US FinTech Market Growth, Trends and Forecast

Key Takeaways:

- FinTech is the new engine under the hood of US finance. AI, cloud, and compliance are fueling an industry racing toward 2030.

- Digital disruptors aren’t just knocking on the door; they’ve moved in from neobanks to embedded finance, and the game has changed.

- The winners will be those who build skyscrapers on solid tech foundations; secure, scalable SaaS platforms built for speed and resilience.

They say change is the only constant. In the US FinTech industry, change isn’t just coming; it’s here. Fueled by customer demand for speed, transparency, and security, financial services are being completely reshaped by digital innovations. From mobile wallets to embedded finance, the shift is rapid, and it’s creating massive opportunity.

To put it in numbers: the US FinTech market was about USD 53.0 billion in 2024, and is projected to grow at a CAGR of ~13.9% between 2025-2033, reaching USD 181.6 billion by 2033. Another report pegs the market value in 2024 around USD 85.7 billion and forecasts a rise to approximately USD 261.2 billion by 2032 (CAGR ~15.1%) across digital payments, lending, robo-advisors, RegTech, and more.

For technology leaders, CTOs, VPs, and CIOs, the challenge isn’t just “should we adopt FinTech?”. It’s how to build secure, scalable, and future-ready SaaS applications that can keep up: faster user expectations, tighter regulation, rising demand for uptime, data privacy, and integration. Delays, cost overruns, or weak security aren’t just annoyances; they risk competitive edge.

That’s where Sigma Infosolutions steps in. With deep expertise in SaaS Development Services in the USA, strong product engineering foundations, and cloud-native best practices, we help financial institutions, neobanks, insurance firms, investment companies, and lenders deliver FinTech platforms that aren’t just live, but also reliable and ready for what’s next.

US FinTech Market Overview

The U.S. fintech market is projected to grow from USD 58.01 billion in 2025 to USD 118.77 billion by 2030, reflecting a robust 15.41% CAGR. Digital payments dominated the market in 2024, accounting for 47.43% of the share. Neobanking is anticipated to experience the fastest growth, with a CAGR of 21.67% from 2025 to 2030.

Retail consumers represented 63.38% of the fintech market share in 2024, while business adoption is expected to expand at a 17.87% CAGR during 2025–2030. Regionally, the West leads in technology infrastructure, while the South is experiencing the fastest growth due to lower operating costs and supportive state policies.

These dynamics underscore the U.S. fintech sector’s evolution, driven by technological advancements, shifting consumer behaviors, and favorable regional policies.

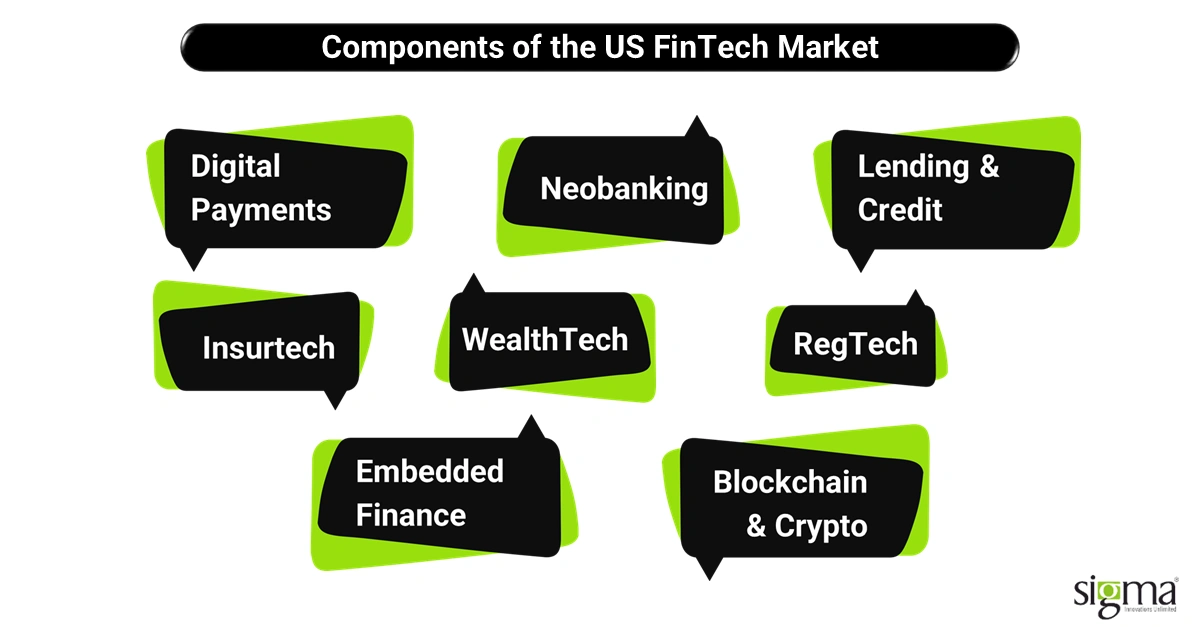

Components of the US FinTech Market

The U.S. fintech market is a dynamic ecosystem, comprised of diverse segments that are transforming how financial services are delivered and consumed.

- Digital Payments: Dominates with mobile wallets, POS systems, and remittance services.

- Neobanking: Branchless digital banks offering integrated financial services.

- Lending & Credit: Includes peer-to-peer lending and AI-driven credit platforms.

- Insurtech: Innovations in insurance through technology, enhancing accessibility and efficiency.

- Wealthtech: Robo-advisors and digital investment platforms democratizing wealth management.

- RegTech: Solutions for regulatory compliance and risk management.

- Embedded Finance: Integration of financial services into non-financial platforms.

- Blockchain & Crypto: Decentralized finance and digital asset solutions.

Key Drivers

- Digital-first customers: More people want banking, lending, payments, etc. via apps or online, not via branches. FinTech adoption in the US hit ~74% in Q1 2025 for using one or more fintech services.

- AI & automation: Tools like machine learning, automation of underwriting, fraud detection etc. are helping companies reduce costs, speed up services, and improve reliability.

- Regulatory evolution: Rules are changing (and being enforced) for data privacy, licensing digital banks, and compliance (AML/KYC). Fintech firms must build platforms that are secure and compliant out of the gate.

- Embedded finance & API-driven models: More companies (non-banks, eCommerce platforms etc.) are embedding financial services in applications. APIs make integration easier.

- Cloud adoption & scalable infrastructure: To handle spikes in demand, ensure availability, and reduce infrastructure bottlenecks, cloud-native architectures are becoming standard.

Investment Activity & Funding

- Funding in FinTech remains strong, though shifting: in Q2 2025, global fintech funding was ~$11 billion, with North America a major share.

- In H1 2025, the U.S. saw about USD 20.9 billion in fintech investment across ~889 deals.

- Payments and insurance tech are getting a lot of attention; lending and digital banking have seen some pullbacks due to risk concerns. For example, digital lending has dropped in funding in recent periods.

Competitive Landscape

Traditional banks are no longer the only game in town. Digitally native players (neobanks, fintech startups) are rapidly gaining share because they are more agile, more cost-efficient, and better at meeting modern customer expectations (easy UX, fast decisions, mobile first). Legacy banks are responding with partnerships, acquisitions, or building their own fintech arms, but often struggle with older systems, compliance risk, and slower development processes.

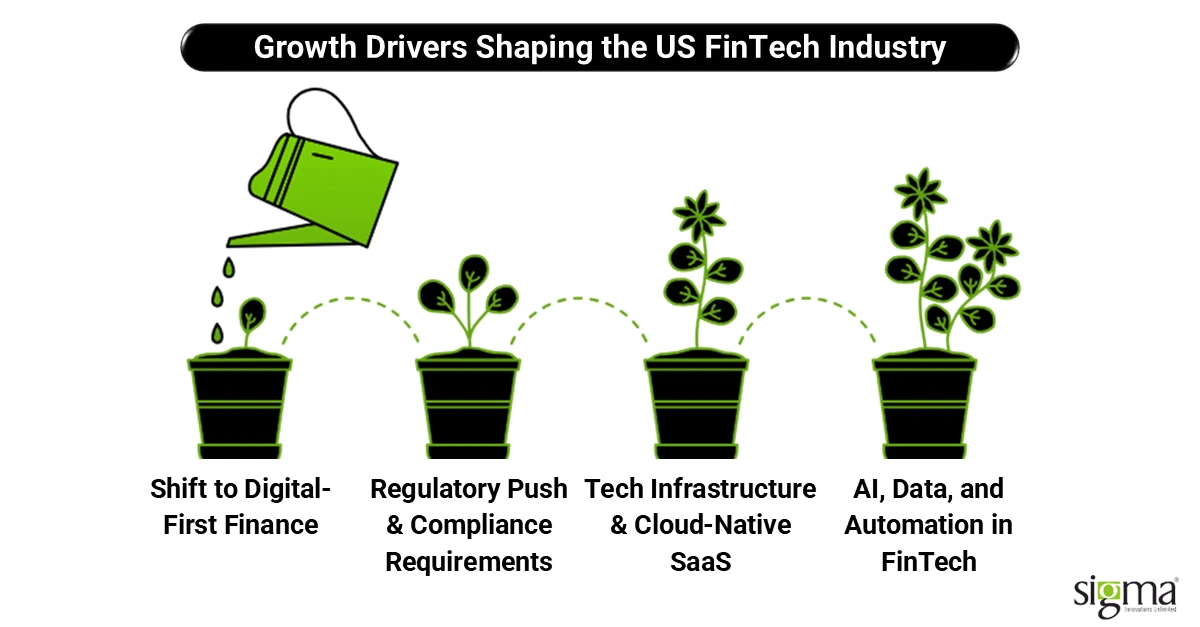

Growth Drivers Shaping the US FinTech Industry

The US FinTech industry is riding strong tailwinds that continue to reshape how financial services are designed, delivered, and consumed. Several forces are pushing this transformation forward:

Shift to Digital-First Finance

Customers no longer compare their banking app only with other banks; they compare it with Amazon or Uber. The demand is clear: instant, mobile, and personalized financial experiences. Embedded finance is gaining momentum in retail, eCommerce, and SaaS applications, where payments, lending, and insurance get integrated seamlessly into customer journeys.

Regulatory Push & Compliance Requirements

The regulatory environment is evolving quickly, with Dodd-Frank, CFPB, OCC guidelines, and SEC scrutiny shaping how firms manage risk and protect consumers. Compliance is no longer optional; it’s mission-critical. That’s why RegTech compliance automation solutions are becoming an essential tool, helping financial institutions cut manual effort, reduce errors, and stay audit-ready.

Tech Infrastructure & Cloud-Native SaaS

The foundation of modern SaaS applications in FinTech is cloud-native architecture. By shifting to the cloud, companies gain agility, scalability, and cost efficiencies. An API-first and microservices approach lets financial platforms launch new products faster, integrate with partners, and adapt quickly to changing market needs.

AI, Data, and Automation in FinTech

From predictive analytics to fraud detection to personalized recommendations, AI and data analytics are redefining financial services. Lenders, insurers, and payment providers are adopting AI and machine learning in FinTech to make smarter decisions, improve customer trust, and manage risks in real time.

Together, these growth drivers show why FinTech leaders need secure, scalable SaaS Development Services in the USA to stay ahead of both customer demand and regulatory pressure.

Also Read: 7 Ways Digital Lending is Revolutionizing US Lending

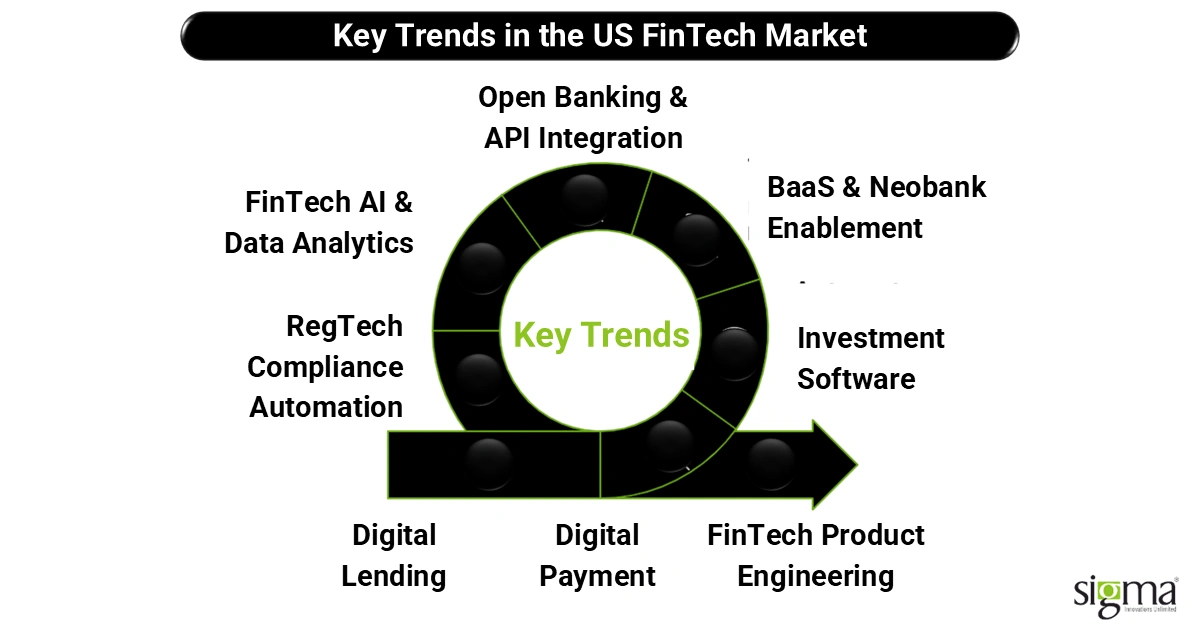

Key Trends in the US FinTech Market (2025–2030)

Here’s what’s shaping the future of FinTech in the US and how Sigma Infosolutions is positioned to help businesses ride each wave.

Digital Lending Solutions

The digital lending market in the USA is growing fast. In 2025, it’s expected to be worth about USD 303.1 billion, and by 2030, forecasts put it at around USD 560.97 billion, growing at ~13.1% CAGR.

Some sub-areas seeing fast growth:

- Buy Now, Pay Later (BNPL) is growing: the US BNPL market is expected to grow from about USD 109 billion in 2024 to about USD 184.05 billion by 2030, at ~8.5% CAGR.

- SME lending and home improvement lending are also gaining because of embedded finance and consumer demand.

- Credit scoring is becoming more AI-driven; loan origination is being automated to speed decisions and reduce risk.

What Sigma can do: We build cloud-native digital lending SaaS, loan origination platforms, and AI-powered scoring systems. With our SaaS Development Services in the USA, lenders can get to market faster, with secure, scalable SaaS applications that meet regulatory standards.

See how we’re helping lenders transform their operations with our digital lending solutions!

Digital Payment Solutions

Payments are becoming faster, more contactless, more seamless.

- Mobile wallets and real-time payments (e.g. via systems like FedNow) are becoming mainstream in the US.

- Contactless payments and NFC, QR codes, peer-to-peer transfers all keep growing.

- Cross-border payments in B2B are improving via blockchain, APIs, and new rails.

What Sigma can do: We design and build custom payment integrations (PCI-compliant), real-time payment solutions, and payment gateways. Our teams ensure the SaaS applications are secure, compliant, and work reliably even under load. This fits into our Digital Payment Solutions offering.

Ready to get a competitive edge in payments? Explore our Digital Payment Solutions!

Investment Software Solutions

Investing isn’t just for the wealthy anymore.

- Robo-advisors and trading apps are democratizing access to investments. More people want easy-to-use apps to manage portfolios, get insights, and see predictions.

- Data-driven portfolio tools with AI/ML are helping firms offer personalized investment advice, risk scoring, and automations around rebalancing.

What Sigma can do: We help build scalable wealth management platforms as part of our Investment Software Solutions. Whether it’s dashboards, automated trading tools, or insight engines, we bring in expertise in ReactJS, Tableau, BI & AI to deliver SaaS applications that deliver reliable investment UX.

Curious how custom software can transform your investment strategy? Learn more about our Investment Software Solutions!

BaaS & Neobank Enablement Solutions

Banking-as-a-Service (BaaS) and neobanks are booming in the US.

- The neobanking market in the US is projected to grow from about USD 34.56 billion in 2024 to around USD 263.67 billion by 2032, at ~27.31% CAGR.

- Non-banks (retailers, SaaS companies) want to offer bank-like services without building a bank: deposits, payments, cards, etc.

- Neobanks are targeting niche segments: gig economy, SMBs, underserved communities, etc. Trust is being built via UX, digital onboarding, and transparency.

What Sigma can do: Our BaaS & Neobank Enablement Solutions include API integration, core banking system build-outs, cloud-native platforms, and more. As a product engineering partner, we can help clients become neobanks or embed banking services in apps, with secure, scalable SaaS applications in the USA.

Discover how our BaaS & Neobank Enablement Solutions can help you build the future of finance!

Open Banking & API Integration Solutions

APIs and open banking are becoming foundational.

- Regulatory pressure and customer demand are pushing banks to open up APIs for payments, data sharing, and account access.

- Open banking helps fintechs and banks collaborate: better access to customer data (with consent), ability to offer value-added services.

What Sigma can do: We build API-first architectures, secure integrations, and compliance-ready SaaS applications. Whether it’s connecting to banks, building partner APIs, or enabling third-party services, we help ensure security and regulatory readiness.

Ready to unlock new revenue streams? Explore our Open Banking & API Integration Solutions!

FinTech AI & Data Analytics Solutions

Data, AI, and automation are no longer optional in FinTech; they are must-haves.

- Use cases: predictive analytics (to foresee risk, defaults, or market shifts), fraud detection (real-time or near real-time), customer personalization (offers, UX).

- Firms are building data lakes, BI dashboards, and ML pipelines to make decisions faster.

What Sigma can do: Our AI & Data Analytics Solutions deliver via Power BI, Tableau, custom ML/AI models, and data engineering. For lenders, payment providers, and insurers, we help build SaaS applications that leverage data, improve risk, reduce fraud, and personalize experiences.

Looking for an edge? Explore our FinTech AI & Data Analytics Solutions today!

RegTech Compliance Automation Solutions

Regulatory compliance is a cost and risk center for FinTech firms. But automation is reducing both.

- Key areas: KYC/AML automation, transaction monitoring, regulatory reporting, fraud detection.

- The global RegTech market was valued at USD 15.8 billion in 2024, and is projected to reach USD 70.8 billion by 2033, at ~18.0% CAGR.North America already holds a large share.

What Sigma can do: Through RegTech Compliance Automation Solutions, we build platforms that are regulator-ready, with audit logs, data privacy, and automation of compliance tasks. This helps clients stay compliant, reduce manual costs, and avoid fines.

Discover a smarter way to manage compliance with our RegTech automation solutions!

FinTech Product Engineering Services

All these trends, digital lending, payments, AI, and RegTech, depend heavily on strong product engineering.

- Rapid product launches matter: FinTech firms need to iterate quickly as consumer expectations change.

- Architecture trends: Cloud-native, microservices, DevSecOps, containerization, strong UI/UX, security baked in from day one.

- Products must scale: handle surges in usage, regulatory changes, integrations, and security threats.

What Sigma can do: Our Fintech Product Engineering Services across SaaS Development Services in the USA include end-to-end product engineering: from design (UI/UX), cloud solutions (AWS, etc.), backend (microservices, APIs), quality and security (DevSecOps), and deployment. We partner with fintechs, banks, lenders, neobanks, etc., to build future-ready SaaS applications that are secure, reliable, and scalable.

We don’t just write code; we engineer fintech products that are built to dominate. Learn more about our Fintech Product Engineering Services!

Long story short, from Digital Lending Solutions to RegTech Compliance Automation Solutions, and through Product Engineering, the US FinTech trends 2025-2030 are pointing strongly toward secure, cloud-native, data-driven, compliant, and embedded SaaS applications. Sigma Infosolutions is positioned to help B2B clients realize these trends with speed, quality, and scale.

US FinTech Market Outlook (2025–2030)

The US FinTech landscape is poised for significant transformation between 2025 and 2030, driven by technological advancements, regulatory evolution, and shifting consumer expectations. Here’s what to anticipate:

- Market Expansion: The US FinTech market, valued at approximately $95.2 billion in 2025, is projected to reach $248.5 billion by 2032, growing at a CAGR of 14.7%.

- M&A Activity Surge: Expect increased mergers and acquisitions among neobanks, payment facilitators, and lending platforms as firms seek scale and integrated solutions.

- AI-Powered SaaS Growth: The AI in FinTech market is anticipated to grow from $18.31 billion in 2025 to $53.30 billion by 2030, at a CAGR of 23.82%.

- Embedded Finance Integration: Embedded finance is set to revolutionize industries by integrating financial services into non-financial platforms, enhancing user experiences and accessibility.

- Opportunities for Mid-Market Players: Mid-market tech-driven lenders and payment facilitators can leverage these trends to offer innovative solutions, tapping into underserved segments and driving growth.

As the FinTech ecosystem evolves, staying ahead of these trends will be crucial for businesses aiming to capitalize on emerging opportunities.

Challenges Ahead for US FinTech Growth

While the US FinTech industry is on a strong growth trajectory, several challenges could slow progress for technology leaders and financial firms:

- Regulatory uncertainty & evolving compliance: Frequent updates to Dodd-Frank, CFPB, OCC, and SEC regulations require constant adaptation. Non-compliance can lead to fines and reputational risks.

- Cybersecurity and data privacy: As digital platforms scale, threats increase. Protecting customer data while ensuring seamless service is a key concern for SaaS applications in FinTech.

- Scaling SaaS solutions globally while maintaining quality: Expanding cloud-native platforms across regions demands robust architecture, consistent uptime, and localized compliance.

- Talent & skills shortage: AI, cloud, DevSecOps, and cybersecurity expertise are in high demand. FinTech firms struggle to recruit and retain professionals who can deliver secure, innovative solutions.

Addressing these challenges requires a combination of cloud-native SaaS Development Services, strong product engineering, and strategic partnerships, areas where Sigma Infosolutions helps US FinTech leaders stay ahead.

Also Read: 5 Ways Open Banking API Integrations Are Powering Modern Financial Solutions

Sigma Infosolutions POV: Enabling FinTech Growth

For technology leaders navigating the rapidly evolving FinTech landscape, the need of the hour is secure, scalable, and future-ready SaaS solutions that deliver agility without compromising compliance or customer trust. Sigma Infosolutions brings a unique blend of cloud-native SaaS expertise and proven engineering accelerators that significantly reduce time-to-market for FinTech innovations.

Our team has deep capabilities across digital lending, payments, investment platforms, Banking-as-a-Service, open banking integrations, AI-driven analytics, and RegTech automation, enabling enterprises to build platforms that are resilient, customer-centric, and regulator-ready. By combining cloud-native architecture, API-first design, and microservices frameworks, Sigma ensures that clients can scale rapidly while maintaining performance and security.

Whether it’s building next-gen loan origination systems, designing PCI-compliant payment integrations, or engineering AI-powered RegTech SaaS, Sigma acts as a trusted product engineering partner, empowering FinTech disruptors and traditional players alike to thrive in a competitive marketplace.

Final Thoughts

FinTech is no longer a peripheral choice; it has become the core driver of transformation in financial services. The next wave of growth will be defined by AI-driven intelligence, cloud-native platforms, and compliance-ready architectures that deliver agility, trust, and scalability. Leaders who embrace these innovations will not only keep pace but set the standard for the industry.

At Sigma Infosolutions, we empower financial enterprises and disruptors alike with secure, scalable SaaS and product engineering expertise to build future-ready FinTech platforms.