The Vital Role of APIs in the Digital Lending Ecosystem

In recent years, the lending landscape has undergone a significant transformation with the advent of digital lending. Traditional lending practices have been disrupted by technological innovations, and one of the key enablers of this disruption is the Application Programming Interface, commonly known as API. APIs have revolutionized the way lending institutions operate, and their importance in the digital lending ecosystem cannot be overstated. In this article, we will delve into the significance of APIs in digital lending and explore their benefits, challenges, and future prospects.

What are APIs?

APIs, or Application Programming Interfaces, are sets of protocols, rules, and definitions that allow different software applications to communicate with each other and share data and functionality. APIs act as intermediaries, enabling seamless interactions between various systems, applications, or platforms. In other words, APIs enable different software to “talk” to each other, facilitating the exchange of information and services in a standardized and efficient manner.

The Importance of APIs in Digital Lending

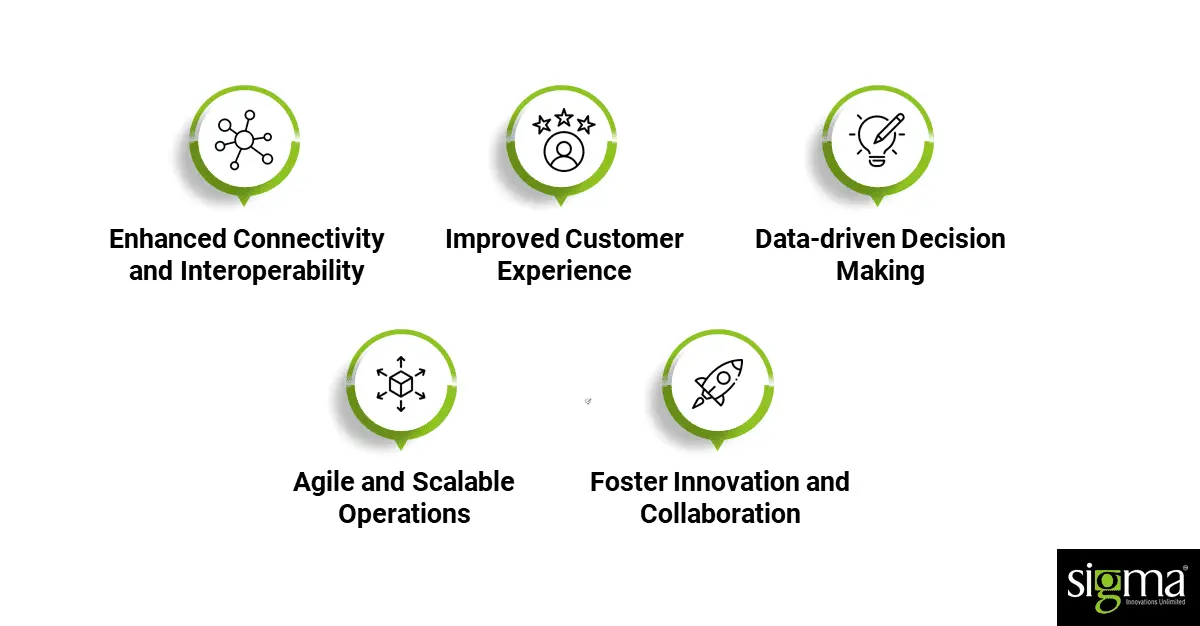

APIs has become the backbone of digital lending, enabling lenders to leverage the power of technology to streamline their operations, improve customer experience, and enhance their competitive advantage. Let’s explore some of the key reasons why APIs are crucial in the digital lending ecosystem:

The Importance of APIs in Digital Lending

Enhanced Connectivity and Interoperability

APIs enable lending institutions to connect with various internal and external systems, such as credit bureaus, payment gateways, identity verification services, and loan origination systems. This seamless connectivity and interoperability enable lenders to access and exchange data and services in real-time, thereby expediting loan processing, reducing manual errors, and improving operational efficiency.

Improved Customer Experience

APIs play a pivotal role in enhancing the customer experience in digital lending. They enable lenders to integrate their lending platforms with third-party services, such as e-signature solutions, online banking systems, and mobile wallets, to offer convenient and user-friendly loan application processes. APIs also facilitate personalized loan offers, real-time loan status updates, and automated notifications, leading to a frictionless and seamless borrower experience.

Data-driven Decision Making

APIs enable lenders to access and analyze vast amounts of data from multiple sources, such as credit bureaus, social media, and financial statements, in real-time. This data-driven approach empowers lenders to make informed and data-backed lending decisions, such as credit scoring, risk assessment, and fraud detection. APIs also enable lenders to continuously monitor and assess borrower creditworthiness throughout the loan lifecycle, leading to better risk management and reduced default rates.

Agile and Scalable Operations

APIs provide lenders with the flexibility to adapt and scale their lending operations based on changing business needs. APIs allow lenders to easily integrate new services, partners, or technologies into their lending processes without disrupting their existing systems. This agility and scalability enable lenders to quickly respond to market dynamics, launch new loan products, and expand their lending operations to new geographies or customer segments.

Foster Innovation and Collaboration

APIs facilitate innovation in the digital lending space by enabling lenders to collaborate with FinTech startups, technology providers, and other stakeholders. Lenders can leverage APIs to access innovative lending solutions, such as alternative credit scoring models, machine learning algorithms, and blockchain-based smart contracts. APIs also foster collaboration between lenders and other financial institutions, enabling partnerships for co-lending, loan syndication, and cross-selling of financial products.

Challenges of APIs in Digital Lending that Will Make or Break Lenders

While APIs offer numerous benefits in the digital lending ecosystem, there are also challenges that need to be addressed for their successful implementation:

Security and Data Privacy

APIs involve the exchange of sensitive data between different systems, making security and data privacy critical concerns. Lenders need to implement robust security measures, such as encryption, authentication, and authorization, to protect the sensitive data exchanged through APIs. Compliance with data privacy regulations, such as GDPR and CCPA, is also crucial to ensure the privacy and protection of borrower information.

Technical Complexity

Implementing APIs can be technically complex, requiring expertise in software development, integration, and maintenance. Lenders need to invest in skilled resources, infrastructure, and tools to build, manage, and monitor APIs effectively. Technical challenges, such as versioning, error handling, and API documentation, need to be carefully addressed to ensure the smooth functioning of the APIs.

Standardization and Interoperability

With multiple lenders, FinTech startups, and technology providers in the digital lending ecosystem, standardization and interoperability of APIs become crucial. A lack of industry-wide standards can result in inconsistencies, incompatibilities, and complexities in integrating different APIs. Establishing common standards and best practices for APIs in digital lending can promote interoperability and simplify integration efforts.

Risk of API Dependency

Digital lenders heavily rely on APIs for various critical functions, such as credit scoring, identity verification, and payment processing. However, this dependency on APIs also poses risks, such as service disruptions, downtime, or changes in API terms and conditions. Lenders need to have contingency plans in place, such as backup APIs or fallback mechanisms, to mitigate the risks associated with API dependency.

Regulatory Compliance

Compliance with regulatory requirements, such as consumer protection laws, anti-money laundering (AML) regulations, and fair lending practices, is a significant challenge in the digital lending ecosystem. APIs used for data exchange and processing must comply with these regulations, and lenders must ensure that their APIs meet the necessary compliance standards. Failure to comply with regulatory requirements can result in legal, reputational, and financial risks.

Future Prospects of APIs in Digital Lending

Despite the challenges, the future prospects of APIs in the digital lending ecosystem are promising. As technology continues to advance, APIs are expected to play an even more significant role in reshaping the lending landscape. Here are some potential future prospects of APIs in digital lending:

Continued Innovation

APIs will continue to drive innovation in digital lending. With the growing adoption of technologies such as machine learning, artificial intelligence, and blockchain, APIs will enable lenders to access and leverage advanced tools and models for credit scoring, risk assessment, fraud detection, and loan servicing. This will result in more accurate and efficient lending processes, improved borrower experience, and better risk management.

Expanded Ecosystem

The digital lending ecosystem is expected to expand further, with more lenders, FinTech startups, and technology providers entering the market. APIs will play a crucial role in facilitating collaboration, partnerships, and co-lending arrangements among different stakeholders. This will enable lenders to access new markets, customer segments, and lending opportunities, leading to increased competition and innovation in the industry.

Enhanced Customer Experience

APIs will continue to enable lenders to offer superior customer experiences in digital lending. With the increasing demand for seamless and convenient lending processes, APIs will facilitate integrations with emerging technologies, such as voice assistants, chatbots, and virtual reality, to provide personalized and interactive borrower experiences. This will result in improved customer satisfaction, loyalty, and retention.

Strengthened Security and Compliance

APIs will continue to evolve to address the security and compliance challenges in digital lending. Lenders will invest in robust security measures, such as advanced encryption, multi-factor authentication, and threat detection, to protect borrower data exchanged through APIs. Compliance with regulatory requirements, such as data privacy, AML, and fair lending, will also be a priority, and APIs will be designed to meet the necessary compliance standards.

Simplified Integration

With the establishment of common industry standards and best practices, APIs will become more standardized and interoperable in the digital lending ecosystem. This will simplify integration efforts for lenders and other stakeholders, reducing complexities and inconsistencies in integrating different APIs. Standardized APIs will also enable easier switching between different technology providers, fostering competition and innovation in the digital lending space.

Improved Efficiency and Cost Savings

APIs will continue to drive efficiency and cost savings in digital lending. By enabling seamless data exchange and automation of various lending processes, APIs will streamline operations, reduce manual efforts, and minimize errors. This will result in improved operational efficiency, faster loan processing times, and reduced costs for lenders, leading to increased profitability and competitiveness.

Customization and Personalization

APIs will enable lenders to offer more customized and personalized loan products and services to borrowers. By accessing and analyzing borrower data through APIs, lenders can gain insights into borrower preferences, behaviors, and financial needs, allowing them to tailor loan offerings accordingly. This will result in more relevant and personalized loan products, leading to improved borrower satisfaction and loyalty.

Conclusion

APIs are expected to play a crucial role in the future of digital lending, driving innovation, expanding the ecosystem, enhancing customer experiences, strengthening security and compliance, simplifying integration, improving efficiency and cost savings, and enabling customization and personalization. Lenders and other stakeholders in the digital lending ecosystem should embrace APIs as a key enabler for their digital transformation efforts and stay updated with the evolving trends and best practices in API development and management.

At Sigma Infosolutions, with our proven FinTech expertise across 100+ projects and 500K+ person-hours, we have been a trusted TECH partner for over 20 years in the IT services industry. To learn more about our services and offerings and get the acceleration your FinTech business needs, please do connect with us.