Security Compliance Checklist for a Fintech CTO

Owing to the nature of the transactions in their systems and the type of sensitive financial information they handle, fintech companies are bound to safeguard their customer data and mitigate the threat of financial crimes. In this regard, the importance of maintaining a robust compliance posture cannot be emphasized enough. Any failure or negligence on the part of banks, lenders, financing companies, or credit unions will have a domino effect, permanently sabotaging business growth. Adherence to security compliance empowers fintech companies to maintain market integrity and foster trust with customers. Additionally, it helps businesses to avoid legal glitches, which are imperative for overcoming financial instability. But what is security compliance? Processes an organization follows to ensure that the activities they perform are in sync with the legal guidelines are called security compliance.

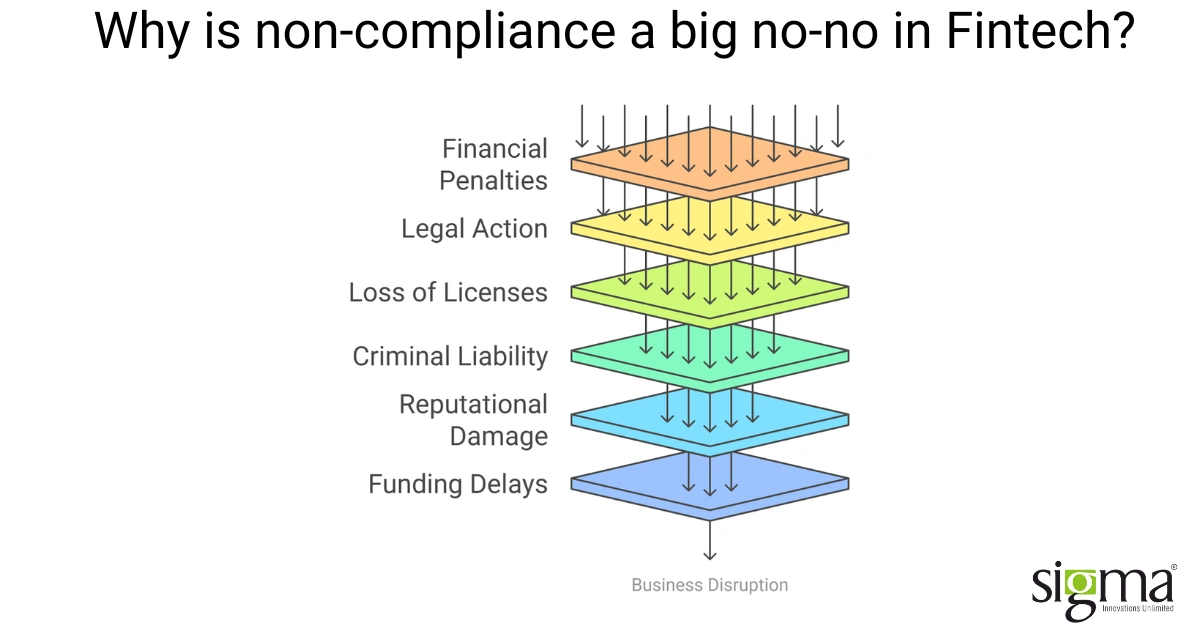

Can fintech companies take adherence to compliance norms lightly? The answer is a big no, because the consequences are devastating! Owing to strict regulatory oversight from agencies like the SEC, FINCEN, CFPB, OCC, FDIC, and CFTC, the impact of failing to adhere to compliance in the fintech ecosystem leads to irreparable damage. For instance,

- Fintech companies end up paying millions of dollars in fines for violating anti-money laundering (AML) regulations.

- Digital payment providers pay millions of dollars in penalties for failing to implement data protection measures

In a race to avoid such devastating consequences, around 93% of fintech companies are investing in compliance technology to safeguard their business interests. This blog provides a comprehensive overview of the imperative aspects of compliance that a fintech CTO must never ignore.

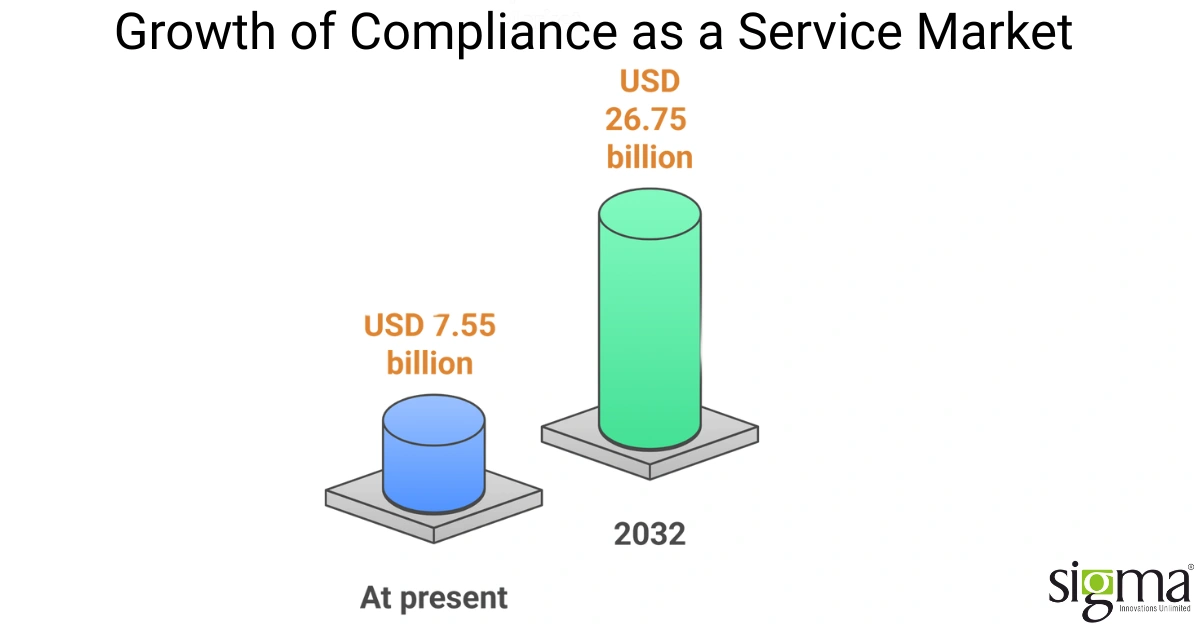

Let us take a look at compliance as a service market

Source: Introspective market research

Common security compliance breaches that need stringent monitoring in fintech

- Risk area

- AML & KYC Compliance

- Consumer Protection

- Securities Law Violations

- Banking & Lending Laws

- Data Privacy & Cybersecurity

- Consequences

- Fines, bans, executive prosecution

- Lawsuits, fines, shutdown orders

- Trading bans, SEC lawsuits, investor loss

- License revocation, fines

- Lawsuits, reputational loss

Role of a Fintech CTO: Ensuring Secure, Scalable Financial Solutions

As a driving force behind technology innovation, a CTO in fintech oversees the technology architecture and execution to ensure scalable solutions that adhere to compliance guidelines. By collaborating with various departments across the organization, the CTO drives security efforts that are crucial in establishing a robust compliance posture. By partnering with the best financial software development services provider, the CTO can seamlessly formulate and implement decisions and products that follow compliance norms. It paves the way for the fintech company to overcome any legal glitches that prevent it from achieving its financial goals.

Formulating a technology roadmap that is strategically in sync with the fintech company’s success parameters, considering regulatory guidelines.

- Staying informed about the latest cyber threats and preparing the organization and its systems to mitigate them.

- Designing secure and resilient systems, including network configuration, data encryption, and access controls, that will withstand cybersecurity breaches.

- Identifying potential vulnerabilities and regulatory non-compliance, and constantly evaluating and monitoring security measures for effectiveness.

- Ensuring that the organization complies with data protection laws such as GDPR, AML, PCA DSS and more.

- Staying abreast of emerging technologies and security trends to ensure that the latest tools and techniques are put to use for the best outcomes.

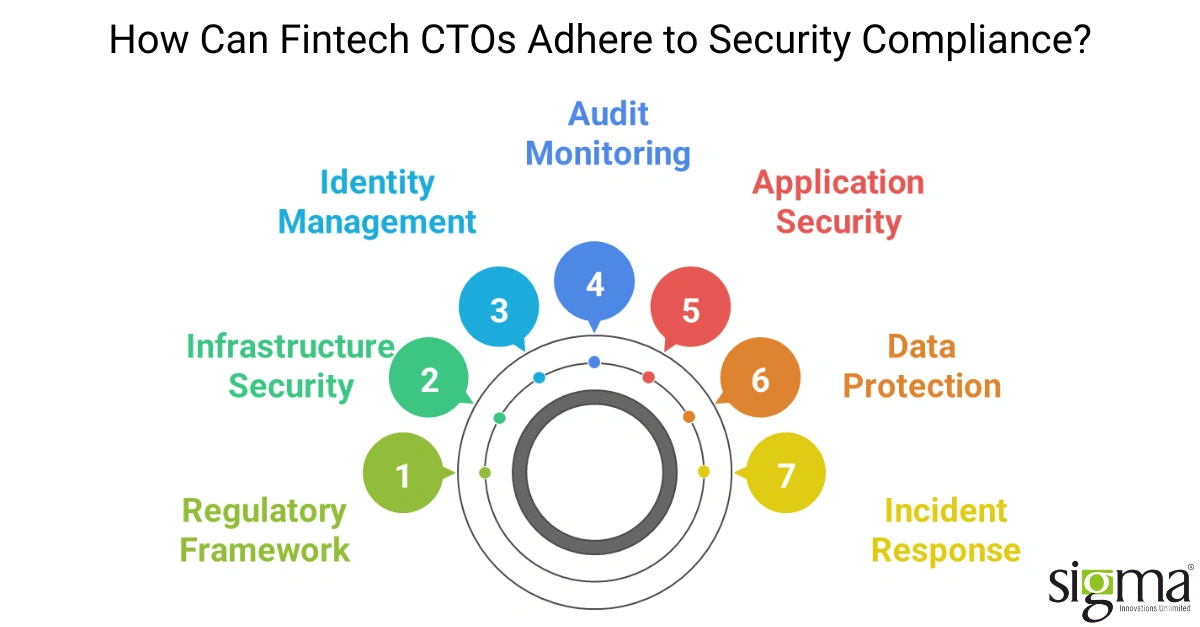

How can a fintech CTO slice through the complicated security compliance maze?

Here are the aspects a fintech CTO must ensure to maintain a robust compliance posture.

Security Compliance Checklist for a Fintech CTO

1. Follow regulatory & legal guidelines

- Identify applicable regulations- payment card industry data security Standard (PCI DSS) compliance, SOC 2, ISO 27001, GDPR, CCPA, GLBA, SOX, MAS, and more.

- Follow Know Your Customer (KYC) and Anti-Money Laundering (AML) practices.

- Maintain documentation and evidence of all compliance activities.

2. Ensuring Infrastructure & Cloud Security

- Stick to the never trust, always verify approach—Zero Trust Architecture and practice least privilege access by granting the minimum level of access to users vital for performing tasks.

- Use industry-standard algorithms to encrypt data at rest and in transit (e.g., AES-256, TLS 1.2+).

- Perform vulnerability scans, penetration testing, and patch management.

- Use Infrastructure as Code (IaC) with version control and security scanning.

- Implement multi-factor authentication (MFA) for accessing privileged accounts and configure secure logging.

3. Ensuring Application Security

- Conduct threat modelling and secure SDLC (software development life cycle) practices.

- Follow shift-left security by integrating security considerations as early in the design phase.

- Follow secure coding guidelines (Open Worldwide Application Security Project- OWASP) and zero in on vulnerabilities by conducting penetration testing.

- Automate testing, ensure code consistency and automate testing, building and deployment via

- Continuous integration and continuous delivery (CI/CD) pipelines.

- Always use static & dynamic application security testing (SAST/DAST) tools and implement API security controls.

- Check for any code injection, privilege escalation, and session hijacking.

4. Ensuring data protection & privacy

- Always maintain a data classification and handling policy.

- Utilize role-based access controls (RBAC) for handling and managing sensitive data.

- Enforce Data Protection Impact Assessments (DPIA) for new features.

- Use tokenization, data masking, or pseudonymization wherever possible and applicable.

- Incorporate data deletion and consent tracking management for end users

5. Ensuring identity & access management (IAM)

- Use single sign-on for providing secure access to multiple systems and leverage IdPs to centralize authentication.

- Automate user provisioning and de-provisioning, and review audit access control lists (ACLs).

- Have privileged access management (PAM) and enforce session timeouts and password rotation policies.

6. Ensuring incident response & business continuity

- Formulate and implement an incident response plan (IRP) annually.

- Establish precise RTO (Recovery Time Objective) and RPO (Recovery Point Objective) targets.

- Implement 24/7 threat detection and response capabilities like SOC.

- Train and guide teams for compliance adherence by conducting breach simulations.

- Always keep offsite and encrypted backups in place and tested.

7. Ensuring audit & continuous monitoring

- Conduct audit trails across infrastructure, apps, and databases by using various compliance monitoring tools.

- Get real-time visibility by integrating compliance dashboards.

What more?

Always choose a financial software development service provider with robust tech capabilities and compliance certifications to build your fintech infrastructure.

Why is Sigma Infosolutions a fintech CTO’s top choice to secure a robust compliance posture?

If you are a CTO of a fintech or a digital lending company, or a wealth management company, Sigma Infosolutions is a one-stop shop for all your enterprise’s compliance needs. This is what we do:

- Creating regulatory readiness by assessing existing gaps and evaluating current systems and creating and implementing a compliance strategy that best fits with your fintech’s product and market aligned with regional and global regulations.

- Providing reliable security-first product engineering services for secure SLDC integrations, embed security controls, and code reviews in product development cycles. Preventing and detecting vulnerabilities by following OWASP-aligned Coding, automated testing and implementing SAST/DAST and DevSecOps pipelines.

- Ensuring cloud deployment meets compliance by following CIS (Center for Internet Security) benchmarks and utilizing full-proof infrastructure on AWS and Azure, and using infrastructure as code for building auditable environments.

- Enabling privacy-by-design and full data lifecycle compliance by implementing robust encryption policies for data at rest and in transit, designing systems for GDPR/CCPA data governance, and applying advanced techniques to reduce exposure of sensitive PII/PCI data.

- Automating what cannot be scaled manually by integrating compliance automation tools and building real-time compliance dashboards to track posture and incidents. Setting up role-based access controls and periodic audits for safeguarding business pursuits.

Read the case study to know more about ensuring due diligence with Power BI integrations.

Emerging trends Fintech CTOs must explore to ensure adherence to compliance norms

Leveraging RegTech solutions and financial compliance software, a CTO of a company can effectively manage and streamline tasks, paving the way for efficient and effective compliance. In addition to RegTech solutions and compliance as a service, utilizing AI for threat detection, blockchain for transactions, and real-time regulatory monitoring tools will become the norm in the future.

Read the blog to know more about Regtech trends.

Wrapping up:

Fintech companies across the globe have lost millions of dollars due to failing to adhere to cybersecurity compliance and cloud security compliance guidelines. Hence, it is imperative for fintech CTOs to choose the best finance software development services with remarkable tech capabilities and make security a business enabler.

CTA: Get in touch with Sigma Infosolutions for maintaining a robust security compliance posture.