Why Loan Disbursement Is Still Slow—and How Technology Can Fix It

It’s 2025, and while the world has moved at lightning speed—AI in everyday apps, instant food delivery, and same-day shipping—loan disbursement still feels stuck in traffic. Even with advancements in digital lending, the time it takes for funds to reach customers can be unexpectedly long. This extended waiting period can be frustrating for those who anticipate quick access to their finances.

For borrowers, delays can be frustrating. But for lenders? These slow loan disbursement timelines hit harder. They impact everything—from borrower trust and retention to internal operations and profitability. When funds don’t move fast, businesses lose their edge. It’s not just about keeping borrowers happy—it’s about staying competitive in a high-speed lending market.

In this blog, we’ll unpack why loan disbursement is still slow despite digital advancements and show how FinTech solutions, such as digital lending software solutions and loan disbursement technology, are changing the game. Whether you’re battling legacy systems, juggling compliance hurdles, or simply trying to modernize your stack, we’ve got insights that matter.

Understanding the Loan Disbursement Bottleneck

Let’s start with the basics. A traditional loan disbursement process may sound straightforward, but once you peek behind the curtain, it’s more like a relay race with too many baton passes—and not everyone’s running.

The Disbursement Lifecycle: Where It All Begins

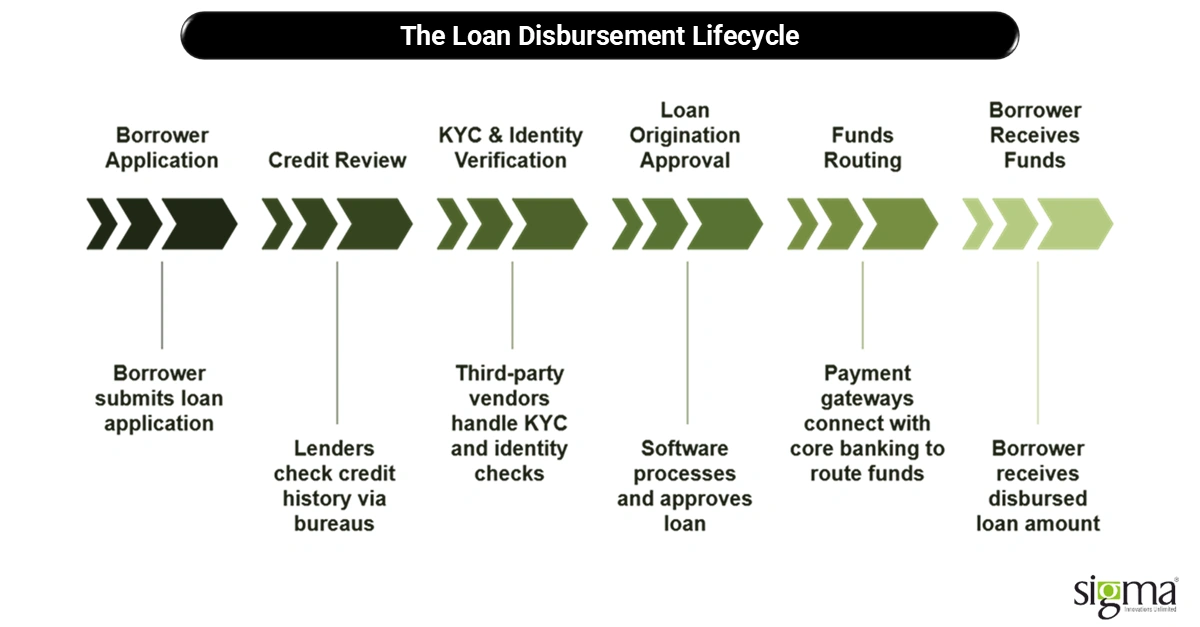

Here’s a simplified version of how things typically go down:

- The loan application is submitted by the borrower.

- Lenders review credit history via credit bureaus.

- KYC and identity verification are handled by third-party vendors.

- Loan origination software processes approvals.

- Funds are routed through payment gateways after connecting with core banking platforms.

- Finally, the money reaches the borrower.

Looks smooth on paper, right? But in reality, each handoff creates an opportunity for delays.

The Cast of Characters (a.k.a. Stakeholders)

Several players are part of this performance:

- Lenders and underwriters are making the approval decisions

- Credit bureaus confirming risk

- KYC vendors validating identities

- Core banking systems authorizing disbursements

- Payment processors and gateways are releasing the funds

With all these moving parts, the risk of lag increases. Many lenders still rely on patchy integrations or manual updates between these systems, which slows everything down.

Expectations vs Reality

In a perfect world, digital loan disbursement would be instant—or at least same-day. But due to legacy systems and fragmented tech stacks, loan disbursement delays are now the norm. Borrowers might expect funds in 24 hours, but they often wait 3 to 7 days. That’s a major mismatch.

Compliance: The Necessary Brake

Regulatory compliance is critical, but it also acts as a speed bump. Anti-money laundering checks, data verification, and fraud prevention—each of these requires precision. And in many cases, manual intervention is still part of the process, especially when software systems don’t talk to each other in real time.

All of this creates a perfect storm for slow loan disbursement, especially in businesses that haven’t yet adopted modern loan disbursement technology or automated loan processing tools.

In short? The system’s stuck in yesterday while the world races ahead.

Major Challenges Slowing Down Loan Disbursement

If you’ve ever wondered why loan disbursement delays are so common, the answer lies in a messy combo of outdated tools, disconnected data, and compliance roadblocks. Let’s unpack the biggest culprits behind slow loan disbursement in today’s lending ecosystem.

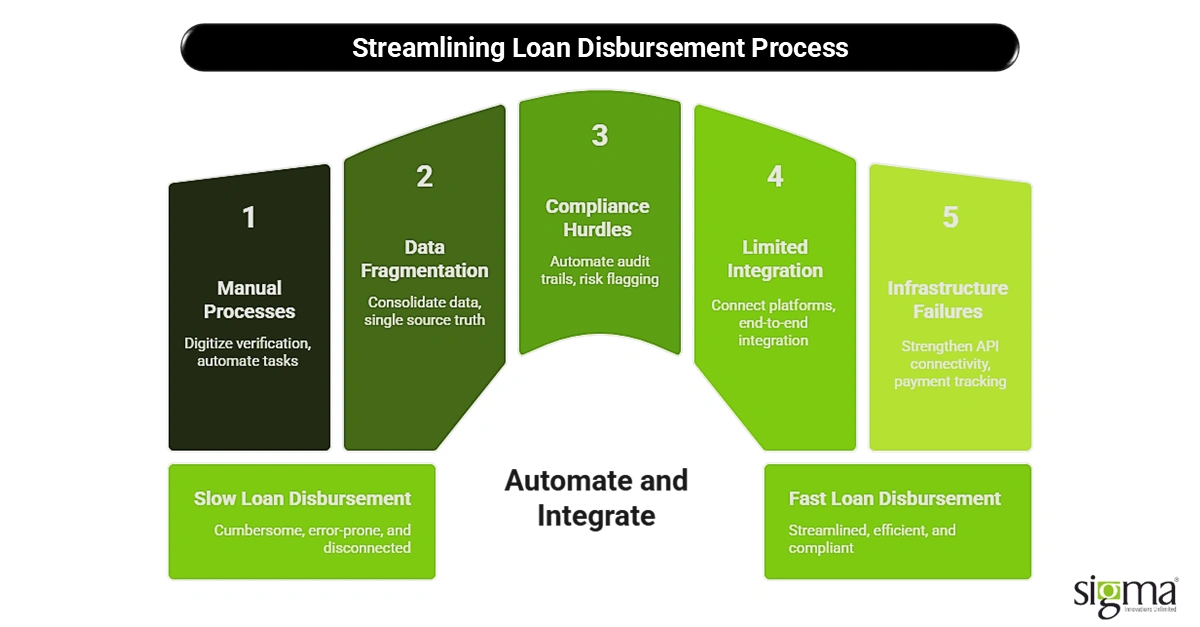

Manual Processes and Legacy Systems

Despite the fintech boom, many lenders are still stuck using paper-based verification, spreadsheets, and outdated dashboards. These manual methods aren’t just slow—they’re error-prone and hard to scale. Some lenders are still using legacy loan origination software (LOS) and loan servicing software (LMS) that were built decades ago, with little or no automation built in.

It’s like trying to stream Netflix on dial-up—technically possible, but painfully inefficient.

Data Fragmentation and Verification Delays

Let’s talk data. To approve and process loans, lenders need to verify identities, screen for fraud, run AML checks, confirm income, and more. The trouble is, these functions often live in different systems.

There’s no single source of truth. Teams end up entering the same data multiple times, chasing down info across tools, and waiting on approvals that could’ve been automatic. The lack of automated loan processing creates friction at every step.

This patchwork approach is a key driver behind loan disbursement delays.

Compliance, Risk, and Regulatory Hurdles

We get it—compliance isn’t optional. But the way many institutions handle it adds extra weight to the process.

Whether it’s delays due to Income-Driven Repayment (IDR) plans or Public Service Loan Forgiveness (PSLF) program validations in student lending, regulatory checks often create bottlenecks.

The need for audit trails, risk flagging, and manual compliance reviews—especially when not automated—means slower movement of funds and more stress for teams.

Limited Integration Across Platforms

Disconnection is another speed killer. Many lenders run their CRM, loan origination software, loan management software, core banking systems, and payment solutions in isolation.

When platforms don’t “talk” to each other, it creates silos where critical data gets lost or delayed.

This lack of end-to-end integration makes it nearly impossible to achieve real-time or even same-day digital loan disbursement.

Infrastructure and Payment Failures

Even when everything else works, poor infrastructure can still ruin the party. Weak API connectivity with disbursement channels like ACH, UPI, or RTP means payments don’t always go out on time—or land where they should.

Outdated payment hubs often lack the automation, tracking, and transparency needed to ensure fast, error-free delivery. Without solid digital payment software solutions, the final step in disbursement becomes the riskiest.

The Role of Technology in Streamlining Disbursement

Thankfully, we’re no longer stuck in the slow lane. The fintech world has been moving fast, and now there’s real momentum behind solving the long-standing pain points of slow loan disbursement. Let’s look at how smart tech is helping lenders break free from legacy bottlenecks—and move toward fast, frictionless digital loan disbursement.

From Legacy to Lightning-Fast: Digital Transformation in Action

Modern financial software development services are designed to eliminate clunky, manual workflows. Instead of relying on spreadsheets, faxes (yes, some still do!), and endless back-and-forths, today’s platforms use automation, data centralization, and APIs to simplify every step.

With powerful digital lending software solutions, lenders can go from loan approval to disbursal in a matter of minutes—not days. It’s like replacing a paper map with real-time GPS. Suddenly, you’re not lost in red tape anymore.

APIs – The Glue Holding It All Together

APIs are the secret sauce here. They allow different systems—loan origination software, loan servicing software, CRMs, KYC platforms, and even digital payment software solutions—to work together in real time.

So instead of waiting for one department to email a spreadsheet to another, everything is connected behind the scenes. This smooth integration means faster approvals, cleaner audit trails, and fewer errors—essential for consistent loan disbursement technology.

Loan Origination Software (LOS) and AI-Driven Decisioning

Legacy platforms just can’t keep up with today’s pace. That’s why many forward-thinking lenders are adopting loan origination software (LOS) and loan management software (LMS) systems. These systems don’t just offer automation—they enable constant updates, high availability, and easy scaling.

And when you layer in AI-driven risk scoring, you get smarter, faster decisions. Instead of rigid scoring models and manual reviews, AI can analyze thousands of data points in seconds to approve (or flag) loans with pinpoint accuracy. This is a game-changer for automated loan processing.

Agile Workflows = Instant Loan Disbursement

Here’s the magic word: agility. When your workflows are automated, connected, and intelligent, you unlock auto-disbursals—often within minutes of loan approval.Borrowers are happy, operations stay lean, and you eliminate a ton of human error.

Lenders using loan management software and investment software development solutions built on modern tech stacks are already seeing the benefits: faster funding times, better borrower satisfaction, and more efficient teams.

With the right technology in place, loan disbursement delays can become a thing of the past. At Sigma Infosolutions, we help lending businesses move from outdated, manual workflows to seamless, real-time digital loan disbursement through robust loan origination software, loan servicing software, and advanced financial software development services. Our solutions are built to improve disbursement SLAs, reduce manual errors, and accelerate borrower onboarding.

Take a look at how we helped Interest Smart Home Loans revamp their lending platform for faster processing and smarter decisioning in this case study.

Game-Changing Tech Solutions in Lending

It’s 2025, and slow loan disbursement is no longer a problem you have to live with. A new wave of fintech solutions is changing the game—making digital lending not only faster but smarter. If you’re still stuck with legacy systems and manual handoffs, here’s a look at the modern toolkit that’s helping lenders leave loan disbursement delays behind.

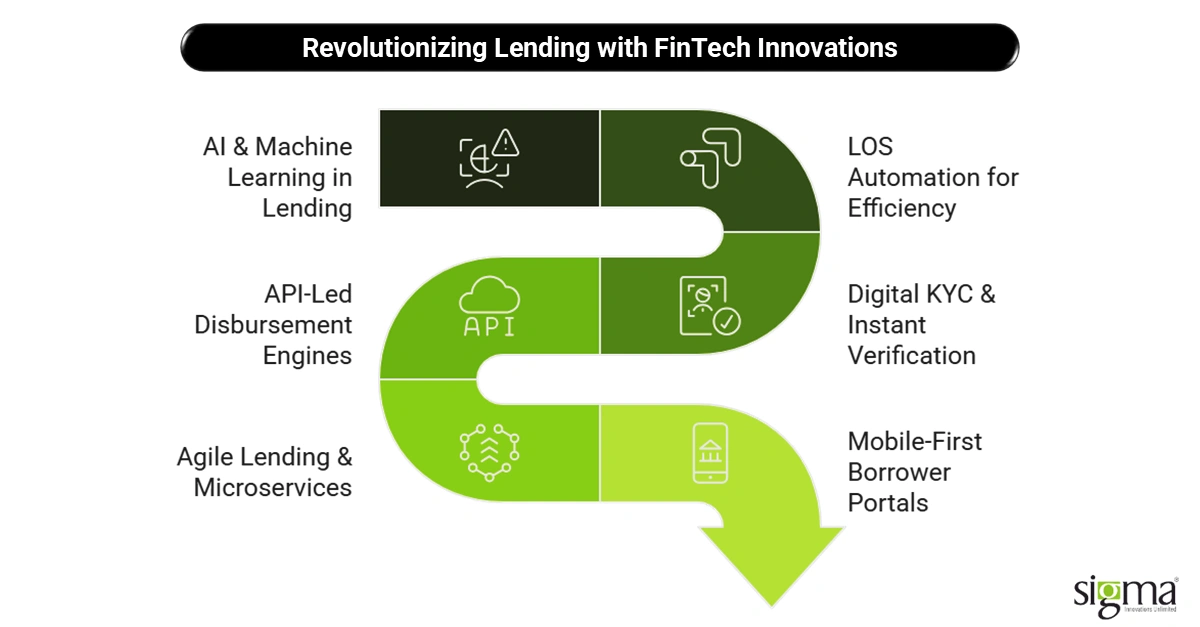

AI & Machine Learning – The Brains Behind Smart Lending

AI is doing more than just automating—it’s thinking ahead. With intelligent underwriting and predictive analytics, lenders can better assess credit risk and spot potential NPAs before they snowball.

Think of it like switching from a flashlight to a floodlight—you don’t just see what’s right in front of you, you see what’s coming.

AI also fuels real-time fraud detection, making your digital loan disbursement process more secure. This means fewer bad loans, faster approvals, and less manual work across the board.

Read the blog to know more about Financial software development services, bridging the credit gap

LOS Automation – The Engine of Efficiency

Today’s loan origination software is built for speed. You can auto-collect documents, apply decision rules, and run credit scoring checks—all without human touchpoints.More importantly, a modern LOS integrates seamlessly with loan servicing software, CRMs, KYC tools, and third-party APIs, so your workflows become a straight line instead of a tangled web.

This end-to-end automation removes bottlenecks, drastically reducing loan disbursement delays and operational stress.

Digital KYC & Instant Identity Verification

Say goodbye to in-person visits and week-long verifications. With tools like facial recognition, biometric checks, and OCR-based document reading, digital KYC is now fast, accurate, and scalable.

The turnaround time (TAT) for identity checks has shrunk from days to minutes. That’s a big win for lenders looking to deliver digital lending software solutions with the speed today’s borrowers expect.

API-Led Disbursement Engines – Speed Meets Accuracy

This is where loan disbursement technology really shines. API-led disbursement engines connect directly with digital payment software solutions and banking rails like ACH, UPI, or RTP.

Funds are routed intelligently based on borrower preferences and bank availability—meaning they land in the right account, at the right time, with full trackability.

You’re not just automating—you’re making smarter decisions in real time.

Agile Lending & Microservices Architecture

Forget the heavy, monolithic systems of the past. Today’s financial software development services are built using microservices—tiny, modular units that allow for faster upgrades, easy compliance changes, and zero downtime.

This means lenders can adapt to regulations on the fly, deploy new features quickly, and monitor the full loan management software stack in real time. Agility isn’t just a buzzword—it’s a competitive edge.

Read our success story: Scaling loan processing through microservice architecture

Mobile-First and Self-Service Borrower Portals

Borrowers expect convenience, and that means mobile-first. With self-service portals, they can upload documents, track their application status, and approve terms—all from their phone.

Not only does this improve borrower satisfaction, but it also reduces your reliance on call centers and manual follow-ups. It’s a win-win for speed and efficiency, especially when your goal is streamlined digital loan disbursement.

From AI to APIs to agile frameworks, these tech innovations are putting slow loan disbursement in the rear-view mirror. Up next, we’ll look at real-world business impact—and how tech-forward lenders are already seeing better ROI, faster TATs, and happier customers.

Real-World Impact

Let’s move from theory to practice. While some lenders are still wrestling with slow loan disbursement, others are using smart tech to zip past those bottlenecks—and they’re seeing real results.

From Slow Approvals to Instant Loans – The Digital LOS Advantage

Take the case of a fast-growing FinTech in the personal lending space. Before adopting a loan origination software, disbursements used to take days—slowing down borrower onboarding and cash flow.

But with AI-driven risk assessment, digital KYC, and automated document processing in place, they now offer near-instant approvals and same-day digital loan disbursement—all while maintaining strict compliance standards and risk controls.

It’s like swapping a bicycle for a bullet train.

Embedded Lending and BNPL – Speed Built In

Another game-changer is embedded lending—where credit decisions and disbursals happen right inside a checkout flow. Buy Now, Pay Later (BNPL) providers are using loan disbursement technology and real-time APIs to issue funds in seconds.

Behind the scenes, it’s a combo of digital lending software solutions, risk engines, and digital payment software solutions working together like a pit crew.

Auto Finance – Driving Change with Dealership APIs

In the auto lending space, smart lenders are plugging directly into dealership systems using APIs. This allows instant sharing of buyer details, real-time credit approval, and digital loan disbursement—often before the buyer finishes the paperwork.

Fewer delays mean more cars on the road, and happier dealers and borrowers alike.

Open Banking – Bridging the Approval-Disbursement Gap

Thanks to Open Banking and direct integrations with financial institutions, lenders can now pull verified income, bank account, and identity data instantly. This eliminates the lag between approval and disbursement.

The result? A tighter, cleaner funnel from “You’re approved” to “Funds deposited,” supported by seamless loan management software and financial software development services.

From fintech startups to established NBFCs, the shift is clear: technology isn’t just nice to have—it’s the backbone of faster, smarter lending. These success stories prove that loan disbursement delays are not just solvable—they’re being solved every day.

Future Outlook on Loan Disbursement

If today’s loan disbursement feels like rush-hour traffic, the future is more like a high-speed expressway. We’re moving toward a world where digital loan disbursement happens in real time, backed by smart systems that predict and act instantly.

Real-Time Disbursement at Scale

Imagine loans disbursed in seconds, not days—even at enterprise scale. That’s where loan disbursement technology is headed. As more lenders embrace digital lending software solutions and cloud-native platforms, disbursement delays are being eliminated by design.

Blockchain and Smart Contracts

One of the most exciting developments is the integration of blockchain. With smart contracts, funds can be auto-released the moment certain conditions are met—no human approval required. Plus, blockchain’s built-in audit trails help meet even the toughest compliance mandates without slowing things down.

This could be a breakthrough for regulated sectors like mortgage or education lending, where compliance and disbursement delays often go hand-in-hand.

Generative AI Takes the Wheel

AI is no longer just scoring risk—it’s now drafting contracts, summarizing credit reports, and even generating explanations for loan decisions. With GenAI embedded in loan servicing software and loan origination software, decision-making becomes faster, clearer, and easier to document.

A Unified Lending Ecosystem

We’re also seeing the rise of fully integrated ecosystems where CRM, LOS, LMS, KYC, payments, and compliance tools talk to each other effortlessly. These unified platforms will bring together financial software development services, investment software development solutions, and digital payment software solutions under one roof.

It’s not just about faster lending—it’s about smarter, more transparent, and scalable operations. And for lenders ready to invest, the future is already here.

Let’s Fix Loan Disbursement—For Good Together!

Let’s face it—slow loan disbursement is no longer just a borrower’s pain point. It eats into lender margins, delays revenue cycles, and puts customer loyalty at risk. In a world where “instant” is the norm, loan disbursement delays can cost you more than just time—they cost you business.

The good news? This isn’t a dead-end. With the right mix of digital loan disbursement tools, loan origination software, and loan servicing software, lenders can completely rethink how fast and smart their disbursement engine runs.

Whether you’re a CTO, Risk Head, or Lending Ops leader, now is the time to explore scalable, intelligent digital lending software solutions that put you ahead of the curve—not behind it.

Explore how Sigma Infosolutions can help streamline your lending operations. Need faster loan disbursement? Let’s talk technology.