Why Off-the-Shelf Investment Tools Are Failing—and How Investment Software Development Fills the Gap

Popular opinion and belief are that sophisticated investments are exclusively categorized for institutional investors—large banks, hedge funds, and other financial giants. On the contrary, a paradigm shift is afoot. As you don’t need to be a mechanic to drive a car, you don’t need to have a Wall Street background to make strategic investments, once purely reserved for privileged institutions. Just as ATMs are making banking available 24/7, custom investment management platform development in fintech is making once-exclusive investments accessible to everyday investors. Advancements in technology and the proliferation of financial software development services are enabling wealth management firms to navigate complex markets and empower their users to make informed decisions in ways that weren’t previously possible.

The outcome—financial democratization. With this financial democratization comes a unique problem—people are in a fray to invest, and wealth management firms and investment firms must cater to their growing needs and scale their operations. As investment firms scale, legacy systems built for simpler times are no longer enough. They should steer away from spreadsheets, siloed tools, and rigid platforms, as these legacy systems fail to keep up with today’s needs of fintech, wealth management, or investor firms for real-time decision-making, data-driven insights, and regulatory agility. Modern firms need technology that can do more than store data—they need platforms that enable smarter operations, seamless integrations, and investor-grade experiences. Let’s understand the negative impact of legacy infrastructure on wealth management or investment firms.

- Reporting bottlenecks due to disconnected systems

- Inability to scale operations without scaling headcount

- Risk of non-compliance due to manual workflows

- Lack of customization for unique fund structures or asset types

- Outdated interfaces that underwhelm investors

Did you know there are around 15,396 investment firms functioning in the USA? The numbers indicate tough competition in the financial sector, where speed, transparency, and differentiation dictate success. Hence, clinging to off-the-shelf tools and working on a cookie-cutter approach is no longer a viable strategy. So, what is the way forward? Leveraging investment software development to create custom platforms.

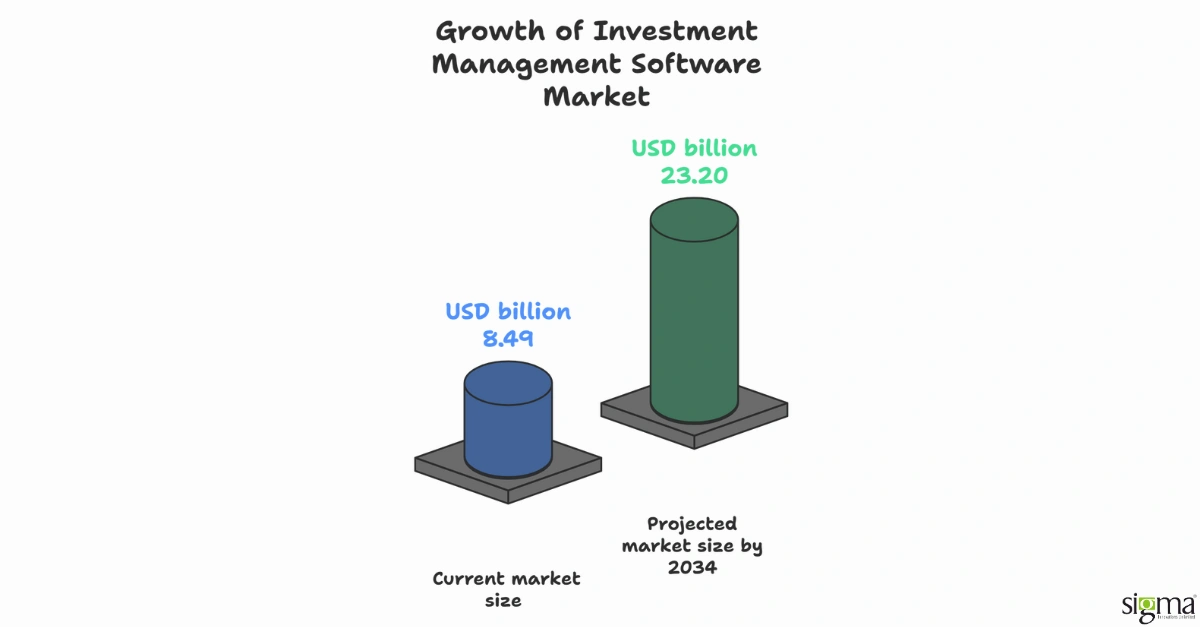

Investment Software Market Value

A Quantum Leap for Modern Firms: Purpose-built Investment Software Development

If you are a forward-thinking fintech business, wealth management firm, or investment firm vying to stay ahead of the curve, how can you turn the tide? The answer is – embracing purpose-built, cloud-native platforms, designed for scale, agility, and performance. From automating rebalancing and investor communications to enabling AI-driven trade decisions and compliance workflows, modern investment technology isn’t just a back-office enabler—it’s an imperative for competitive edge. By adopting modular, API-first architectures and intelligent analytics, firms can, firms can consolidate data into a single source of truth, respond to market shifts with speed and clarity, offer users a personalized, mobile-first experience, ensure continuous compliance without any manual overhead, and launch new products or funds with faster time to market.

Firms modernizing their tech stack today are positioning themselves not just to survive, but to lead in tomorrow’s investment landscape.

Custom-built investment software turns investment chaos into a symphony of success!

A wealth management or investment firm is made up of many moving parts—analysts, compliance, investor relations, operations, etc. Without the right conductor, it’s just noise. Custom investment software acts as the maestro, synchronizing every component into a seamless performance investors can trust.

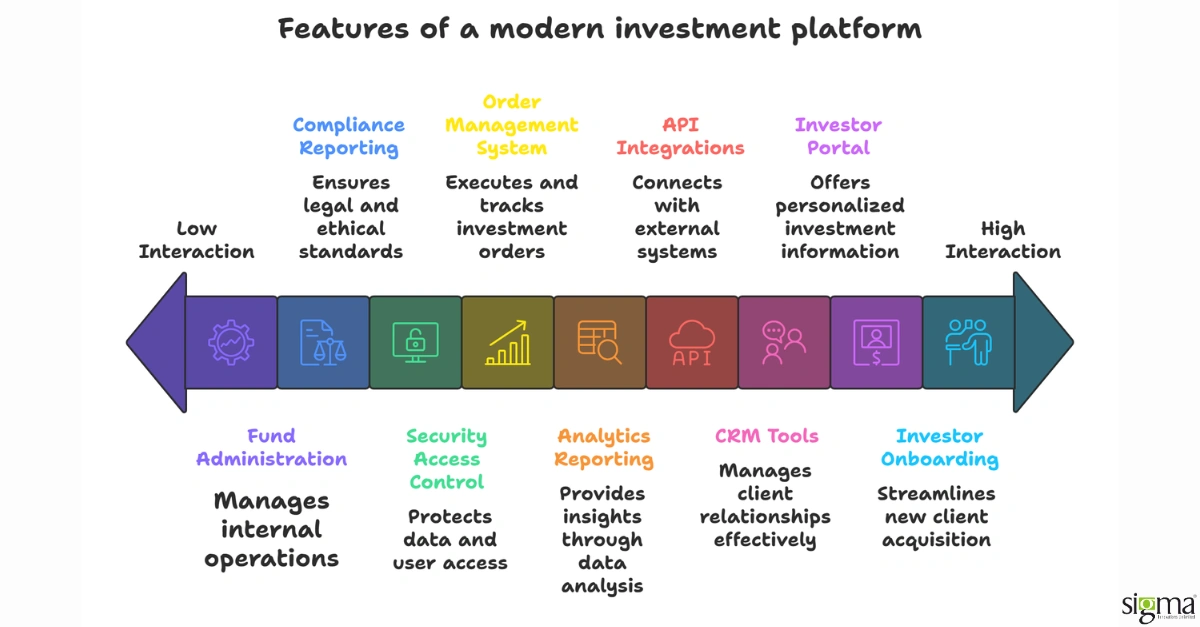

An Overview- Features of a modern investment platform

1. Portfolio Management Module

Can firms track, analyze, and manage investments in real-time by leveraging custom financial software development solutions? The Portfolio Management Module in custom investment platform development software makes it possible with the following features.

- Multi-asset class support (stocks, bonds, real estate, crypto, etc.)

- Real-time net asset value and valuation calculations

- Rebalancing engine

- Risk and performance analytics

- Scenario modelling / what-if analysis

2. Investor Onboarding & KYC solutions

Can firms streamline the investor acquisition and compliance processes with investment software solutions? Investor Onboarding & KYC solutions in the investment software with the below features makes it possible

- Software enables digital onboarding workflows

- Software to facilitate document uploads and e-signatures

- Software for KYC/AML integrations (ID verification, sanctions screening)

- Solutions for Investor profiling & suitability assessment

- Solutions for Regulatory disclosures

3. Order Management System (OMS)

Can investment firms manage and automate trade orders and execution with custom financial software development solutions? Order Management System (OMS) component of the investment software enables organizations to control and automate the entire trade lifecycle—from order to execution—with the below-mentioned features.

- Trade order creation and routing

- Pre- and post-trade compliance

- Execution tracking and settlement integration

- Allocation rules and batch processing

- FIX (Financial Information echange) protocol support

4. Fund Administration / Back Office

Will Custom investment platform development help wealth management firms to automate fund operations and regulatory reporting? Fund administration/back office solutions, which are a part of investment software, help wealth management firms digitize operational workflows and meet regulatory requirements. The key features that enable this are

- Capital calls & distributions

- Waterfall calculations

- Net asset value accounting and reconciliation

- Audit trail & compliance logs

- GIPS reporting and fund fact sheets

5. Investor Portal / Dashboard

Can custom-built investment software help investment firms to provide transparency and engagement for their users? Investor portal systems/dashboards in investment software allow firms to deliver clear visibility and foster meaningful user interaction. The key features enabling this include:

- Investment summaries & performance charts

- Statements & transaction history

- Document vault (K-1s, reports, contracts)

- Secure messaging or announcements

- Mobile & white-labeled options

6. CRM & Communication Tools

Can custom-built investment software help firms to manage investor relationships and communications? CRM & communication tools that are a part of investment software allow firms to coordinate engagement and relationship-building with users. The key features enabling this are

- Contact & engagement tracking

- Pipeline/fundraising workflows

- Email campaign integration

- Investor segmentation

- Activity timeline and notes

7. Compliance & Regulatory Reporting

Can investment software help firms adhere to regulatory compliance and minimize audit work? Compliance & regulatory reporting solutions in the investment software ensure regulatory adherence and safeguards against audit discrepancies. The key features enabling this are

Rule-based compliance checks (e.g., Foreign Account Tax Compliance Act, Securities and Exchange Commission, Alternative Investment Fund Managers Directive)

- KYC/AML updates

- Audit logs & change history

- Customizable report generation

- Data export for auditors/regulators

8. Analytics & Reporting

Can investment software offer deep insights for firms to make strategic data-backed decisions? Analytics & Reporting solutions in custom investment software equip firms with valuable performance intelligence. The key features enabling this include:

- Internal Rate of Return, Total Value to Paid-In Capital, Distributions to Paid-In Capital, Multiple on Invested

- Capital, and other fund metrics

- Benchmarking tools

- Impact reporting

- Customizable dashboards

- Real-time and scheduled report exports

9. API & Integrations

Can investment software enable data exchange with third-party systems? API & integration capabilities in custom investment software bestow firms with smooth interoperability abilities with external systems. The key features enabling this include:

- Integration with custodians, banks, CRMs, ERPs

- Open APIs for data ingestion and export

- Data warehouse and BI tool connectivity

- Secure data feeds (Secure File Transfer Protocol, Webhooks, etc.)

10. Security & Access Control

Can investment software help wealth management firms protect sensitive data and manage permissions? Custom investment software is equipped with security & access control solutions that help firms to safeguard critical data while managing access rights. The key features enabling this include:

- Role-based access control

- Multi-factor authentication

- End-to-end encryption

- Audit trails and activity monitoring

- Compliance with Security Operations Center and System on Chip. A Security Operations Center 2, General Data Protection Regulation, etc.

Additionally, Custom Investment software with advanced capabilities, like AI/ML for predictive analytics, chatbots for user support, blockchain for smart contracts/ tokenized assets, embedded finance (wallets, payouts) allows wealth management firms to offer bespoke solutions and glitch-free experiences and build an everlasting bond of trust with their users.

From Legacy to Leading Edge: Technology’s Impact on Investment Operations

The investment landscape is constantly and rapidly evolving. Driven by market volatility, evolving investor expectations, and increasing regulatory pressures, modern investment firms are reimagining how they operate, and at the centre of this shift is technology. Here’s a deeper look at how digital transformation is empowering firms to operate smarter, faster, and more strategically:

From Spreadsheets to Smart Systems: The sustainable shift

Today’s investment firms are moving away from siloed Excel models and error-prone reconciliations, replacing them with cloud-based investment platforms that automate portfolio tracking, asset rebalancing, and performance calculations. These smart systems centralize data, ensure version control, and support collaborative workflows, allowing wealth management firms to eliminate human error, streamline reporting, and provide hassle-free access to real-time data in investment applications.

1. AI-Powered Decisions: The Differentiator

Leading investment firms are leveraging machine learning and AI models to uncover insights, streamline due diligence, and reduce bias in decisions to ensure they provide apt guidance or solutions to their users. Utilizing predictive analytics to decipher market trends and risk signals, undertaking NLP-based sentiment analysis from earnings calls, news, and social media, and leveraging real-time data for making trade recommendations and signal generation have become the norm of the day for various wealth management firms. These capabilities not only speed up decisions but also enhance the accuracy and depth of insights.

2. Real-Time Portfolio Visibility: Instant reports

In today’s dynamic markets, waiting for end-of-day reports isn’t good enough. Modern investment dashboards now provide live portfolio snapshots, drill-down analytics on exposure, allocation, and performance, and risk alerts and benchmark comparisons. Whether on desktop or mobile, decision-makers, users or investors alike can monitor and act on insights in real time on the go.

3. RegTech & Compliance Automation: Dynamic checklist

Staying compliant is no longer a static checklist—it’s a dynamic, tech-enabled process for wealth management firms. Modern RegTech solutions embed compliance directly into the platform through automated regulatory reporting workflows, real-time alerts for rule violations, audit trail generation and secure document management, anti-money laundering/KYC automation, and investor verification. As regulations evolve across jurisdictions and countries, these tools help firms stay ahead of the curve without adding manual overhead.

4. API-First, Modular Architectures: Agile, flexible systems

Gone are the days of rigid, monolithic systems. Today’s best investment platforms are built on API-first, microservices-based architectures, allowing firms to integrate seamlessly with existing tools—CRMs, custodians, trading systems, accounting platforms, data providers, The technology components in the investment software allow firms to swiftly plug in new services or features without re-platforming and create a tailored digital ecosystem that supports scalability and innovation, This modularity empowers firms to move quickly, adapt easily, and innovate without friction.

Technology is no longer a back-office function—it’s a growth driver. Investment firms that embrace digital transformation are not just reducing costs—they’re enhancing decision-making, improving investor experience, and setting themselves up for long-term competitiveness in the fintech landscape, where trends change on a dime.

Off-the-Shelf Investment Tools—Cookie-cutter approach that doesn’t work anymore!

Off-the-shelf investment tools often look great in demos. But, once implemented, the limitations become clear—especially for firms looking to scale or offer a premium user experience. When it’s time to scale, duct tape doesn’t work, and hence, customization is the only option.

Limited Flexibility & Customization

Off-the-shelf investment tools are built for the broadest possible audience, which often means they’re rigid. Custom capital call workflows, unique fund structures, and cross-border tax logic are a few of the aspects that are left unaddressed by off-the-shelf investment tools. Investment firms are forced to conform to the process of the tool—not the other way around.

Integration Nightmares

Tech ecosystems of investment firms might already include CRM analytics tools and document repositories. Off-the-shelf tools often flat-out fail to integrate effectively, leading to data silos, duplications, or costly manual reconciliation.

Poor User Experience for users

An investor portal is an extension of an enterprise’s brand. Yet many third-party platforms offer clunky interfaces, inconsistent designs, and little room for white-labeling. Users are left with a disjointed experience that feels outdated and impersonal.

Lagging Innovation

Off-the-shelf vendors control the product roadmap. Feature requests are subjected to lengthy queues. It obstructs the ability of an investment firm to innovate, as it is limited by someone else’s priorities.

Compliance & Reporting Gaps

With global regulations constantly evolving, especially in jurisdictions like the EU and APAC, static tools often fall behind. Generating dynamic, audit-ready reports or adapting to new regulatory mandates becomes cumbersome—and risky. When firms stick to off-the-shelf investment tools.

Customization Is the New Standard in Investment Industry

The investment management space is anything but one-size-fits-all. While a boutique real estate fund, a venture capital firm, and a multi-family office may all fall under the umbrella of capital management, their day-to-day operations, investor relationships, regulatory obligations, and growth strategies can vary significantly. What works for one may be completely irrelevant—or even counterproductive—for another. That’s why a tailored technology approach isn’t just a luxury; it’s an imperative. Investment firms are not generic, so the tech in use shouldn’t be either. Here’s what it enables:

Purpose-Built Workflows for Purpose-Driven Investment Firms

Off-the-shelf investment tools force firms to adapt their operations to the software, often creating inefficiencies or workarounds. Custom investment software, on the other hand, maps directly to a firm’s investment lifecycle—whether it’s fundraising, deal sourcing, due diligence, portfolio tracking, or reporting. This alignment improves operational efficiency, reduces manual effort, and allows teams to scale efficiently.

In a competitive turf, Customization Is Your point of differentiation

Investment firms face neck-to-neck competition; to gain an upper hand, a firm has to heavily rely on processes, speed, and user experience. Off-the-shelf investment solutions make it difficult for firms to stand out. With tailored platforms, wealth management firms can embed unique workflows, analytics, and reporting tools that reflect their investment philosophy and service model—be it opportunistic real estate, early-stage tech, or ultra-high-net-worth portfolio management.

Robust Region-Specific Compliance Adherence

From the Securities and Exchange Commission and Financial Industry Regulatory Authority in the U.S. to the European Securities and Markets Authority in the EU or the Monetary Authority of Singapore, compliance regulations vary widely across jurisdictions. Custom investment software solutions can be designed to accommodate evolving regulatory frameworks and automate document generation and audit trails. It enables firms to ensure that the data handling aligns with local and international standards—reducing risk and instilling trust among users.

Cohesive Seamless Branded Experience

The digitally savvy, value-seeking users expect more than just returns—they are on the lookout for intuitive portals, real-time transparency, and a glitch-free digital experience. Off-the-shelf tools fail miserably at this. Tailored investment software solutions allow the creation of custom investment dashboards and analytics, data rooms, and communication workflows that reflect their brand identity and investor service ethos. The result: stronger relationships, higher retention, and easier capital raising.

The diversity within the investment turf demands equally diverse solutions. Tailored financial software development services empowers firms to operate on their terms, turn complexity into clarity, and position themselves for long-term differentiation and success. Hence, customization isn’t cosmetic—It’s a growth strategy.

Off-the-Shelf Investment Tools vs. Custom Investment Software

- Feature / Factor

- Implementation Speed

- Cost

- Fit to Process

- Scalability

- Integration

- User Experience

- Compliance & Reporting

- Competitive Differentiation

- Support & Updates

- Security

- Off-the-Shelf Tools

- Fast setup with predefined features

- Lower upfront, but higher long-term cost due to workarounds and licensing

- Firms must adapt processes to the tool

- Limited customization; harder to scale with complexity

- May not integrate easily with your stack

- Generic UI; may not match your workflows or branding

- One-size-fits-all templates; limited flexibility

- Minimal – same tools competitors may be using

- Vendor-controlled; limited flexibility

- Standard security protocols

- Custom Investment Software

- Longer initial build time but tailored to your needs

- Higher upfront, but cost-effective in the long run

- Software is built around your exact investment lifecycle

- Built to grow with your business and evolving needs

- Seamless integration with internal and external systems (APIs, CRMs, custodians, etc.)

- Branded, seamless UX tailored to internal teams and investors

- Customized to meet regulatory requirements and reporting formats

- High – tailored workflows, UX, and automation become strategic assets

- You control the roadmap, updates, and feature set

- Can implement enhanced, firm-specific security policies and access controls

Tailored Tech, Real Results: The Perfect Case for Custom Investment Software Development Services

Once the realm of institutional giants, custom investment platforms are now within reach for firms of all sizes. Modern development frameworks, secure investment app development, API-first design principles, and cloud-native investment solutions are changing the tide. Owing to such technological components, building bespoke software is faster and more strategic than ever before. In an industry where operational nuance and user experience dictate a firm’s success, custom software development services isn’t just a tech upgrade—it’s a business advantage. Here’s what a purpose-built investment platform can unlock for your firm:

Software That Works the Way a Firm Does

No two investment firms operate the same way—and neither should the software treat them like they do. Whether a firm is automating complex investor onboarding flows, managing capital calls and distributions across multiple funds, or performing real-time waterfall calculations for carried interest, financial custom software development solutions built for investment firms does it all! It mirrors specific workflows, asset classes, and reporting structures, allowing firms to gain precision, eliminate workarounds, and stay focused on value creation—not system limitations.

Seamless Integration with Existing Systems

Custom investment platforms are designed to fit into existing tech stacks and not disrupt them. With robust API integration for financial platforms and microservices, they can integrate effortlessly with custodians and fund administrators, CRM systems, accounting/ERP tools, compliance tools, data warehouses, and custom investment dashboards and analytics. Such robust connectivity breaks down operational silos, ensures consistent data flows, and delivers real-time insights across an organization.

Enhanced User Experience

Users or investors expect more than PDFs and delayed updates—they expect clarity, access, and professionalism. Custom investment platforms empower firms to elevate the client experience through moderniizing intuitive UI/UX across web and mobile. The software allows creation of self-service portals for real-time performance updates and documents and automation of email communications for capital calls, distributions, and NAV updates.

The outcome? Greater transparency, stronger trust, and increased user retention.

Modular Scalability

Unlike rigid legacy systems or generic off-the-shelf tools, custom investment solutions are built to evolve. They can be launched with essential features tailored to fulfill core business goals.

Custom investment software solutions allow the addition of new modules as the needs of an investment firm grow—whether it’s supporting a new fund, onboarding a new investor type, or expanding into new asset classes. It effectively enables firms to scale users, transactions, andworkflows without any need for re-platforming. In simple terms, investment firms do not outgrow custom software; instead, they grow into it.

Built-in Compliance Confidence

Regulatory complexity shouldn’t slow down a business—it should be streamlined through technology. Custom investment platforms can precisely do this by embedding automated KYC/AML workflows incorporating jurisdiction-specific regulatory rules, encrypting communications & secure audit trails, enabling investor eligibility checks, and creating fund-specific compliance guardrails. These attributes empower firms to remain compliant by design, not by exception.

Financial Custom software isn’t just a tactical solution—it’s a foundation for long-term growth, agility, and differentiation. In a market where user expectations are rising and tech-driven firms are gaining ground, a bespoke platform can help wealth management firms deliver more value with less friction.

Why Sigma Infosolutions’ Investment Software Development Services?

At Sigma Infosolutions, we don’t just build software—we architect competitive advantage for investment firms navigating today’s rapidly evolving financial landscape. We specialize in custom investment management platforms for a varied portfolio of fintech businesses, including boutique capital firms, family offices, RIAs, and alternative investment platforms. With a deep domain expertise and a team of seasoned fintech technologists, Sigma Infosolutions delivers modern, secure, and scalable platforms that align with your strategic goals—not slow them down.

Read our success story: Building the Backbone of Boutique Capital Formation Firm from Investment to Operations

What sets Sigma’s investment software development solutions apart?

The Sigma Mindset: Strategy-First Tech

Today’s investment firms don’t just need digital tools—they need digital leverage. We help firms transform operations, deliver remarkable investor experiences, and future-proof platforms with technology that grows in sync with their business strategy.

Cloud-Native, API-First Architecture

We design platforms on the latest cloud-native and microservices-based frameworks for flexibility and performance. This ensures faster deployment cycles, better integration, and easier scaling across operations for businesses.

Accelerated Time-to-Market

Our proven delivery model gets investment firms from concept to go live 4x faster than traditional IT teams—without compromising on quality or compliance. This speed enables firms to rapidly respond to market shifts, investor demands, or regulatory changes with greater agility.

Domain Depth in Capital Markets

Sigma’s Financial Software Development Services’ capabilities bring a nuanced understanding of alternative investment workflows (capital calls, NAV updates, waterfall models), user management, deal pipelines, portfolio performance, and a regulatory obligations across jurisdictions. This means less ramp-up time for investment or wealth management firms and more strategic alignment from day one.

Built-In Security & Compliance

Our investment software development solutions adhere to the strictest global standards—ISO 27001, SOC 2 Type II, GDPR-compliant, It enables secure data handling, encrypted communications, and auditable workflows, and KYC/AML, audit trails, and role-based access control built in by design empower investment firms to establish a strong compliance posture.

Scalable, Modular Growth

We don’t believe in monoliths. Sigma platforms are modular—allowing firms to start with what they need and add capabilities over time without disruption. Whether an investment firm is managing a single fund or scaling across multiple asset classes, we build for long-term evolution.

Final Thought

Choosing the right technology partner is one of the most strategic decisions an investment firm will make. Settling for a generic, off-the-shelf investment tool vendor will limit an investment firm’s ability to scale. Choosing a tech partner who understands the business needs works wonders for a wealth management firm. If you are a C-suite of an investment firm, leveraging Sigma’s Investment Software Development Solutions will empower you to to achieve your cherished goals and steer your venture toward success.