Accelerating Fintech Scalability Through Cloud-Based Solutions

Speed, accuracy, the capability to offer seamless digital-first experiences, data-driven decision-making, and the ability to scale quickly have become the directives dictating an upward growth trajectory for finance enterprises. The technology spearheading such revolutionary changes, enabling massive success with financial digital transformation, is cloud-based solutions.

In the rapidly and ever-evolving industry riddled with tough competition, fintech businesses must be well-equipped to handle spikes in user activity or transaction volume. Failing to do so costs dearly, as they don’t just face performance issues but also tend to lose out on users. Hence, fintech enterprises that fail to adopt cloud-based solutions are at a higher risk of losing a competitive edge. Besides this, without cloud financial management software, fintech businesses are stuck in the rut of traditional systems, lacking flexibility, and are costly to maintain. Devoid of the speed that cloud platforms offer, financial enterprises like wealth management companies and fintech businesses will have to bid adieu to innovation and product development endeavors.

Additionally, traditional or legacy systems and on-premise infrastructure increase operational costs, and data silos and integration challenges also compromise regulatory and compliance posture. Hence, fintech businesses vying for scalability must embrace IT cloud solutions. In this blog, we explore why cloud based solutions and fintech scalability represent a match made in heaven for driving sustainable growth.

Cloud-based solutions: For a paradigm shift from traditional bookkeeping to modern finance

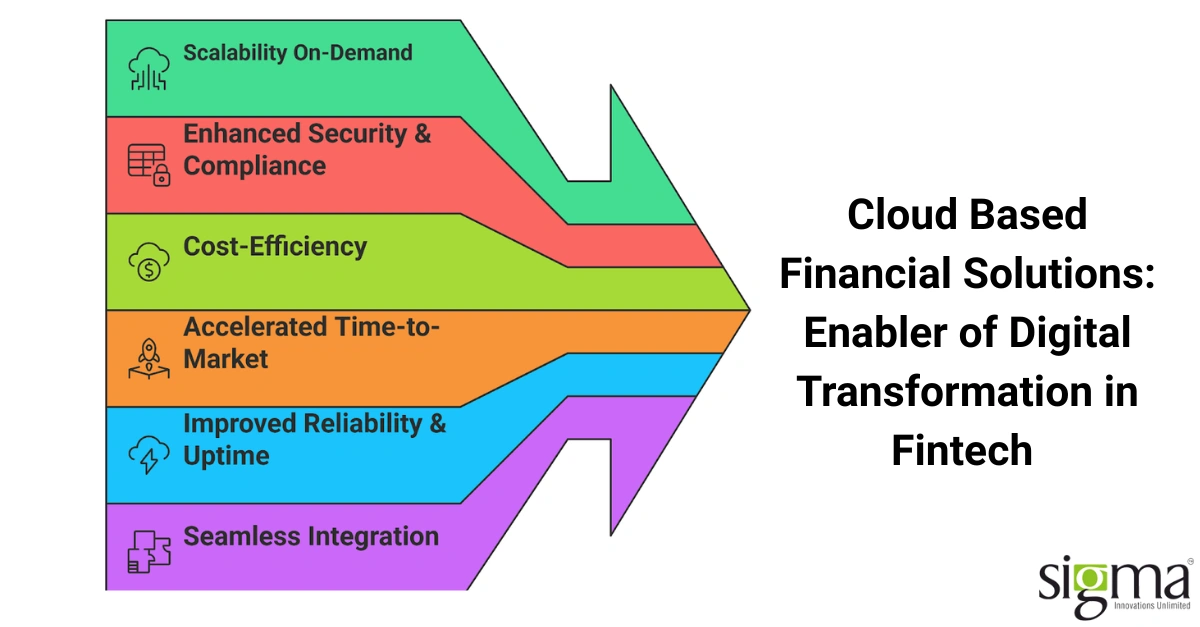

Cloud-based solutions have become a pivotal enabler for both fintechs and financial institutions. By aiding in digital transformation, cloud financial systems have become the backbone of scalable, resilient, and efficient financial enterprises. Here is an overview that entails why cloud-based financial solutions and fintech are truly a match made in heaven.

Let’s take a look at the benefits of cloud finance solutions:

1. Scale with ease

Financial enterprises are plagued by the problem of handling peak transaction volumes. Inability on their part results in missed transactional or business growth opportunities. Cloud-based financial solutions enable fintech companies to efficiently navigate through the complicated maze of fluctuating workloads and turn into a vantage point. By allowing businesses to scale their infrastructure as per user volumes, it fosters dynamic resource allocation, eliminating any further need for heavy upfront investment.

2. Robust security & compliance posture

A robust security and compliance posture is more than a regulatory checkbox—it’s a business advantage empowering fintechs to protect their user data and transactions vital for fostering trust among their clients. Secure cloud financial platforms offer enterprise-grade security features, facilitating encryption at rest and in transit, identification and access management (IAM), firewalls, and threat detection. Such security-grade features in cloud-based solutions equip fintechs to keep up with stringent security norms and overcome the threats of data security breaches. Besides this, cloud platforms offer real-time monitoring of threats, paving the way for quick detection and response to anomalies. Cloud business solutions come with compliance groundwork, as cloud providers maintain certifications for compliance standards (e.g., PCI DSS, ISO 27001, SOC 2, GDPR). Hence, fintechs worry less about audit burdens as they inherit compliance standards. Ensuring regular encryption backups and faster disaster recovery, cloud-based financial solutions minimize downtime, preventing data loss and eliminating operational glitches.

3. Cost effective

Cloud-based financial management software is easy on the pocket, as enterprises can pay as they go without the need for large capital investments in physical infrastructure. Via cloud-based solutions, businesses can optimize budgets and reinvest in product development or customer experience, or in endeavours crucial for their profitability, based on their operational needs.

4. Hit the market ahead of the curve

The ability to build products quickly on niche portfolios has taken centre stage. Hence, if fintech businesses are not moving at a hyper speed, they phase out. Financial enterprises cannot rely on standalone products to set themselves apart. The wave of commoditization in fintech has created intense competition where businesses need to innovate better and faster to stay ahead of the curve. However, with cloud-based solutions at their disposal, fintech companies can step up their game and secure a top spot in the markets with their ability to innovate and develop products. With pre-built tools, APIs, and development environments, cloud platforms enable faster product prototyping, testing, and deployment. It helps businesses to launch new features or services in a fraction of the time it would take with traditional systems.

5. Improved reliability & uptime

24/7 uptime is a non-negotiable aspect for organizations in the financial sector, as they are heavily reliant on it for constant transactions, customer interactions, and business continuity. This is crucial for fintech operations that rely on 24/7 uptime for transactions and customer interactions. This problem can be put to rest by leveraging cloud-based solutions. By leveraging cloud engineering that offers high availability, geographic redundancy, and automatic failover, fintech businesses can ensure that their services remain accessible even during outages.

6. Seamless Integration with digital ecosystems

Modern users expect unified experiences across banking, payments, investments, and even non-financial platforms. Integration ensures that services connect smoothly with others, delivering a frictionless user journey. Cloud accounting, web-based financial solutions, and cloud lending solutions easily integrate with third-party services, such as payment gateways, credit bureaus, CRMs, and analytics tools. It is creating a connected digital ecosystem, improving operational efficiency, and helping fintech businesses to provide a better customer experience. Cloud platforms are purpose-built for connectivity, making them an appropriate choice for fintechs operating on platform-based ecosystems. Cloud-based financial solutions allow businesses to partner with KYC/AML providers, ERPs, and more, facilitating a broader reach and value proposition.

7. Data-backed strategic decisions

Cloud financial systems’ powerful data capabilities across the enterprise empower fintechs to transform from reactive to proactive. Cloud-native infrastructure supports real-time data ingestion and processing, helping businesses to instantly track user behavior, monitor transaction patterns, detect anomalies and keep fraud risks at bay. As cloud-based solutions have integrated access to machine learning, AI, and big data tools, banking firms and wealth management firms can derive predictive insights from vast data sets for credit scoring, portfolio optimization, and faster, effective, data-backed decisions; offer tailored recommendations; and provide financial advice to users. Cloud-enabled dashboards and visualizations provide leadership teams with a single source of truth, helping them make well-informed decisions with confidence and agility.

8. Fostering a culture of innovation

The cloud isn’t just about hosting—it’s about accelerating what’s possible. As a powerful catalyst of innovation, cloud-based financial management software provides access to advanced technologies and scalable infrastructure for fintechs and digital lenders. Without any upfront investments or any built-out infrastructure, cloud solutions help businesses of every scale access AI, machine learning, blockchain, and advanced data analytics. Besides democratizing innovation, AI and cloud synergy in finance create a level playing field for businesses. Additionally, cloud-based solutions’ pay-as-you-go approach creates an ambient sandbox for experimentation, which is a safe and cost-effective space to innovate for wealth management firms opting for robo-advisory powered by AI.

Owing to the vantage points, the transition to cloud in financial services is becoming imperative for businesses looking to scale their business. However, is scalability important in the ever-evolving fintech ecosystem and what are the unique capabilities it can bestow businesses operating in the financial domain?

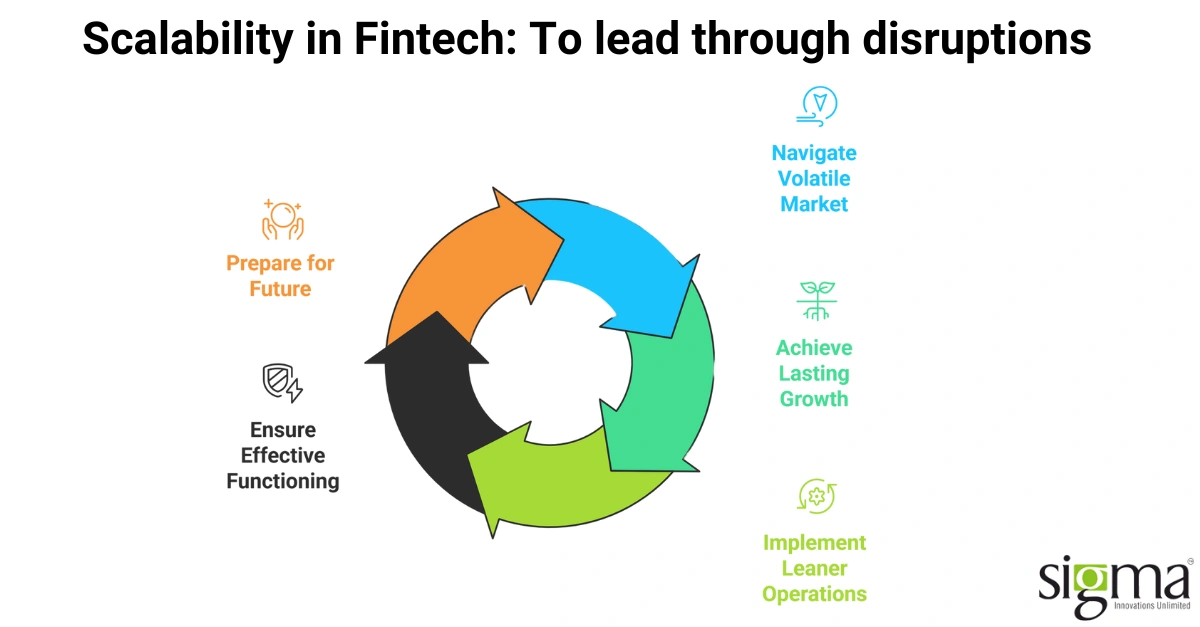

Accelerating Scalability Through Cloud-Based Solutions: To lead through disruption

Scalability in fintech has transitioned from nice to have to a must have. Rapid digital transformation, rising customer expectations, and volatile market conditions make scalability a necessity. Hence, scalable systems powered by business cloud solutions are key to maintaining agility, resilience, and growth in dynamic market conditions.

To navigate through a volatile market

Cloud-enabled scalable infrastructure brings in agility, allowing fintech companies to dynamically adjust capacity-scaling up to meet spikes in demand or scaling down during slow periods without compromising service quality or performance. This elasticity is crucial for maintaining stability and responsiveness in uncertainty.

For business growth that lasts

With scalable cloud-based financial solutions, digital lenders and fintech companies can grow in lockstep with their business initiatives, including new product launches or setting foot in different markets. Eliminating the need for costly system overhauls and supporting smooth onboarding of users, services, and geographies, scalability via cloud-based solutions promotes growth that lasts long.

To achieve leaner operations

Scalability via cloud-based solutions also drives cost-effectiveness. Owing to this, fintechs can optimize resource usage, automate workloads, and reduce IT overhead without having to compromise on maintaining performance, security, and compliance standards.

Effective functioning even under pressure

With cloud-enabled scalable systems, digital lending businesses or fintech companies can steer away from service interruptions or performance degradation that results in negative outcomes. Cloud-based scalable systems are high on efficiency as they are designed to handle surges and maintain uptime—for an uninterrupted, reliable service delivery even under pressure.

Preparing for what’s next

Scalable cloud-based architectures prepare fintech for the future, whether it’s the integration of emerging technologies like AI or blockchain, responding to regulatory shifts, or adapting to changing customer behavior.

Scalability via cloud business solutions empowers fintechs to stay agile, competitive, and resilient—positioning them to not only survive market disruption but instead lead through it.

What Are Cloud-Based Financial Solutions?

Cloud, where everything clicks—faster, safer, and smarter!

Software and services hosted on remote servers and accessed via the Internet are referred to as cloud-based solutions. Cloud-based financial solutions are designed specifically to support various financial operations. Deviating from the traditional on-premise infrastructure, cloud-based financial solutions leverage cloud computing technology to deliver scalable, flexible, and cost-effective financial tools.

Cloud-based financial solutions encompass robust applications, including loan origination, payment processing, risk management, compliance monitoring, customer relationship management (CRM), and data analytics. Operating via cloud-based financial solutions, enables fintech enterprises to streamline workflows, enhance collaboration, improve data security, and accelerate innovation.

By operating in the cloud, via these solutions financial institutions and fintech companies efficiently streamline workflows, enhance collaboration, improve data security, and accelerate innovation. With cloud business solutions, fintechs and financial institutions can ditch the chaos, sync up like a dream team, keep data safer than secrets, and fast-track innovation like it’s on rocket fuel!

Salient features of cloud-based financial solutions:

- Accessibility: Access to systems anytime, anywhere, via any internet-enabled device.

- Scalability: Adjust resources on-demand to meet changing business needs.

- Cost Efficiency: Pay-as-you-go pricing concepts for cost-effectiveness.

- Security: Advanced security protocols and regular updates for data protection and regulatory compliance.

- Integration: Hassle-free connectivity with digital platforms and APIs for seamless workflows.

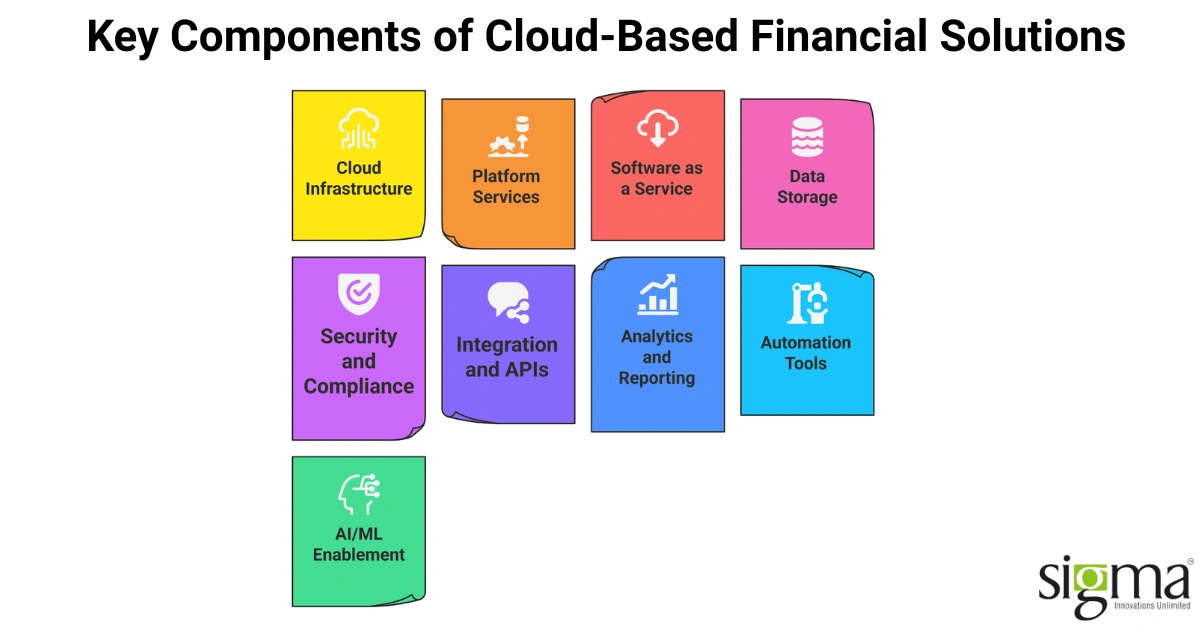

Cloud finance deconstructed: Key Components of Cloud-Based Financial Solutions

What Makes Cloud-Based Financial Solutions Tick?

Cloud-based financial solutions are built on several essential components that work in synergy to deliver secure, scalable, and efficient financial services.

1. Cloud Infrastructure (IaaS): A foundational layer providing virtualized computing resources over the internet, including servers, storage, and networking, allowing fintech companies to rent these resources on demand.

2. Platform Services (PaaS): A framework for developers to build, deploy, and manage applications without dealing with the underlying infrastructure. With tools for application development, testing, and integration, it accelerates innovation and reduces time-to-market.

3. Software as a Service (SaaS): A ready-to-use financial application hosted in the cloud, including loan origination systems, payment processing platforms, and customer relationship management (CRM) tools, which can be accessed through web browsers or APIs, on a subscription basis.

4. Data Storage and Management: Scalable storage systems to securely store structured and unstructured financial data, ensuring high availability, with backup and disaster recovery capabilities.

5. Security and Compliance: A critical component involving encryption, identity and access management, intrusion detection, and regular audits. Hybrid cloud security solutions with compliance modules help fintechs adhere to regulations and other industry standards.

6. Integration and APIs: APIs and integration tools enable seamless connectivity with other systems, third-party services, and legacy applications for smooth data exchange and unified workflows.

7. Analytics and Reporting: Embedded analytics platforms with real-time data analysis, risk assessment, fraud detection, and performance monitoring empower financial firms to make informed decisions.

8. Automation & Orchestration Tools: Workflow automation (processes such as loan approvals, customer onboarding, and compliance checks), DevOps pipelines, and infrastructure orchestration to streamline operations and deployment cycles.

9. AI/ML Enablement: Tools that support machine learning models, AI-driven decision-making, personalization, and fraud detection.

How is the cloud-based financial solution market faring?

Fintech businesses are adopting cloud-based financial solutions vigorously, going by the numbers! The global cloud-based financial solution market, valued at USD 160.9 billion, is expected to grow at a CAGR of 10.8% by 2033 to reach USD 405.1 billion.

Cloud-Based Financial Solutions Vs Traditional On-Premise Systems

Traditional on-premise systems offer direct control, but they often bring higher costs, limited scalability, and sluggish deployment. However, cloud-based financial solutions offer the flexibility, speed, and cost-efficiency that fintechs and financial institutions need to make a mark in the fast-paced, digital-first landscape.

Difference Between Cloud-Based Financial Solutions and Traditional On-Premise Systems

- Aspect

- Deployment

- Scalability

- Cost Structure

- Maintenance

- Accessibility

- Implementation Speed

- Upgrades & Updates

- Security & Compliance

- Disaster Recovery

- Flexibility

- Cloud-Based Financial Solutions

- Hosted on remote servers and accessed via the internet

- Highly scalable; resources can be adjusted on demand

- Pay-as-you-go subscription or usage-based pricing

- Managed by the cloud provider with regular updates

- Accessible anywhere with internet connection

- Rapid deployment, often within days or weeks

- Automatic and continuous updates pushed by providers

- Cloud providers offer advanced security and compliance frameworks

- Built-in backup and recovery options with redundancy

- Easily integrates with other cloud services and APIs

- Traditional On-Premise Systems

- Installed locally on company-owned hardware and servers

- Limited scalability; requires purchasing and installing new hardware

- High upfront capital investment for hardware and licenses

- Managed in-house; requires dedicated IT staff for upkeep and troubleshooting

- Access limited to physical location or VPN setup

- Longer setup time due to hardware installation and configuration

- Manual updates; often infrequent and resource-intensive

- Security depends on in-house IT capabilities and resources

- Requires separate backup solutions and disaster recovery planning

- Integration can be complex and costly with legacy systems

Cloud-Based Solutions at Work: What’s Delivering ROI in Finance

Cloud-based financial solutions are making their presence felt across industries, Here is an overview of some use cases.

1. Fintech

- Global expansion: Leveraging cloud infrastructure, financial infrastructure platforms are providing secure payment processing for global businesses. By handling massive transaction volumes during peak periods devoid of downtime, they are forging ahead into new markets with minimal infrastructure overhead.

- Reimagining investment for everyone: Commission-free trading platforms are leveraging cloud-based financial solutions to scale user onboarding and trading volume. Bestowed with cloud agility, the platform effectively manages spikes in user activity during market volatility while maintaining system reliability and security.

Robo advisory: An opportunity or a threat for fintech? Read the blog to learn more

2. eCommerce

Streamlining Payments & Fraud: eCommerce platforms are integrating cloud-based digital payment gateways with AI-powered analytics that automatically scale during high-traffic sales events for seamless transactions and enhanced fraud monitoring.

3. Manufacturing

Quick vendor and supply chain payments: Manufacturers use cloud finance software to automate supplier invoicing, payments, and credit management, reducing processing times and improving cash flow management.

4. Multi-Location Retail

Unified Reporting & Cash Management: Retail chains are embracing cloud-based ERP and cloud financial management software solutions to consolidate transactions across stores and avail real-time financial insights for faster, data-backed decision-making.

5. Healthcare

Billing & Claims Processing: Healthcare providers are utilizing cloud financial platforms to automate complex billing workflows, ensure data security, and speed up reimbursement cycles.

6. Real Estate

Escrow & Mortgage Management: Real estate firms are leveraging cloud-based platforms for secure, compliant handling of escrow funds and faster mortgage approvals with integrated digital signatures and document management.

To know how cloud-based solutions drive scalability and efficiency in financial operations, read our success story – Scaling loan processing with microservices architecture

Behind the Cloud-based solution: Risks that must be tackled

Despite offering flexibility, scalability and other benefits for fintech companies, cloud-based financial solutions come with their own set of challenges. They include the following:

- Data Security & Privacy—Protecting sensitive financial data with encryption and access controls is essential.

- Regulatory Compliance—Adhering to region-specific financial regulations and data residency laws.

- Legacy System Integration—Ensuring smooth connectivity between cloud platforms and existing infrastructure.

- Vendor Lock-In—Limited flexibility and potential risks tied to long-term provider dependency.

- Performance & Latency—Maintaining uptime and low latency for real-time financial operations.

- Cost Management—Monitoring and optimizing ongoing cloud expenses to avoid overspending.

- Skill Gaps—Need for cloud-proficient teams and strong change management practices.

- Data Governance—Defining clear policies on data ownership, control, and accountability.

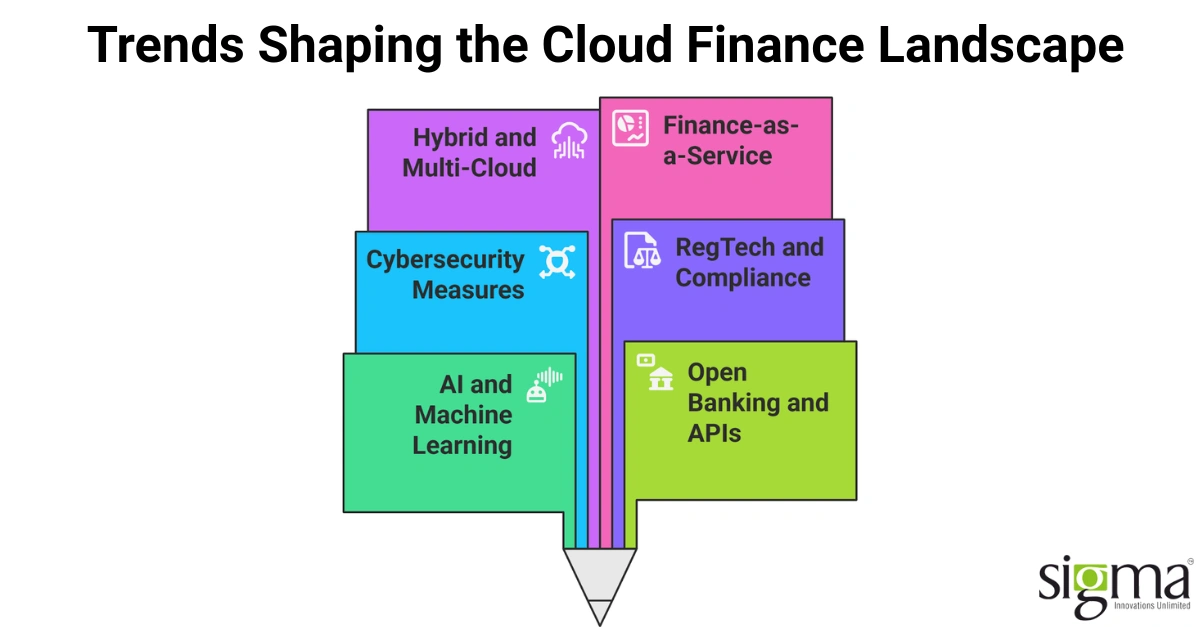

Key Trends redefining what’s possible in the Future of Finance in the Cloud

Driven by emerging technologies and evolving customer expectations accelerated by the cloud, the financial ecosystem is undergoing a massive change. AI-powered analytics are enabling smarter, real-time decision-making, paving the way for strategic growth in the financial sector. Trends like embedded finance are blurring the lines between traditional institutions and digital platforms, and blockchain integration is bringing the focus on transparency and trust across transactions. The rise of no-code/low-code financial tools is democratizing application development, allowing businesses to build and adapt workflows without relying on IT. All these trends, in confluence with cloud-native infrastructures, are not just transforming how finance operates—they’re redefining what’s possible.

1. AI and Machine Learning Integration: Embedding AI and machine learning into cloud platforms to enhance fraud detection, credit scoring, customer personalization, and risk management.

2. Open Banking and API Ecosystems: Cloud computing in banking is fueling the rise of open banking, where APIs allow secure data sharing between banks, fintechs, and third-party providers fostering innovation and enabling businesses to offer better services to their clients.

3. Enhanced Cybersecurity Measures: Zero-trust architectures, advanced encryption, and continuous security monitoring powered by AI, are enhancing compliance and resilience against cyber threats.

4. RegTech and Automated Compliance: Incorporating Regulatory technology (RegTech) solutions in cloud-based platforms to automate compliance monitoring, reporting, and auditing to reduce manual errors and ensure adherence to compliance.

5. Blockchain and Distributed Ledger Technologies: Integration of blockchain into cloud finance systems to increase transparency, reduce settlement times, and streamline cross-border payments and smart contracts.

6. Hybrid and Multi-Cloud Strategies: Taking a hybrid and multi-cloud route to optimize cost, performance, and risk management creates ample scope to leverage the strengths of different cloud providers while maintaining data sovereignty.

7. Finance-as-a-Service (FaaS): A flexible, cloud-based model FaaS delivers financial operations—such as accounting, invoicing, payroll, and reporting—as on-demand services. Owing to this, businesses can outsource core finance functions through scalable platforms, reduce overhead, and gain real-time insights to focus on strategic growth.

8. No-code/low-code financial tool: No-code/low-code financial tools enable fintech businesses to build, customize, and automate workflows without deep programming skills. They accelerate solution development, reduce IT dependency, and enable faster adaptation to changing business needs.

From Legacy to Scalable with Sigma’s Cloud-Based Financial Solutions

Sigma Infosolutions is architecting scalable finance in the cloud era! It is empowering fintechs and financial institutions to modernize their operations through cloud-based, scalable finance solutions. From bespoke cloud strategy to consulting, Sigma offers solutions and services for migration from legacy systems to cloud-native platforms like AWS, Azure, or GCP. Designing and building custom financial applications—from digital payments to forecasting tools—on secure, scalable architectures using microservices and containerization. Sigma’s solutions ensure seamless integration with FinTech APIs, banking platforms, and ERP/CRM systems while maintaining robust data security and regulatory compliance. With Sigma’s development services by your side, financial enterprises can rest assured about real-time analytics for smarter decision-making, continuous cloud performance and cost optimization. The result: faster time to market, reduced IT overhead, and the agility to scale financial operations globally and securely.

An overview of Sigma Infosolutions’ cloud solution capabilities

1. Cloud Strategy & Consulting

To transition from legacy systems to cloud-native platforms with a tailored cloud strategy:

2. Custom Cloud-Based Financial Solutions

Builds secure, scalable cloud applications for

- financial reporting & analytics

- Loan origination & management

- Digital payments & wallets

- Budgeting, forecasting, and cost optimization tools

3. Scalable Architecture for Growth

Designs systems using microservices and containerization (e.g., Kubernetes) for seamless scaling and faster deployment and integration cycles

4. Integration with FinTech APIs & Platforms

Enables connectivity with payment gateways, banking APIs, ERP and CRM tools

5. Data Security & Compliance

End-to-end encryption, role-based access controls and compliance with regulations like PCI DSS, SOC 2, GDPR

6. Real-Time Analytics & Reporting

Utilizing cloud-native tools (like Power BI) for real-time visibility into key metrics, predictive modeling and trend analysis

7. Cloud Optimization

Performance monitoring post-deployment, and cloud infrastructure tuning

Wrapping up:

The rapidly evolving financial landscape makes cloud-based solutions imperative for scalability, agility, and innovation. Cloud solutions for fintech companies enable faster growth, enhanced security, and seamless integration with emerging technologies. While challenges like security and compliance remain, the benefits far outweigh the risks, making cloud adoption a strategic imperative. If you are a fintech CTO or CFO looking to future-proof your business to stay ahead in a competitive market, scalable finance isn’t just the future; it’s happening now!

With Sigma Infosolutions as your strategic growth partner, you can avail yourself of fintech solutions to scale your platforms and shorten your development cycles for positive outcomes.