How RegTech Is Transforming the Financial Services Industry

Key Takeaways:

- RegTech is the seatbelt for financial institutions—keeping businesses safe as they accelerate through fast-changing regulations.

- Think of compliance automation as a co-pilot, not a copilot—it doesn’t just warn of turbulence; it helps chart smoother, faster routes.

- Adopting RegTech is like switching from a flip phone to a smartphone—suddenly, everything from risk checks to reporting is smarter, faster, and always connected.

For financial institutions, navigating compliance is like a high-stakes game of hitting a moving target. Regulations keep changing, costs keep rising, and manual processes often slow financial institutions down. This is where RegTech (Regulatory Technology) steps in—a fast-growing field that uses technology to make compliance smarter, faster, and more cost-effective.

So why does RegTech matter now? Financial services are under pressure from multiple directions: stricter data privacy rules, growing cybersecurity risks, global reporting standards, and increasing penalties for non-compliance. Traditional compliance models—often paper-heavy, labor-intensive, and reactive—can’t keep up. They drain resources, create inefficiencies, and make it harder for institutions to scale.

That’s why RegTech compliance automation is gaining traction. Think of it as shifting from driving a manual car in heavy traffic to using an AI-powered navigation system that predicts the best routes, avoids roadblocks, and gets you to the destination faster. With automated regulatory compliance, banks, fintechs, and digital lenders can streamline reporting, monitor risks in real time, and ensure regulatory accuracy—all while reducing costs.

At Sigma Infosolutions, we believe compliance shouldn’t be a burden—it should be a competitive edge. With our expertise in AI, cloud, BI & analytics, and custom financial software development services, we help financial institutions implement regtech solutions that bring efficiency, transparency, and agility into their compliance processes. For us, it’s not just about keeping up with regulations—it’s about enabling financial services players to move ahead with confidence.

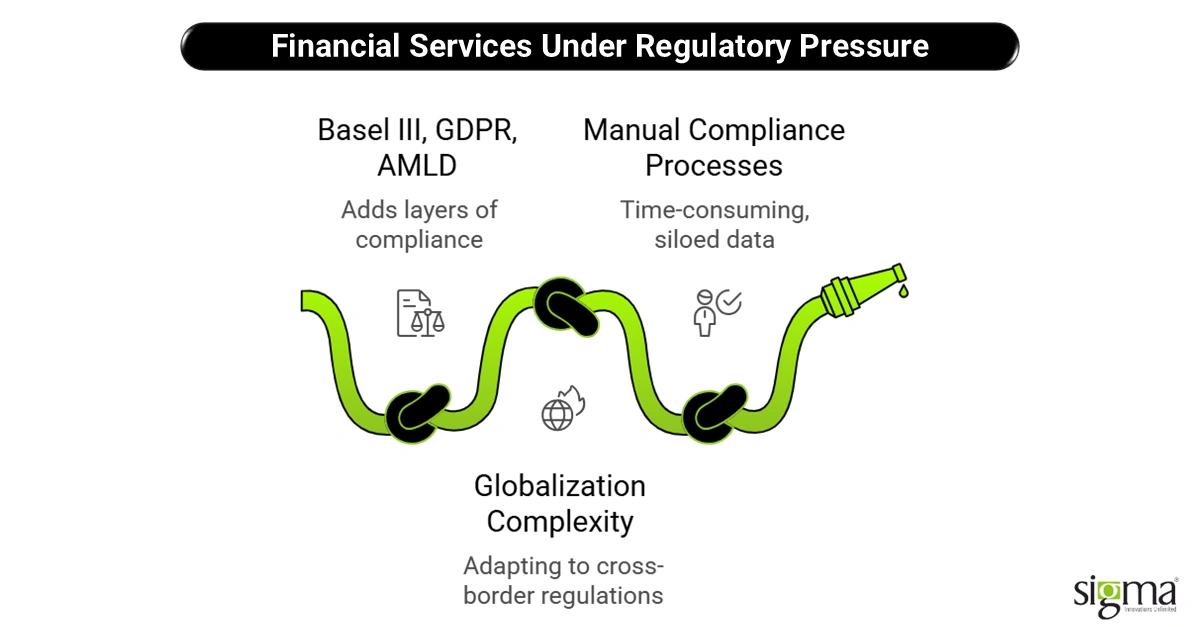

The Regulatory Pressure on Financial Services

The financial services industry today is navigating one of the most complex regulatory environments in history. From Basel III’s capital requirements and GDPR’s strict data privacy rules to AMLD’s anti-money laundering directives and the Dodd-Frank Act in the U.S., the list keeps growing. Each new rule adds layers of compliance that financial institutions must track, interpret, and implement with precision.

The costs of compliance tell the real story. According to Deloitte, retail and corporate banks now spend over 60% more on compliance than they did before the last financial crisis. Meanwhile, fines for non-compliance in the U.S. alone have crossed tens of billions of dollars in recent years—proof that the stakes are higher than ever.

Globalization adds another twist. Cross-border regulations, the rise of digital assets, and new frameworks for ESG (Environmental, Social, and Governance) reporting have introduced an extra layer of complexity. What works in one jurisdiction may not be enough in another, leaving institutions scrambling to adapt.

The pain points are clear: manual compliance processes are time-consuming, siloed data creates blind spots, and traditional methods make organizations vulnerable to audit risks. For financial leaders, this isn’t just a regulatory headache—it’s a major roadblock to innovation and growth. That’s why the demand for regtech solutions and compliance automation has never been greater.

What Is RegTech? Breaking Down the Concept

RegTech (Regulatory Technology) is the use of modern technology—AI, cloud, data analytics, and automation—to simplify and strengthen how financial institutions manage compliance. Instead of relying on manual checks, spreadsheets, and endless paperwork, RegTech enables automated regulatory compliance that is faster, smarter, and more cost-efficient.

It’s important to note that RegTech isn’t the same as FinTech. While FinTech focuses on creating innovative financial products and customer experiences, RegTech is more about the backbone—ensuring those products and institutions stay within the rules. In short, FinTech builds the future of finance, and RegTech makes sure it’s safe and compliant. They complement each other rather than compete.

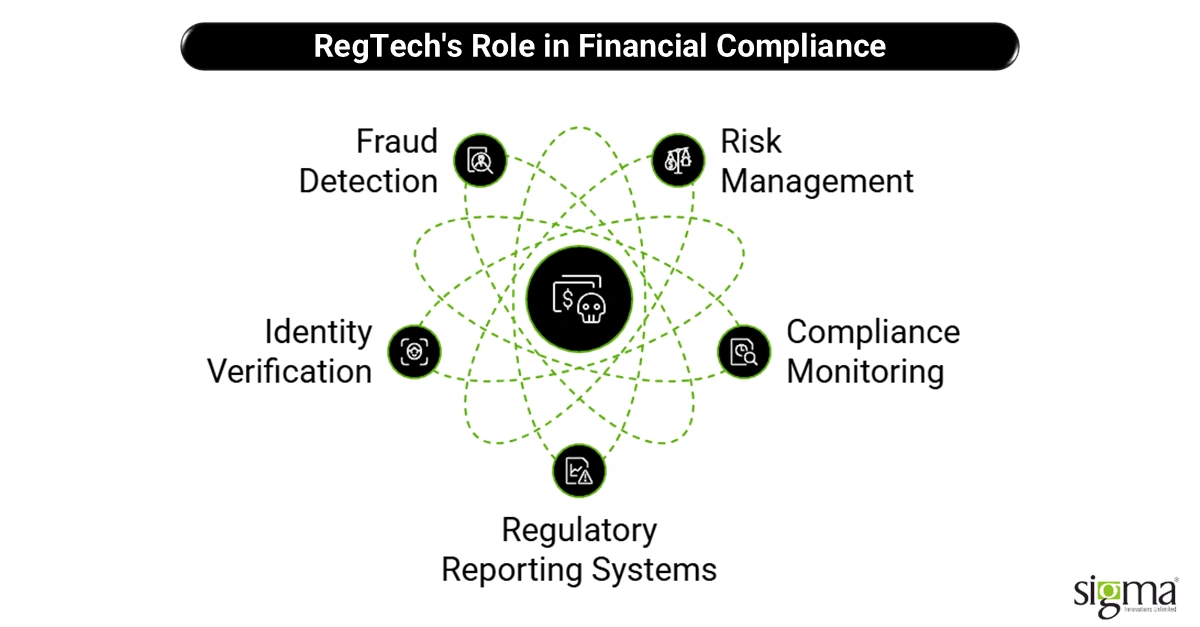

RegTech covers a wide scope of solutions, including:

- Risk management – identifying, assessing, and reducing financial and operational risks.

- Compliance monitoring – automating routine compliance checks and reporting.

- Regulatory reporting systems – simplifying how data is gathered and submitted to regulators.

- Identity verification – strengthening KYC (Know Your Customer) and AML (Anti-Money Laundering) processes.

- Fraud detection – using advanced analytics to catch suspicious activity before it causes damage.

With its ability to deliver regtech compliance across multiple areas, RegTech has become a must-have in today’s financial ecosystem.

Also Read: Reimagining Digital Payment Solutions in a Multi-Channel World

Market Growth and Adoption Trends

The global RegTech market is on fire. Valued at around USD 17.0 billion, it’s expected to soar to USD 70.6 billion by 2030, growing at about 23% CAGR.

North America currently leads with over 30% of global revenues, while Asia Pacific is catching up fast—expected to command up to 28–30% by 2026. Banks are the fastest adopters, followed closely by lending, insurance, and wealth management.

On the investment side, capital is flowing into RegTech startups. For example, leading firms are raising multi-million rounds—from AI-powered due diligence platforms to identity-verification tools—reflecting strong investor confidence and the rising profile of regtech solutions.

At Sigma Infosolutions, we see this as more than just a trend—it’s a now-or-never moment for financial institutions. With mounting regulatory complexity and rising costs, compliance automation isn’t a luxury—it’s a business imperative. That’s why our financial software development services and risk and compliance software, powered by AI, cloud, and analytics, are the right tools at the right time to transform compliance from a burden into a competitive advantage.

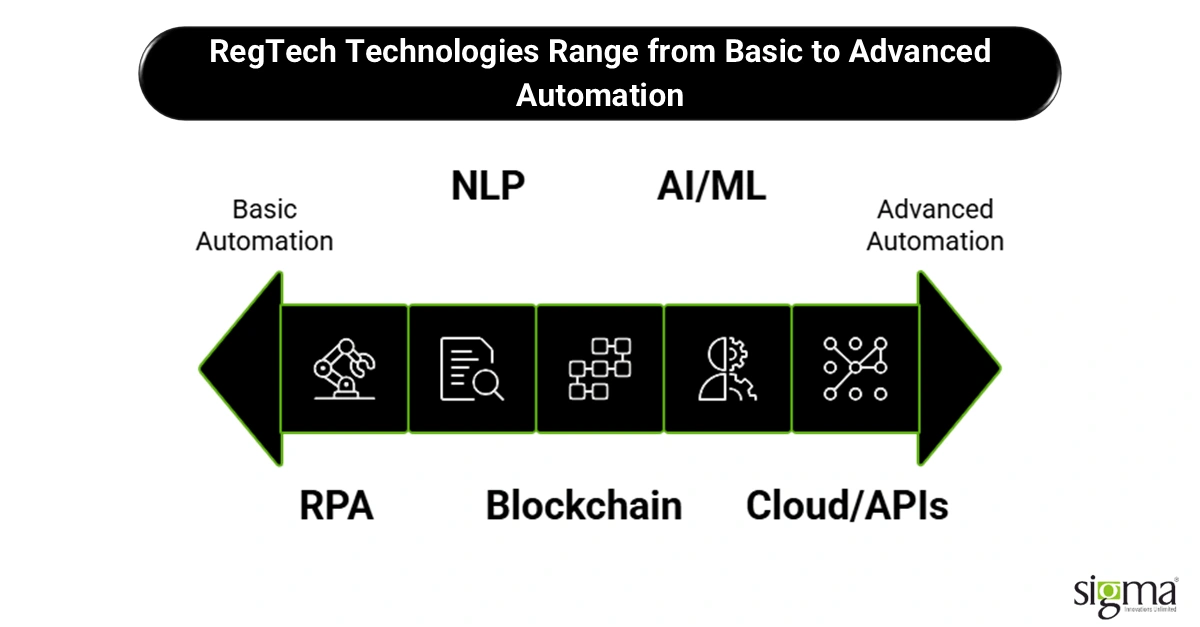

Key Technologies Powering RegTech

What makes regtech solutions so powerful isn’t just the idea of automation—it’s the cutting-edge technologies working behind the scenes. Each one plays a role in turning compliance from a reactive, manual process into a proactive, streamlined system.

- Artificial Intelligence (AI) & Machine Learning (ML): AI and ML sit at the heart of modern risk and compliance software. They enable real-time monitoring of transactions, detect anomalies, and predict potential risks before they escalate. At Sigma Infosolutions, our AI and BI & Analytics services empower financial institutions to deploy smarter systems that learn continuously and improve compliance accuracy over time.

- Natural Language Processing (NLP): Regulatory documents can be dense and confusing. NLP technology parses complex regulations and translates them into structured, actionable insights. This helps institutions implement regtech compliance faster. With our custom development expertise, we build solutions that integrate NLP into compliance workflows for greater clarity and speed.

- Blockchain & Smart Contracts: Blockchain creates tamper-proof audit trails and enables transparent, secure data exchanges. Smart contracts automate rule enforcement, reducing the scope for human error. Our team leverages blockchain to design regulatory compliance solutions that deliver trust and accountability at every step.

- Robotic Process Automation (RPA): Think of RPA as the tireless assistant that handles repetitive compliance tasks—reporting, data entry, document validation—freeing teams to focus on strategic decision-making. Sigma integrates RPA into compliance infrastructures to deliver efficiency at scale.

- Cloud & APIs: Regulations evolve, and compliance systems must scale quickly. Cloud platforms and API-based integrations give financial institutions the flexibility they need. With our AWS Cloud expertise, we design scalable API-based RegTech integrations that future-proof compliance systems.

In short, these technologies don’t just solve today’s challenges—they create a compliance infrastructure that adapts as regulations change. At Sigma Infosolutions, we bring these tools together through financial software development services to help financial institutions turn compliance into a strategic advantage.

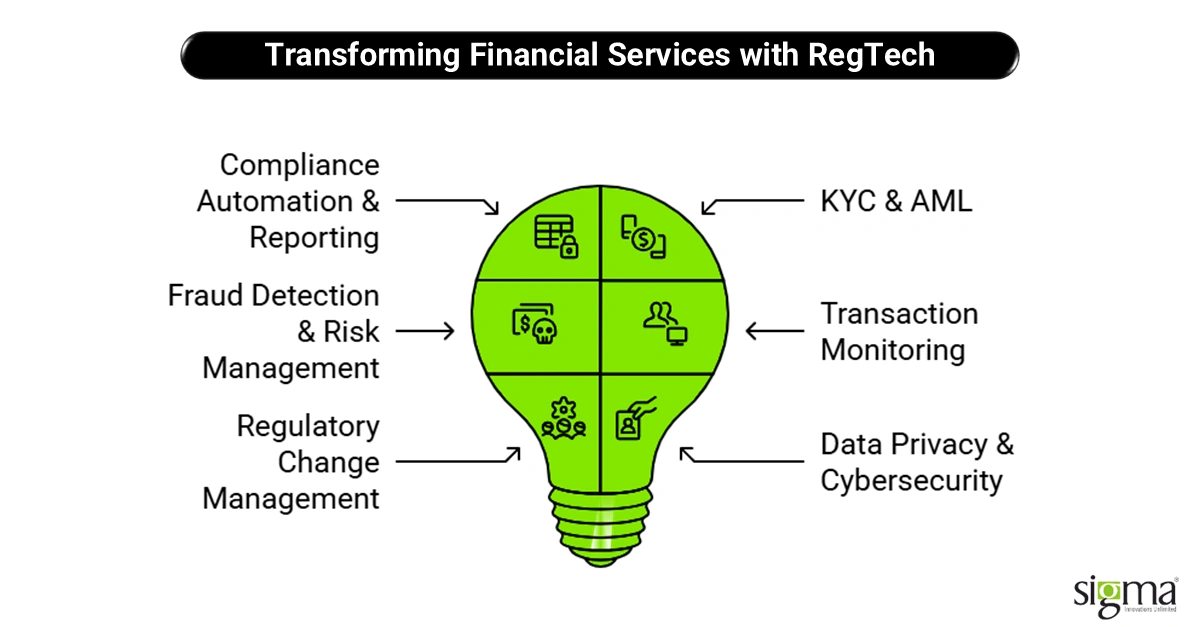

How RegTech Is Transforming Financial Services (Use Cases)

The promise of regtech solutions isn’t abstract—it’s already reshaping how financial services operate. From banks to digital lenders, real-world applications are proving how compliance automation can transform compliance from a bottleneck into a growth enabler.

- Compliance Automation & Reporting: Manual reporting often leads to delays and errors that can result in penalties. With automated regulatory compliance, institutions can streamline data collection, ensure accuracy, and meet filing deadlines consistently. Many U.S. banks now use AI-driven tools to automate regulatory reporting systems, cutting reporting times by up to 60%. Sigma Infosolutions helps clients integrate these tools through financial software development services tailored to their regulatory needs.

- KYC & AML: Verifying customer identity and screening for money laundering risks traditionally takes days. RegTech speeds up Know Your Customer (KYC) and Anti-Money Laundering (AML) checks through AI and digital lending compliance software, reducing onboarding to minutes while improving accuracy.

- Fraud Detection & Risk Management: Predictive analytics and machine learning allow institutions to flag suspicious activities before they turn into costly breaches. For instance, some U.S. credit unions deploy credit risk compliance platforms to proactively detect anomalies. Sigma supports such use cases with AI-powered risk and compliance software.

- Transaction Monitoring: Real-time transaction monitoring solutions powered by AI give compliance teams instant visibility into unusual activity. This not only prevents fraud but also helps meet regulators’ expectations for ongoing monitoring.

- Regulatory Change Management: Laws evolve quickly—think about the constant updates around data privacy, ESG reporting, or digital assets. RegTech platforms powered by API-based integrations make it easier to adapt compliance processes without overhauling existing systems.

- Data Privacy & Cybersecurity: With sensitive financial and customer data at stake, RegTech strengthens defenses against breaches. Tools that automate privacy compliance checks and enforce cybersecurity protocols reduce both risk and reputational damage.

These applications aren’t just theory. U.S. financial institutions—from large banks to fintech startups—are already adopting RegTech for efficiency, cost savings, and a stronger compliance posture.

At Sigma Infosolutions, we see ourselves as enablers of this transformation. By combining automation, BI & analytics, AI-driven compliance, and cloud infrastructure, we deliver regulatory compliance solutions that help institutions stay ahead of the curve, minimize risks, and focus on growth.

Benefits of RegTech Adoption for Financial Institutions

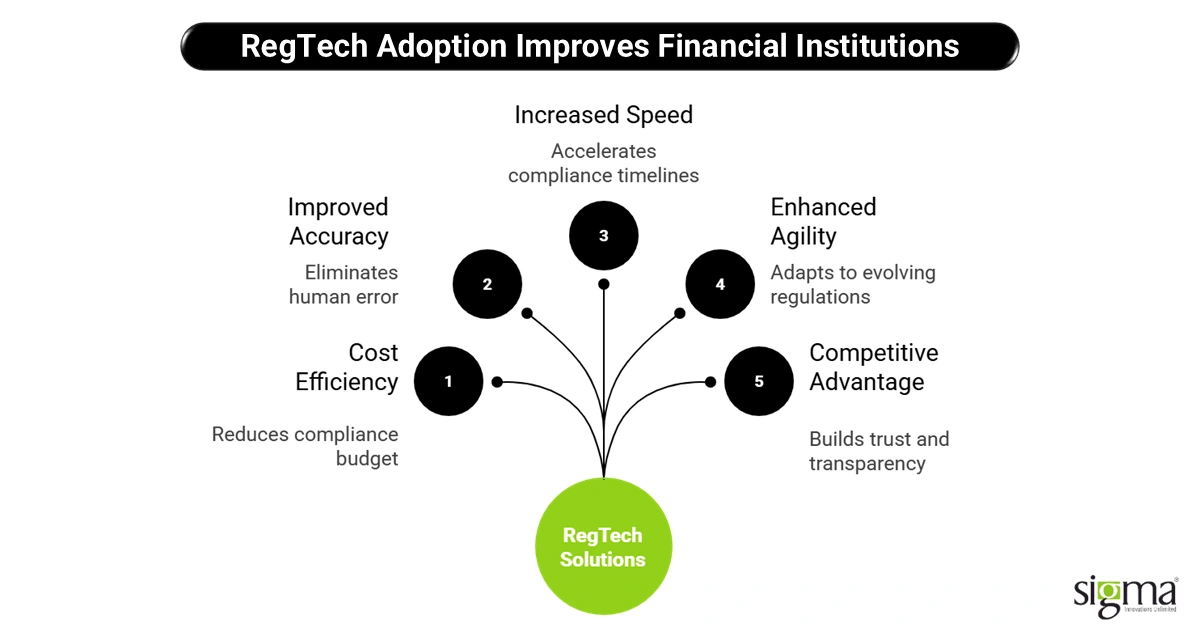

For financial institutions, the shift to regtech solutions is more than just a compliance upgrade—it’s a strategic move that drives measurable business value. The benefits extend far beyond avoiding fines and staying “in the clear.”

- Cost Efficiency: Traditional compliance teams often consume millions in annual budgets. By leveraging compliance automation and risk and compliance software, institutions can cut manual effort, reduce headcount needs for repetitive tasks, and bring compliance costs down significantly.

- Accuracy: Manual processes are prone to errors—one missed entry can trigger costly penalties. Automated regulatory compliance improves accuracy by eliminating human error and standardizing reporting processes.

- Speed: From customer onboarding to filing regulatory reports, RegTech accelerates timelines. Compliance cycles that used to take weeks can now be handled in hours, creating agility without sacrificing thoroughness.

- Agility: As regulations evolve—whether around data privacy, digital assets, or ESG disclosures—financial institutions using regulatory technology can adapt quickly. Cloud-based platforms and API-based RegTech integrations mean updates can be rolled out seamlessly, without system overhauls.

- Competitive Advantage: Customers, investors, and regulators value transparency. Institutions that use advanced regulatory compliance solutions not only avoid penalties but also build trust, positioning themselves as leaders in responsible finance.

- ROI on RegTech Investments: The payoff is clear. Reduced compliance costs, fewer fines, faster operations, and improved trust all translate into a stronger bottom line. That’s why leading banks, fintechs, and insurers are making RegTech a core part of their digital strategy.

At Sigma Infosolutions, we help institutions capture these benefits by delivering financial software development services that bring compliance automation, AI-driven insights, and scalability into one seamless framework.

Also Read: Power Up Your Platform with a Digital Payment Solution Built for You

Challenges and Barriers to RegTech Adoption

While the potential of regtech solutions is clear, adoption isn’t always smooth sailing. Many financial institutions face real barriers when trying to implement compliance automation at scale.

- Integration Challenges: Legacy systems in banks and insurers weren’t built with modern regulatory technology in mind. Integrating new platforms often requires complex workarounds, creating delays and added costs.

- Data Privacy and Security Concerns: RegTech relies on sensitive financial and customer data. Institutions worry about storing this information in the cloud, especially when global regulations like GDPR and CCPA come into play.

- High Initial Setup Costs: While the long-term ROI is strong, the upfront investment for risk and compliance software can feel daunting—particularly for mid-sized lenders and regional banks.

- Regulatory Skepticism: Not all regulators are quick to embrace new tech. Some remain cautious about automation, AI, or blockchain in compliance, making institutions hesitant to fully commit.

- Skills Gap: Managing automated regulatory compliance requires talent skilled in AI, analytics, and cybersecurity. Many organizations lack these resources internally.

At Sigma Infosolutions, we help financial institutions overcome these barriers. Our financial software development services are tailored to fit existing infrastructures, with scalable cloud solutions that ensure data security, cost efficiency, and regulatory trust. By combining AI, BI & Analytics, and custom development, we enable institutions to adopt RegTech confidently—without disrupting business continuity.

The Future of RegTech: Emerging Trends

The future of regtech in financial services looks even more transformative than today’s landscape. With regulations growing more complex, institutions are turning to smarter, predictive, and scalable tools to stay ahead.

- Predictive Compliance: AI and predictive analytics are moving compliance from reactive to proactive. Instead of flagging issues after they occur, future risk and compliance software will predict risks in advance and recommend preventive actions.

- RegTech-as-a-Service (RaaS): Cloud-based compliance platforms are gaining traction. Offering regtech compliance on-demand makes adoption easier, scalable, and cost-efficient—especially for mid-tier financial institutions.

- Integration with Open Banking & Digital Assets: As Open Banking expands and digital assets gain regulatory clarity, RegTech will play a central role in ensuring secure data sharing, identity verification, and automated regulatory compliance across ecosystems.

- ESG Compliance Tracking: With investors and regulators demanding transparency, regulatory compliance solutions will extend into ESG performance—tracking everything from carbon footprints to diversity metrics.

- Global Harmonization: Cross-border regulatory collaboration is on the horizon. This opens opportunities for standardized compliance frameworks, streamlining operations for international players.

At Sigma Infosolutions, we believe the next five years will see RegTech evolve from a “compliance tool” into a strategic growth enabler. By combining AI, BI & Analytics, AWS Cloud, and financial software development services, we’re helping institutions not just keep up with regulations but turn compliance into a competitive advantage.

Final Thoughts

In today’s regulatory landscape, RegTech is no longer optional—it’s mission-critical. Financial institutions that still rely on manual processes are at risk of higher costs, increased errors, and missed opportunities. By contrast, those embracing compliance automation are cutting costs, improving accuracy, and building resilience for the future.

The next frontier in operational efficiency lies in automated regulatory compliance—where AI, analytics, and cloud technologies work together to create smarter, faster, and more transparent compliance systems. Beyond avoiding fines, this shift enables institutions to build customer trust, innovate with confidence, and gain a real competitive edge.

At Sigma Infosolutions, we specialize in helping financial institutions harness the power of financial software development services, risk and compliance software, and regtech solutions. With deep expertise in AI, BI & Analytics, and cloud integration, we deliver regulatory compliance solutions that are not just scalable but future-ready.

If your institution is ready to transform compliance from a burden into a growth driver, let’s talk. Explore how Sigma’s FinTech development services can help you adopt RegTech compliance automation with confidence. Learn more here!