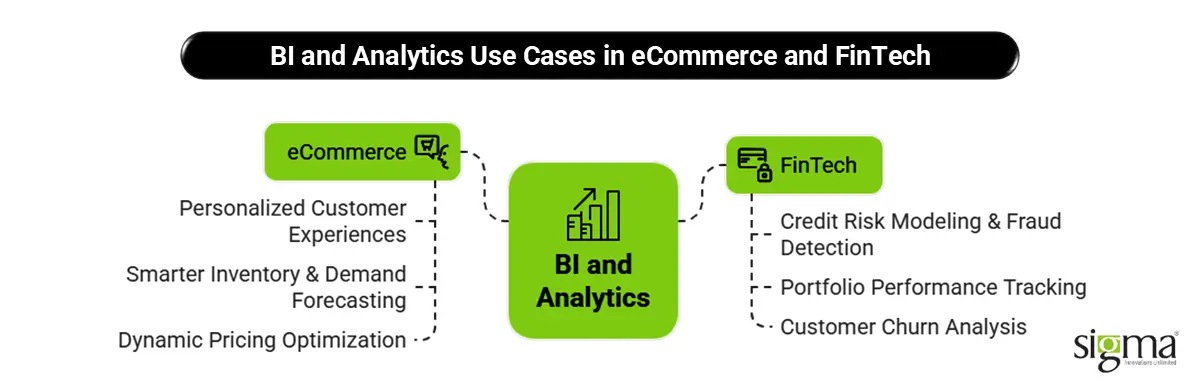

BI in Action: Use Cases Driving Competitive Edge

Business Intelligence isn’t just a behind-the-scenes tool anymore—it’s center stage, powering real-time decisions and high-impact outcomes. Let’s zoom in on how BI and Analytics services are helping companies in eCommerce and FinTech outsmart the competition and stay ahead of market curves.

eCommerce Use Cases

1. Personalized Customer Experiences

Ever feel like your favorite online store just gets you? That’s no accident. With BI and Analytics, brands use behavioral analytics to understand browsing patterns, past purchases, and customer intent. These insights power highly personalized product recommendations, boosting both conversion rates and loyalty. It’s like having a digital shop assistant who knows exactly what you’re into.

2. Smarter Inventory & Demand Forecasting

Gone are the days of guessing what’s going to sell. Using BI and data analytics, eCommerce businesses can forecast demand spikes based on trends, seasonality, and regional buying behavior. That means fewer stockouts, less dead inventory, and higher profits. This kind of agility is made possible by cloud-native, business intelligence solutions.

3. Dynamic Pricing Optimization

Thanks to real-time competitor tracking and purchase trends, retailers can automatically adjust pricing to stay competitive. Tools like Power BI development services integrate market data to help businesses strike the perfect price—maximizing both margins and market share.

FinTech Use Cases

1. Credit Risk Modeling & Fraud Detection

In FinTech, speed and accuracy are everything. BI and Analytics help lenders build predictive models to assess creditworthiness in real time, reducing risk and manual underwriting delays. At the same time, anomaly detection algorithms flag potential fraud before it causes damage.

2. Portfolio Performance Tracking

With business intelligence services & solutions, asset managers and investors gain a real-time view of portfolio health—returns, volatility, allocations, and more. These insights enable fast rebalancing and smarter decisions, especially in volatile markets.

3. Customer Churn Analysis

Keeping a customer is always cheaper than acquiring a new one. FinTech companies use BI and Analytics to spot early churn signals—such as declining logins or transaction volumes—and activate retention strategies tailored to each lifecycle stage.

Whether it’s hyper-personalized marketing or intelligent fraud prevention, these use cases prove that BI and Analytics aren’t just helpful—they’re mission-critical for modern growth.

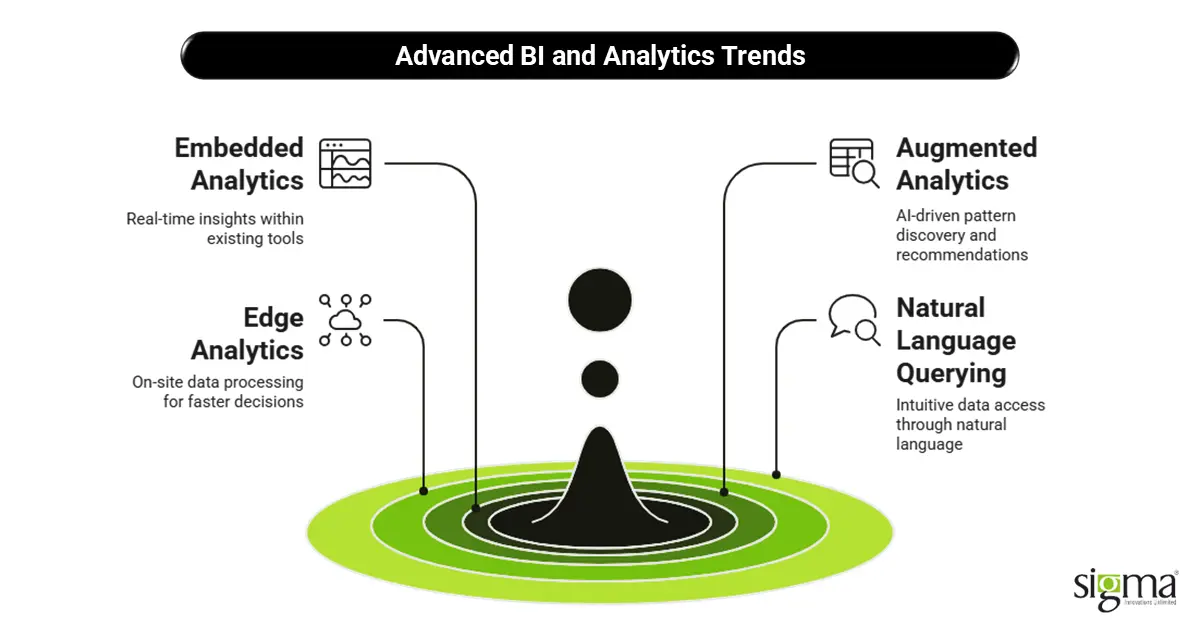

Advanced BI Trends Powering the Playbook

BI and Analytics aren’t standing still—they’re leveling up. Today’s advanced trends are reshaping how eCommerce and FinTech companies gather, analyze, and act on data. These shifts are not just upgrades—they’re essentials for companies looking to stay sharp in an increasingly competitive market. Let’s walk through the major trends redefining business intelligence solutions and how they’re powering the modern playbook.

1. Embedded Analytics in SaaS Products

Imagine using a fintech or eCommerce tool that serves up real-time insights right where you’re working. That’s the magic of embedded analytics. Instead of toggling between dashboards and apps, users get actionable insights within the platform they already use. Think of it as having your own personal analyst baked into your business tools. Many SaaS business intelligence solutions now come equipped with embedded dashboards that update automatically—no more waiting for the monthly report.

2. Augmented Analytics with AI/ML

BI and data analytics are getting a serious boost from artificial intelligence and machine learning. This isn’t about replacing analysts—it’s about supercharging them. Augmented analytics leverages AI to auto-discover patterns, surface hidden trends, and even recommend next steps. For example, a retailer might get an alert saying, “Sales for women’s footwear are down 12% in the Midwest—here’s why.” Now that’s what we call insight with impact.

3. Edge Analytics for Real-Time Decision-Making

In fast-moving environments, speed matters. Edge analytics enables data to be processed at the source—whether it’s a POS system, mobile app, or IoT device—rather than waiting for it to hit the central server. This reduces latency and drives faster decisions. For FinTech, that could mean flagging a suspicious transaction as it happens. For eCommerce, it might mean updating promotions in real-time based on store-level demand.

4. Natural Language Querying & Data Democratization

Not everyone speaks SQL—and they shouldn’t have to. With natural language processing (NLP), users can ask questions like “What were our top 5 performing products last quarter?” and get instant answers. This kind of data democratization puts the power of business intelligence services & solutions into the hands of marketers, sales teams, and customer support reps—not just data scientists.

Modern tools like Power BI, ThoughtSpot, and Tableau are making BI more intuitive, accessible, and powerful than ever before. Whether it’s through power BI development services or AI-driven insights, these trends are redefining what’s possible for businesses that dare to innovate.

Read Our Success Story: Empowering Due Diligence with Power BI Integration

Data Governance and Security: A Competitive Enabler

When it comes to BI and Analytics, having lots of data isn’t enough—having trusted data is what separates leaders from laggards. In today’s data-first world, where split-second decisions impact millions in revenue, data governance and security aren’t just IT concerns—they’re core business priorities.

Trust Starts with Clean, Governed Data

Without consistent standards, even the most advanced BI and Analytics services fall short. Poor-quality data leads to flawed insights, which leads to bad decisions. That’s why strong data governance—clear ownership, quality controls, and access policies—lays the foundation for any successful business intelligence solution.

Secure Cloud Architecture = Scalable Confidence

Most modern BI & analytics development services run on cloud platforms, and that’s a good thing. These platforms offer end-to-end encryption, identity management, and built-in compliance frameworks (think HIPAA, SOC 2, GDPR). For industries like FinTech and healthcare, where regulatory requirements are strict, secure cloud architectures ensure data stays protected while enabling agility.

Governance as a Driver of Agility

Contrary to what some believe, data governance doesn’t slow things down—it speeds them up. With defined roles, secure access, and audit trails in place, teams can confidently explore, share, and act on data faster. That’s a massive win for agility, innovation, and risk mitigation—especially in highly regulated spaces like lending, insurance, and payments.

Strong governance is like guardrails on a fast highway. It doesn’t restrict speed—it keeps you safe while moving fast. And for companies serious about unlocking the full value of BI and data analytics, that safety net can be a serious competitive advantage.

Also Read: Tableau: Is It The Business Intelligence Solution For You?

Crafting Your BI Strategy Playbook

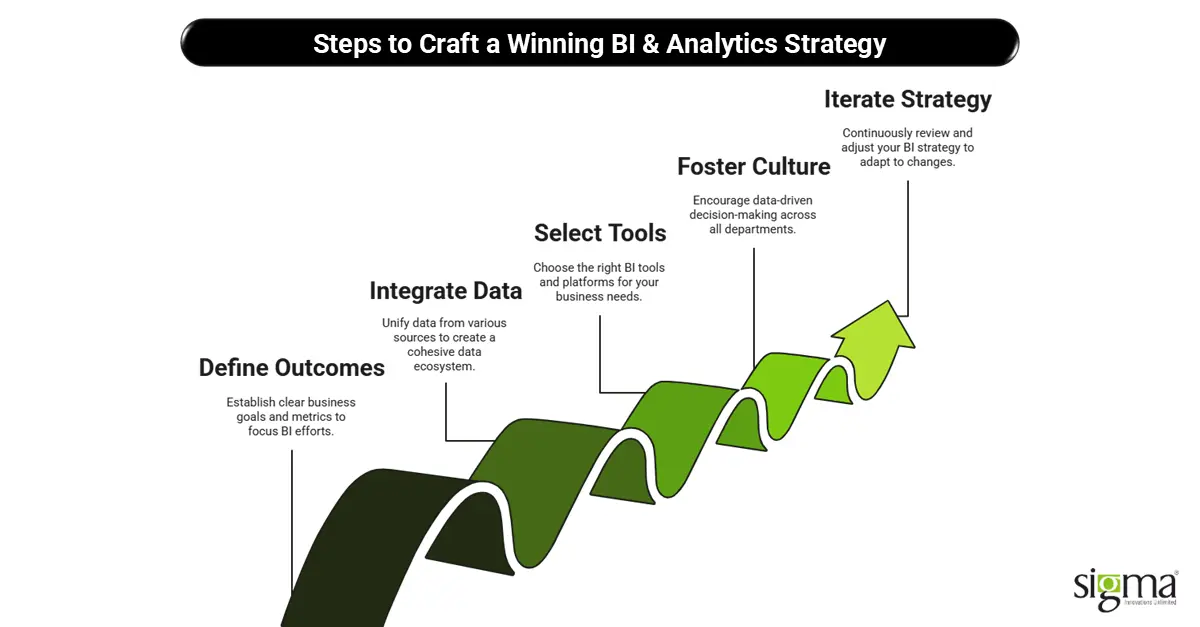

You wouldn’t build a house without a blueprint—so why build a data-driven business without a strategy? A solid BI and Analytics playbook doesn’t just give you better dashboards; it gives you clarity, speed, and the ability to outpace competitors. Whether you’re in eCommerce or FinTech, here’s how to craft a winning BI game plan.

1. Define Business Outcomes and Metrics

Start with the end in mind. What are you trying to achieve—higher customer retention? Smarter pricing? Lower fraud rates? Once your business goals are clear, you can define key metrics and KPIs that matter. This keeps your BI and Analytics efforts focused and impactful.

2. Audit and Integrate Data Sources

Data lives in many places—ERPs, CRMs, web apps, payment systems. It’s time to break those silos. Identify what data exists, where it lives, and how it flows. Then integrate it. Unified data is the lifeblood of all successful business intelligence services & solutions.

3. Select the Right BI Tools and Platforms

Choose tools that meet your scale, use cases, and team skill levels. Whether you’re leveraging Power BI development services, Tableau, or Looker, the right platform should offer flexibility, visual appeal, and ease of integration with your existing stack.

4. Foster a Data-Driven Culture

Even the best tech won’t help if your team doesn’t use it. Educate, empower, and encourage all departments—from marketing to finance—to use BI and Analytics services in everyday decision-making. This shift doesn’t happen overnight, but it pays off big.

5. Iterate with Feedback and Business Changes

BI strategies aren’t “set it and forget it.” Business needs evolve, markets shift, and new data sources emerge. Keep your BI initiatives agile—review outcomes regularly and tweak your approach as needed.

How Sigma Infosolutions Helps eCommerce & FinTech Clients Unlock BI-Led Growth

At Sigma Infosolutions, we bring deep expertise in BI & Analytics development services tailored to fast-moving industries like eCommerce and FinTech. From integrating siloed systems to building custom dashboards and predictive models, we help you turn data into decisions.

Our focus is on scalable cloud-native solutions, user-friendly visualizations, and long-term support to make sure your BI strategy actually delivers business outcomes.

Conclusion & Strategic Takeaways

To compete effectively in the hyper-competitive world, BI and Analytics aren’t optional—they’re essential. The companies that win are the ones turning data into insight and insight into action. Whether it’s optimizing pricing in eCommerce or managing credit risk in FinTech, BI and Analytics services are the engine driving smarter, faster decisions.

But here’s the kicker: true competitive advantage comes when data intelligence becomes a core strategy, not just a reporting layer.

The BI and analytics software market, valued at USD 35.85 billion, is projected to reach USD 112.4 billion by 2032, growing at a compound annual growth rate (CAGR) of 13.6%. What do these numbers mean? Businesses are embracing BI and analytics for a massive competitive edge. So if reaching new heights of success is your enterprise’s cherished goal, then leveraging BI and analytics is non-negotiable.

Ready to lead with insight? Let’s talk.

At Sigma Infosolutions, our BI & analytics development services are designed to help you build powerful, scalable, and industry-specific solutions that deliver real business value. If you’re ready to explore how business intelligence solutions can transform your eCommerce or FinTech operation, our team is here to help.