Robo advisory: An opportunity or a threat for fintech?

High operational costs, inability to serve a large client base, high minimum investment thresholds, and time-consuming manual portfolio rebalancing are problems that negatively impact the operational efficiency of wealth management and investment firms. This scenario has become a bygone era with the advent of sleek, automated platforms—ROBO ADVISORS—that are game changers in the investment management and wealth management ecosystem. From automated portfolio management, fast-tracking client onboarding, low-cost advisory services, and 24/7 access and engagements, robo-advisors are adding a unique value. In straightforward terms, what is the unique value they are adding? Harnessing the potential of fintech software, robo-advisors are empowering wealth management and investment companies to scale efficiently, meet the needs of a diverse client base, and foster revenue growth. Undoubtedly, the financial ecosystem is riddled with the ripples of digital transformation across verticals and functionalities. Algorithm-based platforms are challenging traditional advisers. Are robo advisors an opportunity or a risk for the ecosystem? In this blog, let us deep dive to understand the pros and cons of robo advisory.

What is a robo-advisor?

Also referred to as automated investment advisors, automated investment management, and digital advice platforms, robo-advisors are digital platforms that offer automated financial planning and investment services by creating portfolios based on financial situation, goals, and risk tolerance with negligible or no human interference.

Robo advisors: New or old?

The advent of robo-advisors began in 2008, aiming to assist the tech ecosystem. Owing to the potential that computer software holds in making investment advice more accessible, it was pivoted exclusively towards wealth management. The initial application was as a simple and basic interface to handle passive, buy-and-hold investments and to rebalance assets within target-date funds (TDFs). Today’s robo-advisors use passive indexing strategies optimized with modern portfolio theory, making them adept for socially responsible investing or other effective methods that mimic hedge funds.

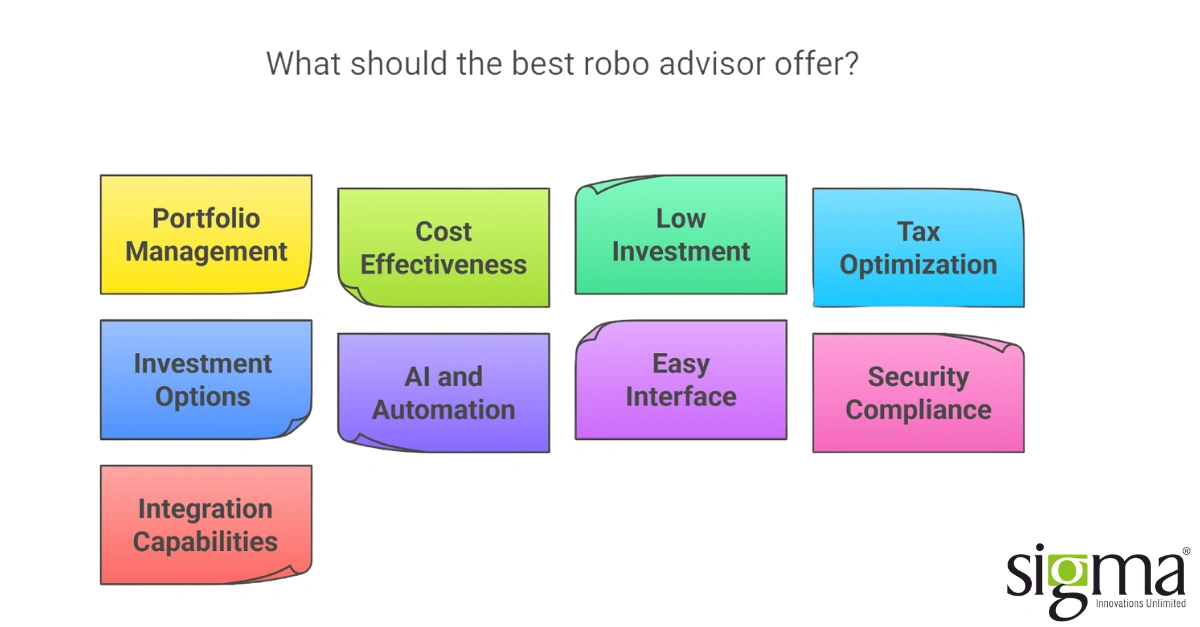

Attributes of a best robo advisor

As a form of digital financial advisory, providing automated algorithm-driven investment management services, robo-advisors analyze financial data to make effective and efficient investment recommendations. Besides being available round the clock, robo-advisors simplify investment processes, select and rebalance portfolios, and provide tax optimisation options, empowering wealth management firms to appease their customers. Here are some of the most sought-after features in the best robo-advisors.

1. Customized portfolio management

Robo-advisors must be equipped to provide goal-based investment solutions and accordingly customize the portfolios. Ex: providing investment solutions for retirement or buying a house. Additionally, they should assess risk, adjust and allocate assets, and automatically rebalance portfolios to create avenues for users to fulfill their investment goals.

2. Transparency and cost effectiveness

Robo-advisors must have clear-cut disclosures on the trading charges, account minimums, and low management fees.

3. Option for low minimum investment

Wealth management firms cater to the needs of different users. Ranging from customers who are making small sum investments for the first time to users who are willing to make hefty investments in one go, the users have varying needs. Hence, robo-advisors in fintech should provide options for low minimum investments, making them an ideal choice for novice investors.

4. Ensuring tax optimization

Robo advisors must do the balancing act of tax optimization. By automatically selling losing investments to offset gains, robo advisors must put their best foot forward in tax loss harvesting. To simplify, a robo-advisor must exhibit due diligence and provide the necessary advice to customers to sell an investment at a loss to reduce the tax owed on capital gains from another investment.

5. Manifold investment options

Robo advisors must be capable of providing robust investment options, i.e., they should have broad exposure across various asset classes by leveraging low-cost ETFs. Additionally, they should provide comprehensive solutions for thematic investing like SRI (Socially Responsible Investing) and ESG (Environmental, Social, and Governance) investing.

6. Adept at AI and automation

Robo-advisory platforms must have the required integrations for offering AI-powered insights and predictive analytics to enable data-backed decisions. They should provide advisory to users for making regular investments through recurring contributions and should have integrated financial planning tools to make recommendations pertaining to mindful spending and strategic saving.

7. Easy-to-use interface

Robo advisors must have user-friendly interfaces. With intuitive dashboards providing visualizations of performance and asset allocation goals, they should offer a high-quality customer experience, along with a fully functional app with real-time updates and notifications.

8. High security and compliance

An important attribute of a robo-advisor is that it should ensure the safety of user data and transactions through bank-level encryption. Additionally, a robo-advisor must be a member of SIPC to protect the users and help them tide over a brokerage firm’s failure.

9. High integration capabilities

Robo advisors must have IRA and 401(k) integrations in place to support retirement accounts and rollovers. Additionally, they should have bank account syncing to track cash flow and third-party integrations to provide a holistic financial visibility to the user.

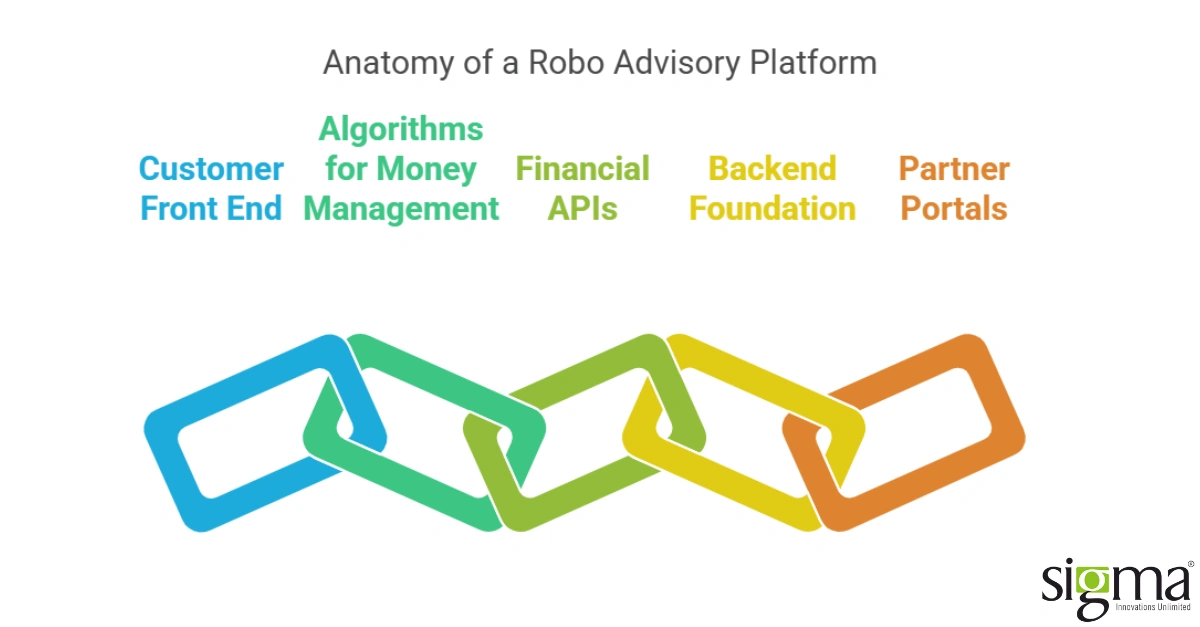

Components of a robo advisory platform

Several key components must come together and function in tandem to craft a robo-advisory platform that truly serves the users’ needs.

- Customer front end: A user-friendly interface, which is an interaction point, usually a web dashboard or a mobile/web app, for user onboarding and profile creation, and for managing and monitoring investments.

- Algorithms for money management: A machine learning AI algorithm platform that analyzes user information, assesses risks, optimizes portfolios, and offers investment advisory.

- Financial APIs: APIs that connect with bank accounts and integrate with other financial systems, enabling automation of investments, providing recommendations for money management strategies, handling trade executions, and portfolio rebalancing.

- Backend foundation: A workspace for refining and authenticating portfolio balancing strategies and facilitating the development of investing algorithms that enable constant enhancements.

- Partner portals: A dashboard that allows tracking of balance and other relevant metrics that provide an overview of the financial well-being of the user

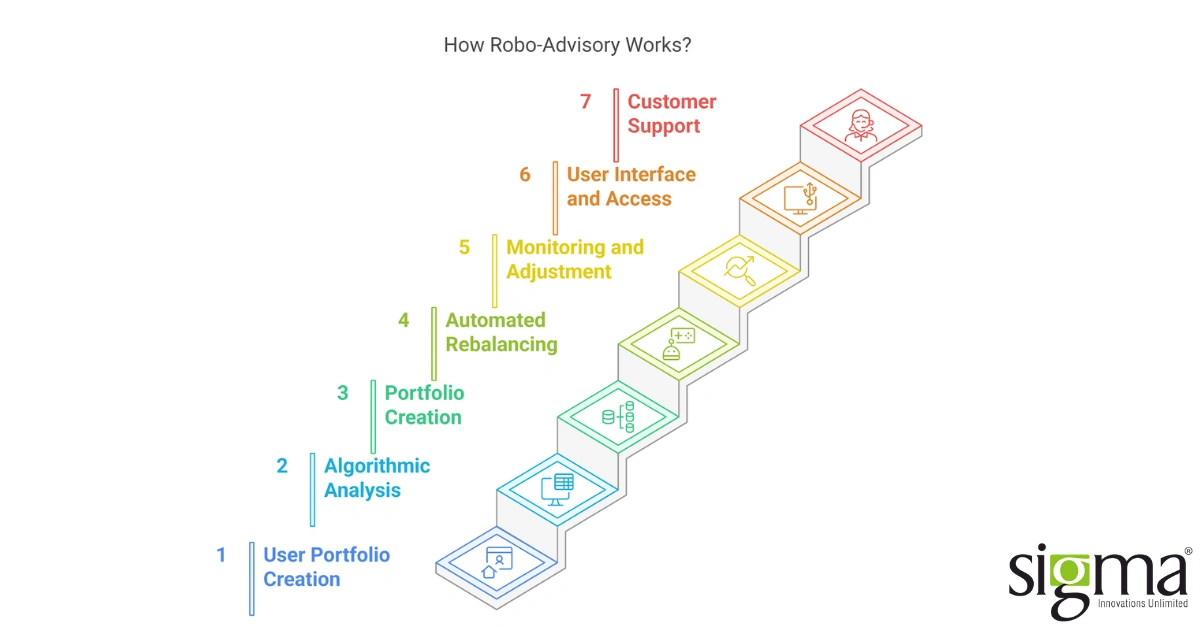

The functional side of robo-advisory platforms: How do they work?

Use cases of robo advisor platforms: The set of circumstances where they fit perfectly

The use cases of robo-advisory are versatile. From providing dynamic automated investment solutions to personalized advice, robo-advisory has become a linchpin across verticals and is changing the finance and wealth management turf.

In wealth management firms:

Robo advisors play a vital role in bringing wealth management firms up to the mark while implementing robotic process automation. Robo-advisory platforms enable wealth management firms to offer bespoke investment advice and financial planning solutions to clients.

In banks and fintech companies:

Robo-advisory is making its presence felt in the banking and fintech space too. With the integration of robo-advisory into their banking systems, banks are able to offer automated financial planning and investment solutions. It is empowering banks and fintech companies to minimize manual advisory services, optimize their operational efficiency, and enhance customer engagement.

In organizations offering employee benefits:

Organizations offering employee benefits are embracing robo-advisory with vigor. With robo-advisory at their behest, they are equipped with tools for retirement planning and investment management. Robo-advisory is enabling organizations to help their employees make informed decisions and ensure their financial well-being.

In insurance firms:

In the insurance sector, robo-advisory is at the forefront of offering investment-linked insurance products to policyholders. The integration of robo-advisory platforms into their systems is allowing insurance companies to enhance the value proposition of their products by equipping them to maximize the investment strategies of their clients or policyholders.

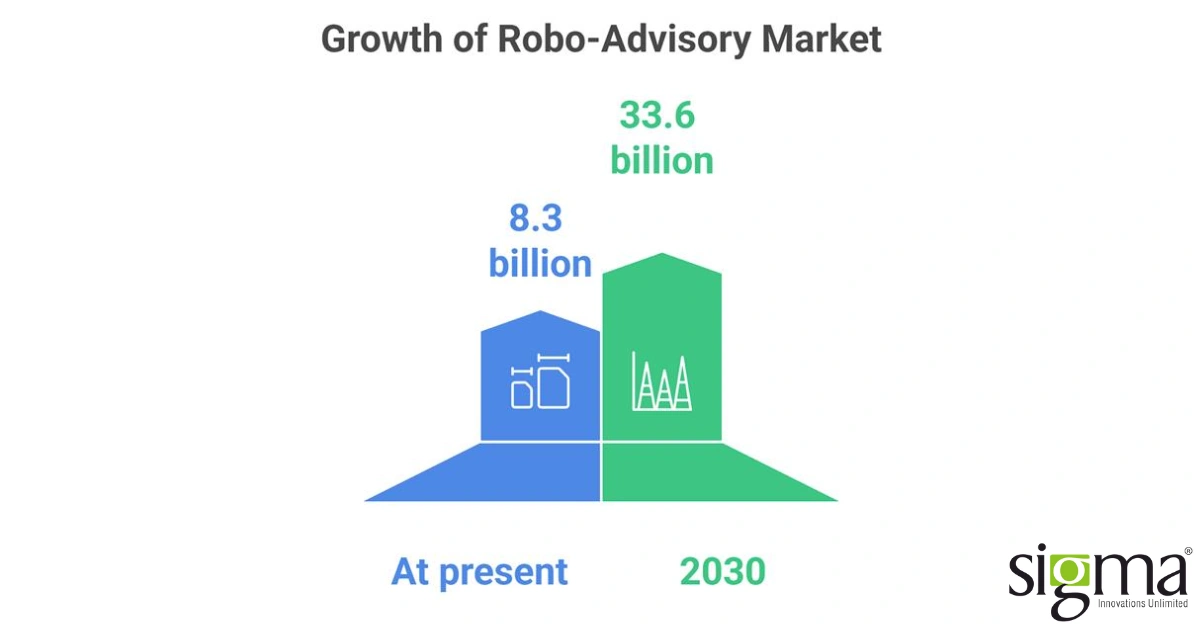

From niche to mainstream: Robo-advisory’s booming market!

Owing to massive adoption in recent years, the robo-advisory market is witnessing manifold growth. Presently valued at US$8.3 billion, the robo-advisory market is poised to reach US$33.6 billion by 2030, growing at a CAGR of 26.4%. Aspects like the growing use of mobile devices among netizens, the convenience they offer users, and constant availability as an advisor to offer investment and other management recommendations have tipped the odds in favor of robo-advisory platforms, resulting in remarkable market growth.

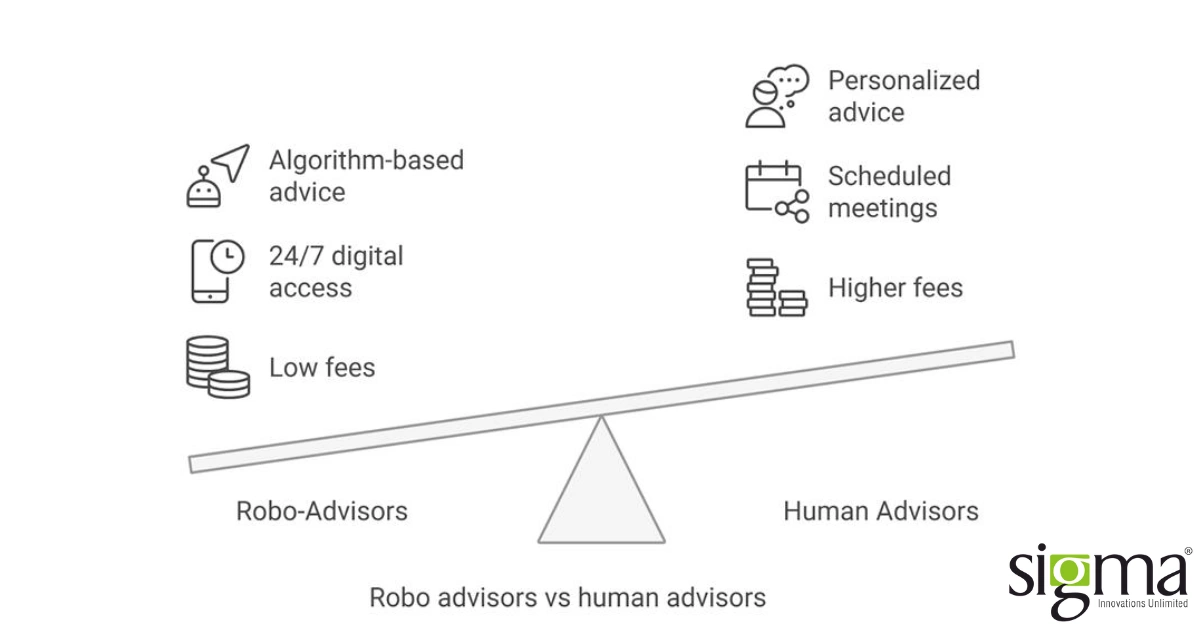

Let’s take a look at robo advisors vs human advisors:

Comparing robo advisors vs financial advisors

- Characteristic

- Cost

- Accessibility

- Personalization

- Minimum Investment

- Emotional Guidance

- Speed & Efficiency

- Complex Situations

- Scalability

- Robo-advisors

- Low fees

- 24/7 digital access via app/web

- Algorithm-based recommendations

- Low or no minimums

- None — purely data-driven

- Instant onboarding, automation

- Limited — best for simple, goal-based planning

- Highly scalable with low human overhead

- Human-advisors

- Higher fees

- Office hours or scheduled meetings

- Personalized advice based on deeper conversations

- Often requires $50K+

- Offers emotional support during market downturns

- Slower due to manual processing

- Better suited for complex needs (Example: Tax planning)

- Limited by advisor capacity

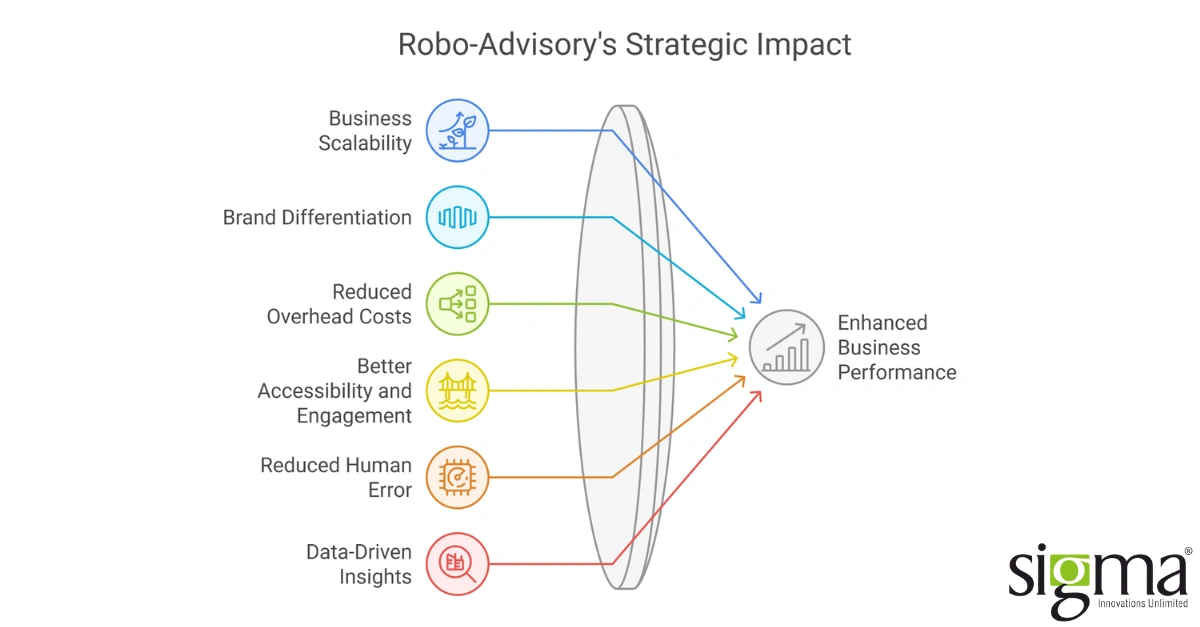

The upside for fintech and wealth management firms with robo-advisory

When robo-advisory platforms came into existence, the important benefit they offered was providing convenience by eliminating the hassles of paperwork. Wealth management firms were able to avoid signing stacks of documents; robo-advisory eliminated the scope of physical documentation. Besides offering convenience and helping wealth management firms go paperless, robo-advisory platforms offer numerous benefits that have opened new opportunities in the fintech ecosystem.

- Business scalability: With robo-advisors, wealth management firms and fintech companies can handle a high volume of clients and assets with minimal human intervention. As they can recommend investment recommendations and strategies to a wide client base via robo-advisors, wealth management companies can ramp up their user acquisition capabilities and foster robust revenue growth by scaling their business.

- Brand differentiation factor: The use of robo-advisory allows fintech and wealth management firms to position themselves as tech-driven and digitally savvy financial service providers. Such brand positioning helps in attracting clients or users who seek digital-first investment solutions.

- Reduced overhead costs: Roboadvisory in wealth management creates ample scope for automation, eliminating the need for human advisors in certain scenarios and drastically bringing down operational and overhead costs for companies. Reduced overhead costs empower wealth management companies to offer good competitive fees to their users and gain better profit margins.

- Better accessibility and engagement: Robo-advisory allows wealth management firms to make investment services accessible to a wide audience segment. Additionally, the easy-to-use interface of the robo-advisory platform enhances the user experience, playing a vital role in enhancing engagement and ultimately helping businesses to retain clients.

- Reduced human error: A small error while recommending investment strategies could cost wealth management firms dearly. From losing clientele to reputation, the cascading effects of error can be devastating. Adopting robo-advisory will allow wealth management firms and insurance firms to automate several tasks and reduce human errors. Besides minimizing human errors, robo-advisors help fintech companies avoid wasting time on manual tasks and channel it toward business growth initiatives.

- Data-driven insights for competitive edge: With robo-advisors by their side, wealth management firms can have real-time access to users’ preferences, choice of portfolios, market trends and investment behaviors. It allows enterprises to make informed decisions about product and service innovations and craft effective strategies for rapid client acquisition, providing a competitive advantage.

A strategic growth partner, through its financial software development services, cloud banking solutions, customer software development services, and digital transformation services, can help businesses adopt robo-advisory solutions.

Read the blog to learn more about cloud banking solutions for automated platforms.

The downside for fintech and wealth management firms of robo-advisory

Though there are benefits for the fintech sector with robo-advisory, it is not devoid of pitfalls. Robo-advisors lack the capabilities to manage the human side of investing. They also cause customer churn when subjected to a client’s complex investment or financial needs, which might result in losses for wealth management firms. Wealth management business is not just about investment recommendations or managing a portfolio; it’s about building a rapport with customers by ensuring their financial well-being. Besides replacing human financial advisors, the robo-advisory platforms fail to address behavioral biases or navigate emotions or fear that arise during a downturn, which might not strike the right chord with the users. Some of the other concerning issues associated with robo-advisors are as follows:

- Robo-advisory platforms function with standardized algorithms, which restrict the scope of advice and recommendations.

- As algorithm-driven and automated models, robo-advisors fail to understand the unique financial situation of a user or attach any sentimental value to a financial goal.

- As digital platforms, robo-advisors focus only on transactions without considering a user or investor’s financial aspirations.

- Due to their automated nature, robo-advisory platforms pose a threat to compliance and regulation. As regulatory guidelines cannot classify these platforms, it is impossible to make robo-advisors liable for poor investment decisions.

- Additional loopholes that make robo-advisory platforms less trustworthy include the inability to maintain data privacy, inadequate algorithm transparency, and failing to adapt to ever-evolving AI trends.

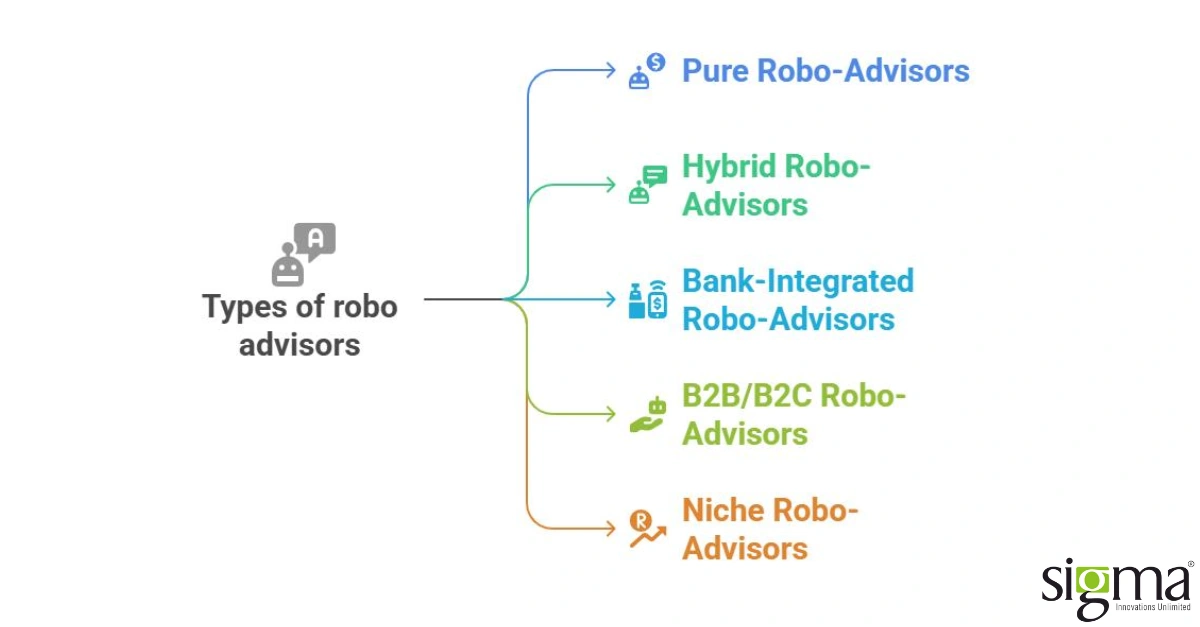

Types of robo-advisors and examples:

- Pure Robo-Advisors: They are fully automated robo-advisors with no scope for human advisor interaction. They are an ideal choice for cost-conscious investment solutions.

Example: Betterment and Wealthfront. - Hybrid Robo-Advisors: Robo-advisory platforms that combine algorithms with an optional human financial advisor interface. They are ideal for customers seeking a blend of tech or automation and human financial advice.

Example: Vanguard PAS, Schwab Intelligent Portfolios. - Bank-Integrated Robo-Advisors: Robo-advisory platforms offered by digitally transformed banks. They are ideal for customers already availing themselves of the bank services.

Example: Chase You Invest Portfolios, and Wells Fargo Intuitive Investor. - B2B or B2C or White Label Robo-Advisors: Robo-Advisory platforms created exclusively for financial organizations to rebrand themselves and offer investment recommendations to clients. They are ideal for wealth managers, fintech start-ups and registered investment advisors.

Example: Bambu, and AdvisorEngine. - Niche/Specialized Robo-Advisors: Robo-advisory platforms focused on specific demographics or values.making them an ideal choice for targeted user segments.

Example: Ellevest (for women), Wahed (Shariah-compliant)

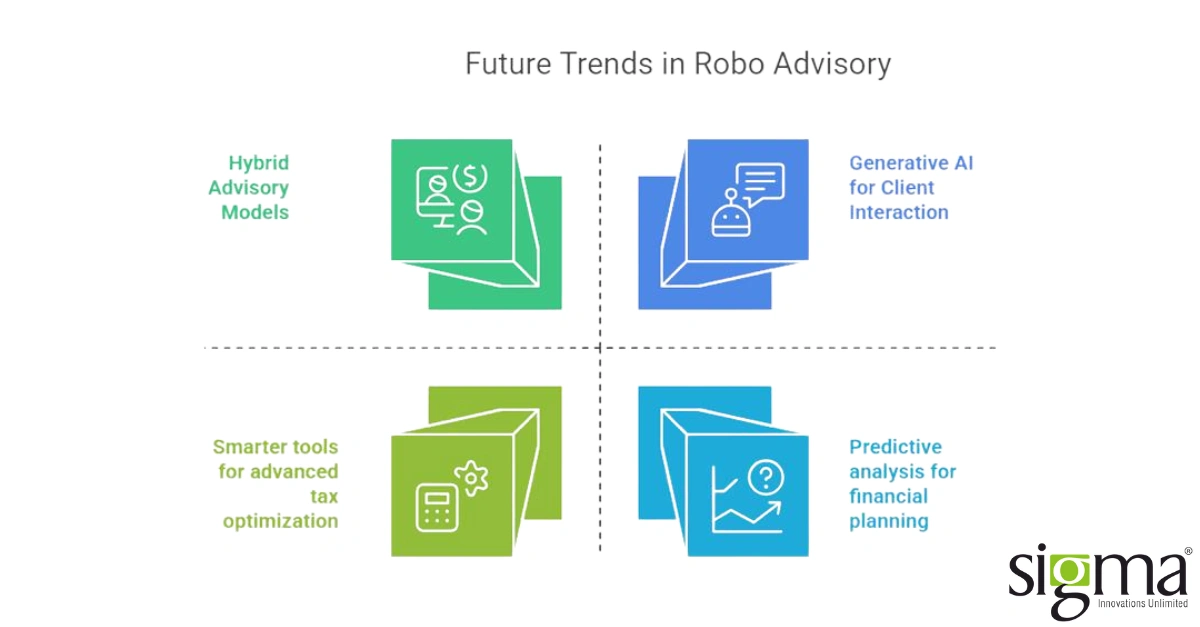

Future outlook for robo-advisory

An overview of trends that will shape the future of robo advisory platforms

- Hyper-personalization by leveraging AI/ML

- Generative AI for Client Interaction

- Hybrid Advisory Models

- Smarter tools for advanced tax optimization

- Predictive analysis for financial planning

Tech and digital acceleration for adapting robo-advisory with Sigma Infosolutions

Robo-advisors are becoming the new norm in wealth management and fintech turf. As imperative tools for scalable, customized investment and financial planning, they are empowering the stakeholders of the fintech ecosystem to increase profit margins. Sigma Infosolutions combines deep financial domain expertise with cutting-edge technology and digital transformation services, making businesses well-equipped to incorporate robo advisor options into legacy systems.

Sigma Infosolutions offers end-to-end custom software development services, investment software development solutions, and technology development services for enhancing existing legacy systems with required AI/UX/UI and automation solutions that are imperative for robo-advisory platforms. With a deep understanding of investment workflows, KYC and global financial regulations (SEC, FINRA, GDPR, etc.), providing required power BI, API and payment integrations, implementing machine learning models for personalized advice, risk profiling, and behavior analysis, Sigma Infosolutions can bring wealth management firms and fintech startups up to speed and help them add robo-advisory platforms to their systems.

Read to know more about Sigma Infosolutions empowering due diligence with power BI integrations

Wrapping up:

Robo-advisory has undoubtedly democratized investment services, emerging as a transformative force to reckon with in the financial services and wealth management sectors. With proficient automation and data-driven personalization, the best robo-advisor platforms are reducing operational burdens and enhancing customer engagement, creating a massive scope for wealth management firms and fintech companies to scale economies. However, this technological leap is not without challenges. With guidelines that keep the robo-advisory recommendations in check and guardrails to prevent data security breaches, the use of these platforms can be optimized. Robo-advisory represents both an opportunity and a disruption. For fintechs and wealth management firms willing to evolve by integrating hybrid advisory models, maintaining transparency, and leveraging financial software development services and AI responsibly, robo-advisory platforms are powerful catalysts for growth.