Power Up Your Platform with a Digital Payment Solution Built for You

Ever feel like your payment system is slowing down your entire platform? You’re not alone. Many fast-growing digital platforms—from online marketplaces to SaaS tools and gig economy apps—start with a generic, plug-and-play payment setup. But as customer demand, transaction volume, and complexity grow, that one-size-fits-all solution becomes a bottleneck instead of a booster.

In today’s digital-first economy, the B2B digital payments market is exploding—with a projected CAGR of over 11.8% through 2032. Businesses aren’t just selling online anymore—they’re embedding payments into experiences, building marketplaces, and scaling SaaS integrations faster than ever before.

So, what’s the next step? It’s not about upgrading to another generic tool. It’s about leveraging a digital payment solution that fits your platform like a glove—something that grows with you, integrates seamlessly, and simplifies the complexities. Whether you need marketplace integrations or SaaS integrations, it’s time to break free from clunky systems and step into a payment experience tailored for your future.

Let’s explore how you can power up your platform with a solution designed just for you.

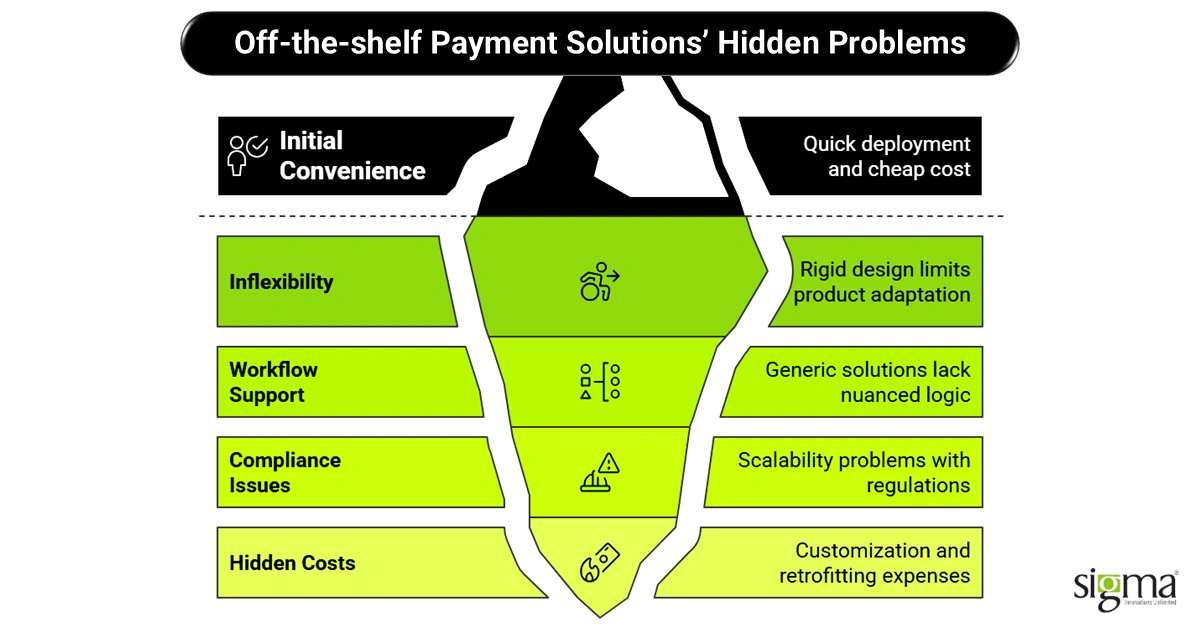

The Real Problem with Off-the-Shelf Payment Solutions

At first, off-the-shelf payment systems seem like the perfect fix—quick to deploy, packed with features, and relatively cheap. But for fast-scaling platforms, especially in the SaaS, marketplace, or gig economy space, that convenience wears off fast.

Instead of supporting your growth, they make you jump through hoops. You end up bending your workflows, sacrificing customer experience, and spending a ton of resources just to make it work. That’s not innovation—it’s improvisation. And it’s costing you.

Here’s where these cookie-cutter solutions typically fall short:

Inflexibility that slows you down

- Most prebuilt platforms are rigid by design.

- You’re forced to adapt your product to their rules instead of the other way around.

- You lose control over user experience and operational agility.

No support for industry-specific workflows

- A SaaS application integration has vastly different needs compared to a multi-seller marketplace integration.

- Generic solutions can’t handle the nuanced logic of payout structures, fee splits, refund rules, or usage-based billing.

- This lack of flexibility leads to manual workarounds, killing efficiency.

Poor compliance and scalability

- Expanding across regions or scaling user volume? Good luck with that.

- SaaS and gig platforms need platform integration services that comply with local tax, KYC/AML, and data security regulations.

- One-size-fits-all systems don’t scale well and introduce compliance risks.

Hidden costs and constant retrofitting

- The licensing might look cheap upfront, but the real cost hits later.

- You spend time and money customizing APIs, patching workflows, and hiring external consultants.

- Retrofits also delay go-to-market timelines, hurting your bottom line.

Off-the-shelf systems weren’t built with your business model in mind. They weren’t built for the complexity of SaaS platforms, gig economy tools, or marketplace ecosystems. That’s why it’s time to move away from patchwork solutions and invest in something smarter: a payment engine that’s tailor-made for how your business runs.

Also Read: Security Compliance Checklist for a Fintech CTO

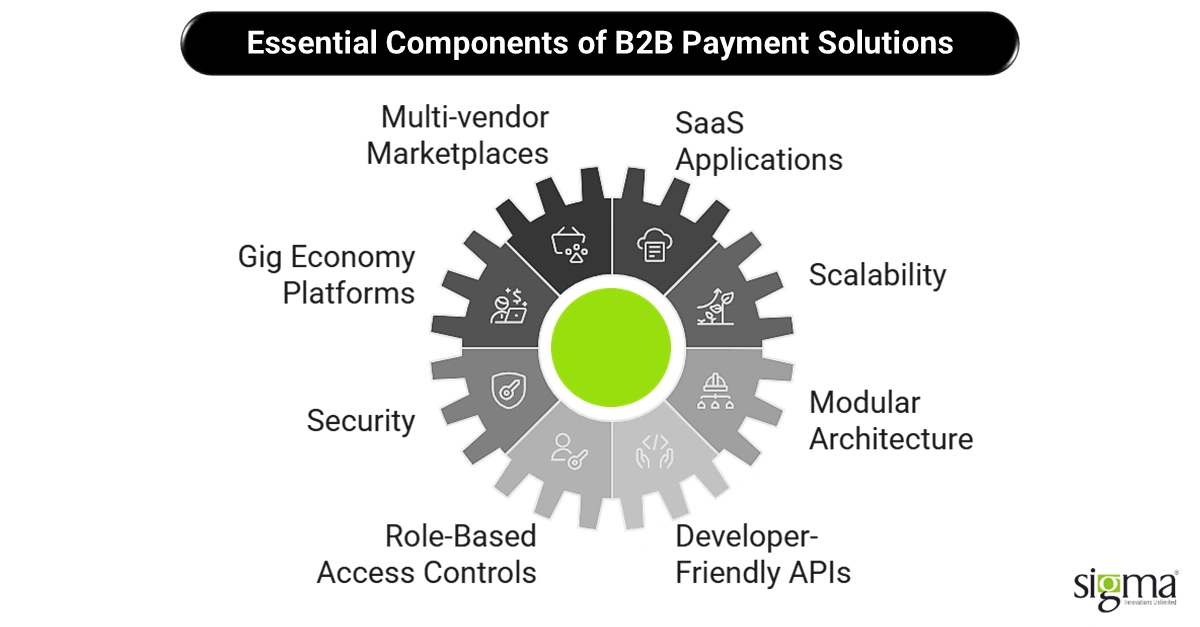

What B2B Platforms Truly Need in a Payment Solution

Let’s cut to the chase—B2B platforms don’t need just any payment system. They need one that’s built for the way they do business. Whether you’re running a multi-vendor marketplace, a SaaS platform, or a gig economy tool, the payment engine behind your product should work like a natural extension of your operations—not a complicated patchwork of workarounds.

Here’s what modern platforms are actually looking for:

Real-World Use Cases, Real Needs

Multi-vendor Marketplaces

- Need split payments, custom commission logic, and escrow handling that ensure vendors and platform owners both get paid accurately and on time.

- Require digital payment automation solutions that adapt to different sellers, categories, and transaction rules.

SaaS Applications

- Need subscription billing, usage-based pricing models, and tight fraud protection.

- Often require workflow automation through platform integration to streamline billing cycles, user role access, and internal accounting.

Gig Economy Platforms

- Need instant payouts, 1099 tax compliance, and dispute resolution baked into the system.

- Require real-time data handling and flexibility to accommodate freelancers, service providers, and variable-rate contracts.

Must-Have Features in a Modern Payment Solution

A future-ready B2B payment solution should be more than just “functional.” It must be flexible, fast, and built to scale:

- Scalability – Whether you’re onboarding 100 or 100,000 users, your system should flex with your growth.

- Security – Built-in fraud detection, encryption, and compliance support (PCI DSS, KYC, AML).

- Modular Architecture – Plug in what you need. Turn off what you don’t.

- Role-Based Access Controls – Keep sensitive operations and workflows in the right hands.

- Developer-Friendly APIs – Because your devs should be building features, not fighting payment infrastructure.

Transforming SaaS Workflows with Sigma’s Custom Digital Payment Solutions

A mid-sized SaaS company offering a project management tool approached Sigma Infosolutions with a familiar challenge: their out-of-the-box payment setup couldn’t handle tiered pricing models, automated subscription renewals, or real-time fraud alerts. The finance team, overwhelmed by manual spreadsheets and disconnected workflows, needed more than a quick fix—they needed transformation.

Sigma responded with a custom payment gateway integration, built specifically around their pricing logic and user role hierarchy. We delivered workflow automation through platform integration, connecting their billing engine, CRM, and payment processor into a single, streamlined flow. No more dropped transactions. No more human error.

The impact was real:

- 40% savings in platform roll-out

- 100+% average YoY growth

- 60% reduction in document processing time

- Validation accuracy improved by 95%

These results reflect the kind of impact Sigma delivers across industries.

- In AlgoPay’s case, we enabled rapid scalability with a robust API-led architecture and seamless multi-currency payments.

- With DivideBuy, we helped scale their BNPL platform by integrating real-time payment flows and automating customer onboarding.

- And in this case study, we applied advanced document validation automation using Amazon Textract—reinforcing how smart integrations accelerate operational efficiency even beyond payments.

Your platform deserves better than a stitched-together system.

With Sigma’s digital payment automation solutions and deep domain expertise, you can build secure, scalable, and seamless experiences—tailored to your workflows and built for long-term growth.

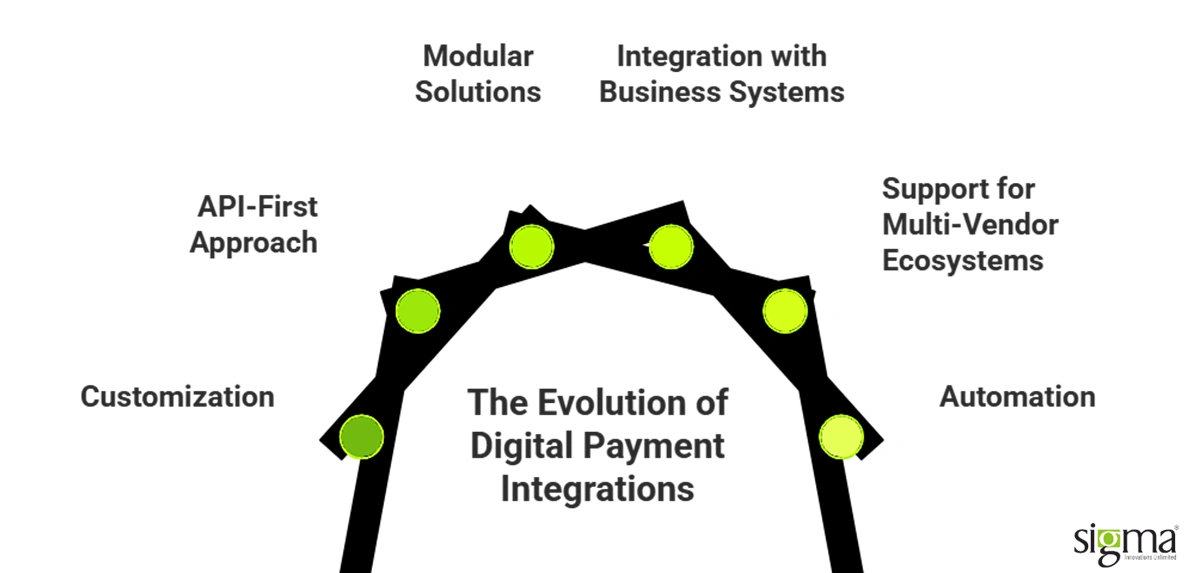

The Rise of Tailored Digital Payment Integrations

In today’s fast-paced digital world, payments have moved from the sidelines to center stage. Businesses aren’t just looking for tools that process payments—they want solutions that power their platform strategy. The old product-centric model is giving way to platform-centric ecosystems where payments are tightly woven into every business interaction.

That shift is fueling the rise of tailored digital payment integrations—custom-built, API-first payment layers that adapt to how each business operates. Giants like Stripe, Adyen, and Dwolla have made modular, headless payment solutions the norm. But for many B2B platforms, even these out-of-the-box tools require deep customization to match business logic, user roles, and backend systems.

Why “Tailored” Beats “Templated”

A templated approach can’t handle:

- Tiered pricing in SaaS products

- Variable commissions across vendors

- Multi-step payouts in gig economy apps

What these platforms truly need is custom payment gateway integrations that:

- Reflect their unique pricing, workflows, and compliance needs

- Connect with CRMs, ERPs, and external tools for SaaS app third-party API integration

- Support multi-vendor ecosystems through custom integrations for multi-vendor marketplaces

It’s no longer enough to just plug in a payment button. Growth-focused platforms want integrations that drive automation, reduce overhead, and create better customer and vendor experiences.

Whether it’s enabling usage-based billing, syncing tax data, or automating real-time payouts, these custom integrations aren’t just a nice-to-have—they’re a strategic advantage.

And that’s where Sigma comes in. Our deep expertise in Software Product Engineering Services and Artificial Intelligence Development Services lets us go beyond plug-and-play. We deliver digital payment automation solutions that fit your platform like a puzzle piece—seamless, smart, and scalable.

Also Read: Robo advisory: An opportunity or a threat for fintech?

Why Sigma Infosolutions?

Tailored Tech for Real-World Complexity

At Sigma Infosolutions, we don’t believe in “almost fits.” We specialize in building digital payment solutions that are tailored to your business model, workflows, and growth plans—not the other way around.

With deep roots in eCommerce, Fintech, and custom software development, we understand the complexities of modern digital platforms. Whether you’re running a multi-vendor marketplace, a SaaS app, or a gig economy tool, we’ve got the technical muscle and industry insight to build exactly what you need.

We’ve successfully delivered integrations for platforms like Shopify, Magento, BigCommerce, and fully custom SaaS systems—helping our clients achieve payment experiences that feel seamless, secure, and scalable.

Marketplace & SaaS Platform Integrations

Our engineering teams specialize in building:

- Custom payout flows with multi-party logic and timing controls

- Reporting dashboards for financial transparency and compliance

- Role-based financial access to manage internal and external stakeholders

- Features like subscription billing, tax compliance, wallet integrations, and recurring payments

From ACH to real-time payments (RTP) to localized payout systems, we support a full range of global and domestic transaction flows.

API Integration Services & Beyond

We offer full-stack capabilities for modern, API-first platforms:

- RESTful and GraphQL APIs that play well with your stack

- Webhooks with intelligent error handling and fallback logic

- Built-in data compliance and transaction traceability features

Whether you’re looking for api integration services, marketplace integrations, or saas integrations, we combine engineering excellence with real-world business logic. It’s not just about writing code—it’s about making your payment ecosystem smarter, safer, and easier to scale.

With Sigma Infosolutions, you get a team that thinks ahead, codes with purpose, and delivers value at every step.

Leverage Sigma’s Custom Development Services to fulfill all your enterprise’s objectives

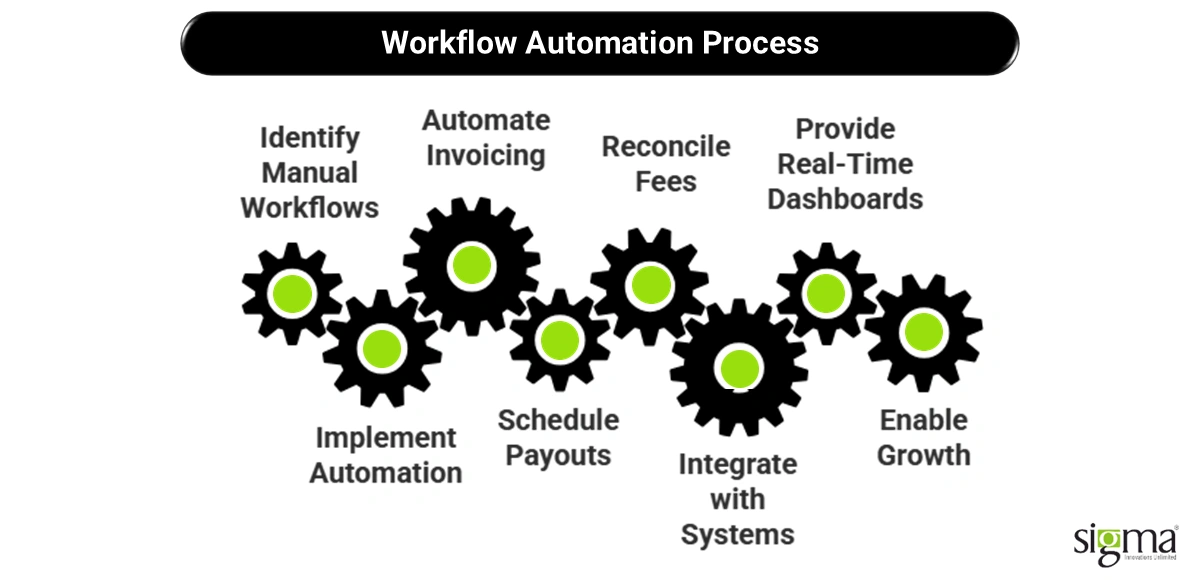

Workflow Automation with Platform Integrations

Let’s face it—manual payment workflows are productivity killers. If your finance or operations team is stuck juggling spreadsheets, chasing down payout errors, or manually reconciling invoices, it’s time to make a change.

That change starts with workflow automation through platform integration. With Sigma Infosolutions, B2B platforms across industries are replacing outdated payment operations with smart, API-led automation. The result? Less manual work. More control. Faster decisions.

What Can You Automate? A Lot More Than You Think.

Here’s what modern B2B platforms are already automating using our digital payment automation solutions:

- Invoicing

Automatically generate, send, and track invoices triggered by platform activity (subscription renewals, job completions, usage spikes). - Payout Scheduling

Set up rules to release funds based on milestones, job completion, or batch logic. Ideal for connecting gig economy tools with custom solutions. - Fee Reconciliation

Match platform commissions, taxes, discounts, and transaction fees in real-time. No more month-end chaos.

All of this happens behind the scenes—driven by logic you define, not a rigid template you’re forced to adapt to.

The API-Led Architecture Behind the Magic

Sigma builds these automation systems on robust, scalable, API-led architectures. That means your digital payment system can easily plug into the tools you already use:

- Accounting Software – QuickBooks

- CRM Platforms – Salesforce

- ERP Systems – Microsoft Dynamics, SAP

Through seamless custom payment gateway integrations, we ensure every transaction, trigger, and payout syncs with your backend in real time. You get smoother operations and fewer errors—without disrupting your existing workflows.

Real-Time Dashboards: Visibility for Finance Teams

Automation is great, but visibility is even better. That’s why we deliver real-time dashboards built specifically for your finance and operations teams. With one glance, you can:

- Track payouts and collections

- Monitor failed transactions or chargebacks

- Reconcile payments by vendor, product, or geography

- Analyze trends and forecast cash flow

This isn’t just about saving time—it’s about unlocking smarter decisions.

With Sigma’s workflow automation through platform integration, your payment infrastructure becomes a powerful growth enabler. Whether you’re managing a multi-vendor marketplace, a SaaS product, or a gig economy tool, we help you go from slow and siloed to fast and fully integrated.

Choosing the Right Integration Partner

When it comes to building or scaling your payment infrastructure, choosing the right integration partner is just as important as choosing the right tools. A strong partner doesn’t just “hook things up”—they future-proof your systems and align technology with your long-term business goals.

Before making a decision, here’s a quick checklist of what to look for in a payment integration partner:

Key Traits of a Reliable Integration Partner

- Tech Maturity & Domain Experience: Do they understand your industry—be it SaaS, marketplace, or gig economy? Can they handle complex platform integration services with confidence?

- Speed to Value & Scalability: Can they deliver fast results without sacrificing long-term stability?

- Compliance-Ready Builds: Are they fluent in PCI DSS, KYC/AML, and tax compliance best practices?

That’s where Sigma Infosolutions stands out. As a trusted partner in SaaS integrations, custom integrations for multi-vendor marketplaces, and beyond, we don’t just build software—we engineer results.

Our team combines deep tech expertise with industry insight to deliver integration architectures that are:

- API-first and modular

- Resilient under load

- Designed with real-time visibility and auditability

But we don’t stop at go-live. Sigma provides full lifecycle support—from planning and development to post-deployment optimization. We scale with you, ensuring your payment systems evolve as your platform grows.

When you choose Sigma, you’re not just plugging in a solution. You’re choosing a long-term partner committed to your digital success.

Final Thoughts

Here’s the bottom line—generic payment systems may get you started, but they won’t take you where you need to go. As your platform grows, so do the expectations of your users, vendors, and internal teams. You need a digital payment solution that scales with you, adapts to your workflows, and adds real business value.

Digital payments today are no longer just a technical feature. They’re a strategic enabler—powering faster onboarding, seamless transactions, better compliance, and smarter financial decisions. Whether you’re running a SaaS product, a gig platform, or a multi-vendor marketplace, the right solution gives you an edge.

At Sigma Infosolutions, we don’t just plug in payments. We architect API integration services and custom workflows that move at the speed of your business. From complex billing structures to real-time payouts, we build with scalability, security, and simplicity in mind.

Ready to power up your platform?

Let’s build a payment experience that fits your platform—not the other way around. Partner with Sigma Infosolutions today to get started.